Akshay Dashora pores over his colour-coded excel sheet with the concentration of an opening batsman. What gets his mother’s goat, though, is that this dedication is reserved for studying analytics of different cricketers. She mocks him for not paying as much attention to his studies when he was a student. The 28-year-old only offers a wry smile in return.

Since 2014, Dashora—an avid cricket lover—has been a regular online fantasy sports (OFS) platform user. As the sector has blossomed over the years, his options have increased too. From using only Dream11 back then, the Udaipur resident now tries his luck on six applications, including Howzat, Gamezy, Faboom, Sixer and LeagueX. He’s become so adept at it now that it takes him under 30 minutes to make teams on two or three platforms simultaneously compared to the hours his friends and he would spend on the same when they were in college.

Most applications tell users to choose 11 players, including the captain and vice captain, after registering themselves for free. Eventually, they earn points based on the players’ performance. “But this format has limitations… gamers cannot win, especially if the captain and vice-captain do not perform well,” says Pratik Kumar, co-founder of Faboom Fantasy Sports, set up in March 2019. “We decided to level up Faboom for it to stand apart and created two innovative formats: Rank Fantasy and Boost Fantasy. In both formats, all the 11 players become important. In Rank Fantasy, you rank them all while in Boost Fantasy, you can apply different multipliers (boost) to all your players.”

During the Indian Premier League (IPL) match between Sunrisers Hyderabad (SRH) and Delhi Capitals on October 27, Wriddhiman Saha of SRH scored 87 runs. Dashora, an assistant account manager at Adglobal360, had placed him in the 1.8x multiplier and earned Rs 3,000—the highest he has got so far—for an entry fee of Rs 99.

![fantasy legue1 fantasy legue1]()

For sports buffs like him, the IPL has brought some much-needed entertainment during the pandemic. And OFS platforms have gained the most, with a massive surge in engagement. Depending on the platform they choose and the contests they participate in, users can win daily rewards, and even money in case there is an entry fee. Some practice contests can be played for free, but people can earn bonus cash by sharing referral codes and links.

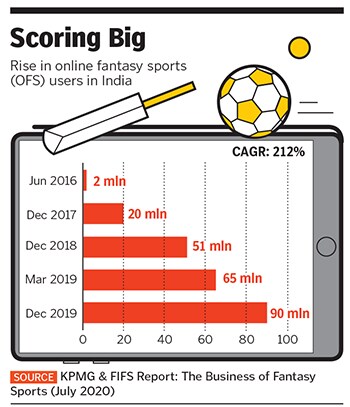

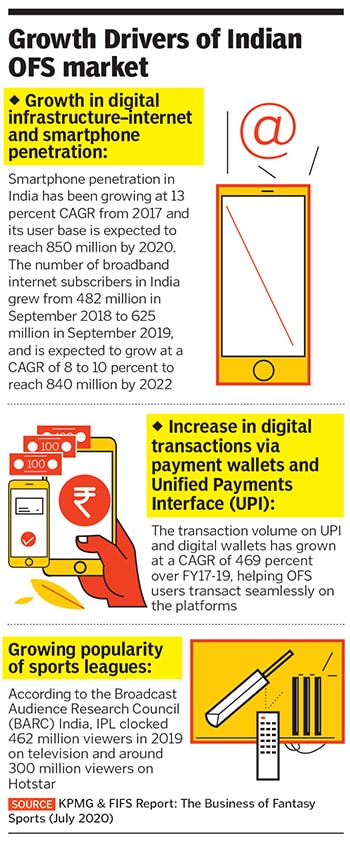

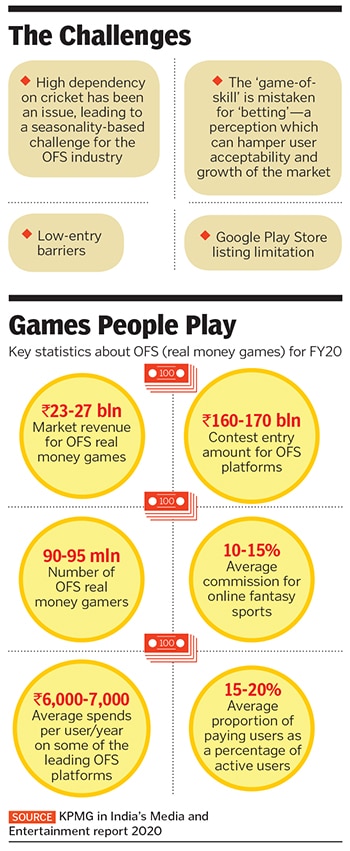

“There were close to 90 million registered users on fantasy sports platforms at the end of FY20, which is likely to have exceeded 100 million on account of the IPL,” says Girish Menon, partner and head-media & entertainment, KPMG India. “Of these, 15 to 20 percent of the active user base are paid users.”

