There were eight contenders in the fray. And with most of them having a hefty background in hospitality, it was supposed to be a close call. The winner, though, was a Noida-based company, which reportedly paid Rs300 crore and bought Viceroy Bangalore Hotels, which owns the Marriott-managed five-star Renaissance Bengaluru Race Course Hotel, and was in debt of Rs1,100 crore.

Back in December 2022, Radisson Hotel Group inked a deal with an FMCG company from Uttar Pradesh to bring two of the properties it owned—Namah Resort in Jim Corbett, and The Manu Maharani in Nainital—under its portfolio of brands. In 2014, the homegrown FMCG major had joined hands to open Radisson Blu Hotel in Guwahati.

Meanwhile, in 1987, a small family-owned business in North India—which traces its origin to 1929 when it set up a small perfumery shop in Chandni Chowk, Delhi—was making its debut into foods and beverages by rolling out the ‘Catch’ brand of salt and pepper sprinklers. The launch was followed by an introduction of a range of spices, pastes and grinders. Over a decade later, the same company started selling beverages—Catch Natural Spring, mixers, clear flavoured water, soft drinks and juice beverages.

![]()

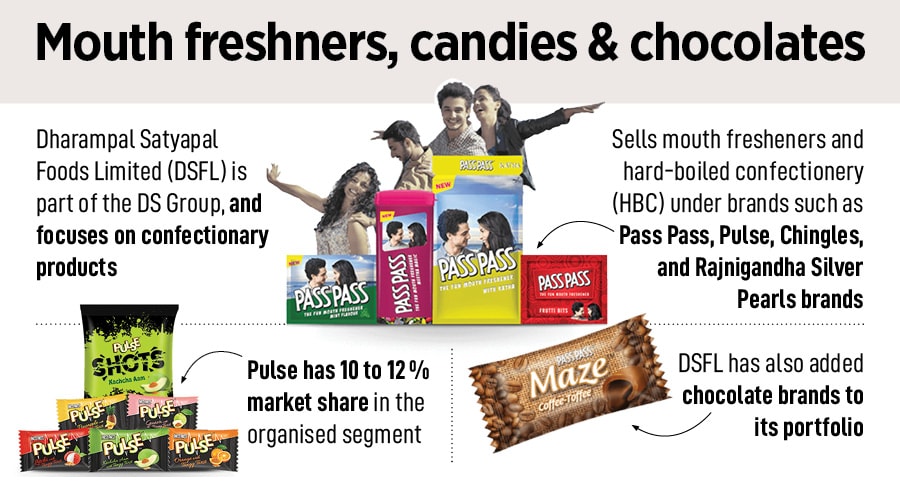

Two-and-a-half decades later, an upstart dairy brand from the cowbelt was getting ready to take the fight to Goliaths, Amul and Mother Dairy, by rolling out a premium milk brand Ksheer. The challenger brand had also lined up aggressive plans to launch flavoured milk and dairy whitener over the next few months. Two years later, in 2015, the same dairy company tried its luck in the hard-boiled candy (HBC) market with its brand Pulse.

![]()

Fast forward to February 2023. Là¤derach, a luxury Swiss chocolate brand founded in 1962, announced that it was joining hands with an Indian partner—which owned gourmet food retailer Le Marche—to launch the brand in India. Four months later, the Indian partner makes its biggest and boldest bet in the confectionery market by buying The Good Stuff company, makers of LuvIT chocolate and confectionery brand which is estimated to be over Rs90 crore. “We have been increasing our presence in the confectionary segment. With LuvIt, we will now enter the chocolate segment," says Rajiv Kumar, vice chairman of Dharampal Satyapal (DS) Group, which operates across the hospitality, confectionery, luxury retail, food and beverages, FMCG, pan masala and tobacco markets.

![]()

DS Group is the same conglomerate which bought Viceroy Bangalore Hotels, stitched a partnership with Radisson Hotel, owns dairy brand Ksheer, has a presence in salt, spices and pepper sprinklers with Catch and Kewal, and is the biggest player in the hard-boiled candy market with Pulse. With the acquisition of LuvIt, the DS Group will have to take on big boys such as Cadbury and Dairy Milk to make a dent in the world of chocolates.

