Singh had also settled dues of some Rs2,200 crore that the airline owed in debts and built SpiceJet into India’s second-largest airline before a series of woes in the past few months pushed it into some serious turbulence. “You have to give him credit," says Jitender Bhargava, former executive director of Air India. “He prevented an imminent collapse. But the question is—is his aggressive growth strategy responsible for the travails of SpiceJet?"

Today, Singh, the wily businessman, has his back against the wall. A series of misfortunes, including the global ban on Boeing Max aircraft, that SpiceJet owned, and the Covid-19 pandemic meant that SpiceJet has been facing some serious headwinds. Apart from disgruntled employees, including pilots, who allege that their pay hasn’t been revised to pre-pandemic levels, the airline has also had to grapple with some safety incidents in the past few months.

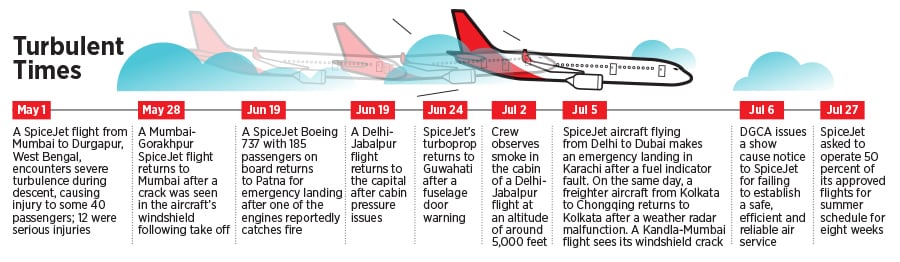

Between May and July, the airline saw nine incidents ranging from smoke in the cabin to the cracking of a windshield and emergency landing in Karachi, prompting India’s aviation regulator to ask the airline to fly at 50 percent of its approved flights for two months.

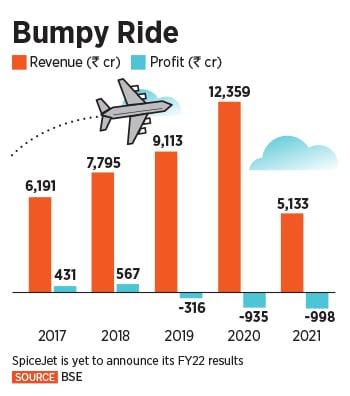

“SpiceJet finds itself with a fairly fragile balance sheet and this is reflected in delayed payments to suppliers, credit holds and mounting dues," says Satyendra Pandey, managing partner of aviation advisory firm AT-TV. “This despite significant scaling down of operations. Cargo has been a success story, but how that is leveraged towards restoring the core airline to profitability remains to be seen." As of 2021, SpiceJet had cash and cash equivalents of some Rs73 crore, while its total debt stands at over Rs9,700 crore.

![]()

That’s why Singh has swung into action quickly. On August 3, after months of turbulence, he offered a glimmer of hope after reports emerged that the airline was in talks with a Middle Eastern carrier for a partial stake sale. “The company continues to be in discussions with various investors to secure sustainable financing and will make appropriate disclosures in accordance with applicable regulations," says an airline spokesperson.

If the sale goes through, it will bring a much-needed equity infusion into the airline, and help it stabilise before preparing for its next leg of expansion at a time when the country’s domestic aviation market has seen new entrants, bringing about more competition. Singh is also relying on his plan to hive off a cargo business that he had built up in the past two years to bring cash on the table.

“The proposed hiving off of SpiceXpress is proceeding as per plan," says the airline spokesperson. “Separating the logistics business will result in a one-time gain of Rs2,555.77 crore, wiping out our substantial negative net worth. We are also working with our banks on government-backed schemes and will also be inducting additional Max aircraft into our fleet, which will provide us better cash liquidity and operational feasibility."

“Unlike the Wadias of GoFirst, who have the cash reserves, the question has always been about how Singh will bring in the cash needed to stabilise the airline," says an industry expert on condition of anonymity. “Nearly half of his shares are pledged. It’s like when a patient is in the ICU, you need to stabilise them before starting treatment. SpiceJet is in that situation now and a cash infusion is much-needed immediately."

What’s been going on at SpiceJet?

While the company hasn’t announced its financial results since the September-December quarter, a financial assessment of the airline in September 2021 by the Directorate General of Civil Aviation (DGCA) found that SpiceJet was operating on “cash and carry", and approved vendors were not being paid on regular basis leading to a shortage of spares and frequent invoking of minimum equipment list (MEL).