According to KPMG estimates, the market for fantasy sports is close to Rs 16,500 crore in terms of the contest entry amount (CEA) and around Rs 2,500 crore in terms of revenues of operators, as on FY20. KPMG data shows overall OFS operators’ revenues stood at Rs 920-plus crore in FY19 and increased by almost 3x to Rs 2,470 crore in FY20, driven by growth in user engagement and CEA.

“With live sports back in action, Faboom has seen an overall surge of 240 percent in terms of monthly active users. Revenue has jumped by over 5x due to the IPL,” claims Kumar, adding that the platform currently has 800,000 users. The company clocked $1 million in revenue last year and hopes to grow it 4x by the end of the financial year.

And unlike other OFS platforms who have cricketers as brand ambassadors, Gurugram-based Faboom has opted for YouTuber Bhuvan Bam. Its unique offering—which is helping drive engagement—gives users a chance to play against him at Rs 11.

![vinit godara and sanjit sihag_myteam11_175019 vinit godara and sanjit sihag_myteam11_175019]() Sanjit Shiag (left), COO and co-founder, and Vinit Godara, CEO and co-founder, MyTeam11

Sanjit Shiag (left), COO and co-founder, and Vinit Godara, CEO and co-founder, MyTeam11

Bigger players like Jaipur-based MyTeam11 has a user base of close to 15 million, with 1 to 1.5 million monthly active users on average. “We’ve seen massive growth due to the long break in live sports. We are currently looking at 3 million monthly active users on our platform,” says Vinit Godara, co-founder and CEO, MyTeam11. Founded in 2016, the company is the second largest OFS player in the country after Dream11 in terms of users (over 9 crore). “Our core revenue model,” says Godara, “is the platform fee on paid contests, which is 12 to 15 percent. Beyond this, we depend on our strategic associations to support the core revenue model.”

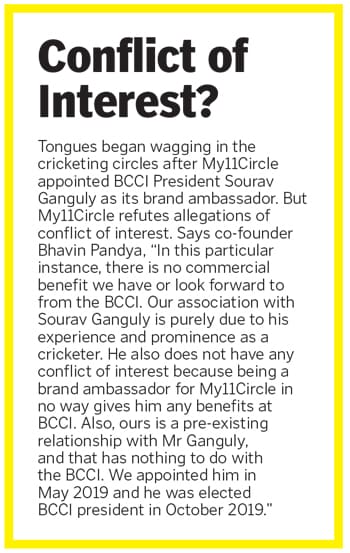

![my11circle-revised-box my11circle-revised-box]()

With the fantasy sports space getting crowded, each player has no option but to bring its own USP to draw customers. For instance, My11Circle allows a player to make fantasy teams and play directly with legendary cricketers. This year, it brought on board Afghanistan leg-spinner Rashid Khan, former India cricket captain and Board of Control for Cricket in India (BCCI) President Sourav Ganguly and Australian all-rounder Shane Watson. "We are expecting a 900 percent increase in contest entry amount of users in IPL 2020 compared to IPL 2019,” says Bhavin Pandya, co-founder and CEO, Games24x7. The online gaming company’s portfolio includes RummyCircle and Ultimate Games, and is backed by investors like Tiger Global and The Raine Group. Pandya and co-founder Trivikraman Thampy launched My11Circle in 2019. “We are foraying into international markets soon, launching casual games exclusively for the US markets,” adds Pandya.

Since the start of the IPL, Delhi-based BalleBaazi has seen a 4x increase in active users, with over 5 million of them on the application. “Our target is to add another million by the end of the tournament as we continue to introduce new features on the platform,” says Saurabh Chopra, co-founder & CEO at BalleBaazi, which was founded in January 2018 and currently has a month-on-month growth rate of 40 percent. Chopra is not only confident about sustaining engagement, but hopes to grow 10x in the next 30 months. “We are entering a period called the ‘Cricketing Sports Fiesta’, where we will witness three IPLs and two World Cups being played in a span of 24 months,” he says.

