Despite the strong showing, the stock price is far short of its initial public offering (IPO) price of Rs 2,160 last November. A week after the results, the stock tanked further to around Rs 540 as Paytm’s lock-in period for pre-IPO investors expired on November 15. Softbank, one of its biggest backers with a 17.45 percent stake worth around $900 million, has started the process to sell 29 million shares or 4.5 percent of its holding worth $200 million. It’s currently trading at around Rs.549 on the Bombay Stock Exchange.

“It’s very difficult to predict near term prices," says Sameer Bhise, executive director at JM Financial where he serves as the lead analyst for finance and fintech companies. Zomato’s share price, for example, similarly tanked 11 percent after its lock-in for pre-IPO investors ended this July but recovered soon after. “Though fundamentally, the way we are looking at it, Paytm’s business model is shaping up reasonably well. Domestic investors have stayed away from the stock but over the next 12-18 months, as the move towards profitability continues, investors will start looking at it favourably."

“Consistent improvement in profitability is a key catalyst for the stock," echoes Manish Adukia, equity research analyst at Goldman Sachs, in a note. “We expect multiples for the stock to re-rate higher as Paytm approaches adjusted EBITDA breakeven by mid-CY23."

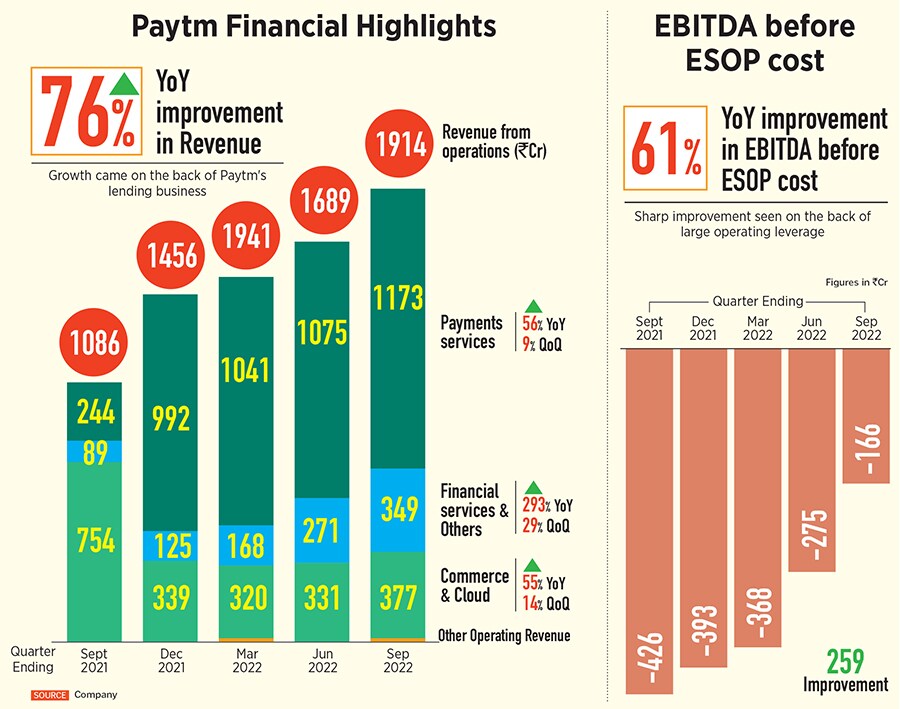

During the analyst call shortly after the Q2FY23 results were announced, Vijay Shekhar Sharma, Paytm’s boss, reiterated that the company was on track to achieve its adjusted EBITDA breakeven target by September 2023.

![]()

“It’s unlikely that he will miss that target," says Anand Lunia, founding partner at India Quotient, an early stage venture capital fund. “In fact, going by the revenue growth they are seeing every quarter, he’ll probably achieve it a quarter prior."

