IndiGo has beaten Air India to the mother of all aviation deals. Now, the rivalr

IndiGo's new order of 500 A320 family aircraft indicates the growth potential of the Indian aviation market

India’s largest airline, IndiGo, has come out with all guns blazing to set the Paris Air show on fire.

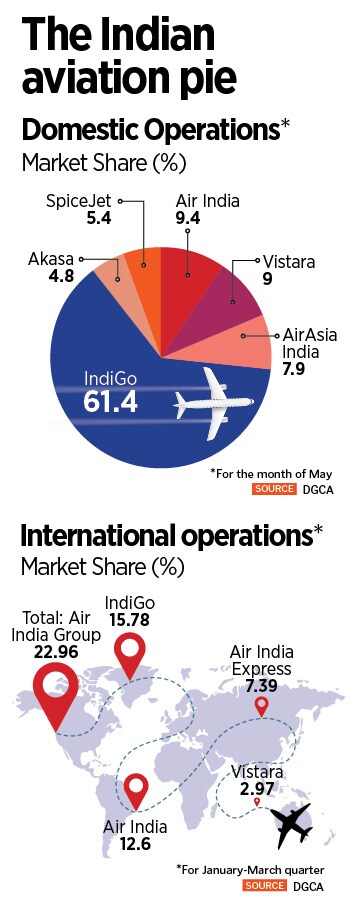

A few months after Air India placed what was then referred to as the mother of all aviation deals with its 470 aircraft order with Boeing and Airbus, IndiGo—India’s largest airline by market share and fleet size—has upped the game a notch, and sent a clear message of intent to the world, which had been a tad bit awestruck with Air India’s turnaround plans.

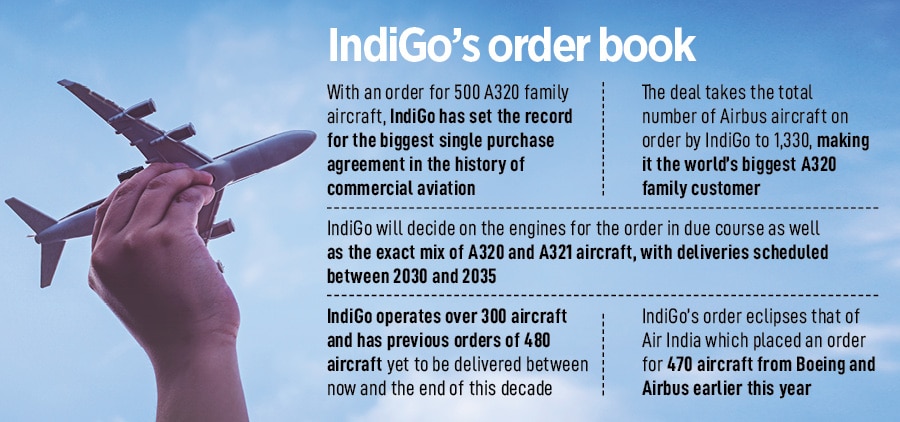

With a firm order of 500 A320 family aircraft, IndiGo has set the record for the biggest single purchase agreement in the history of commercial aviation. The deal would mean the airline will now have 1,330 aircraft on order from Airbus, making it the world’s biggest A320 family customer.

And that’s not all. Rumour mills are abuzz about another likely purchase from IndiGo, this time for a few wide-bodied aircraft, typically used for long-haul flights, which could be signed in Paris. IndiGo’s 1,330 aircraft order from Airbus involves the short-haul, narrow-bodied A320 family.

“An order book now of almost 1,000 aircraft well into the next decade enables IndiGo to fulfil its mission to continue to boost economic growth, social cohesion, and mobility in India," said Pieter Elbers, CEO of IndiGo, in a statement. It’s still unclear how much IndiGo will have to cough up for the deal, although bulk deals such as these are often heavily discounted.