Like most of these platforms, BalleBaazi also sees a majority of its users willing to shell out money. “We are seeing 80 percent of users preferring the pay-to-play format while the remaining 20 percent like to first put their skills to test and play the free-rolls on our app,” adds Chopra.

Cricket lover Akash Jauhari has used multiple OFS platforms and juggled between three at a time, spending 30 to 40 minutes to make teams on them. “It’s the little things that make you shift from one platform to another. For instance, the team names that appear on the application… all other platforms would only have ‘Mumbai’ or ‘Hyderabad’. Only Dream11 has the right to use the exact team name,” says the senior executive-digital marketing, Disney+ Hotstar. “Even minor technical glitches like points showing up late on the application due to a lag can put off the consumer.”

New Entrants

From less than 10 such players in 2016, the number swelled to over 140 by end-2019. Apart from the smaller players, others who have made their debut include major business houses like Times Internet, Bigtree Entertainment (through BookMyShow), Living Media Group (through Aaj Tak) and Paytm.

![fantasy legue3 fantasy legue3]()

The IPL proved to be a good time for many, including those headquartered overseas, to make an India foray. GoodGamer, for instance, launched its application on September 18, just before the tournament began. This is the first time the company headquartered in Vancouver has moved to the Indian market. It claims to see 16,000 to 17,500 downloads per day with over 8,000 new registrations daily. “At present, we have over 250,000 registered users in less than a month and we expect 500,000-plus registered users by the end of this IPL. We are growing with our Rs 1 lakh guaranteed prize pool with only Rs 1 as entry fee,” says Charles Creighton, CEO of GoodGamer, which closed a seed funding round of $2.5 million in October. Unlike traditional offerings, GoodGamer also offers its users proposition contests. “They are based on specific events during the game that are independent of the final outcome,” explains Creighton. “Some of the new features being added include in-depth player injury reports and alerts, an artificial intelligence-based lineup optimiser and private contests where the creators can earn a commission for creating and managing contests.”

Founded in January 2020, Fantasy Akhada is another new entrant. “The title sponsorship of IPL also moved to the OFS category and hence the acceptance level of this industry is at an all-time high. These factors have led to an increased interest from venture capitalists,” says founder Amit Purohit. The startup raised $150,000 from angel investors in July. And, in September, commentator Harsha Bhogle invested an undisclosed amount. The platform claims to have seen a 3x increase in user base—it has 60,000 users on an average per month.

On September 18, sports-focussed digital media agency Sportz Interactive launched Fantasy Gully. The platform—not a fantasy application or website—allows users to compare fantasy cricket platforms, thereby helping them maximise their winnings. Arvind Iyengar, director, Fantasy Gully, and CEO of Sportz Interactive, says: “Our ‘Menu Card’ helps users discover and compare contests offered by top fantasy platforms, so that they can determine the options that best suit them. Second, the ‘Lineup Builder’ uses deep data and sophisticated algorithms to give users ideal player lineups for their fantasy game-play.”

Through Fantasy Gully, users can play across three or more platforms. Though it is free now, Iyengar hopes to move to a freemium model soon. “We hope to generate subscription revenue from users willing to pay for premium content and personalised alerts and analysis,” he says. Additionally, the platform hopes to generate sizeable revenue through partnerships with fantasy operators for collaborations around products and features.

Challenging times

![fantasy legue4 fantasy legue4]()

While OFS platforms seem to have forged a loyal partnership with users, they’re fighting various other battles. One big setback is that Google Play Store’s Developer Program Policy doesn"t permit online fantasy sports played with real money on the Play Store in India. The policy states, “We don"t allow content or services that facilitate online gambling, including, but not limited to, online casinos, sports betting and lotteries, and games of skill that offer prizes of cash or other real world value.”

As a result, OFS platforms need to pay a higher customer acquisition cost, hence the massive push in terms of marketing, including signing top cricketers. KPMG’s Menon explains: “They have to look at alternative means such as TV and digital advertising, sports sponsorships etc to attract users on their websites, resulting in a side-loading of the apps on user smartphones.” According to KPMG estimates, the spend on marketing and brand building by OFS operators was Rs 2,293 crore in FY20.

Indian OFS players are understandably upset. “The Indian courts of law have repeatedly passed judgments in favour of real money gaming and have categorised fantasy sports as a game of skill. Google, as a digital giant, should duly comply with the law of the land instead of adopting region-agnostic policies across the globe,” says Chopra of BalleBaazi.

