How EaseMyTrip grew to give India's online travel giants a run for their money

Once a mom-and-pop store, EaseMyTrip is now India's second-largest online travel agency with a market cap in excess of Rs 7,500 crore

The Pitti brothers have always had an entrepreneurial streak in them. It was back in school, long before India’s digital revolution got underway and video content became readily available across mobile phones, that the brothers honed their entrepreneurial skills.

Nishant and Rikant Pitti, the youngest of the siblings, would download movies and sell those CDs to their classmates at a time when the film industry was troubled by piracy. It’s another story that, years later, they also dabbled in producing Bollywood movies, and wouldn’t have appreciated anybody downloading and distributing their movies.

The sons of a coal trader, the trio grew up in a rather modest household in eastern New Delhi and have been rather inseparable, continuing to live together in a joint family comprising 14 people.

Today, the brothers, Nishant, Prashant, and Rikant, run EaseMyTrip, which has emerged as India’s second-largest online travel agency with a market capitalisation in excess of Rs 7,500 crore. That’s rather a phenomenal achievement, especially since the company was virtually unknown to many until a few years ago, and even managed the feat without any funding from venture capitalists.

“Nishant and Rikant were always entrepreneurial," says Prashant, a co-founder at EaseMyTrip and the most studious among the three. “They were trying to do different things at different times." Prashant, meanwhile, went to study electrical engineering at the IIT-Madras even as his brothers were busy setting up a travel agency.

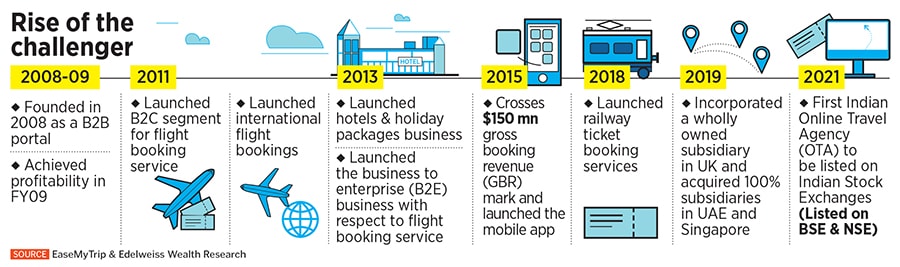

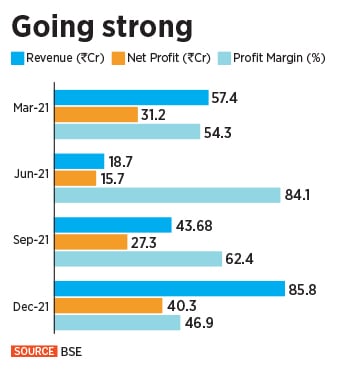

Today, EaseMyTrip has an annual revenue of Rs 150 crore, with profits of Rs 62 crore, and generates over 90 percent of its revenue from airline bookings. In 2021, EaseMyTrip became the first Indian Online Travel Agency (OTA) to be listed on Indian bourses. The company doesn’t charge a convenience fee that has come to define the online travel agency space and claims to be the second-largest online travel agent after MakeMyTrip.

“EaseMyTrip is the fastest growing and only profitable company in the online travel portal in India," brokerage firm ICICI Direct Research said in a report last month. “Lean cost model and no convenience fee strategy remain key pillars supporting such rapid, profitable growth. This has also led to stickiness by customers with a healthy repeat transaction rate of 86 percent in the B2C channel."

“There are 11 or 12 new-age companies in India, and we are one of them," Prashant says. “But most of these new-age companies are loss-making in lieu of growth while EaseMyTrip is growing fast and profitably. I am already at pre-pandemic numbers and my last quarter GMV was Rs 1,290 crore, which was my highest ever. Clearly, we must have eaten market share."

Over the past three months, the company has completed three acquisitions as it looks to expand its business—from focusing only on airline travel to areas such as hotels, bus, and rail booking. In November last year, the company acquired Spree Hospitality, which has a network of hotels in Bengaluru, Mumbai, Pune, Chennai, Goa, Hyderabad, Kochi, Manali, Amritsar, Dehradun, Coimbatore, and Delhi, among others.

Just a month before that, it acquired B2B travel marketplace Traviate, which operated with over 1.2 million hotels and enabled some 200,000 transactions. Then, in December, the company acquired YoloBus, an intercity mobility platform. “International travel has not returned yet," adds Prashant. “Pre pandemic, our domestic and international split was 80:20. Right now it must be 96:4. We have grown so much in domestic that it can compensate for my international business."

