How IHCL is consistently achieving strong financial results

From a refreshed brand portfolio to focusing on an asset-light business model, the hospitality major is reshaping its future

Puneet Chhatwal is beaming with pride—and he has every reason to.

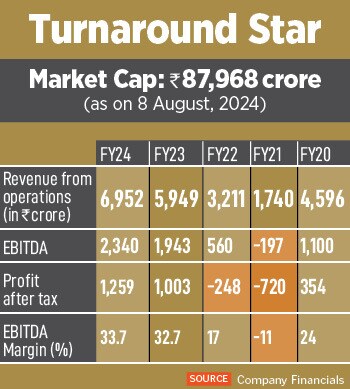

“As one of the largest hospitality players…", as I begin my question, Chhatwal interrupts: “We aren’t one of the largest, we are the largest Indian hospitality player." The last fiscal delivered the best financial metrics for the company, marking eight consecutive quarters of record performance. IHCL clocked in an all-time-high consolidated revenue of Rs6,952 crore, a 17 percent increase compared to FY23 Ebitda stood at Rs2,340 crore, a 20 percent increase, and profit after tax (PAT) touched Rs1,259 crore, a 26 percent increase. Chhatwal adds, “I don"t like to sound arrogant, but I think the time has come where we have to say we are ‘not one of the’, but ‘the largest’ and the benchmark in the sector in India." The underlying strength of the company’s balance sheet was highlighted by the free cash flow of Rs1,162 crore.

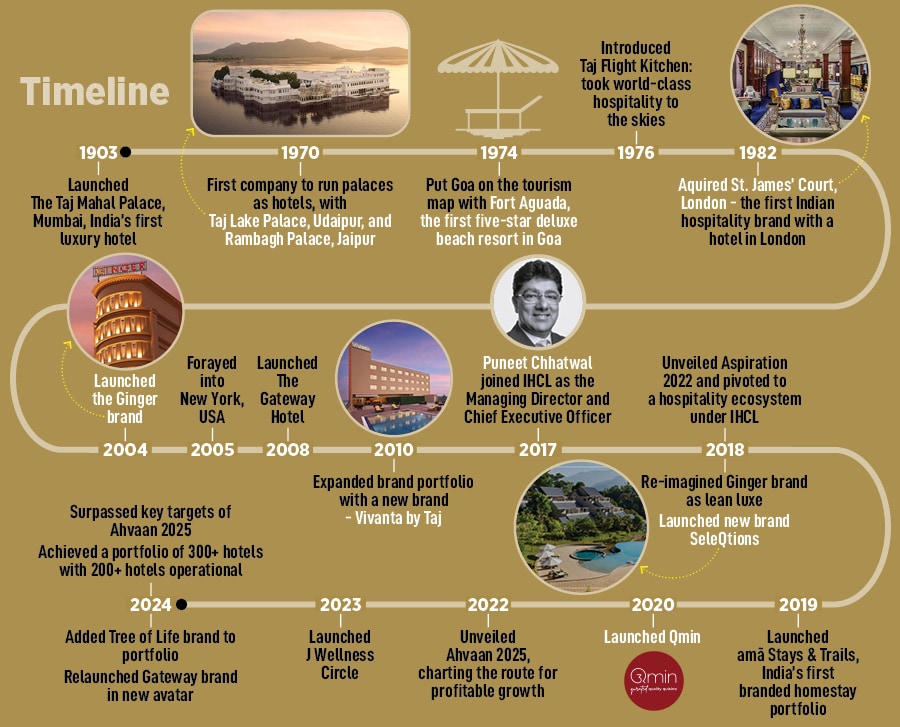

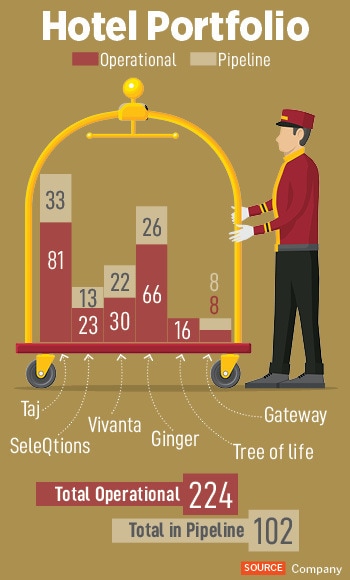

IHCL has a market capitalisation of Rs87,968 crore (as on August 8). Currently, the company has a portfolio of 326 hotels, including 102 under development, globally across four continents, 13 countries and in over 130 locations.

With an announcement of almost one property a week, IHCL is rapidly expanding. Why now? Chhatwal laughs, “I have some impatient colleagues sitting around me, who start every morning saying ‘dil maange more’. But on a serious note, yes, we are making up for lost time."

The sector was hit terribly because of the pandemic, and the subsequent lockdown. “There was almost no way to make any revenue… the sector saw its worst in the last 100 years," explains Chhatwal. But as it happens during every crisis, something changed. Since then, IHCL has experienced a robust recovery and is now performing better than it did pre-pandemic.

It’s not only IHCL but also other Indian hospitality companies that have recognised how international players have entered segments where they could have expanded as well. “As an industry also, we are fairly under-penetrated compared to markets such as Dubai or Singapore," he adds.

