All kinds of tech companies witnessed a hockey-stick uptick in business at the onset of the pandemic. The reason was that with the offline world being hurled into a vortex of unpredictability with restrictions and lockdowns, many people’s tech inhibitions evaporated as they got accustomed to buying and selling on smartphones.

“Now let me tell you something that is not so simple," says Kuhar, who was born and brought up in Sonipat, some 90 kilometres from North India’s tech and IT hub of Gurguram in Haryana.

On a sultry afternoon, Kuhar is out to sell insurance. The agent navigates tedious dusty stretches, some concrete roads and an expansive belt of farmlands on his old bike to reach Guhna village in Sonipat. Mahender Deswal, one of the farmers keen to buy life insurance, greets him with a warm smile at a small kirana store. “Simple, lassi pi le (have a bottle of lassi)," says Deswal, who opens his smartphone, scans the QR code and makes the payment. “Samsung kab khareeda (when did you buy a Samsung handset)," Kuhar asks out of curiosity. “Sale tha Republic Day pe. Flipkart se liya (bought it from Flipkart on the Republic Day Sale)," replies the farmer. Over the next hour or so, Deswal asks a raft of questions around policies. “Iski gardan pakdunga agar gadbad hua to (will grab his neck if something goes wrong)," smiles the farmer, who decides to buy a life insurance cover for his family.

Some 1,200 kilometres from Sonipat is Choti Ballia village in Begusarai, Bihar. Ankit Agrawal, whose father happened to be the first person from his village to study in Mumbai, went to his birthplace to attend a family function in February 2012. While everybody was enjoying the folk music and immersed in dance, Agrawal was busy with his annual ritual of making his father understand the need to move beyond the ‘agent uncle’ who was almost part of the family and conspicuously spotted during every family gathering.

![]()

“You still pay a premium through him," asked the commerce grad from Kolkata, who completed his MBA in finance from University of Delhi, and had been working with UBS in New York since September 2009. “It’s about trust," replied his dad. “He didn’t sell me a policy. He sold me a promise, and I get to see him regularly. So it’s reassuring," replied his dad, who was a loyal customer of Life Insurance Corporation (LIC).

![]()