![]() The airline, however, says that it delayed announcing its results for the last fiscal after a ransomware attack on the company’s IT systems. “Our financial results for Q4 FY22 have been delayed due to reasons beyond the company’s control as a result of the ransomware attack that affected our IT systems, which includes certain data as well," says a SpiceJet spokesperson. “While we have our financials prepared pre-ransomware attack and now have also retrieved our systems and data, the auditors would require to re-authenticate whether those numbers remain intact from what they have audited, and the audit trails are maintained. This process is normal in such events."

The airline, however, says that it delayed announcing its results for the last fiscal after a ransomware attack on the company’s IT systems. “Our financial results for Q4 FY22 have been delayed due to reasons beyond the company’s control as a result of the ransomware attack that affected our IT systems, which includes certain data as well," says a SpiceJet spokesperson. “While we have our financials prepared pre-ransomware attack and now have also retrieved our systems and data, the auditors would require to re-authenticate whether those numbers remain intact from what they have audited, and the audit trails are maintained. This process is normal in such events."

On August 1 however, the airline said it struck a full and final settlement with the Airports Authority of India (AAI) and has cleared all outstanding principal dues of the airport operator.

“With this, SpiceJet will no longer remain on ‘cash and carry’ at AAI-run airports across the country and will revert to advance payment mechanism for daily flight operations," a statement from the company said. “SpiceJet’s ability to clear the pending dues reflects the airline’s improved cash flow in recent times."

For a few months now, the airline has been in the eye of a storm, largely due to safety-related incidents. In early May, a SpiceJet aircraft from Mumbai to Durgapur in West Bengal ran into severe turbulence. Videos from inside the cabin went viral on social media, and it soon came to light that two people were taken to the ICU after the plane landed while 12 others were injured in the mid-air chaos.

The captain, first officer and crew were immediately de-rostered and the country’s aviation watchdog also deputed a multidisciplinary team to carry out regulatory investigation in addition to suspending a maintenance engineer who had allowed the damaged aircraft to soon take off from Durgapur to Kolkata despite the incident.

“We must remember that a pilot, at any critical juncture, will use all his life’s learnings to overcome a situation," says a senior pilot with SpiceJet on condition of anonymity. “This seems to be a case where the radar wasn’t functioning properly, the signal was weak, and the pilots decided to go ahead and got caught in turbulence. My sense is if the airline had enough financial might, and its checks and balances were really in place, the situation would never have arisen."

![]() SpiceJet has denied the allegation. “The investigation report of the said case has been submitted to the regulator. No such findings of an unserviceable weather radar were deduced. The aircraft, in fact, had already operated four sectors prior to the incident on May 1," a SpiceJet spokesperson tells Forbes India.

SpiceJet has denied the allegation. “The investigation report of the said case has been submitted to the regulator. No such findings of an unserviceable weather radar were deduced. The aircraft, in fact, had already operated four sectors prior to the incident on May 1," a SpiceJet spokesperson tells Forbes India.

However, the May incident seems only like the top of the iceberg. Over the next two months—in June and July—the airline that was once on the verge of shutting down in 2014 saw nine worrisome incidents.

“On a number of occasions, the aircraft either turned back to its originating station or continued landing to the destination with degraded safety margins," DGCA said in a show cause notice to SpiceJet on July 5. “There is poor internal safety oversight and inadequate maintenance actions, which have resulted in degradation of the safety margins."

The airline maintains that its airlines are safe. “None other than the civil aviation ministry told Parliament on July 25 and August 1 that SpiceJet planes were absolutely safe," emphasises the SpiceJet spokesperson. “A series of spot checks were carried out recently on all operating aircraft of M/s Spicejet from July 9 to 13. A total of 53 spot checks were carried out on 48 aircraft which did not find any major significant finding or safety violation," the aviation ministry told Rajya Sabha in a reply to a question last week.

Despite that, an air of concern still looms over the airline. According to a report by Local Circles, a community-based social media platform that surveyed 45,000 users, 44 percent of the respondents travelling on domestic routes said they were avoiding SpiceJet flights over safety concerns while 21 percent each were avoiding IndiGo and Air India. “Low-cost airlines by definition try to cut costs wherever they can," says Shukor Yusof, founder, and analyst of Malaysia-based aviation consultancy firm Endau Analytics. “It"s not just in India, it"s everywhere. A company like SpiceJet is looking at the losses that they"ve incurred over the last two years. It’s up to the DGCA to be more assertive."

