The curious case of the Paytm buyback

Though buybacks reduce the number of shares in the market and so increase the price of the remaining shares, since the day of Paytm's buyback announcement the stock price has slipped over 10 percent

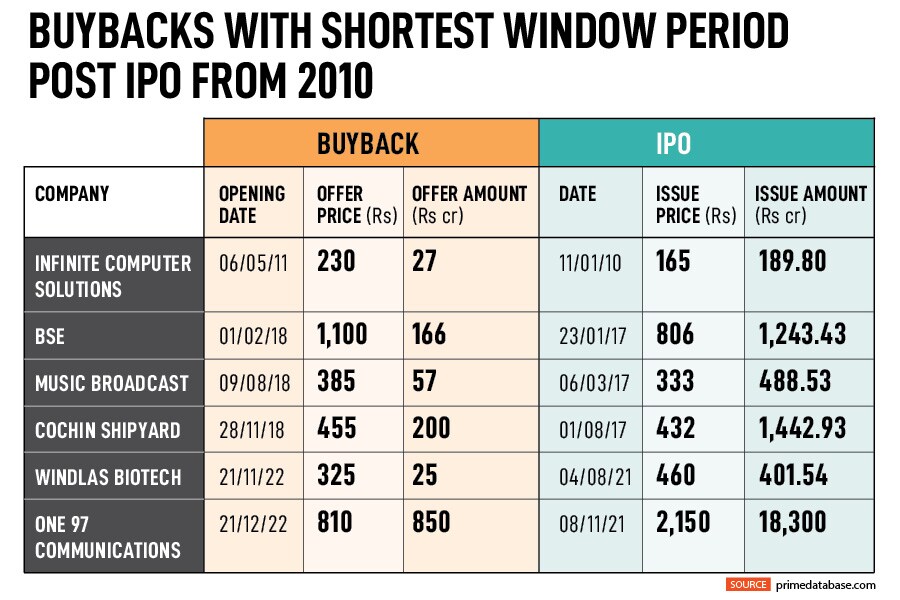

On December 13, new age fintech company One97 Communications which operates Paytm, announced the board’s approval for share buyback worth Rs 850 crore, just a year after the company went public on November 18, 2021. The company will be buying back shares at a price not exceeding Rs 810, a 50 percent premium over that day’s closing price of Rs 539.50. The company’s directors as well as key management personnel will not sell any shares during the buyback period.

On December 8, Paytm had announced a proposal for buyback of its shares saying “prevailing liquidity/ financial position, a buyback may be beneficial for our shareholders". That raised concerns among investors while the stock has been on a downward slope.

The initial public offering (IPO) of Paytm worth Rs 18,300 crore had priced its issue at Rs 2,150 a piece. The issue, subscribed 1.89 times, was a mix of offer-for-sale (OFS) and fresh issuance of shares. Since listing, investors in the IPO of One97 Communications have lost almost 75 percent of their investment.

The Paytm board believes that the buyback is a sign of confidence that the company is on a clear path to deliver cash flow profitability, and the buyback will not have any impact on their growth plans in the near future or on profitability plans.

However, it has done little to boost investor confidence. Since the day of the board approval of its buyback, the stock price has slipped over 10 percent.

“The Paytm buyback announcement is strange, and the regulator must do something about it. Only one year ago they raised Rs 8,300 crore in fresh issue (Rs 10,000 crore was OFS so in a firm that needed Rs 8,500 crore in equity for their business, what happened in a year that they have surplus money to announce a buyback? Have those investment opportunities disappeared or is it just a gimmick to support a free fall in price? The Securities and Exchange Board of India (Sebi) should really block such proposals to ensure investors" interests are safeguarded," Mayank Joshipura, associate dean-research and professor (finance), School of Business Management, NMIMS says.

The Paytm board has said that there is surplus liquidity that can be productively applied to a buyback of shares. The company also said that the proceeds from the IPO are not being directed towards the share repurchase plan.

“We would like to deny any speculations about our expansion plans being impacted because of our buyback. Looking at the monetisation opportunities in our core payment and credit business, we have a clear path to deliver cash flow profitability and are ahead of our profitability guidance," a Paytm spokesperson told Forbes India in an email statement. “This buyback will not have any impact on our growth plans in the near future as we will continue to invest in sales, technology, marketing and other areas. Furthermore, the buyback will be executed in line with Sebi regulations and in a transparent manner, as we hope to build long-term value for our shareholders."