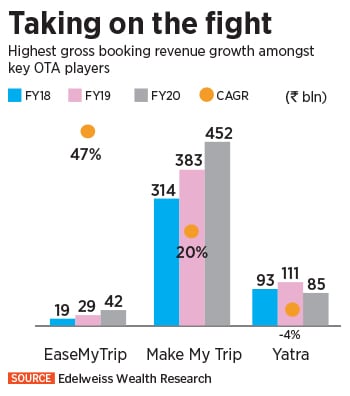

“While EaseMyTrip has the largest agent network in the Indian OTA industry, it also ranks second in terms of air ticket volume and third in terms of gross booking revenue (GBR) and a number of registered customers," brokerage firm Edelweiss Wealth Research said in a report. “Over FY18-20, the company recorded the highest growth in air ticket booking volume (47.7 percent CAGR) and air ticket gross booking revenue (50 percent CAGR) among key OTAs in India."

Founded in 2008, EaseMyTrip (EMT) initially commenced as a B2B venture that provided a platform for travel agents to sell air tickets. It was also a time before online travel agents found momentum in India, and users were heavily dependent on travel agents to do bookings.

A few years before that, Nishanth and Rikant had started a small mom-and-pop travel agency called Duke Travel Agency. “During that time, my brothers found a lot of pain points that could be solved using technology," Prashant says. In 2008, with Rs 15 lakh as capital, the brothers set up EaseMyTrip largely to serve travel agents.

At that time, Prashant says, travel agents had to pay up some Rs 30,000 to airlines as advance. “If there are ten airlines, a capital of Rs 300,000 will be stuck," he adds. That’s how the brothers came up with the idea of EaseMyTrip. “The solution was that EaseMyTrip will integrate with all the airlines, and travel agents needed to use EaseMyTrip and put only Rs 20,000. So, their capex reduces dramatically. Also, our offering was that we will pay the commission to them since we were aggregating a bunch of them."

The brothers started off the journey in their one-bedroom apartment where they grew up and converted it into a small office. The first six months were rather challenging and, at one point, the company was almost on the brink of a collapse when one of the travel agents duped the company by booking air tickets using fake credit cards. The bootstrapped company encountered a loss of Rs 26 lakh overnight.

The brothers started off the journey in their one-bedroom apartment where they grew up and converted it into a small office. The first six months were rather challenging and, at one point, the company was almost on the brink of a collapse when one of the travel agents duped the company by booking air tickets using fake credit cards. The bootstrapped company encountered a loss of Rs 26 lakh overnight.

“We didn’t give up and thought of giving it another shot. We borrowed some money and our father also supported us," says Prashant. “Since then, we’ve ensured that EaseMyTrip never comes to the brink of bankruptcy. That was our first and last mistake."

Of the commission they got from the airlines, EaseMyTrip kept one percent and passed the remaining to the agents. “We were not making money," says Prashant. “If I"m getting 8 percent from the airlines and I"m giving 6.5 percent to the travel agent, within that 1.5 percent, I have to manage my operations, my server cost, my employee cost, and everything. Which is why, I had to do a lot of things very differently, compared to what everybody else was doing."

By 2011, the online travel company pivoted to a customer-facing business, and with well-established players around, the company was also under severe pressure to make a differential offering. “When we got into the B2C market, we saw our competitors were not only getting the margin from the airlines but they were also getting convenience fees from customers," says Prashant. “Think from my perspective, B2C was not my main business—it was the travel agent business. So I didn"t have to focus so much on it."

The ‘no convenience fee’ policy worked quite well for the company, and with word-of-mouth, they started getting more users on their platform. The company claims to have had an over 80 percent repeat transaction rate in the last five years. “What actually helped us to grow was our competitors trying to milk some more money at the last step," says the 37-year-old.

The big break, however, came in 2016. “From 2016 till 2020, we grew at more than 50 percent per year in our B2C business," Prashant says. “So, the curve is very alike VC-funded curve. Our growth came slowly in the beginning, but it exploded in the latter part. As more and more word-of-mouth spread, we got to a tipping point in 2016."

In 2020, as the pandemic hit, Prashant says the company benefitted largely from the mess that Indian aviation underwent with cancellations. By then, almost 94 percent of the business was consumer-focussed with the remaining coming from travel agents. “Prior to the pandemic, we were the third largest. But, just after the first wave, I became the second largest." Much of that, he feels, was due to a conscious decision to repay travellers from their kitty as against a credit shell offered by airlines.

In 2020, as the pandemic hit, Prashant says the company benefitted largely from the mess that Indian aviation underwent with cancellations. By then, almost 94 percent of the business was consumer-focussed with the remaining coming from travel agents. “Prior to the pandemic, we were the third largest. But, just after the first wave, I became the second largest." Much of that, he feels, was due to a conscious decision to repay travellers from their kitty as against a credit shell offered by airlines.

