India batted first and Rohit Sharma went on to smash a century. Virat Kohli and KL Rahul scored half-centuries each and India put up a rather colossal total of 336 in 50 overs. In response, Pakistan could only score 212 in 40 overs after rain disrupted play. The men in blue went on to win by 89 runs after the Duckworth-Lewis method was applied.

Somewhere in between, Chhawchharia received a phone call that would go on to change his life. “Little did I know that my life will change that day," Chhawchharia tells Forbes India over a Zoom call. The caller, who Chhawchharia prefers to keep anonymous, informed him about a decision by a group of banks in India designating him as the man in charge of deciding the fate of one of India’s beloved airlines, Jet Airways, which had stopped flying a few months before that.

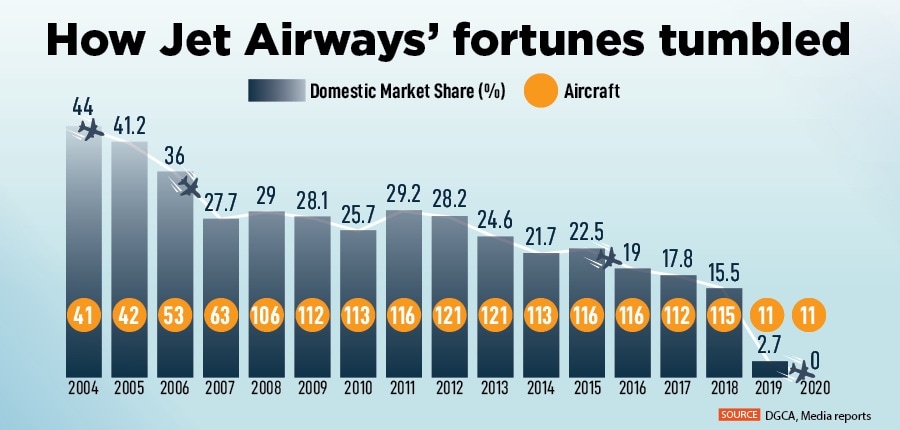

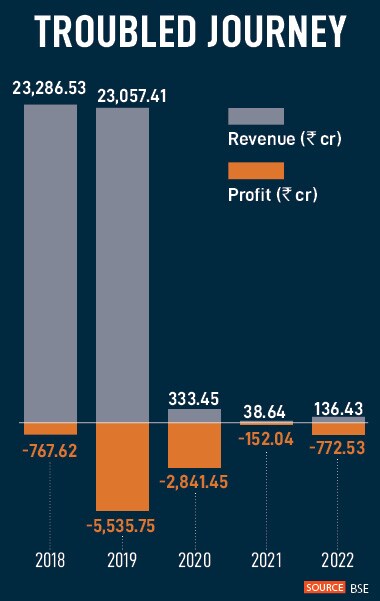

Chhawchharia, of course, knew Jet Airways, and its turbulent journey since debt began spiralling out of control at the Mumbai-headquartered airline in 2018. He had been a frequent flier and a platinum member on the country’s oldest private airline. Apart from leading the restructuring practice and looking after the eastern region for the consultancy firm, Grant Thornton, Chhawchharia had little to do with the airline then.

This time around, he was tasked with overseeing one of corporate India’s biggest insolvency cases and the first one in the country’s aviation history. While he had been following the news closely and knew that the banks led by the SBI (State Bank of India) were trying to revive the business by infusing more capital into the company, Chhawchharia had no clue that he was only staring at the tip of the iceberg. “I had no way to know what was happening on the inside," says the 49-year-old.

On June 16, 2019, lenders to Jet Airways, including SBI, its largest creditor, agreed to insolvency proceedings against the debt-laden carrier. Three days later, the National Company Law Tribunal (NCLT) approved the proceedings.

Since then, Jet Airways, which once had a domestic market share of 54 percent, has found a new buyer, as part of the insolvency proceedings, in the Jalan-Kalrock consortium and wants to fly out sometime between April and June this year. But, with a decision by the company’s lenders to challenge a recent order by a regional bench of the NCLT allowing the transfer of ownership to the consortium (JKC), that take-off will have to navigate an air pocket first.