The recent changes to the Gaming Act by the state of Andhra Pradesh, which has decided to ban online gaming and betting platforms has proved to be another blow. Besides, the laws in Assam, Odisha, Telangana, Nagaland and Sikkim are unclear on whether games of skills can be played for a fee. Residents of these states, therefore, are not permitted to play any pay-to-play formats of online games. “This has definitely impacted our business. We have seen an approximate fall of around 8 to 10 percent in the overall scheme of things,” says Godara of MyTeam11.

![fantasy league1 fantasy league1]() Bhavin Pandya, co-founder and CEO, Games24x7 that runs My11Circle Abhishek Madhavan, senior vice president, growth and marketing, Mobile Premier League the app interface of Vancouver-based GoodGamer, which has forayed into India

Bhavin Pandya, co-founder and CEO, Games24x7 that runs My11Circle Abhishek Madhavan, senior vice president, growth and marketing, Mobile Premier League the app interface of Vancouver-based GoodGamer, which has forayed into India

OFS platforms are trying to break the perception of illegality attached to these games. Says Pandya of My11Cricle, “The legality of fantasy sports has been examined and upheld as a game of mere skill by several high courts, including the Rajasthan, Punjab and Haryana high courts.”

What next?

With the IPL ending on November 10, the new challenge for these platforms would be to sustain growth and engagement rates. “We know that post the IPL, there will be a slight dip in the bullish nature of user engagement, so it is important to sustain and stay relevant in the remaining 10 months. But we account for this fact every year and strive to maintain a balance between the two,” says Godara.

While players like MyTeam11 might lose out a little because it is focussed only on field sports, others like Mobile Premier League (MPL)—"an all-encompassing gaming platform with all kinds of games"—may be assured of a smooth run. The Bengaluru-based platform has 60 games, from esports to casual games and fantasy sports. "Since we are not a fantasy app, our funding, expansion and marketing outlooks are not solely tied to events like the IPL. The IPL, for us, is a great vehicle to reach the masses. Even when there was no cricket during the lockdown, our growth trajectory was fast and consistent, unlike other fantasy apps," says Abhishek Madhavan, senior vice-president, growth and marketing, MPL. The platform has over six crore registered users, with each user playing at least six games on an average.

Since the IPL, MPL claims its daily new user acquisition rates have gone up by 4x. "Our GMV (gross merchandise value) was at about $350 million in March 2020 and it is currently at $1 billion despite being out of the Google Play Store," adds Madhavan. By the end of the IPL, the platform hopes to cross eight crore users. MPL has India captain Virat Kohli as its brand ambassador, and is sponsoring Royal Challengers Bangalore and Kolkata Knight Riders in the IPL this year. “After the IPL, we have other brand-focussed engagements such as our partnership with (reality show) Bigg Boss as presenting sponsor and our upcoming partnerships on platforms such as YouTube,” adds Madhavan.

While India remains a cricket-crazy country, people have warmed up to tournaments such as the Indian Super League (football), Pro Kabaddi League and Premier Badminton League too. Their popularity has prompted many OFS platforms to include sports such as football and basketball on them.

MyTeam11, in fact, plans to include games such as MyTeam11 Quiz, a knowledge-based quiz, and 13-card format—MyTeamRummy and MyTeamPoker. GoodGamer also has plans to foray into skill gaming in the near future to compete with the likes of MPL and Paytm First Games. Says Creighton, "We are adding Point Rummy and Ludo. In December, we will be adding 15 to 20 more casual gaming titles that are new to the Indian market. We feel that by adding new skill-based games, we will be able to attract a wider audience and earn revenue all year round.”

Illustration: Chaitanya Surpur

Illustration: Chaitanya Surpur

Sanjit Shiag (left), COO and co-founder, and Vinit Godara, CEO and co-founder, MyTeam11

Sanjit Shiag (left), COO and co-founder, and Vinit Godara, CEO and co-founder, MyTeam11

Bhavin Pandya, co-founder and CEO, Games24x7 that runs My11Circle Abhishek Madhavan, senior vice president, growth and marketing, Mobile Premier League the app interface of Vancouver-based GoodGamer, which has forayed into India

Bhavin Pandya, co-founder and CEO, Games24x7 that runs My11Circle Abhishek Madhavan, senior vice president, growth and marketing, Mobile Premier League the app interface of Vancouver-based GoodGamer, which has forayed into India