Kumar explains the audacious gambit. The Indian confectionary market, he underlines, is valued at approximately Rs23,000 crore, and chocolates make up almost 60 percent of it. The per capita consumption of chocolates in India is far lower than the global standards—140 grams per year in India as against 10 kg per year in the UK—and there is a huge opportunity in this segment. “We hope to make LuvIt a Rs500-crore brand over the next three to five years," he says, adding that LuvIt will benefit from the expansive distribution network of DS Group, which has over 3,000 dealers and seven lakh retailers across India.

![]()

SWEET INTENT, BITTER REALITY

Notwithstanding an aggressive diversification gambit by DS Group over the last few decades, and Kumar’s intent to accelerate the pace of confectionery play, the conglomerate is confronted with a bitter reality. To understand it, we need to have a close look at the way the DS Group, which has an estimated Rs5,500 crore in revenue, is structured.

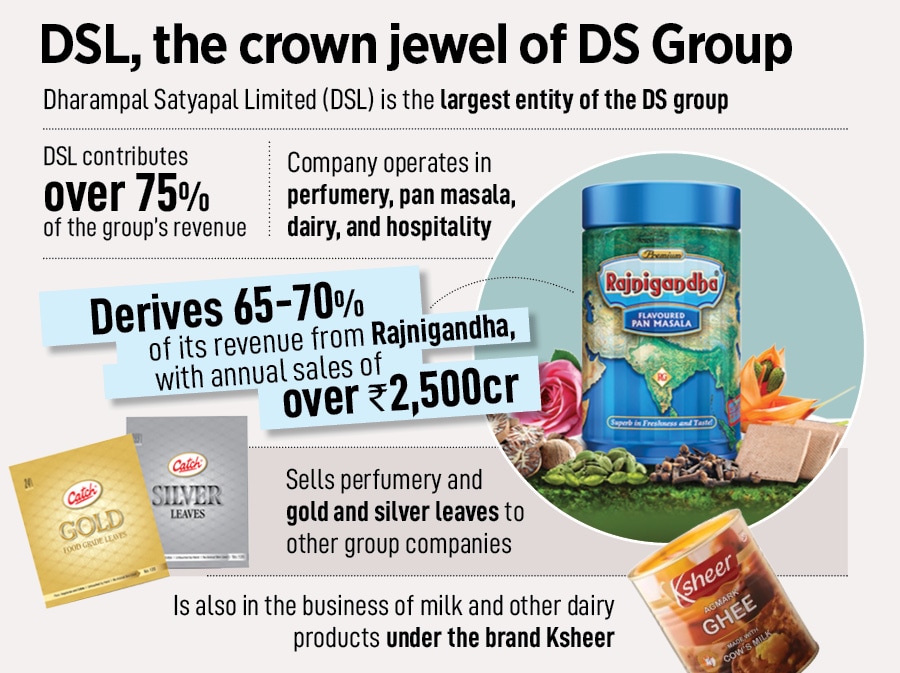

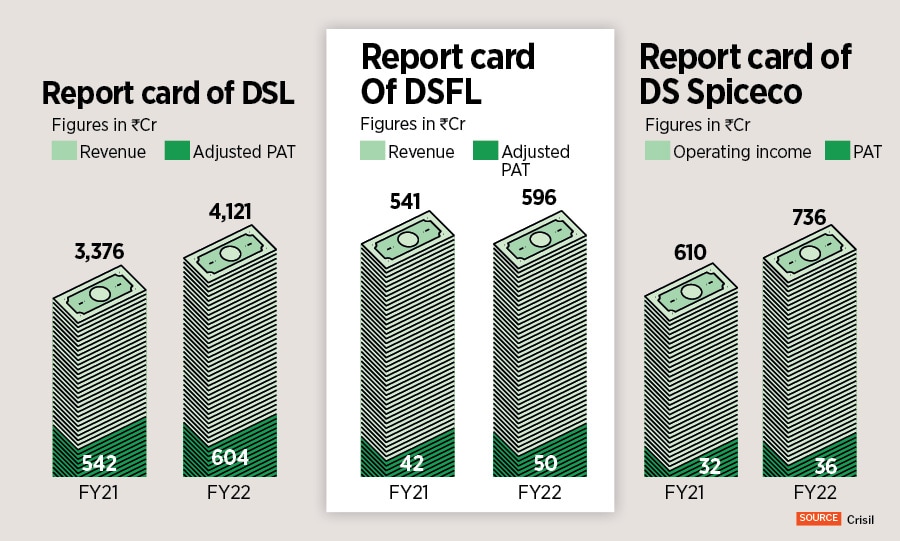

![]() Dharampal Satyapal Limited (DSL) happens to be the biggest entity within the DS Group. With operations in perfumery, pan masala, dairy and hospitality, DSL posted a revenue of Rs4,121 crore and an adjusted PAT (profit after tax) of Rs604 in FY22. While DSL contributes over 75 percent to the group’s revenue, it gets over 70 percent of its sales from pan masala brand Rajnigandha, according to a recent rating report by Crisil.