“Everybody was screaming for refunds and airlines were not giving refunds in hard cash," says Prashant. “Airlines were saying I will keep the money in your wallet for whenever you want to book it next time. This was the status quo everybody was following. EaseMyTrip had about Rs 200 crore in the bank account at that time. We decided to shell out Rs 110 crore to give customers hard cash, and not a credit shell."

That move led to humongous goodwill for the company and also worked out well in terms of the balance sheet as none of the airlines went bankrupt and “we got the money after 2-3 months".

Today, at 60,000-odd, EaseMyTrip has the largest network of travel agents across almost all major Indian cities—the number is higher than both MakeMyTrip and Yatra. “EaseMyTrip has been profitable since inception and is the only profitable player among key OTAs in India," Edelweiss said in the report.

“It"s ‘No Convenience Fee’ strategy, which attracts a large number of customers, mainly need-based travellers which account for 1/3rd of domestic air travellers," says Pravin Sahay, a research analyst at Edelweiss wealth management. “The company has a lean cost structure, which has enabled it to remain profitable even in challenging times, especially when peers (including industry leader) have suffered losses."

Take, for instance, the company’s move to shift towards a WhatsApp-led customer care centre compared to a dial-in. During the first wave, when the country went into lockdown and offices were shut, Prashant says the company was flooded with calls from customers who wanted to know the status of their booking. “During the pandemic, we were available to consumers while nobody else was able to serve them."

By Prashant’s estimates, calls during the pandemic were up 10x, while, at the same time, call abandonment too rose significantly. “All a customer needed to hear was, ‘please be patient’, things will get back to normal," he says. But with massive call drops and abandonment, they weren’t getting that assurance too. That’s when EaseMyTrip integrated WhatsApp into their system whereby a call is disconnected and the caller is directed to a WhatsApp-based chat.

“This system is live even right now," says Prashant. “We do not voluntarily cut the call, but 37 percent of all my queries are solved on chat, not on call. Earlier, one agent was speaking to one customer at a time, but now one agent is chatting with eight customers simultaneously. Because of this, I was able to reduce my call centre team from 200 to 110 people, which created huge savings for the company."

In the meantime, the company also fortified its backend, hiring people and investing in technology to ensure a leaner organisation. “During the pandemic, while everybody was losing people, we were hiring people in technology. We increased our technology team from 45 people to 75," says Prashant. “Earlier, I used to have a rescheduling team of 40 people. During the pandemic, using machine learning, we automated as much as possible and now I only have 3-4 people who are solving the cases for rescheduling."

Then, as airlines and hotels struggled with a cash crunch, the Pitti brothers, who claim to have a habit of investing all the money back into the company, used their reserves to negotiate better discounts with airlines. The company currently has some Rs 250 crore in reserves.

“But all that money is coming from the profits which we have accumulated for the last 13 years," says Prashant. “It"s not our ancestral money. It"s not the money that VCs pumped in. Airlines and hotels had a severe cash crunch during July and August last year. They were craving for cash. If you see our balance sheet, before the pandemic, I had a limited number of advances given to the airlines. But if you see my September 2021 numbers, you will see I have given somewhere around Rs 130 crore as advance to the airlines."

“But all that money is coming from the profits which we have accumulated for the last 13 years," says Prashant. “It"s not our ancestral money. It"s not the money that VCs pumped in. Airlines and hotels had a severe cash crunch during July and August last year. They were craving for cash. If you see our balance sheet, before the pandemic, I had a limited number of advances given to the airlines. But if you see my September 2021 numbers, you will see I have given somewhere around Rs 130 crore as advance to the airlines."

“I believe the company’s focussed approach towards specific segments, lean cost structure, and asset-light model will play out in future as well," Sahay of Edelweiss tells Forbes India. “I expect the company to continue to gain market share in the domestic air travel market and introduce new verticals through inorganic ways to deliver healthy profitability in the coming years. I estimate the company to deliver a revenue and profit CAGR of 62 and 67 percents, respectively, over FY22-24."

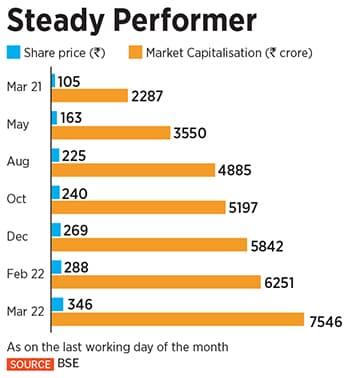

Last March, EaseMyTrip became the first online travel agency to go public. The company made its stock market debut at a 10 percent premium to the IPO price of Rs 206 per share. During the bidding process, Easy Trip Planners, the parent company of EaseMyTrip, saw tremendous interest from investors, with the subscription tally soaring to 159 times. The company had initially planned on listing in March 2020 at a valuation of Rs 4,500 crore, but the onset of Covid-19 delayed that plan. The second time, the valuation was nearly Rs 3,000-3,500 crore, but indications of a second wave had left EaseMyTrip with only two options—delay the IPO or go for a lower valuation.

