How Shan Kadavil is building FreshToHome into a proficorn

The online fish and meat delivery platform is flush with funds, and the co-founders want to turn it into a one-stop shop for non-vegetarians in India

In a startup ecosystem that’s obsessed with churning unicorns, Shan Kadavil claims to be an exception.

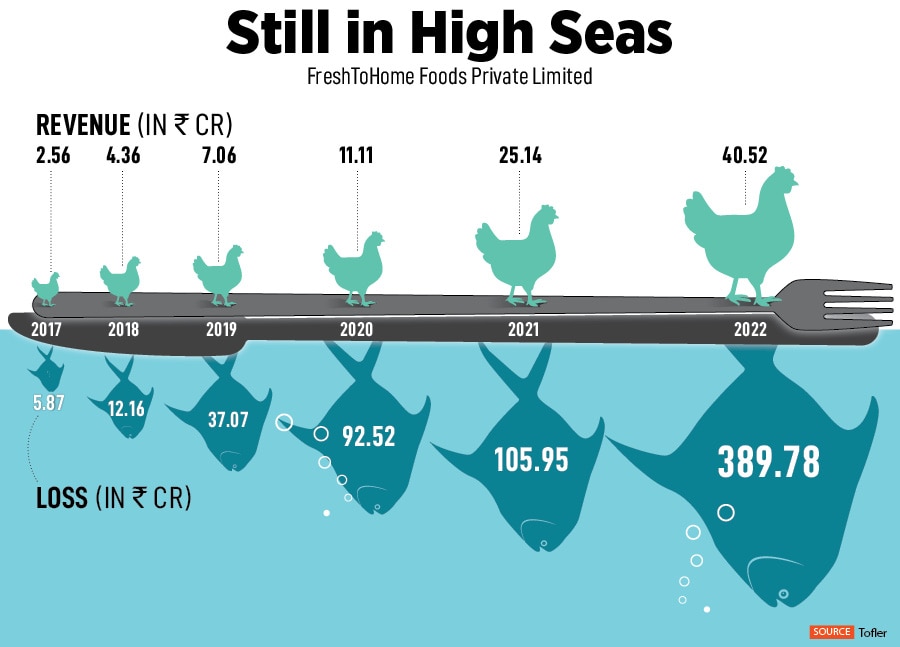

The CEO of the seven-year-old startup, FreshToHome doesn’t believe in chasing sky-high valuations, or at least flaunting it, even as he raised a spectacular $104 million amidst a funding winter. Instead, the 45-year-old is playing the long game, when he intends to take his company public three years later and in the process, win over the bourses. That has meant a steady focus on operating income and profitability at his fish and meat delivery platform, which he claims is already bringing in revenues of Rs1,300 crore a year and is operationally profitable.

The company competes with the likes of Licious in the country’s $50 billion seafood and meat market. It currently operates in 160 cities, of which 154 are in India. The rest are in the Middle East region. “At a high level, we are a destination for preservative and antibiotic-free fish and meat," Kadavil tells Forbes India in an interview. “We have been very clear from the beginning that we don’t intend to feed our customers what we don’t feed our children."

Kadavil set out to build FreshToHome in 2015 as India’s answer to Whole Foods, one of the world"s leading retailers of natural and organic foods. He previously had a stint in Silicon Valley where he had built and operated popular games such as Farmville, and Mafia Wars while working at Zynga. FreshToHome has raised more than $250 million in seven years, with the latest round of $104 million being led by Amazon Smbhav Venture Fund. The company had, in 2020, raised $121 million in its Series-C round. Yet, it doesn’t speak about its valuation, instead referring to itself as a proficorn, a unicorn or startup that’s operationally profitable.

“We are quite big and we"ve given two to three times higher valuation increase to our investors when compared to the last one," Kadavil says. “But, at the time of a public listing, the demand for a pre-IPO company will be mirroring what capital markets look at, including profit after tax multiple. That"s is our focus and that’s why we don’t pay so much attention to being a unicorn."