Dharampal Satyapal Limited (DSL) happens to be the biggest entity within the DS Group. With operations in perfumery, pan masala, dairy and hospitality, DSL posted a revenue of Rs4,121 crore and an adjusted PAT (profit after tax) of Rs604 in FY22. While DSL contributes over 75 percent to the group’s revenue, it gets over 70 percent of its sales from pan masala brand Rajnigandha, according to a recent rating report by Crisil.

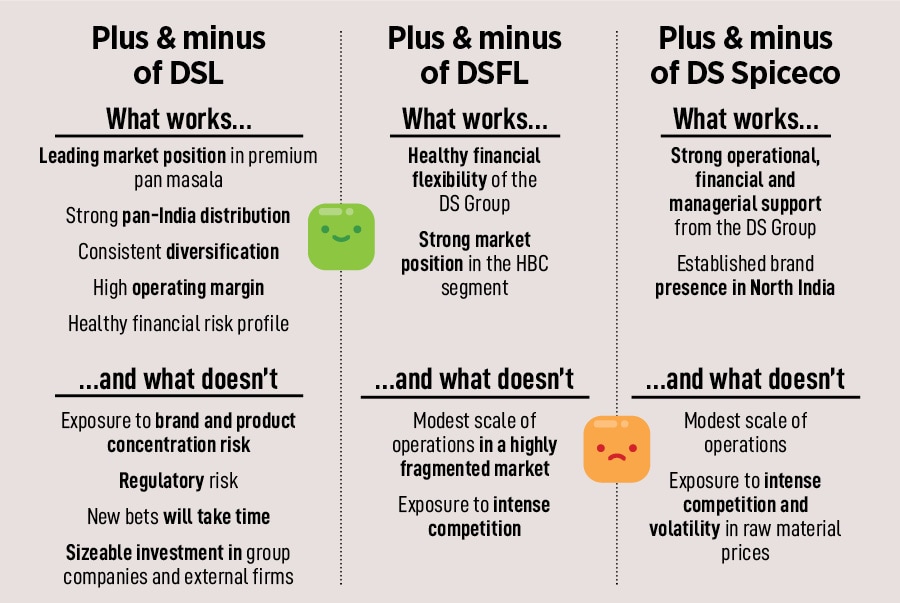

The credit rating agency explains what has worked for the group. First is its leading market position in the premium pan masala market. In the tobacco and pan masala business for over 80 years—the group rolled out India’s first branded chewing tobacco brand BABA in 1963—the flagship brand Rajnigandha commands 65 to 70 percent market share. In fact, the group has recently rolled out Mastaba, a mass market pan masala brand.

The second big plus for the group has been its retail footprint. Its network consists of 3,000 dealers and seven lakh retailers across the country. And it is this funnel which the DS Group has been using to push a range of its confectionery brands such as Pulse, Catch, Pass Pass and Chingles.