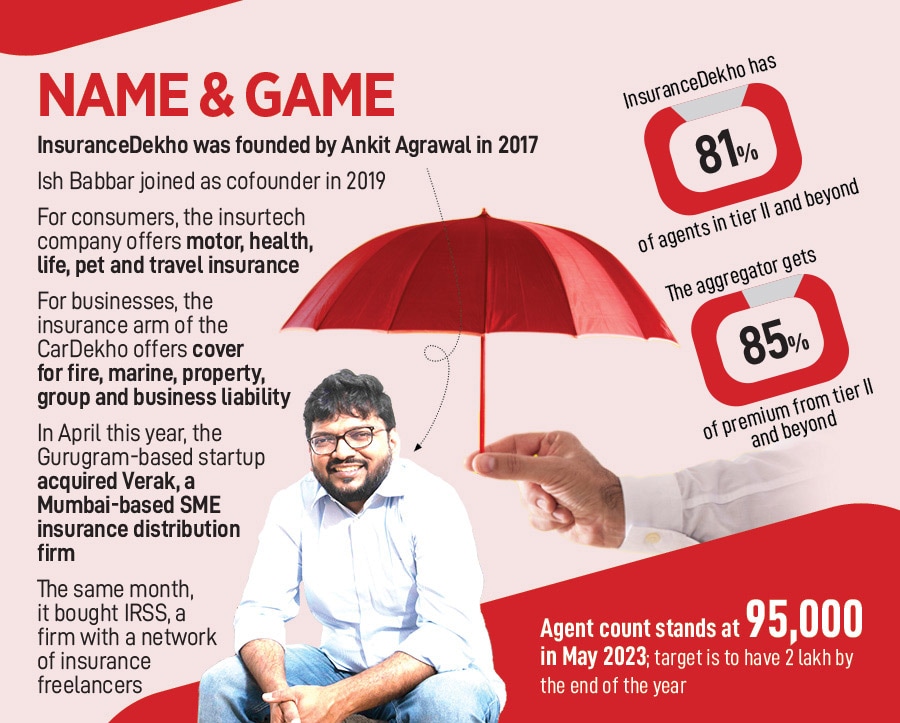

A decade later in Gurugram, Agrawal talks about the power of artificial intelligence (AI), the magic of machine learning (ML), and the simplicity of human behaviour. “One doesn’t need AI and ML to solve basic problems surrounding us," says the founder and CEO of InsuranceDekho, who travelled extensively across smaller towns and villages across Haryana and Rajasthan, met over 3,000 insurance agents there, and decided to take the plunge into the world of insurance in 2017 by co-founding InsuranceDekho along with Ish Babbar. “We were the sixth player to enter the market," recalls the entrepreneur who is infamous among his friends for being conventional in his approach. “They used to call me pagal bihari," smiles Agrawal, who had quit his job at investment banking company UBS, taken a salary cut of over 40 percent and had relocated to Bengaluru to join a startup in August 2013 in order to test his aptitude for a startup life.

![]()

Agrawal was getting into the business of insurtech by using the best of the offline (insurance agents) and the online world (technology). “I wanted to empty the bag of an insurance agent," he says. Traditionally, he lets on, agents used to arm themselves with a calculator, a notebook and voluminous documents of a battery of insurance companies. “I wanted to clear their bags, and arm themselves with just a smartphone and an app," he says.

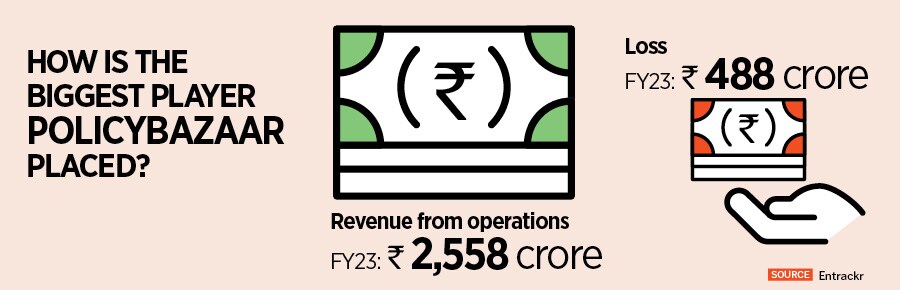

The idea was ridiculed by industry analysts, rivals and naysayers. They too had their reasons to be sceptical. Founded in 2008, PolicyBazaar had been selling insurance online and had emerged as the biggest aggregator by 2017. There were a clutch of other online players such as Coverfox who had a sizable lead over InsuranceDekho.

“You are trading on a sure-shot policy of disaster," taunted many, who were aghast with the strategy of using agents to sell policies. “Are you trying to become LIC?" was the other question asked to the greenhorn founder who was convinced about his methods. In Bharat, he tried to reason, financial services and insurance are going to be completely offline for at least next 10-20 years. “While the payment mode will be online like a QR code or Unified Payments Interface (UPI), insurance policies will need hand holding, trust, and education. “First stage will be the agent, and then tech will take over," he argued.

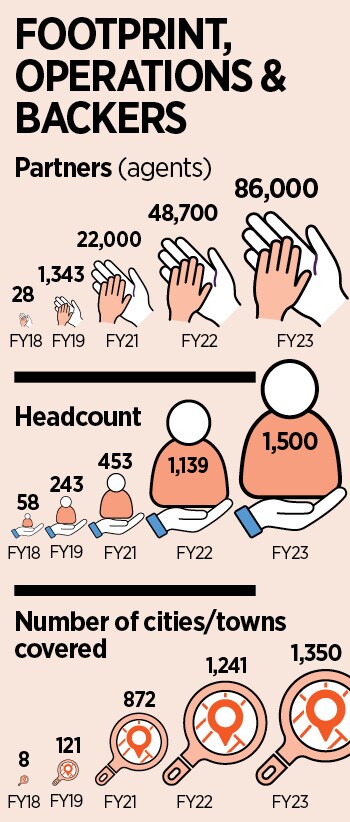

In 2017, the ‘pagal Bihari’ was ready to prove that there was a method in his madness. He built an army of agents, over 90 percent were selling insurance for the first time. He started small. In FY18, the agent count was 28, the next fiscal it increased to 1,343, and then jumped to 22,000 in FY21. Over the next two fiscal years, the number swelled further: From 48,700 to 86,000 in FY22 and FY23, respectively. During the same period, InsuranceDekho expanded its reach from eight cities in FY18 to 1,350 small towns, villages and cities in FY23.