With the latest round of funding, the company wants to ramp up its omnichannel expansion, in addition to building its business around the 160 existing markets. Already, the company has set up 30 stores in Bengaluru and is gearing up to open more. The company also operates a patented AI-based technology called Commodities Exchange, which allows fishermen or farmer to electronically auction their produce to FreshToHome.

“Omnichannel is the next big frontier for us," Kadavil says. “The stores that we set up have resulted in a fair amount of growth from a new user perspective. For a B2C company, the biggest pain is going to be on marketing, and we see a huge reduction in marketing because people will come to try out the stores."

“Omnichannel is being considered by many D2C players across categories given that offline is still a preferred destination of customers for many parts of the product purchase journey," says Abhijit Routray, engagement manager at consultancy firm Redseer. “The same applies to meat/poultry. The key here is to set up shops in the right micro-markets with a keen eye on profitability while ensuring short breakeven times for the stores, as demand is expected to be robust."

Much of Kadavil’s decision to set up FreshToHome came from his love for devouring fresh fish from Kerala while living in Bengaluru.

Kadavil grew up in the Middle East after early schooling in Kerala, and moved to Bengaluru after a stint in the US where he worked for nearly a decade. An engineer by profession, Kadavil led the enterprise business unit of SupportSoft, a California-headquartered technical support company for businesses and consumers before moving to India with Zynga as its country manager.

“We used to make games for a living," Kadavil says. “It was games like Farmville, Mafia Wars, and so on. Zynga was the second-largest IPO after Google then. Farmville did more than a billion dollars in revenue." It was also during his stint at Zynga that Kadavil met many of his co-founders at FreshToHome, which counts eight co-founders including BM Tambakad, the CFO, Jayesh Jose, the CTO, and Nilkamal Malakar, the chief data officer.

“I had no connection to the seafood and meat industry back then," Kadavil says. “I relocated back from the US around 2009. Back then, I had then been buying fish from my current co-founder, Mathew Joseph’s company." Mathew, a fish exporter from Kerala had set up an online platform, SeaToHome, that would sell fresh fish from Kerala to New Delhi and Bengaluru. By 2014, however, Joseph, with limited access to technology, had to shut down the portal. That’s when Kadavil and the other co-founders stepped in to build FreshToHome.

Much of FreshToHome’s success has been led by its ability to fulfill deliveries in metros such as Delhi and Mumbai. Usually, orders placed are delivered the next day for seafood and poultry. Currently, Delhi, Mumbai, and Bengaluru list among FreshToHome’s top markets in the country despite ramping up its presence to 154 cities in the country.

While India’s overall meat market was worth Rs3,30,000 crore gross merchandise value (GMV) in 2019, the market is set to grow to more than Rs4,60,000 crore by 2024, according to Redseer Consulting. It only helps that over 70 percent of the Indian population consumes meat in some form. “This is particularly prominent in eastern and southern India. For instance, over 98 percent of West Bengal’s and Andhra Pradesh’s population consumes meat. Fish is the most consumed form of meat," Redseer said in a report.

It has also helped that the larger meat market is highly fragmented with wet shops accounting for a bulk of the sales. “But the online meat space is dominated by few players," adds Routray. “We have a couple of early leaders but this space is still nascent and there is plenty of growth headroom for the players to grow."

FreshToHome claims to be the only ecommerce player in the country that can provide a chemical-free and antibiotic-free certification for all batches of products. The company operates its supply chain warehouses across key metros in the country where products are often shipped before they are packaged and sent to consumers. Today, 99 percent of what the company sells is fish and meat but has also begun offering products such as batter and chutney apart from ready-to-cook offerings.

“We have another app called FTH daily that has got vegetables, fruits, milk and so on. But FreshToHome is a one-stop for non-vegetarian products," Kadavil says. FreshToHome accounts for about 90 percent of the group’s revenues with the rest coming from FTH Daily. Eventually, Kadavil reckons that FTH Daily will be integrated into FreshToHome.

First Published: Mar 15, 2023, 13:08

Subscribe Now