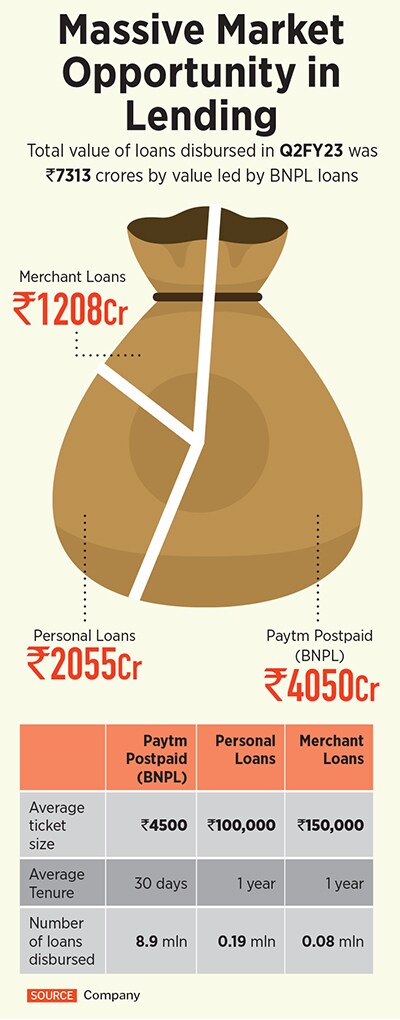

The reason behind the scorching revenue growth is Paytm’s loan distribution business which it has silently been building out over the last 18 months. In this three-month period ending September, Paytm disbursed loans worth Rs 7,313 crore, almost as much as the Rs 7,600 crore it disbursed in the entire year ending March 2022. This represents a massive 482 percent jump from the same quarter a year ago (YoY), but from a low base as the business had only just taken off then. More meaningfully, loans disbursed grew 32 percent quarter-on-quarter (QoQ).

As a result, Paytm’s financial services vertical, which is made up of its lending business, insurance business and wealth management business, has seen a 293 percent jump in revenue YoY and a 29 percent jump QoQ. For comparison, Paytm’s core payments services vertical grew 56 percent YoY and nine percent QoQ. A third vertical ‘Cloud and Commerce’ saw a healthy 55 percent revenue growth YoY and 14 percent QoQ.

In effect, Paytm’s business model has changed from being a payments-only provider to a platform that acquires payments customers and then offers them a host of services, primarily loan disbursals.

Sharma explained this new business model by providing a “summary" of it during the September quarter earnings call. “We acquire customers, and we had 80 million transacting customers [that is, monthly transacting users or MTUs], and these customers in turn bring us merchants and we have 30 million merchants who in turn work and give commerce services to consumers. This makes our core business model to acquire customers on payments. And in turn, because this gives us insight, ability to distribute and a great brand name, we work with our lenders to distribute credit."

*****************

Prior to its IPO, Paytm was looking to grow its payments business at any cost. It did so by entering a number of allied businesses, including bill payments, online shopping, travel and movie ticketing, among others. It led many to question whether Paytm was spreading itself too thin and burning money in the process. However, post-IPO, over the last four quarters, Paytm has trimmed its non-performing businesses. “Our primary focus in our payments business is to have profitable revenue rather than GMV as a metric," said Madhur Deora, Paytm’s chief financial officer, during the September earnings call. “The key thing is can you make revenue and can you make a net payment margin off of it. So that"s what we optimise for."

![]() A former senior Paytm employee who spoke with Forbes India on the condition of anonymity confirms, “They have changed their focus. Vanity metrics like GMV are no longer a priority."

A former senior Paytm employee who spoke with Forbes India on the condition of anonymity confirms, “They have changed their focus. Vanity metrics like GMV are no longer a priority."

So on the payments front, for example, revenue from payments services to consumers, a hard-to-monetise, low-margin business, grew 55 percent YoY to Rs 549 crore on the back of continued growth in monthly transacting users—79.7 million at present, up 39 percent YoY.

