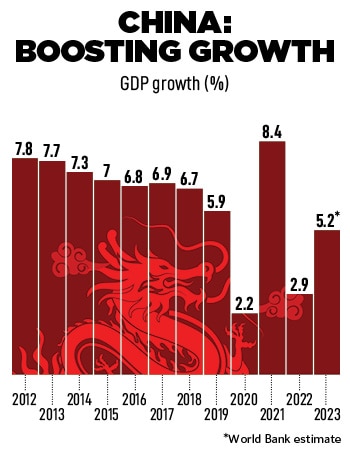

Economists widely estimated that Chinese households had accumulated savings of around RMB 7 trillion during the three years of the pandemic which, they believed, would help to boost domestic consumption levels to the pre-pandemic level of eight percent and Gross Domestic Product (GDP) growth of five percent in CY23.

But a year later, as per the World Bank, China’s recovery from coronavirus induced setbacks, among other shocks, remains ‘fragile’, impacted by pain in the property sector and weak global demand for exports, low consumer confidence, and high levels of debt. It expects the Chinese economy to slow down to 4.5 percent next year and 4.3 percent in 2025.

Evidently, the reopening thesis did not fully play out and China finds itself on the brink of a confidence trap: “China has seriously disappointed investors. The reopening trade was wildly enthusiastic in January, but since then has totally turned around," Washington-based global emerging financial markets investment firm Kleiman International’s Managing Partner Elizabeth Morrissey tells Forbes India.

“There seems to be a persistent lack of confidence among consumers, homebuyers, corporates and investors. Weak expectations could be reinforcing each other and become entrenched and self-fulfilling," Citibank said in a report earlier this year.

China’s ballooning real estate crisis, a crackdown by the government on leading tech companies, its hostility towards neighbouring countries, and its strained relations with the US, has shaken the confidence of investors and consumers, and laid bare major political and structural issues in key areas of the economy.

![]() Aswath Damodaran, professor of finance, NYU Stern School of Business highlights the dark side of operating in a regime where a government sets the rules without any legal or political challenge. “Take a look at what"s happened to the big Chinese tech companies, Alibaba, Tencent… they lost basically 60-80 percent of value and their pathway to being trillion-dollar companies. So, I think that businesses are recognising, at least in the last two or three years, the downside of being in an authoritarian [country]," he explains.

Aswath Damodaran, professor of finance, NYU Stern School of Business highlights the dark side of operating in a regime where a government sets the rules without any legal or political challenge. “Take a look at what"s happened to the big Chinese tech companies, Alibaba, Tencent… they lost basically 60-80 percent of value and their pathway to being trillion-dollar companies. So, I think that businesses are recognising, at least in the last two or three years, the downside of being in an authoritarian [country]," he explains.

In fact, many investors are doubtful if China’s recovery has legs and if they can meaningfully profit from portfolio allocations to China in the medium term. A survey by Bank of America showed that the mood of investors changed from “unabashedly bullish" to “fatigued scepticism" given the poor returns from the mainland. Long-term emerging market investors are looking for reliable cues on the “new normal" of China’s economic scenario.

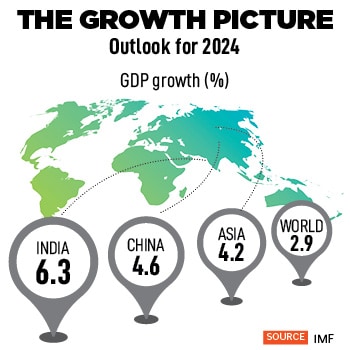

In November, China’s industrial output grew at the fastest pace since February 2022 at 6.6 percent, retails sales rose 10.1 percent, fixed asset investment in urban areas expanded to 2.9 percent, and urban unemployment rate stayed at 5 percent. The IMF revised its GDP growth outlook by 40 bps to 5.4 percent for the year on the back of higher-than-expected growth in the third quarter and the policy measures undertaken by the government to support the property market.

But most economists are reading the economic data with caution because of a low base effect. The patchy recovery indicates weak domestic demand, they point out. This is a key concern for Beijing.

At the Central Economic Work Conference last week, Xi Jinping’s government outlined the growth roadmap for 2024. "Next year, we must persist in seeking progress while maintaining stability, promote stability through growth, and establish the new before breaking the old," the government-release said as it elaborated strategies to tackle softening demand and slowdown.

![]()

As if to validate its focus on prioritising economic growth, three days later, China announced a mega stimulus package. The People’s Bank of China (PBOC) injected commercial lenders with a record amount of $112 billion of one-year loans to revive the economy. This move is likely to address fears of cash scarcity given the increase in issuance of government debt.

The stimulus package, coupled with measures to support the property market, comes as lifeline. Will it rescue China’s economy and boost growth?

“In our view, China is undergoing another critical economic rebalancing. Despite the soft GDP and stock performance, there could potentially be a more promising future ahead," Bank of America’s research analyst Winnie Wu notes. “We expect the China economy and market to see an ‘L-shaped’ performance in the coming quarters."

But geopolitical conflicts, a shifting demographic profile, and high youth unemployment, pose concerns for China. Moreover, after a decade of flat returns, investors are shifting portfolio allocations and eyeing better opportunities in other Asian markets such as India, for example, and it may be challenging for Beijing to restore the confidence of foreign investors after the series of crackdowns on private companies recently.

“I think for the moment, at least, the balance seems to have shifted towards India on that basis. It"s not permanent. You"re always going to have three steps forward, two steps back. But at the moment, I think India does have an advantage over China because of its political system, and that"s not been true for much of the last two decades,", says Damodaran.

Aswath Damodaran, professor of finance, NYU Stern School of Business highlights the dark side of operating in a regime where a government sets the rules without any legal or political challenge. “Take a look at what"s happened to the big Chinese tech companies, Alibaba, Tencent… they lost basically 60-80 percent of value and their pathway to being trillion-dollar companies. So, I think that businesses are recognising, at least in the last two or three years, the downside of being in an authoritarian [country]," he explains.

Aswath Damodaran, professor of finance, NYU Stern School of Business highlights the dark side of operating in a regime where a government sets the rules without any legal or political challenge. “Take a look at what"s happened to the big Chinese tech companies, Alibaba, Tencent… they lost basically 60-80 percent of value and their pathway to being trillion-dollar companies. So, I think that businesses are recognising, at least in the last two or three years, the downside of being in an authoritarian [country]," he explains.