![]()

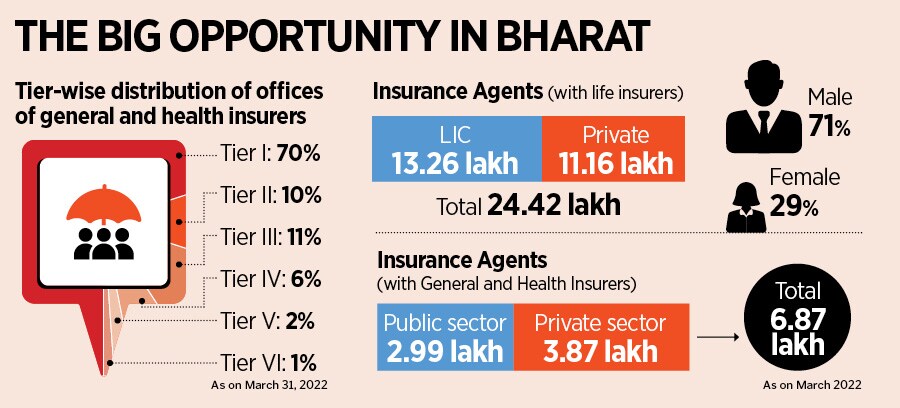

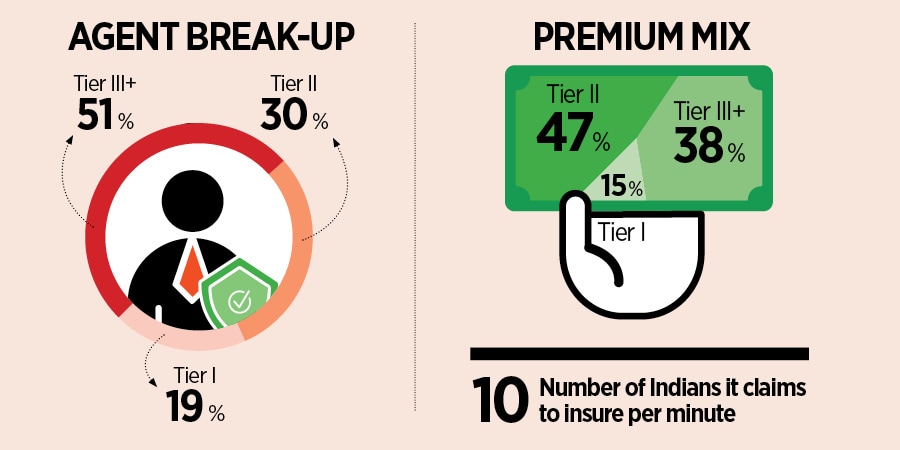

A further deep-dive into the data helps in decoding Agrawal’s “method". The founder had placed 51 percent of agents in Tier III, and another 30 percent in tier II cities. In terms of premium collected, the respective percent stands at 47 percent and 38 percent (see above box).

![]()