“When safety issues start coming up, it’s clear that an aircraft is cutting costs," says an industry expert. “The other problem is that all the management power rests with one individual and there is only one decision-maker in Ajay Singh. Add to that, the industry is not getting any easier with competition and rising costs. All that means SpiceJet’s woes aren’t going to go away soon unless the promoter can manage some equity infusion."

The Turnaround Man

For Singh, the ongoing crisis at SpiceJet isn’t something he isn’t familiar with. After all, he has a reputation for turning things around.

As a young, 30-something MBA graduate from Cornell University, Singh started as a director of the Delhi Transport Corporation (DTC) which had been running heavy losses in 1995. He was instrumental in turning around the fortunes of the public transport company before going to work as advisor to the late Pramod Mahajan, India’s telecommunication minister.

“The successful turnaround of loss-making DTC in 1996, the overhaul of Doordarshan and launch of DD Sports and DD News as independent channels, and the National Telecom Policy and Information Technology Act, which led to a reduction in the cost of mobile calls and revolution in the telecom and IT industries in India all had Mr Singh’s footprint," says an airline spokesperson.

SpiceJet started as a low-cost airline in 2005 after Singh and London-based Bhulo Kansagra joined hands to purchase a defunct airline that was registered between the SK Modi group and Lufthansa group. The airline, ModiLuft, had all the necessary flying licences in place, and the duo renamed the company SpiceJet. Singh invested Rs10 crore and upon starting, operations offered tickets at a base price of Rs99. By 2010, when Singh decided to leave SpiceJet, the company had more than Rs800 crore in cash reserves.

In 2014, Singh made a comeback to the airline. SpiceJet, then owned by Tamil Nadu-based billionaire Kalanithi Maran, had to shut operations after debt spiralled out of control. Singh stepped in, bought the controlling stake, and turned in 18 consecutive months of profits. “You know, when I took over SpiceJet, people told me, ‘you"re completely nuts, you’re crazy… this is impossible, it’s never been done anywhere in the world’," Singh told Forbes India in October 2020. “For me, it was easier to revive something than to set it up again. It’s all about a never-say-die attitude."

After settling all its dues, the airline went on to place a record order of 205 aircraft for a staggering $22 billion from American aircraft manufacturer Boeing and seemed well on course to challenge the country’s largest airline by market share, IndiGo, in one of the world’s largest aviation markets.

But by 2019, SpiceJet’s Max aircraft were grounded in line with global norms after more than 300 people died in two fatal air crashes—in Indonesia and Ethiopia—leading to scrutiny of the American aircraft maker’s business practices. The Federal Aviation Administration, US’s civil aviation regulator, subsequently sought changes to the aircraft, updating its software, wiring and crew procedures before it could fly. The aircraft only took to the skies in November 2021.

Then, even as Covid-19 hit and the airline industry came to a standstill, Singh turned his airline business into a cargo one, and by his own admission, there wasn’t a single day when SpiceJet didn’t operate. SpiceJet’s aircraft were engaged in transporting medicines, personal protection equipment kits and farm produces. In fact, Singh claims, his airline was the first to approach the government to allow carrying cargo, specifically medical equipment and medicines, on passenger seats.

Newer Avenues

That also led him to build up a subsidiary—SpiceXpress—that remained the company’s mainstay during the pandemic, offsetting losses from the passenger airline business. “We have to look at Singh’s decision-making over the past few years," says Bhargava. “If you recall when Jet Airways folded, he was the first to take away their aircraft and slots. When you are in a competitive environment and you are the first mover, you are a gainer. Then Covid came. He was the first who bought into the cargo business. Which means you have a track record of making correct decisions."

That also raises the question of whether the airline is extremely dependent on Singh. “If you bring specialists and experts from outside, say, for instance, at Air India where Campbell Wilson has come," Yusuf explains, “he"s not going to be on his own, he"s going to put into place people in his team, in his management, who will expand, develop and improve the overall management capabilities."

India’s airline industry has slowly swung back to normalcy with domestic traffic growing nearly three times in June compared to the year-ago period. That number was only 12 percent lower than the pre-Covid figure. In addition, two new airlines will soon take to the skies intensifying competition in the sector. India will require 2,210 new aircraft over the next 20 years, according to Airbus, with the country’s passenger traffic expected to grow at 6.2 percent per annum by 2040, the fastest among major economies.

