A string of pre-budget recommendations which the industry had made to the government for consideration were ignored in the FY24 budgetary announcements announced February 1. Instead of that came a ‘double whammy’ blow of sorts. The finance minister Nirmala Sitharaman announced the removal of tax exemptions on income from non-ULIP (unit linked insurance plan) policies purchased after April 1, 2023, where the aggregate annual premium is above Rs 5 lakh.

The government, also, in a move to drive people towards an exemption-less new tax regime, lowered personal taxes and made life insurance policies somewhat less attractive as pure tax saving instruments (under Section 80C).

Insurance companies will need to change their product mix or simply need to sell more policies to ensure volume growth, experts say. While they will continue to grow in 2023 and beyond—and there might be a flurry of business till March-end (as investors will try to take a tax benefit before this financial year ends)—they will need to put in more effort to ensure premium volumes and margins do not sag in the next fiscal.

Protection, not investment

For years, life insurance products had been sold, or should we say mis-sold, as financial tools that could attract returns, bonuses (on sum assured) and savings in tax. The tax savings could be a maximum of Rs 1.5 lakh under Section 80C (of the Income Tax Act, 1961) on payment of premium on the policy. Contributions of up to Rs 2 lakh towards the National Pension System (NPS) under Section 80CCD, also attract tax savings for the full contribution.

LIC and its agents could be considered guilty parties to influencing individuals’ minds by selling an insurance policy as a financial product. Which is why people got fixated with returns on investments before deciding on which policy to take. And the government wants to change this.

“The government’s budget moves are to tell people to buy insurance not for investment but for protection," says Vighnesh Shahane, managing director and CEO at Ageas Federal Life Insurance, a private sector insurer. In India, insurance has been a push product, “customers need that incentive through tax savings to invest in insurance", Shahane says.

If people were to shift towards the new regime, it will simply mean that the option for individuals to avail of any tax exemptions on life insurance bought would vanish. But Avinash Singh, senior research analyst at Emkay Global Financial Services, in a post-budget analysis on the budgetary announcements, says, “A complete shift to a deduction-free new tax regime should not be a material event for private life insurance companies."

![]() A blended 20 percent tax rate indicates that approximately Rs 4.2 trillion of total deductions were claimed by individual taxpayers under Section 80C and around Rs 362 billion under Section 80D. With an estimated Rs 11.3 trillion (except the principal repayment on home loan, stamp duty on home purchase and tuition fee payment) eligible for deduction under Section 80C, and only Rs 4.2 trillion being claimed for deduction, it seems that private life insurers’ dependency on the Section 80C deduction is lower, Singh observes, based on this government-based data.

A blended 20 percent tax rate indicates that approximately Rs 4.2 trillion of total deductions were claimed by individual taxpayers under Section 80C and around Rs 362 billion under Section 80D. With an estimated Rs 11.3 trillion (except the principal repayment on home loan, stamp duty on home purchase and tuition fee payment) eligible for deduction under Section 80C, and only Rs 4.2 trillion being claimed for deduction, it seems that private life insurers’ dependency on the Section 80C deduction is lower, Singh observes, based on this government-based data.

The debate is also open as to how many individuals will choose the new tax regime over the old tax regime. Experts feel that the attractiveness of a life insurance product might diminish in the next fiscal, but it will not vanish.

“Considering that, broadly, since Indians do not get a retirement or a pension income, they have a propensity to save. We expect them to continue to buy insurance, with a mindset to save, including taking advantage of the 80C and 80CCD limits, under the old tax regime," says Bahroze Kamdin, partner at Deloitte India.

A Bajaj Allianz Life India’s life goal preparedness survey 2023 released on February 16 showed that life insurance is the most preferred investment option for 65 percent of the life goals. This figure (life insurance) rises to 77 percent for a secure and carefree retirement. The survey, conducted in October last year, covered people aged 22-25 across 13 cities including metros, Tier 1 and emerging Tier 2 cities.

Ageas Federal, a private sector unlisted company that sells term and ULIP plans besides others, shows a 22 percent rise in number of policies sold at 70,861 in FY22.

Impact on insurers

The removal of Section 10(10D) exemption on life insurance maturity and surrender proceeds will have a material impact on short-term growth, analysts say. In the 2021 budget, ULIPs with an annual premium of over Rs 2.5 lakh per year had lost this exemption. This year’s budget has extended the cap on new non-linked policies purchased in FY24, where the premium is above Rs 5 lakh.

Deloitte’s Kamdin believes the move to remove these exemptions has been well thought out by the government. “Until recently, there was no level playing field amongst different types of investments. Through the latest announcements, the government is trying to bring all investment products on par. They have also grandfathered the old provisions," she says.

Emkay’s Singh says as per the recent moves (of 2023 and 2021 earlier), a Rs 7.5 lakh annual premium per person remains tax-free on maturity-–in the form of Rs 5 lakh on non-ULIPs and Rs 2.5 lakh on ULIPs. This means that life insurers will still be able to address majority of the population.