Walking the tightrope

Chhawchharia was brought in as an interim resolution professional (IRP) in June 2019 before he was made the resolution professional (RP) in July of that year. Under the norms, the interim resolution professional has 270 days to find a suitable resolution for the stressed account, failing which the last option of liquidation will be taken.

As an RP, his role involved superseding the board of directors of the company while also making the day-to-day operational and financial decisions. Alongside, he also had to run a process to find a suitable buyer to maximise value for the creditors. That meant, taking decisions that could swing fate both ways, and often made without the luxury of time.

“I make decisions which may go right, which may go wrong," Chhawchharia says. “But I will know the outcome in real-time. I don"t have to wait till next month or next year when the financials are released to know whether what we did was right or wrong. The one thing in the life of an RP is that you must make decisions."

With officers and managers of the company reporting to him and providing access to documents and records, Chhawchharia also had to verify and admit all the claims that were made against the airline by debtors. In all, claims of over Rs 40,000 crore were made against the airline, according to reports, with only about Rs 22,000 crore being admitted finally. Of this, financial creditors were to receive some Rs 7,800 crore.

“Jet was not the largest case that we have handled," Chhawchharia says. “We have been involved with larger cases in terms of the debt of the banks. But in terms of the complexities and challenges, it was."

“Under the prevailing circumstances in India then, Ashish was perhaps the best person that we could bring on as a resolution professional then," says Shivan JK, the CEO and MD at Dhanlaxmi Bank. Shivan was the chief general manager in the SBI’s stressed assets vertical during the Jet Airways’ crisis. “The situation was dire then with aircraft being grounded and staff not being paid. He is level-headed, doesn’t waver much despite the pressures and remains steady whatever maybe the provocations."

Jet was the first aviation company in India to go through the insolvency process under the new Insolvency and Bankruptcy code. Sixteen thousand employees used to work with the company at its peak and by the time the company suspended operations in April 2019, that number stood at around 12,000.

“There were over 10 lakh customers whose tickets were impacted because they had purchased advance tickets," Chhawchharia says. “There were almost 30 financial creditors and 4,000 operational creditors from all over the world as Jet was operating in 20+ overseas locations apart from 42 in India. We received creditor claims in 28 different currencies from across the world. That shows the kind of widespread network of people who are affected by this. We also had an overseas liquidation process which had started in the Netherlands and the UK around the same time that Jet Airways became insolvent."

It also didn’t help that the senior management had left the organisation. Vinay Dube, the then CEO, had resigned in May of that year along with the company’s Chief People Officer Rahul Taneja, and CFO Amit Agarwal. “All the directors of the company, I repeat, all the directors had resigned," Chhawchharia says. “There was no one there to even tell us what was going on. The lead bank had given me a brief about the background and recent history of the case from their perspective but naturally even they were not aware of the details of operational issues."

The company had also not completed the books of accounts and financials for the year even though it should have been completed according to SEBI norms. In addition, accessing information had become tough as only a skeletal human resources team was working from the office. Offices mostly had employees who were coming to collect their relieving letters.

“We faced issues in accessing information as the IT infrastructure was blocked by the service providers and almost all senior employees had left," Chhawchharia says. “We started navigating, cobbling together information from various resources. There were still some junior resources there. Whatever someone would tell us, we pieced things together. Even the books of accounts and financials for the year ended March 31, 2019, which should have been completed by May as per the SEBI regulations, were not completed."

![]()

Messy days ahead

In addition, Chhawchharia also had to ensure that the 11 aircraft that belonged to the airline weren’t left to sit idle and needed to be regularly maintained. “There were several issues," Chhawchharia says. “There were overseas aircraft lessors who don’t understand the Indian IBC process and then you have these 10-11 aircraft which was still sitting on the ground. I quickly learnt that if I don’t do something about them, these will become a piece of junk. They need to be regularly maintained as per the OEM guidelines and we needed permits, funds, and technically qualified personnel to manage the same."

Over the next few months, the airline, now under the watch of Chhawchharia, made various attempts to find suitors after admitting all the claims. By October 2020, the committee of creditors finalised a proposal by Murari Lal Jalan, a relatively unknown businessman with business ties to the UAE and Uzbekistan after a consortium led by him and Kalrock Capital offered a total infusion of Rs 1,375 crore. That included Rs 900 crore towards capex and working capital, and Rs 475 crore to settle claims of the creditors.