“It’s a big deal to kick off the Paris Air show and is clearly choreographed to have as much impact as possible," says Shukor Yusuf, founder of Malaysia-based aviation consultancy firm Endau Analytics. “In China"s absence, India is taking on the role of price maker." IndiGo will decide on the engines for the order in due course, as well as the exact mix of A320 and A321 aircraft, with deliveries scheduled between 2030 and 2035.

“Essentially, IndiGo has locked in delivery slots for the next decade by way of this order," says Vinamra Longani, head of operations at Sarin & Co, a law firm specialising in aircraft leasing and finance. “The large order book of close to 1,000 Airbus aircraft implies IndiGo may continue to use the sale and leaseback model to finance its fleet acquisition. This is a model that has worked well for the airline and one it has mastered to perfection." In a sale and leaseback model, an airline acquires the aircraft and sells them to a lessor, before leasing it back for use. The sale is usually at a profit and helps with cash.

“Essentially, IndiGo has locked in delivery slots for the next decade by way of this order," says Vinamra Longani, head of operations at Sarin & Co, a law firm specialising in aircraft leasing and finance. “The large order book of close to 1,000 Airbus aircraft implies IndiGo may continue to use the sale and leaseback model to finance its fleet acquisition. This is a model that has worked well for the airline and one it has mastered to perfection." In a sale and leaseback model, an airline acquires the aircraft and sells them to a lessor, before leasing it back for use. The sale is usually at a profit and helps with cash.

Since it began operations in 2005, IndiGo has stuck with Airbus for most of its aircraft, barring a few ATR aircraft, which has helped the airline bring down costs significantly in India’s cutthroat aviation market. In all, the airline operates over 300 aircraft, with a pending order of 470 aircraft from a previous deal. “The fuel-efficient A320 Neo family aircraft will allow IndiGo to maintain its strong focus on lowering operating costs and delivering fuel efficiency with high standards of reliability," IndiGo said in a statement.

“This order includes replacement capacity and growth capacity," says Satyendra Pandey, managing partner, aviation services firm, AT-TV. “By sticking to the single fleet type, Indigo will be able to extract efficiencies and deliver competitive economics. And the capabilities of the aircraft, including range, will enable Indigo to fly to new destinations, including as far as Japan in the east and London out west."

“In many ways, the order is IndiGo’s way of proving a point," says an industry veteran, on conditions of anonymity.

Air India’s recent turnaround plans will see it go head-to-head with IndiGo, especially since Air India is looking to replicate IndiGo’s success in its timely performance, staff behaviour, and a young fleet. With Air India’s plans to offer the likes of free meals, entertainment, and frequent flyer programmes, IndiGo could be left in the lurch as price-sensitive Indian buyers could give the airline a run for its money.

Air India has been improving its foreign network, especially to North America, and Europe, and its recent order of more than 70 wide-bodied aircraft, including Airbus A350 and Boeing 787 and 777, are aimed at enhancing its international operations. On the domestic front, with the merger between Air India and Vistara, and another between Air India Express and AirAsia India, the Tata group wants to create a full-service carrier and a low-cost carrier under its umbrella.

“What its [Air India] end game is really about is the integration of Air India with Vistara in the full-service space, and on the other hand the streamlining of products in the low-cost space with AirAsia India and Air India Express," Longani had told Forbes India earlier. “That will be challenging for the likes of IndiGo, because it will look at mixing and matching the low-cost carrier with the international operations, which bring a lot of money, and coupled with loyalty programmes and connecting smaller cities to the international route will make it a formidable player."

Rahul Bhatia (left) Co-Founder, IndiGo Airlines and Pieter Elbers, CEO, IndiGoImage: Benoit Tessier / Reuters

Rahul Bhatia (left) Co-Founder, IndiGo Airlines and Pieter Elbers, CEO, IndiGoImage: Benoit Tessier / Reuters

“IndiGo is now planning to launch their frequent flyer programme, and even announce an order for wide-bodied aircraft which will come into play for its long-haul flights," the veteran says. “That’s its way of telling the Tata group that it is coming after them."