One of Chhatwal"s first major strategic moves was to strike the right balance between asset-heavy and asset-light models. “We worked through finding the sweet spot between properties we own and lease versus third-party assets that we manage," he remarks. This comprehensive asset management has helped the business immensely. Currently, the ratio is around 60:40, the majority being asset-owned properties. “With strict control on cost—a learning from the pandemic phase—we have been able to grow our margins… from 13 to 15 percent traditionally to over 33 percent. This is almost a 2.5x increase," reveals Chhatwal. “Moving towards asset-light models has worked very well for IHCL, and many other hospitality players too," explains Nikhil Agrawal, equity analyst, Kotak AMC.

Going forward, while the ratio might change, IHCL has no intention of selling its owned assets. “Some of our iconic properties are like crown jewels, not just of our company, but of the nation," he says.

IHCL, which was traditionally known for its iconic Taj Hotels properties, also decided to change its brandscape and diversify. For instance, it relaunched two older brands—Ginger and Vivanta. “Looking at all our brands, based on price, category, customer profile—Taj is still very relevant, but for about 50 million Indians. Whereas a majority of play will be around Gateway, Vivanta, Ginger and the others." Currently, IHCL is looking at occupancy rates of about 70 percent.

New brands were added, including a homestay portfolio am࣠Stays, online gourmet food delivery service Qmin, private membership club, The Chambers, among others. “The new businesses that we have added are doing over 35 percent in margins," claims Chhatwal. “The company has definitely outperformed the industry. We are now seeing that with a lot of the non-core revenue coming in, their revenue dependence on the core business is coming down," remarks Agrawal.

New brands were added, including a homestay portfolio am࣠Stays, online gourmet food delivery service Qmin, private membership club, The Chambers, among others. “The new businesses that we have added are doing over 35 percent in margins," claims Chhatwal. “The company has definitely outperformed the industry. We are now seeing that with a lot of the non-core revenue coming in, their revenue dependence on the core business is coming down," remarks Agrawal.

In February, IHCL announced a strategic alliance with the Tree of Life Resorts & Hotels, which gave it access to 14 resorts. Additionally, IHCL introduced multiple F&B brands such as Seven Rivers Brewing Company, Southern Spice, Bombay Brasserie and Thai Pavillion, among others.

“IHCL is looking at diversification on all fronts. For a conventional hotel business, the only way to increase ARR and occupancy beyond a point is not easy. So, by focussing on various businesses, including homestays and villas, going the B2B way for Qmin, expanding TajSATS with the number of new airports coming up etc, is all taking care of growth. Also, it is important to note, that these are also your future growth businesses," says Prashant Biyani, vice president (Institutional Equity Research), Elara Capital.

In terms of infrastructure, India has been seeing a lot of upgrades that Chhatwal believes will further fuel the demand for the F&B and tourism sector in India. For instance, the rapidly growing four-lane highways, a large influx of aircraft and airports, high-speed trains such as Vande Bharat and more.

“The way we have expanded our brandscape, we touch our consumers at all price points. Also, more recently, the current generation," states Chhatwal, “prefers to ‘live in the now’, which means they are more keen to have work-life balance… take more holidays and spend on themselves." This new trend has created a drive-in demand for both international and domestic destinations.

Additionally, spiritual tourism in India holds untapped potential that has yet to be fully explored. “We have only seen what happens when people start going to Ayodhya, but there are a number of temples all over India and many more spiritual destinations that can be explored. With some tailwinds, such destinations could propel the sector to an entirely new level," explains Chhatwal.

Additionally, spiritual tourism in India holds untapped potential that has yet to be fully explored. “We have only seen what happens when people start going to Ayodhya, but there are a number of temples all over India and many more spiritual destinations that can be explored. With some tailwinds, such destinations could propel the sector to an entirely new level," explains Chhatwal.

The company expanded its international footprint with signings in Frankfurt, Dhaka, Bhutan and Nepal. “Outside the Indian subcontinent, we only want to grow the Taj brand selectively. Honestly, I don’t know of another consumer brand from India, which has a footprint and brand recognition at a global scale. We need to keep increasing this footprint and stay relevant by adding strategic dots on the map," notes Chhatwal.

In July 2024, IHCL announced the signing of a luxury hotel and boutique resort in the Kingdom of Bahrain, both under its iconic Taj brand. This is a significant milestone, making IHCL the first Indian hospitality company to establish its presence in the Kingdom of Bahrain. With a portfolio of seven hotels, including four currently under development in the Middle East, this new signing further solidifies IHCL"s presence in the region.

IHCL is looking to add one more brand to its portfolio, and will soon be running 10 brands. However, Chhatwal emphasises that the company will only introduce new brands if there is genuine demand, rather than launching them merely for the sake of growth. However, he believes brands such as Ginger and am࣠Stays can be scaled up a lot more and a lot faster. “There should be at least 500 Ginger-branded properties in India," he states.

The managing director and CEO, who took charge of a company with a rich legacy in 2017, admits, “It has been an exhilarating journey." Industry analysts credit IHCL’s success to the fact that the company has been evolving constantly basis consumer demand patterns.

Watch: Meet Kapil Chopra: The hotelier determined to fix India"s public health system

So far, “I think whatever ball we hit, it either went for a four or a six." It seems that Chhatwal has found the winning formula—the right balance of brand, product portfolio, business model, keeping growth at the core—"diversification of the topline".

First Published: Aug 08, 2024, 15:36

Subscribe Now