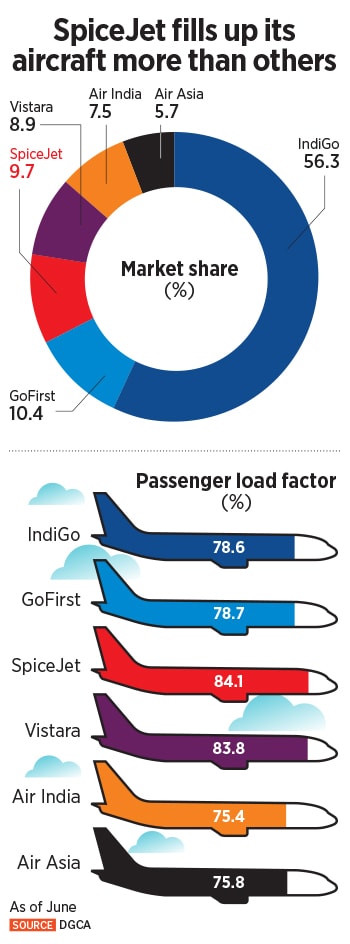

“India is a challenging market for every airline because we are a price-sensitive market," adds Bhargava. “Capacity is being regularly added, and fares are generally below the cost of producing a seat. If you look at the last five years, SpiceJet on most occasions has had the highest occupancy factor, which means that you are being able to fill up seats, and people are patronising the airline. Yet, when you still do not break even or accumulate amassed reserve, it reflects on the domestic market situation."

SpiceJet claims to have had the highest load factor in 84 out of the past 85 months. “Our revenues vis-a-vis our operating fleet are very healthy and SpiceJet has continuously outperformed the market and maintained leadership in passenger RASK among listed Indian peers," says the airline spokesperson.

“So, the question is, has the market, SpiceJet’s performance, and the leadership come together for SpiceJet?" asks Bhargava. “Maybe not. Or is it on a standalone basis that you have the over-ambitiousness of Ajay Singh to be responsible? When you grow an airline, it must be calibrated growth. You can"t induct a large chunk of his craft in one go, diluting the yield, because that’s what has happened."

So, what’s SpiceJet’s plan despite all the turbulence? “Between now and the next calendar year, SpiceJet will induct more than 20 new Max planes into its fleet," the spokesperson adds. “In addition, the airline will be inducting a substantial number of freighters. The domestic and international expansion is as per the long-term plan and a continuous process." In addition, the company also expect substantial growth opportunities once it hives off its logistics business.

“The transfer of business to SpiceXpress will allow the new company to rapidly grow its innovative logistics platform and its unique fulfilment as a service business model," the spokesperson says. “We are confident that the performance of SpiceXpress as an independent entity will leverage and unlock significant value for SpiceJet and all its shareholders."

All that means is that despite all the headwinds, Singh seems on track to pull SpiceJet out of turbulence. He has done it once in the past. And he clearly has the expertise to do it again now.

The airline, however, says that it delayed announcing its results for the last fiscal after a ransomware attack on the company’s IT systems. “Our financial results for Q4 FY22 have been delayed due to reasons beyond the company’s control as a result of the ransomware attack that affected our IT systems, which includes certain data as well," says a SpiceJet spokesperson. “While we have our financials prepared pre-ransomware attack and now have also retrieved our systems and data, the auditors would require to re-authenticate whether those numbers remain intact from what they have audited, and the audit trails are maintained. This process is normal in such events."

The airline, however, says that it delayed announcing its results for the last fiscal after a ransomware attack on the company’s IT systems. “Our financial results for Q4 FY22 have been delayed due to reasons beyond the company’s control as a result of the ransomware attack that affected our IT systems, which includes certain data as well," says a SpiceJet spokesperson. “While we have our financials prepared pre-ransomware attack and now have also retrieved our systems and data, the auditors would require to re-authenticate whether those numbers remain intact from what they have audited, and the audit trails are maintained. This process is normal in such events." SpiceJet has denied the allegation. “The investigation report of the said case has been submitted to the regulator. No such findings of an unserviceable weather radar were deduced. The aircraft, in fact, had already operated four sectors prior to the incident on May 1," a SpiceJet spokesperson tells Forbes India.

SpiceJet has denied the allegation. “The investigation report of the said case has been submitted to the regulator. No such findings of an unserviceable weather radar were deduced. The aircraft, in fact, had already operated four sectors prior to the incident on May 1," a SpiceJet spokesperson tells Forbes India.