Lenders were to also receive a 9.5 percent stake in the airline and a part of the payment to lenders was from the sale of property owned by Jet Airways. That meant a 95 percent cut from their total admitted claims of Rs 7,800 crore.

But, over two years since, the airline still hasn’t found a way to fly—during this period the Indian government sold Air India to the Tata Group and Akasa took to the skies. That’s because, for several months, the consortium and the lenders, led by the SBI, were engaged in a tiff over the transfer of ownership after the lenders said the consortium had failed to meet all the conditions precedent mentioned in the plan. The conditions precedent included getting the AOC (air operator’s certificate), approval of the business plan from the Directorate General of Civil Aviation (DGCA) and the Ministry of Civil Aviation (MoCA), slot allotment approval, international traffic rights, and approval of the demerger of the ground handling business into Airjet Ground Services Ltd (AGSL), a subsidiary of Jet Airways AGSL.

“The intent of the IBC is expeditious resolution enabling companies to restructure and re-emerge after financial strife," says Satyendra Pandey, managing partner, aviation services firm AT-TV. “As such, timely resolution is critical in this case, due to a multitude of factors that has just not happened. Yet, over three years later, the revival of the airline (which is the core goal of the process) is still pending."

The relationship between the consortium and the lenders seemed on track until early 2022, after which it went sour. Among other issues were payment of dues and uncertainty over who pockets the income from the rental of an aircraft that Jet Airways owned. Later, the NCLAT directed the consortium to pay unpaid provident fund and gratuity dues of employees. The consortium will now have to cough up some Rs 200 crore additionally towards gratuity after the Supreme Court dismissed its appeal against the order.

“The process has not been straightforward and has had numerous twists and turns along the way," adds Pandey. “Compare this to US airline restructurings including bankruptcies where companies several times the size of Jet Airways are able to restructure and emerge in 14–20 months. Overall, this does not bode well for Indian aviation as it sets a reference point and precedent for future scenarios."

“This whole thing should have been closed a little earlier," adds Shivan of Dhanlaxmi Bank. As part of the tiff between the lenders and the consortium, last month, Chhawchharia had asked the airline to refrain from calling Kapoor its CEO and instead refer to him only as CEO-designate. In return, the consortium shot off a rebuttal. “I can only tell you there is no issue in this regard," Chhawchharia affirms.

Handy experience

In many ways, Chhawchaharia’s handling of the Jet Airways saga is also thanks to a deviation in the flight path he took early on in his career.

![]() Born to a family of professionals, especially chartered accountants, Chhawchharia’s tryst with the world of business began rather early. Post qualification, he began work at Arthur Andersen, which was then the world’s largest professional services firm. “We have our old family firm as well," Chhawchharia says. “So, I was trying to build out new services. Back in 2005, one of my clients here got an opportunity to acquire the business headquartered in the UK where I advised on the acquisition process."

Born to a family of professionals, especially chartered accountants, Chhawchharia’s tryst with the world of business began rather early. Post qualification, he began work at Arthur Andersen, which was then the world’s largest professional services firm. “We have our old family firm as well," Chhawchharia says. “So, I was trying to build out new services. Back in 2005, one of my clients here got an opportunity to acquire the business headquartered in the UK where I advised on the acquisition process."

That manufacturing company had operations across the globe, particularly US, Brazil, China, and Taiwan. Soon after, the management asked Chhawchharia to step in on a two-year deputation and move to the UK to help with the turnaround and integration of the business. The business, however, was under financial stress, even though it was doing well operationally. “My job was to turn the company around and integrate it into the owner’s business, which was also a global supplier," says Chhawchharia.

That opportunity meant that Chhawchharia suddenly found himself on the other side of the table, unlike his earlier stint as an advisor or a consultant. Within 18 months, Chhawchharia says, he turned around the fortunes and, in the process, also acquired more business. That tenure also gave him a very different lens on companies, operations, challenges as compared to, being an advisor, auditor, or risk advisor.

In 2010, Chhawchharia came back to India. But, staying away for more than half a decade from the world of consulting also meant that many of his peers were already ahead in their professional careers. In 2011, he joined Grant Thornton and started their eastern region practice. “I questioned myself on a couple of occasions at that time, that did I do the right things by taking up the UK deputation because out here in the professional services field, there was no real credit for that," Chhawchharia says.