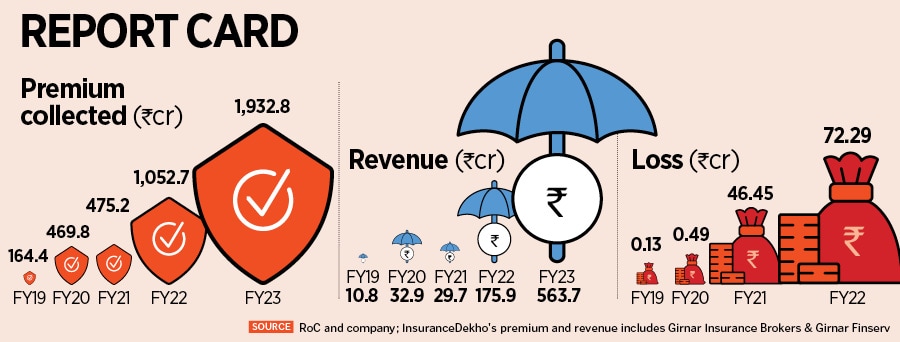

When the dynamics is viewed from the lens of revenue, the math works out the way it was designed. From a meagre revenue of Rs10.8 crore in FY18, the numbers have leapfrogged to Rs563.7 crore in FY23. Though the bottomline has slipped from a profit of Rs13 lakh in FY18 to a loss of Rs72.29 crore in FY22, Agrawal claims that the FY23 loss numbers are lower than the last fiscal. “We are expecting to become profitable by FY24," he says.

![]()

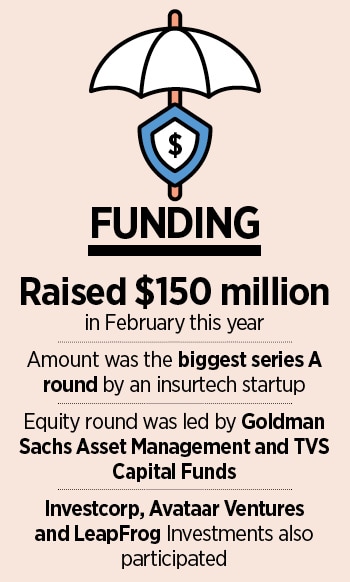

In February this year, he adds, InsuranceDekho raised an institutional round of $150 million. The biggest Series-A round by an insurtech startup in India added a marquee list of funders to its name: Goldman Sachs Asset Management, TVS Capital Funds, Investcorp, Avataar Ventures and LeapFrog Investments.

![]()

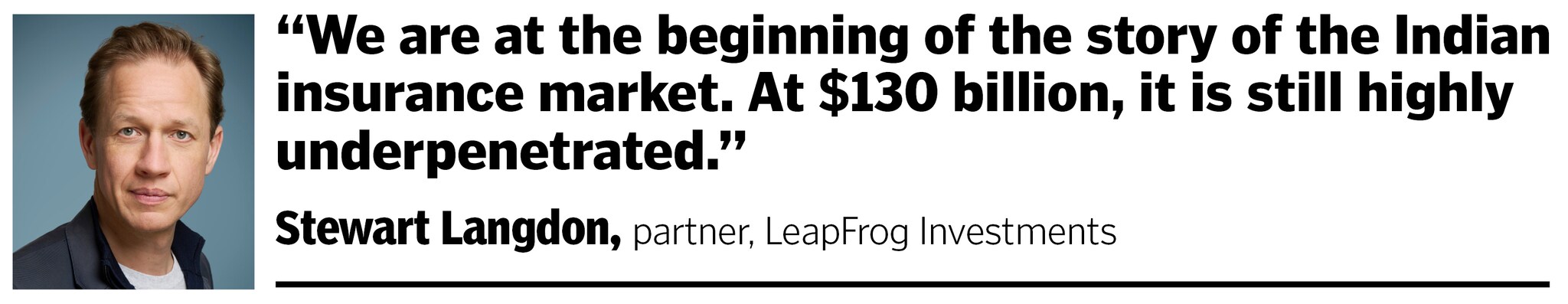

The backers are delighted with the progress made by InsuranceDekho. “We are at the beginning of the story of the Indian insurance market. At $130 billion, it is still highly underpenetrated," says Stewart Langdon, partner at LeapFrog Investments.

![]()

InsuranceDekho, the venture capitalist reckons, is doing something differentiated by creating a digital platform that puts the customers’ interests at the centre of the process. “For years, all of these agents simply flogged one company’s products regardless of the customer’s needs," he maintains.

InsuranceDekho, in contrast, put the shoe on the other foot by allowing the agents to offer products from the entire market. “InsuranceDekho has built a model that works for the customers of Tier II, III and IV, where 83 percent of our customers live and where the big Indian consumer opportunity resides," he adds.