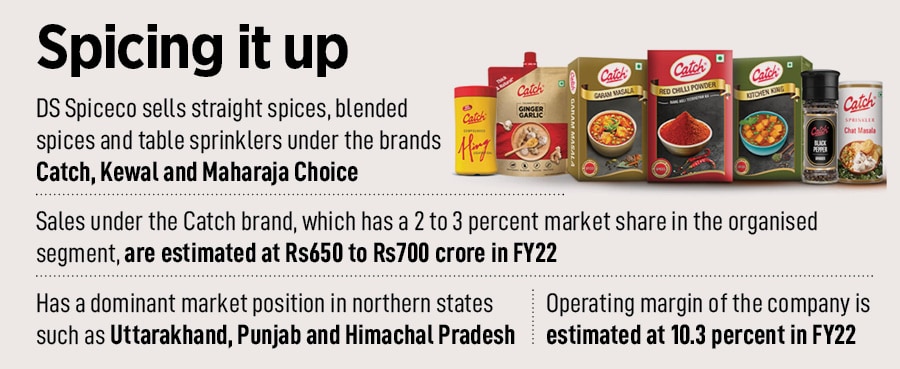

The second big component of the DS Group is DS Spiceco. With operations in straight spices, blended spices and table sprinklers under the brands Catch, Kewal and Maharaja Choice, Spiceco has a dominant market position across a bunch of northern states such as Uttarakhand, Punjab and Himachal Pradesh. The revenue of Spiceco has seen a decent growth over the last two years—from Rs610 crore in FY21 to Rs736 crore in FY22. The third company in the DS Group pecking order is Dharampal Satyapal Foods Limited (DSFL), which focuses on confectionary products. The company sells mouth fresheners and HBC under brands such as Pass Pass, Pulse, Chingles, and Rajnigandha Silver Pearls brands.

Industry analysts and FMCG experts explain why DS Group’s diversification drive into non-tobacco and non-pan masala FMCG is not likely to make a serious dent. “The fault lies in the structure," says Rajan Gahlot, assistant professor at the University of Delhi. As long as Rajnigandha aggressively continues to drive the growth and profits, there would be less incentive to make other verticals grow at a furious pace. Take, for instance, Catch. The brand was rolled out in 1987, and even after three-and-a-half decades, it is not among the top five in its category. “It has nothing to do with the quality, but everything to do with the way it has been handled," he reckons.

![]()

CATCH-22 & WHAT TO DO?

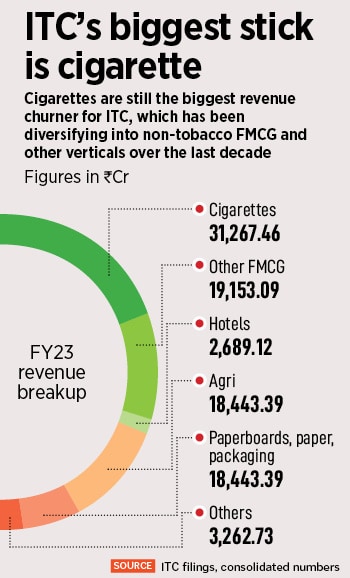

DS Group, Gahlot underlines, is not alone in facing a dilemma of chasing pan masala and tobacco versus pushing other FMCG verticals. Look at ITC. With a contribution of Rs31,267.46 crore, cigarettes still formed the biggest chunk of its revenue in FY23. It’s not that ITC has been slow in pushing non-tobacco products and brands. The margins and nature of the product—cigarette—are such that it will take years for other siblings in the group to overtake the big brother. Add loads of regulatory uncertainties and risk in the pan masala and tobacco market, and you will get to see the cruel dilemma of players like DS. If they don’t diversify, they are doomed. And if they diversify at a slow pace, they are equally doomed. “It’s a Catch-22 situation for them," says Gahlot, pointing out another grim reality. All new ventures will take years to show results. “There would be no hockey-stick growth, and expecting a pan masala kind of growth would be unrealistic," he adds.

![]()

Another problem for the DS Group in its effort to morph into a serious FMCG player lies in the nature of non-pan masala and non-tobacco segments. Take, for instance, confectionery. There is a huge unorganised, unbranded market across the country, and in the branded play, DS Group is pitted against biggies such as Perfetti Van Melle. In chocolates as well, there are monstrous rivals in Mondelez and Nestle. “It’s not easy to take market share from the big boys who have lorded for years," says Gahlot.