As the second wave hit, the company decided to go ahead with its plan at a lower valuation of Rs 2,000 crore. The 13-year-old company sits on a market cap of Rs 7,600 crore, as of March 30. The brothers own a 75 percent stake in the company and, last year, offered bonus shares in the ratio of 1:1 out of its free reserves.

Today, EaseMyTrip also ranks second in terms of air ticket volume and third in terms of gross booking revenue and the number of registered customers. The company has also seen its registered customer grow at a CAGR of 21 percent in the past three years.

“EMT has achieved the fastest growth in gross booking revenue (GBR) during pre-Covid levels with air ticketing segment reporting CAGR of 46.3 percent during FY18-20, versus top two players combined CAGR of 13.9 percent during the same period," ICICI Securities said in a report. “Market leader MakeMyTrip (51 percent market share) reported a CAGR of 19.7 percent in GBR while Yatra reported 1.1 percent de-growth during the same period. The market size of the top two players was at 14x of EMT in FY18. It has now declined to 3.1x of EMT as of FY21. This indicates that the company has constantly gained presence and market share (now second largest with 19 percent market share) in the domestic air-ticketing space due to its lean cost model and no convenience fee strategy."

India’s travel market is worth a staggering Rs 2.58 lakh crore of which almost 50 percent is air travel booking, while 29 percent is in hotel booking. The rest comes from rail and bus bookings. Of the air travel booking market, about 70 percent is in online air ticketing, providing a huge potential for the likes of EaseMyTrip to tap into.

The online travel market, meanwhile, is expected to double over the next five years, from $16 billion in 2020 to $31 billion by 2025 at a CAGR of 14 percent. “We believe the low-cost model and the no convenience fee strategy would strongly support the company in gaining market share further from competitors, going ahead," ICICI Direct says.

In 2020, the company also unleashed a campaign, rallying on the patriotic fervour amidst the banning of Chinese apps in the country. “Since EaseMyTrip was 100 percent Indian, we got 90-plus celebrities sharing the message that Indians spent Rs 7 lakh crore on holidays," says Prashant. “Why not spend that money on an Indian company." It also helped that the Pitti family has a rather close connection with Bollywood.

For six years, between 2014 and 2020, the brothers dabbled in producing movies, including the likes of Manikarnika: The Queen of Jhansi, and Fanney Khan. The decision to foray into film producing was largely to help promote the EaseMyTrip brand through product placement. “But we have stopped that now."

“In the past, EaseMyTrip was involved in many unrelated loss-making businesses like coal trading, share trading, and movie production," Edelweiss says in its report. “If similar endeavours are undertaken in the future, it may dent profits as well as the company’s market perception."

Already, the company has begun to follow its peers as it looks to tap into the wider market. The company now charges a convenience fee whenever a customer uses a discount coupon on the platform.

“We like EaseMyTrip for its user-friendly platform, unique travel offerings, low-cost model,

and healthy financial position. The company is consistently gaining market share led by its two strong growth pillars and is now well placed to withstand any competition which may come up in the future given the strong liquidity and its improving brand visibility in the domestic air ticketing segment," Rashesh Shah, an analyst for ICICI Direct Research, said in a recent report.

Now, with international air travel bookings resuming after a two-year lockdown, the company is gearing up to tap into the growing segment. In addition, the company is also expanding its global footprint, from its current presence in the UAE, Singapore, the UK, the Philippines, Thailand, and the USA. "The travel in this new era has been redefined by new trends mostly around safety and technology," says Shah. "Hence, we expect the company’s business volume to also grow at very healthy rate going forward. It is also expanding business in the international markets like UAE, Singapore, UK, Philippines, Thailand, and the US so as to tap the opportunity from huge anticipated pent-up global demand for the travel and tourism as well in the coming months."

For now, Prashant says, all their attention is on growing the business and making it the frontrunner in India’s OTA market. “I"m acquiring companies in the non-air space to grow. My non-air business is organically growing 2.5x every year. It"s just that the pace is slow because we all started this 4-to 5 years ago. But, one big acquisition and this can change dramatically."

What are the brothers now looking forward to as the Indian travel industry emerges out of the shutdown? “We will not shy away from using the money when an opportune time arrives," says Prashant. “We keep our ear very close to the ground and we react quickly which enables us to take faster decisions and stay ahead of our competitors."

First Published: Mar 30, 2022, 14:46

Subscribe Now