Motilal Oswal analysts say the imposition of tax on maturity proceeds will reduce the attractiveness of non-participating (which don’t offer bonuses) life insurance products for HNIs and wealthy customers and may adversely impact the premium volumes of insurers. But insurance companies are hesitant to quantify the exact impact of Sitharaman’s decisions.

HDFC Life’s CEO Vibha Padalkar had told media on budget day that they could see a 10 to 12 percent impact on their topline due to this proposal. Max Life Insurance’s managing director and CEO Prashant Tripathy has said that its share of business from customers holding such policies is “approximately around 9 percent of individual annual premium equivalent (APE) for 9MFY23 and was around 6 percent for FY22".

Tripathy has also said they do not expect this sale to completely disappear. Most insurance companies are confident that customers could shift to a lower ticket size policy and alternative products. SBI Life appears to be “the least vulnerable, given the granular nature of the business and lower exposure to the non-par segment," Emkay’s Singh says. ICICI Prudential does not share the mix of par and non-par separately, but analysts believe it to be placed in the middle. HDFC Life, SBI Life and Max Life declined to participate in the story.

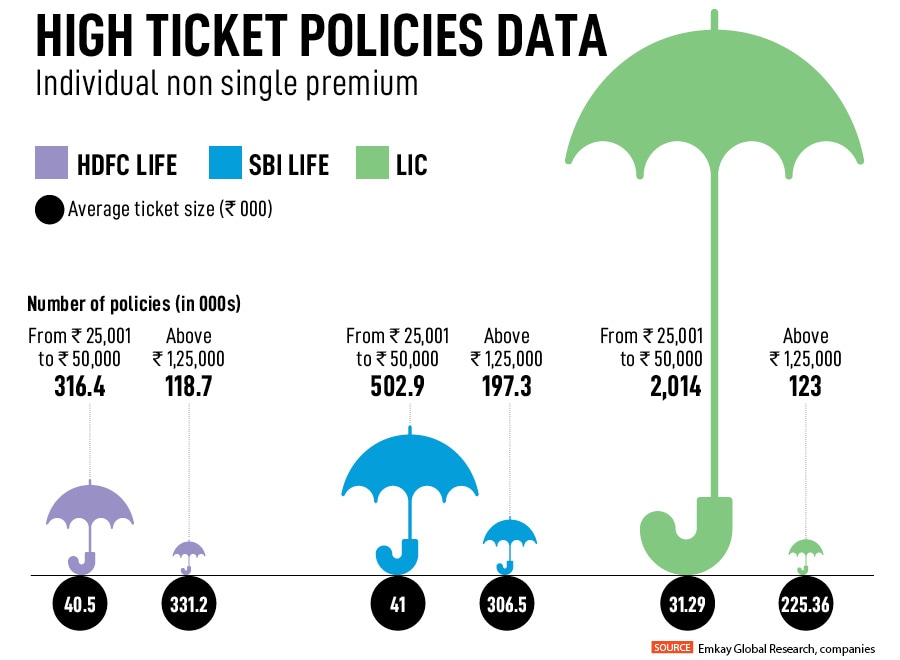

Data shows that the average ticket size of individual regular policies where the annual premium is above Rs 1.25 lakh varies for insurance companies. For HDFC Life there are 1.19 lakh such policies with an average ticket size of Rs 3.3 lakh, while for LIC there are 1.23 lakh such policies for an average ticket size of Rs 2.2 lakh (see table).

![]()

“High net worth individuals will get impacted, but only to some extent. This segment is still small and LIC will be less impacted than some of the private insurance companies," Kamdin says.

A source at a large private sector life insurance company said the pace of growth for APE for the entire industry could fall to about 12-15 percent in FY24 from about 15-20 percent in the current fiscal. “But we could see a recovery beyond that time frame across different life products," he said on condition of anonymity.

![]() The same source said the “psychological impact" of the new tax regime and the 80C exit will be seen on the entire market. “There will be a short-term impact but for most people the cap is consumed by other elements of the 80C category [such as EPF, PPF and ELSS]. So, while in the short-term a small percentage—4 to 5 percent of the tax paying universe—may not opt for a life insurance product, this behaviour of the individual is likely to change over the next three years. “One must understand that there is no instrument in the Indian market, besides life insurance, which offers you savings for a long term of over 25-30 years," the source said.

The same source said the “psychological impact" of the new tax regime and the 80C exit will be seen on the entire market. “There will be a short-term impact but for most people the cap is consumed by other elements of the 80C category [such as EPF, PPF and ELSS]. So, while in the short-term a small percentage—4 to 5 percent of the tax paying universe—may not opt for a life insurance product, this behaviour of the individual is likely to change over the next three years. “One must understand that there is no instrument in the Indian market, besides life insurance, which offers you savings for a long term of over 25-30 years," the source said.

Back to the basics

Experts say insurers will need to revise their product mix and start to sell policies more aggressively, rather than focus on sales of the high-ticket premium products.

Bancassurance and agency routes will remain the most effective channels in coming months, but the change will be to focus on volume growth.