Operating wide-bodied aircraft may not be any trouble for IndiGo, especially since it already has widespread operations out of Indian cities. But it’s the cost of maintaining a fleet with bigger aircraft that could pose a concern. “Even there, it could work with the likes of the Airbus A330, which hasn’t been a very successful product, and where Airbus will be happy to take on some costs, and help IndiGo," the industry insider adds.

India’s airline market has emerged into something of a duopoly, led by IndiGo and Air India, with the two airlines cornering nearly 90 percent of the market. In May, IndiGo had a market share of 61.4 percent, breaching the 60 percent mark for the first time since it began operations. The Air India group had a domestic market share of 26.3 percent. On international routes, Air India has a 23 percent market share, while IndiGo had a 15.78 percent.

“Market share in and of itself is meaningless," says Pandey of At-TV. “Market share along with profitability is what airlines have to aspire to and on that front IndiGo has fared well. That said, competitive dynamics are only getting more intense, both domestically and internationally. IndiGo and its peers have to contend with exponentially improving road and rail networks in the country and aggressive, well-managed and well-capitalised competitors internationally."

The recent deal will also help IndiGo maintain a relatively young fleet, with many older aircraft being replaced, and reduce potential risks. “Usually, the big checks kick in during the sixth year of operation for an aircraft, and through the sale and leaseback model, IndiGo makes sure that its aircraft are returned by the sixth or eighth year, as is required, and replace them with a younger fleet. This helps keep costs low," says the anonymous industry insider.

Still, IndiGo’s mammoth order is also an indication of the enormous underlying potential for travel in the country, which has once again emerged as the world’s fastest-growing large economy. Much of this is driven by a growing middle class and rising disposable income that tends to be spent on travel.

“The deal also signals a resounding acknowledgment from Airbus of IndiGo as a world-class airline, that will not only survive but is expected to grow," adds Longani. “Otherwise, manufacturers look to diversify their order book as much as possible."

India is expected to add over 2,200 aircraft over the next 20 years according to Boeing, which will require enormous investments into infrastructure, training, and MRO (maintenance, repair, and operations). “India will need 31,000 more pilots and 26,000 mechanics to fly and maintain all those airplanes," Boeing India’s president, Salil Gupte had told Forbes India recently.

India’s domestic passenger traffic growth is estimated to grow between 8 and 13 percent in the current fiscal to reach 150 million, while international passenger traffic for Indian carriers is likely to grow between 10 and 15 percent, according to credit rating agency, ICRA. Yet, losses continue to haunt the industry, which was hit hard by the Covid-19 pandemic. In the ongoing fiscal, losses of India’s airlines are expected between Rs 5,000 crore and Rs 7,000 crore, according to ICRA.

Much of this is also because India’s airlines continue to grapple with structural issues, including the taxation on aviation turbine fuel (ATF), high airport charges, lack of secondary airports, and currency fluctuations. This is also why, India often sees airlines folding up after accumulating colossal debt. Between 2018 and 2023, one airline has shut down operations while another has announced voluntary insolvency.

“India"s market is cut-throat, with thin margins," adds Yusof, of Endau. “India is the most active market post-Covid, given it has lagged behind other countries for decades. Profits will, however, still be elusive due to intense competition and a high tax environment [fuel], plus a weakened rupee."

Yet, for the likes of IndiGo, which has demonstrated a clear path to profitability, and Air India, backed by wealthy promoters, the opportunity remains huge as the skies consolidate, even though the country’s aviation industry remains a work in progress. This year, IndiGo is expected to onboard 10 crore passengers.

“For the Indian aviation industry as a whole, the orders at the Paris Air Show notwithstanding, much work lies ahead," adds Pandey. “At an industry level, profitability continues to be elusive and market potential has not correlated with investor returns. Only Indigo has been consistently profitable while most of the others have lost money. The overall return on capital for the industry has been negative and failing significant structural changes, this situation is not expected to turn around anytime soon."

First Published: Jun 20, 2023, 10:39

Subscribe Now