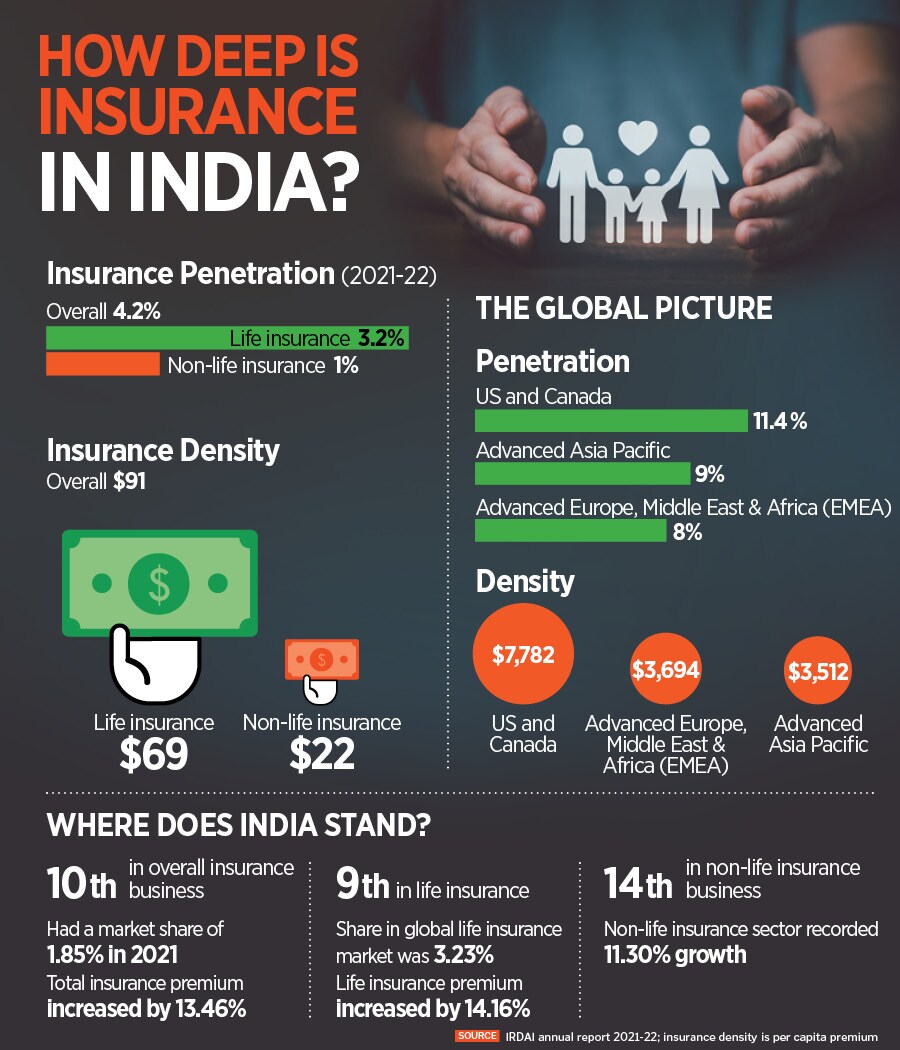

![]() The insurance opportunity in India is massive. The overall insurance penetration in India stands at 4.2 percent. The equivalent number for life and non-life stand at 3.2 percent and 1 percent, respectively. When one looks at the global numbers, the big Indian opportunity becomes crystal clear. While the US and Canada have a penetration of 11.4 percent, the insurance density (which means per capita premium) is at $7,782. The equivalent number for India is just $91.

The insurance opportunity in India is massive. The overall insurance penetration in India stands at 4.2 percent. The equivalent number for life and non-life stand at 3.2 percent and 1 percent, respectively. When one looks at the global numbers, the big Indian opportunity becomes crystal clear. While the US and Canada have a penetration of 11.4 percent, the insurance density (which means per capita premium) is at $7,782. The equivalent number for India is just $91.