![]()

If intense competition is an issue, then lack of brand building is an equally serious roadblock hampering growth. The beverage, confectionery and other FMCG brands under the stable never got enough advertising and marketing push. “Where do you get to see dairy brand Ksheer?" asks Ashita Aggarwal, professor of marketing at SP Jain Institute of Management and Research. The group, she reckons, has to start behaving like an FMCG company. The small-ticket items in the confectionery segment have to be fanned out across the country with ample advertising and marketing support. “It’s a volume game, and it will take time. One should not be in the game only for the sake of being in it," she says. If the group seriously wants to de-risk itself from pan masala and tobacco, then it has to rejig its FMCG strategy.

![]() The biggest issue, though, affecting the transformation is something that has made the group: Pan masala and tobacco. The lucrative nature of the business, the hesitancy on the part of the government to clamp down on tobacco and liquor products due to their high contribution to the tax kitty, and the inability to play the new game—read non-FMCG—with a high sense of urgency might haunt the legacy tobacco and liquor players, says an FMCG analyst with one of the top brokerage houses. You can definitely be an FMCG and cigarette or liquor conglomerate, but then you will be biased towards the categories which will give you the most and easy money, he says, requesting not to be named.

The biggest issue, though, affecting the transformation is something that has made the group: Pan masala and tobacco. The lucrative nature of the business, the hesitancy on the part of the government to clamp down on tobacco and liquor products due to their high contribution to the tax kitty, and the inability to play the new game—read non-FMCG—with a high sense of urgency might haunt the legacy tobacco and liquor players, says an FMCG analyst with one of the top brokerage houses. You can definitely be an FMCG and cigarette or liquor conglomerate, but then you will be biased towards the categories which will give you the most and easy money, he says, requesting not to be named.

Kumar, for his part, underlines that the group is firmly on its track to beef up its FMCG play. “FMCG is the biggest business for the DS Group and contributes 80 percent to the turnover," he proudly claims. Kumar, though, declines to share the financials and give a break-up of what percent of FMCG revenue comes from pan masala and tobacco. But if Kumar has to seriously proclaim itself as an FMCG player, then the share of pan masala and tobacco has to progressively come down and non-FMCG play has to make a massive dent. Till then, just like the name of the salt brand, DS Group has to live with a Catch-22 situation.

Dharampal Satyapal Limited (DSL) happens to be the biggest entity within the DS Group. With operations in perfumery, pan masala, dairy and hospitality, DSL posted a revenue of Rs4,121 crore and an adjusted PAT (profit after tax) of Rs604 in FY22. While DSL contributes over 75 percent to the group’s revenue, it gets over 70 percent of its sales from pan masala brand Rajnigandha, according to a recent rating report by Crisil.

Dharampal Satyapal Limited (DSL) happens to be the biggest entity within the DS Group. With operations in perfumery, pan masala, dairy and hospitality, DSL posted a revenue of Rs4,121 crore and an adjusted PAT (profit after tax) of Rs604 in FY22. While DSL contributes over 75 percent to the group’s revenue, it gets over 70 percent of its sales from pan masala brand Rajnigandha, according to a recent rating report by Crisil.

The biggest issue, though, affecting the transformation is something that has made the group: Pan masala and tobacco. The lucrative nature of the business, the hesitancy on the part of the government to clamp down on tobacco and liquor products due to their high contribution to the tax kitty, and the inability to play the new game—read non-FMCG—with a high sense of urgency might haunt the legacy tobacco and liquor players, says an FMCG analyst with one of the top brokerage houses. You can definitely be an FMCG and cigarette or liquor conglomerate, but then you will be biased towards the categories which will give you the most and easy money, he says, requesting not to be named.

The biggest issue, though, affecting the transformation is something that has made the group: Pan masala and tobacco. The lucrative nature of the business, the hesitancy on the part of the government to clamp down on tobacco and liquor products due to their high contribution to the tax kitty, and the inability to play the new game—read non-FMCG—with a high sense of urgency might haunt the legacy tobacco and liquor players, says an FMCG analyst with one of the top brokerage houses. You can definitely be an FMCG and cigarette or liquor conglomerate, but then you will be biased towards the categories which will give you the most and easy money, he says, requesting not to be named.