“They will need to build more awareness regarding various products. Bancassurance will continue to be a strong distribution channel but insurers will look towards other agencies/channels and expand into smaller towns to boost volumes. Tier 2-3 cities had anyway been identified as routes for expansion," says Deloitte’s Kamdin. SBI Life has seen a 20 percent year-on-year growth in new business APE totaling Rs 12,260 crore in December 2022. For HDFC Life individual APE rose 23 percent y-o-y totaling Rs 6,870 crore for the 9MFY23, compared to the corresponding period a year earlier.

The life insurance industry reported decent growth in new business in January 2023, with retail APE for the industry growing at 9.9 percent y-o-y. But Emkay’s Singh calls the growth for the sector a “non-event" as the focus will shift to FY24 against the backdrop of withdrawal of tax exemptions.

The uncertainty of all this is being reflected in some of the listed insurance stocks. The HDFC Life stock is down 11.1 percent to Rs 514.5 at the BSE from a pre-budget January 31 level, ICICI Prudential is down 5.4 percent at Rs 428 and SBI Life is down 3.73 percent at Rs 1,174 in the same period. LIC has fallen 7.62 percent in the same period, but this was more due to the concerns over investments towards the Adani Group.

While the stock recommendations are broadly unchanged, Emkay has revised downwards the target prices for the stocks, stating that they are likely to remain rangebound in the near term.

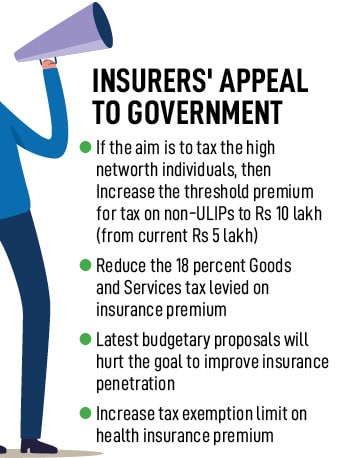

![]() Insurance firms, from both life and health segments, have through the Confederation of Indian Industry (CII) appealed to FM Sitharaman to have a re-look and revise some of the budgetary proposals (see chart), but a conclusive dialogue has yet to take place.

Insurance firms, from both life and health segments, have through the Confederation of Indian Industry (CII) appealed to FM Sitharaman to have a re-look and revise some of the budgetary proposals (see chart), but a conclusive dialogue has yet to take place.

Assuming the Finance Ministry does not modify any of the announcements made in the budget, the visible impact of the budgetary announcements will be seen and measured after product strategies and consumer behaviour start to unfold in FY24. “We [the industry] need to start selling protection plans better, target mass customers and increase the penetration," says Ageas Federal’s Shahane.

The new fiscal will thus test some players more than others, to see how they manage volume growth, distribution costs, margins and yet keep the products competitive and attractive. Which then means going back to the basics and doing the job effectively.

A blended 20 percent tax rate indicates that approximately Rs 4.2 trillion of total deductions were claimed by individual taxpayers under Section 80C and around Rs 362 billion under Section 80D. With an estimated Rs 11.3 trillion (except the principal repayment on home loan, stamp duty on home purchase and tuition fee payment) eligible for deduction under Section 80C, and only Rs 4.2 trillion being claimed for deduction, it seems that private life insurers’ dependency on the Section 80C deduction is lower, Singh observes, based on this government-based data.

A blended 20 percent tax rate indicates that approximately Rs 4.2 trillion of total deductions were claimed by individual taxpayers under Section 80C and around Rs 362 billion under Section 80D. With an estimated Rs 11.3 trillion (except the principal repayment on home loan, stamp duty on home purchase and tuition fee payment) eligible for deduction under Section 80C, and only Rs 4.2 trillion being claimed for deduction, it seems that private life insurers’ dependency on the Section 80C deduction is lower, Singh observes, based on this government-based data.

The same source said the “psychological impact" of the new tax regime and the 80C exit will be seen on the entire market. “There will be a short-term impact but for most people the cap is consumed by other elements of the 80C category [such as EPF, PPF and ELSS]. So, while in the short-term a small percentage—4 to 5 percent of the tax paying universe—may not opt for a life insurance product, this behaviour of the individual is likely to change over the next three years. “One must understand that there is no instrument in the Indian market, besides life insurance, which offers you savings for a long term of over 25-30 years," the source said.

The same source said the “psychological impact" of the new tax regime and the 80C exit will be seen on the entire market. “There will be a short-term impact but for most people the cap is consumed by other elements of the 80C category [such as EPF, PPF and ELSS]. So, while in the short-term a small percentage—4 to 5 percent of the tax paying universe—may not opt for a life insurance product, this behaviour of the individual is likely to change over the next three years. “One must understand that there is no instrument in the Indian market, besides life insurance, which offers you savings for a long term of over 25-30 years," the source said. Insurance firms, from both life and health segments, have through the Confederation of Indian Industry (CII) appealed to FM Sitharaman to have a re-look and revise some of the budgetary proposals (see chart), but a conclusive dialogue has yet to take place.

Insurance firms, from both life and health segments, have through the Confederation of Indian Industry (CII) appealed to FM Sitharaman to have a re-look and revise some of the budgetary proposals (see chart), but a conclusive dialogue has yet to take place.