Praveen Sridharan talks about the volume game and the massive under-penetrated segment. “The big opportunity for InsuranceDekho is to expand distribution into tier II and beyond," says partner at TVS Capital Funds. The next 400 million population (lower and middle income class) living in the next 1,000 towns will be the key segments to be targeted. The team at InsuranceDekho, he underlines, demonstrated deep understanding of the space, excellent execution skills and an ambition to enable access to insurance to six lakh villages of India. “With its agency model and digital DNA, they offer a powerful mechanism for this coverage," he says.

Meanwhile, Rajat Sood reckons technology will go a long way in expanding insurance coverage and making it more accessible and affordable. "InsuranceDekho leverages technology to streamline the insurance buying and selling process," says the managing director at Goldman Sachs Asset Management. With its tech-based solutions and a nationwide partner network offering last-mile reach, InsuranceDekho is well positioned to capitalise on the continued growth of India’s insurance industry, he adds.

![]() Agrawal, for his part, talks about his mission. “We have added one more thing to roti, kapda and makaan. It’s Bima (insurance)," he says. Insurance, he adds, is not just about taking money and giving certificates. “It’s about a promise, trust and affection," he says, sharing his one-point advice to any youngster looking to make a mark in the entrepreneurial world. “Kuch banana hai toh LIC jaisa banao’ (If you want to build anything, build like LIC)," he says.

Agrawal, for his part, talks about his mission. “We have added one more thing to roti, kapda and makaan. It’s Bima (insurance)," he says. Insurance, he adds, is not just about taking money and giving certificates. “It’s about a promise, trust and affection," he says, sharing his one-point advice to any youngster looking to make a mark in the entrepreneurial world. “Kuch banana hai toh LIC jaisa banao’ (If you want to build anything, build like LIC)," he says.

The journey, he adds, was not a cakewalk. Apart from a wide sea of sceptics, Agrawal had to contend with the problem of training manpower. Since most of the agents were first-timers, the startup had to spend an inordinate amount of time in imparting skills. Another challenge was to build a culture of trust and accountability. “It’s not a fast and furious game," he says. Insurance, Agrawal underlines, demands loads of patience and trust. “We can’t lower the benchmark on any of these," he says.

What about competition from the biggest player in the segment, PolicyBazaar? Agrawal prefers to play down all rivalry talks. “There is room for all," he says. “I don’t see my company in numbers and revenue," he adds. “My biggest win would be to take insurance to six lakh villages," he says. “Is the target not over-ambitious," I ask. The entrepreneur smiles. “Well, people still call me pagal Bihari," he smiles. “Just remember, insurance is not just click and pay."

The insurance opportunity in India is massive. The overall insurance penetration in India stands at 4.2 percent. The equivalent number for life and non-life stand at 3.2 percent and 1 percent, respectively. When one looks at the global numbers, the big Indian opportunity becomes crystal clear. While the US and Canada have a penetration of 11.4 percent, the insurance density (which means per capita premium) is at $7,782. The equivalent number for India is just $91.

The insurance opportunity in India is massive. The overall insurance penetration in India stands at 4.2 percent. The equivalent number for life and non-life stand at 3.2 percent and 1 percent, respectively. When one looks at the global numbers, the big Indian opportunity becomes crystal clear. While the US and Canada have a penetration of 11.4 percent, the insurance density (which means per capita premium) is at $7,782. The equivalent number for India is just $91. Agrawal, for his part, talks about his mission. “We have added one more thing to roti, kapda and makaan. It’s Bima (insurance)," he says. Insurance, he adds, is not just about taking money and giving certificates. “It’s about a promise, trust and affection," he says, sharing his one-point advice to any youngster looking to make a mark in the entrepreneurial world. “Kuch banana hai toh LIC jaisa banao’ (If you want to build anything, build like LIC)," he says.

Agrawal, for his part, talks about his mission. “We have added one more thing to roti, kapda and makaan. It’s Bima (insurance)," he says. Insurance, he adds, is not just about taking money and giving certificates. “It’s about a promise, trust and affection," he says, sharing his one-point advice to any youngster looking to make a mark in the entrepreneurial world. “Kuch banana hai toh LIC jaisa banao’ (If you want to build anything, build like LIC)," he says.