Whereas payments services to merchants—29.9 million at present—saw revenues grow 56 percent YoY to Rs 624 crore. Sources of revenue from merchants include not just MDR revenues but subscription revenues from services/devices they sell to merchants—including QR codes, Paytm point-of-sale (Pos) terminals and Soundboxes which alert merchants via audio that a payment has been received. Of its roughly 29.5 million merchant base, 4.8 million presently use Paytm’s PoS terminals and Soundbox devices which audio alert merchants when a payment is received.

Payment services, still Paytm’s core business, contributes 61 percent to Paytm’s top line, while financial services and cloud and commerce contribute 18 percent and almost 20 percent, respectively.

*****************

The revenue mix is set to change with lending, Paytm’s big bet, already on a tear. Wealth management and insurance, Paytm’s other businesses under its financial services vertical, are yet to take off in the same manner.

Within the financial services vertical Paytm’s insurance and wealth management businesses are yet to take off in the manner credit has.

Paytm Money, the wealth business, lags its peers Zerodha, Groww and Upstox in terms of active traders. Its insurance application is still pending with the insurance regulator, IRDAI. “The idea with these businesses is not so much to compete with the Zerodhas of the world, but to become profitable, self-sustaining units in themselves," says the former employee quoted above. “VSS’ mandate to the heads of these businesses is to make your own money and spend your own money."

So the bulk of Paytm’s financial services revenue comes from credit, said Sharma during the September quarter earnings call. The company clocked Rs 349 crore in revenue from financial services in Q2FY23.

Paytm’s credit strategy is three-pronged: Of the Rs 7,313 crore of loans disbursed by Paytm this quarter, 55 percent of them by value were buy-now-pay-later loans (BNPL) or what the company calls Paytm Postpaid. Twenty-eight percent were personal loans to consumers and 17 percent to merchants. The latter are high-margin loans with average ticket sizes of Rs 1 lakh and Rs 1.5 lakh respectively, whereas the low-margin BNPL loans have average ticket sizes of Rs 4,500.

![]() BNPL loans, therefore, presently account for the lion’s share of Paytm’s loan disbursal business by number and value. “Even though Paytm’s credit business is largely built on BNPL loans right now, the scope for growth on the lending model is quite large," says Bhise.

BNPL loans, therefore, presently account for the lion’s share of Paytm’s loan disbursal business by number and value. “Even though Paytm’s credit business is largely built on BNPL loans right now, the scope for growth on the lending model is quite large," says Bhise.

In fact, the company is using BNPL loans to drive the growth of its other credit products. For example, 40 percent of personal loans have been disbursed to Paytm’s BNPL customers, demonstrating Paytm’s ability to cross-sell.

Similarly, Paytm’s device ecosystem helps it better assess merchants’ creditworthiness. Eighty-five percent of merchant loans by value in Q2FY23 were disbursed to existing device merchants. Deora mentioned that device merchants typically become eligible for credit in about five to six months from taking a device. About 1.5 million merchants (of Paytm’s 4.8 million device merchants) have already been “white-listed" for credit disbursals.

Moreover, its Postpaid user base of six million (with acceptance at 15 million online and offline merchants), represents just four percent of its 80-million strong MTUs. Similarly personal loan penetration stands at 0.6 percent of the MTU base, and merchant loan penetration at 4.4 percent of the device merchant base. So there’s massive headroom to grow and cross-sell.

“Paytm is driving a significant amount of payments traffic—that’s their moat.

The amount of data it generates from the payments are being made on its platform and the insights that generates in terms of the kind of customers, their risk profile, cash flows etc is humongous. Even for merchant loans, it is immediate validation of whether the credit is good or not because you are effectively lending against cashflows that are anyway coming to you. So it’s a very strong moat," explains Bhise.

There’s one catch though. Paytm doesn’t lend money on its own. It has partner NBFCs—nine in all including HDFC, Piramal Finance, Aditya Birla Finance, Clix Capital and Hero Fincorp— for whom it originates, manages and then collects loans.

For every BNPL loan disbursed, Paytm earns a 3-3.5 percent commission. Whereas for every personal loan and merchant loan disbursed, it earns a 4 percent and 5 percent commission, respectively.