But that stint also meant that Chhawchharia had first-hand experience in turning around distressed businesses, particularly from a financial and operational point of view. “I can certainly say that those years and that experience has helped me a lot, because now what we"re doing in terms of driving the restructuring, insolvency and turnaround practice, it’s nothing but revival, a turnaround of companies looking at businesses, financial status, and operational challenges," Chhawchharia says.

“So, I kind of feel happy that I did that and there are very few people in the professionals" services field who have that experience of being on the other side."

By 2016, Chhawchaharia also helped set up the restructuring and insolvency practice at GT when the new Insolvency and Bankruptcy Code (IBC) was being framed by the Indian government. Much of that was because of a belief by him and his firm that the new law could be potentially a large professional practice that requires credible service providers. “If you asked me six years ago, I didn’t have all the answers, but I raised my hand, took this as a challenge, and started with some small pilot assignments. Then the whole wave came with the Big 12 filings and since then we haven’t looked back."

Since then, Chhawchaharia says his company would have done more resolutions than many of its peers. He is currently the resolution professional in the Sintex-BAPL case.

Will Jet fly again soon?

Chhawchharia’s tenure as the resolution professional at Jet Airways now remains completed since the court approved the plan by the consortium.

“Technically, my role in Jet Airways is over as an RP," Chhawchharia says. As per the regulations, once the court approves the plan, the role of the RP is demitted. As defined in the plan, the monitoring committee takes over control of the company, making it a quasi-board. “I"m a member of that committee supporting the preservation of assets and assisting in the implementation process as per the approved plan," Chhawchharia adds.

The monitoring committee comprises seven members that include three nominated by the successful bidder, three by the financial creditors, and Chhawchharia. Now with the lenders challenging the decision by the NCLT to hand over the ownership of the airline to the successful bidder, Jet Airways’ plan to fly out this year will most likely be hit hard.

“The process has stretched on longer than what anyone would have expected," Chhawchharia says. “Various impediments have been cleared, including several legal challenges to the plan itself. But with the cooperation of the CoC members, the resolution plan was approved by them in October 2021 and thereafter approved by the NCLT on June 21. This wasn’t too bad in comparison to some of the other cases we read about, especially if you consider the peak period of the pandemic in between. The last 18 months or so in the implementation phase since the plan approval has been unanticipated."

But, even then, the delay will most certainly hit the credibility of the airline hard. Over the past few months, some of the hires by the company have either left or been sent on leave without pay. Among others, reports suggest that Nakul Tuteja, the vice president of human resources and administration, and HR Jagannath, the vice president of engineering, have left. Ronit Baugh, the head of communications, too left recently to join Air India. Additionally, the airline has also come under pressure from vendors with whom it had tied up for services including catering and call centre management.

“At the heart of the matter is whether a revived airline is better for their books as compared to a liquidation," adds Pandey. “And it seems much ambiguity prevails. Asset sales for Jet Airways, which include aircraft, parts and simulators are still not concluded. And in spite of an investor, a revived AOC, a management team and several letters of intent, numerous hurdles remain. Lenders seem to have lost faith in the ability of the revived Jet to generate sizeable returns. This too due to sizeable write-offs they have taken."

So, does he expect the airline to eventually take off? “My team and I have worked very hard and for a long time to make this happen," Chhawchharia says. “All the stakeholders are eager to complete this process at the earliest and the monitoring committee is doing its best to move to the best conclusion."

Chhawchharia has a lot at a stake with Jet Airways. And only once the airline takes to skies, he can finally breathe a sigh of relief.

Born to a family of professionals, especially chartered accountants, Chhawchharia’s tryst with the world of business began rather early. Post qualification, he began work at Arthur Andersen, which was then the world’s largest professional services firm. “We have our old family firm as well," Chhawchharia says. “So, I was trying to build out new services. Back in 2005, one of my clients here got an opportunity to acquire the business headquartered in the UK where I advised on the acquisition process."

Born to a family of professionals, especially chartered accountants, Chhawchharia’s tryst with the world of business began rather early. Post qualification, he began work at Arthur Andersen, which was then the world’s largest professional services firm. “We have our old family firm as well," Chhawchharia says. “So, I was trying to build out new services. Back in 2005, one of my clients here got an opportunity to acquire the business headquartered in the UK where I advised on the acquisition process."