Proxy advisory firms are not convinced. Institutional Investor Advisory Services (IiAS), in a note on December 12, argued that whichever way the board articulates it, Paytm is returning equity capital to its shareholders, those who came in pre-IPO, and during and since the IPO. “But there is little merit in bucketing cash this way," it said.

Stakeholders Empowerment Services (SES) remains concerned as to the misuse of freedom in determining funds more than required being raised in the IPO. “Probably it was a wonderful opportunity for existing shareholders to encash at Rs 2,150, creating a hype and enticing retail shareholders," SES said in a note on December 14.

“The company is achieving two objectives in one stroke--avoiding selling pressure and giving a window to pre-IPO investors to sell and avoid capital gain as also using the proceeds to buy from the market at the current rate, thus making their new transaction as tax neutral, having pocketed gains, and creating additional demand," SES added in the report.

That is not all. The market expectations are widely different for listed companies and Paytm’s board appears to still be learning some of these harsh realities. Despite being one of the largest IPOs in India, the company has not been able to win investor confidence," IiAS said.

Buybacks are generally used as tax-efficient instruments to return excess cash to shareholders. They signal that the company has strong cash flow generation, which is more than required to maintain the company’s growth trajectory. In Paytm’s case, the company continues to report cash losses annually. Therefore, the buyback is essentially a return of equity capital to its shareholders.

In the September quarter, Paytm had narrowed earnings before interest, taxes, depreciation, and amortisation (EBITDA) losses and reported an increase in its revenue. In the second quarter of FY23 its consolidated net loss widened to Rs 571 crore from a loss of Rs 473 crore a year earlier.

“Unless the buyback price is higher than the issue price of Rs 2,150, the buyback will favour Paytm’s pre-IPO shareholders and employees. Employees have been issued stock options at a significant discount to market price Vijay Shekhar Sharma (founder, CEO) was granted 21 million stock options at Rs 9 in FY22 alone. IPO shareholders are unlikely to see the buyback positively, unless they entered the stock at a price lower than the to-be-announced buyback price. It is unclear if the size of the buyback will be sufficiently meaningful to move the needle," IiAS said in the report.

Vijay Shekhar Sharma holds 8.91 percent in One97 Communications as per BSE data in September. Of the remaining, 1.34 percent stake is held by institutional (domestic), 77.25 percent by institutional (foreign) in the company while 6.37 percent is held by retail investors, and Axis Trustee Services holds 4.77 percent.

So far, a constant weakness in the stock price has not deterred the confidence of foreign global brokerages like Morgan Stanley and JP Morgan.

“The total outlay owing to the buyback would be Rs 1,050 crore and includes applicable buy-back taxes. Cash position has been strong at Rs 9,180 crore as of September, and will remain strong post-buyback as well," Morgan Stanley analysts said in a note on December 13.

Paytm has $1.1 billion in cash as of September and the $127 million outlay of cash for buyback (including buyback tax) is not a significant amount, according to JP Morgan analysts. They see the buyback announcement at a 50 percent premium to provide support to the stock price in the near term.

“We expect it to burn $33 million over the next three quarters before turning adjusted EBITDA breakeven in Q2FY24. The reduction in cash because of the buyback offsets the reduction in share count thereby keeping our target price unchanged," JP Morgan said in a note on December 14, with a target of the stock hitting Rs 1,100 by March 2023.

The tightening of buyback norms by the market regulator Sebi will ensure transparency and efficiency, benefit investors, especially retail participants, reduce the timeline for the process and provide more flexibility to companies, experts say. In its board meeting in December, Sebi took a slew of significant decisions to change the guidelines in the buyback process of shares by companies.

“These amendments aim to streamline the process of buyback, create a level playing field for investors and promote ease of doing business," Sebi chairperson Madhabi Puri Buch said at a press briefing on December 20.

Along with a few other rejigs, Sebi has made announcements to phase out buybacks through the stock exchange route while it will create a separate window on stock exchanges for it till the time buyback through a stock exchange is permitted. The market regulator has also increased the minimum utilisation of the amount earmarked for buyback through the stock exchange route from the existing 50 percent to 75 percent.

Sebi has permitted an upward revision of the buyback price until one working day prior to the record date of buyback and reduced the timeline for completion of buyback by 18 days.

First Published: Dec 23, 2022, 16:48

Subscribe Now