Eventually, Paytm hopes to grow its payments bank into a small finance bank which will allow it to lend on its own books and earn a higher fee. For example, say Paytm borrows at 8-10 percent and lends at 16-17 percent, it can keep that spread. “This is a long term proposition. There’s lot of regulatory bridge to cross before that happens," says Bhise.

First, Paytm needs to get a clean chit from the Reserve Bank of India (RBI) relating to new customers acquisitions for its payments bank. In March, the regulator barred Paytm Payments Bank from onboarding new customers pending an IT audit.

During the September earnings call, the management shared that the audit is now complete and they have received the RBI’s observations around it. “The observations are largely around continued strengthening of IT outsourcing processes and operational risk management," read Paytm’s Q2FY23 earnings release. However, the company added that it can’t predict when it will be allowed to resume acquiring customers. Bhise believes that this is a now mere “housekeeping issue" and should get resolved soon.

Additionally, Paytm needs to ensure that non-performing loans (NPLs) on the loans it disburses are kept under control. “Things might be looking rosy right now but NPLs typically have a lag effect of about six to nine months. So we’ll have to wait and see. Only then will we know the quality of it borrowers," says the co-founder and CEO of a fintech player in the lending space, who spoke to Forbes India on the condition of anonymity.

*****************

“It’s a matter of time before the stock recovers," says Lunia.

Consider this: While Paytm’s $16 billion dollar valuation in the private markets, prior to its IPO, might have been unsustainable, it’s present $5 billion valuation seems absurd given its sizeable revenues. The company’s FY22 revenues stood at Rs 5,000 crore and FY23 revenues are estimated to hit Rs 7,900 crore or roughly $1 billion, a massive 58 percent jump. Meanwhile, its rival PhonePe is reportedly raising funding at a valuation of $12 billion, despite clocking Rs 1,646 crore in revenue in FY21, one-third that of Paytm.

Or consider how RazorPay, one of India’s other leading fintechs but not as large or fast-growing as Paytm, is also valued at $5 billion, albeit in the private market.

“The conversation has now shifted from how Paytm will make revenues to when it will turn EBITDA positive. That is a big change and testimony to Paytm’s business model," says Lunia.

In the short term, however, a key overhang for the stock is the expiry of its lock-in period for anchor investors which took place on November 15. Softbank, as mentioned above, has started the process to sell 4.5 percent of its 17.5 percent stake. The Japanese conglomerate is facing its own headwinds, having posted a heavy $7.2 billion loss at its Vision Fund Investment arm in the July-September quarter, following a record $17 billion loss in the preceding period. So it isn’t surprising that it is paring down its stake in Paytm to achieve some liquidity.

Similarly, China’s Alibaba Group, another backer of Paytm with a 31.1 percent stake, is facing government scrutiny in China. They might also be looking for some liquidity given the expiry of the lock-in period, which might lead the stock to tumble further.

“Paytm needs to work on the trust factor. Investor trust has to return," says the ex-employee quoted above. “The good thing is that Paytm is already making money. It’s set to hit Rs 8,000 crore in revenue (in FY23), which for an Indian company in the fintech space is phenomenal. They need to now consistently meet what they say. If they can do that, trust will return."

A former senior Paytm employee who spoke with Forbes India on the condition of anonymity confirms, “They have changed their focus. Vanity metrics like GMV are no longer a priority."

A former senior Paytm employee who spoke with Forbes India on the condition of anonymity confirms, “They have changed their focus. Vanity metrics like GMV are no longer a priority." BNPL loans, therefore, presently account for the lion’s share of Paytm’s loan disbursal business by number and value. “Even though Paytm’s credit business is largely built on BNPL loans right now, the scope for growth on the lending model is quite large," says Bhise.

BNPL loans, therefore, presently account for the lion’s share of Paytm’s loan disbursal business by number and value. “Even though Paytm’s credit business is largely built on BNPL loans right now, the scope for growth on the lending model is quite large," says Bhise.