The economics and politics of falling oil prices

Despite forecasts of a looming oil market deficit of 2.4 million barrels per day, prices have remained surprisingly low. Here's why

After seven hours of tensed haggling, members of the Organisation of the Petroleum Exporting Countries (OPEC+) managed to reach an uneasy truce in Vienna on June 4. This was the first in-person meeting in over three years to chalk out production policy steps as crude oil prices struggled amid macro-economic challenges, supply volatility, and demand uncertainty.

In a confusing move, the 23-member alliance of oil producers, which includes heavyweights Russia and Saudi Arabia, agreed to leave their production target unchanged for this year. However, as part of the deal, Saudi Arabia announced it would go ahead with an additional voluntary one-month production cut of 1 million barrels per day (mbpd) from July. Importantly, It did not specify until when.

Also, in a statement, the oil producing cartel informed it would “adjust the level of crude oil production to 40.46 mbpd starting January 1 2024 until December 31 2024". In effect, it lowered oil output by 2 mbpd to stave off lower demand. Earlier, in April, seven member-countries, led by Saudi Arabia, announced additional voluntary cuts of 1.15 mbpd while Russia, in March, pledged a voluntary reduction by 500,000 bpd this year.

Moscow and Riyadh have renewed ties under a new OPEC+ agreement to review cooperation and response to swings in demand after a March 2020 dispute led to a one-month discontinuation of their oil partnership and stoked a price war. The two have put up a united front since.

The market sentiment in the days leading to the June 4 meeting was charged with conflicting statements from member countries. It seemed as if the stage was set for further supply cuts to prop up oil prices: “I keep advising [oil market speculators] that they will be ouching. They did ouch in April. I don’t have to show my cards, I’m not a poker player… but I would just tell them, watch out," Saudi energy minister Prince Abdulaziz bin Salman reportedly warned the market on May 23.

The bluff was called soon after. But was it a bluff, a rethink, or part of a pact? Intriguingly, despite the expected market tightening, oil prices have not inched up. Why?

*****

Oslo-headquartered Rystad Energy, an independent energy research and business intelligence company, says the oil market is projected to face a significant deficit averaging 2.4 mbpd until December. Its senior vice president, Jorge Leon, believes a combination of stronger-than-expected supply, lagging demand, and non-fundamental factors, are keeping oil prices from increasing despite the shortfall in the market.

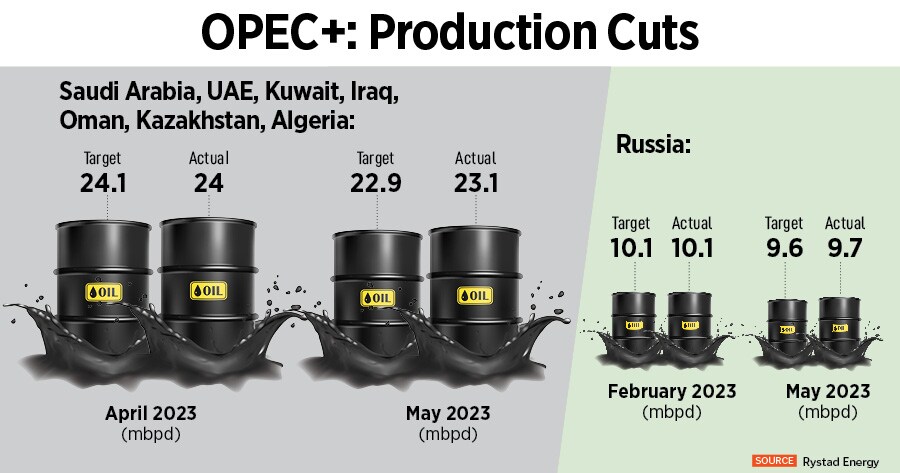

Interestingly, as per the May oil production data, OPEC+ member countries deviated from planned production cuts announced in April. The output from the group of seven countries dropped to 900,000 bpd versus the promised cut of 1.15 mbpd. Likewise, Russia lowered production by only 400,000 bpd—lower than its pledge to cut output by 500,000 bpd.

This can offer some clues on why prices are not holding up in the market.

“The mismatch between Russia’s production decline and increased seaborne crude exports is significant and puzzling," Leon states, “Despite the announced cuts, exports have risen from 3.3 mbpd in February to around 3.5 mbpd in recent weeks."

The intriguing aspect, according to Leon, is that if this ongoing disparity persists, with high exports and alleged production cuts, it could potentially lead to a significant shift in the supply dynamics and provoke a notable response from the rest of the OPEC+ group. “While the likelihood of this occurrence is low, its potential impact on prices is substantial, which may be a contributing factor to the prevailing bearish sentiment in the market," he adds.

In April, international crude oil was trading at $85/bbl. Currently, it has climbed down to around $75 in a challenging year. Experts recall how oil markets have traditionally been driven by physical demand and supply dynamics. But a gloomy economic outlook coupled with rising US interest rates and a credit squeeze across many US and European banks has led to an underlying shift in market fundamentals.

This, according to some analysts, explains why OPEC+ is holding production as a precaution to cushion the global economy from the impact of higher oil prices at a time when inflation is a concern worldwide. Many analysts believe the group ministers have adopted a wait-and-watch strategy as demand forecasts are tepid and maintaining the current output level is the most prudent approach against the current macroeconomic backdrop.

However, supply disruptions due to legal disputes between governments, for example, can throw a spanner. As can aggressive tactics to keep oil prices firm if demand in China does not recover soon.

“We forecast that oil demand will increase by 1.7 mbpd in 2023. This growth rate is relatively conservative. Our growth forecast for this year has mainland China and jet fuel as the main growth engines. The latest mobility data shows mixed signals," Leon says in a note, “Much will depend on China’s economic performance in the second half of this year and the effectiveness of the country’s recently announced stimulus measures, and on the ability of the US and Europe to avoid an economic slowdown amid interest rates hikes."

There has been a robust rise in China’s crude imports. On the face of it, these strong import numbers suggest oil demand remains strong. But more importantly, crude storage has been increasing in the last few months—indicating that demand hasn’t caught up. Data shows Chinese refineries added around 1.7 mbpd to their inventories last month with possibly close to 1 billion barrels in storage. High stock levels may keep China on the sidelines temporarily. More so because demand has not picked up meaningfully.

“Households are reducing their leverage. That’s not a good sign for consumption, which is over half of GDP. It suggests they lack confidence in the future. Confusingly, most top-down numbers are good, but bottom-up feedback from companies is very negative, and investors generally believe in the company"s feedback more," says Mark Matthews, head of research, Asia, Julius Baer Group.

Bank of America says China’s private sectors have low risk appetite, and, therefore, have held back capex plans despite low funding costs, mainly due to concerns about soft domestic and external demand, as well as policy uncertainty. “In addition, sluggish new-home sales along with deteriorated funding conditions for developers continued to weigh on both new starts and real estate investment. The resulting land sales decline further curtailed local governments" revenue and capped their ability to pay back existing liabilities and borrow new debts to fund infrastructure investment," its economists explain.

In fact, several large global banks have reduced their GDP growth forecasts for China: Goldman Sachs to 5.4 percent from 6 percent Bank of America to 5.7 percent from 6.3 percent JP Morgan to 5.5 percent from 5.9 percent Nomura to 5.1 percent from 5.5 percent earlier.

Even as China, the world’s second largest economy, is weathering major headwinds, as its post-Covid recovery is losing momentum, the oil market is awaiting contours of a much-talked-about stimulus package, which the government is widely expected to unveil soon to revive growth.

Sonal Varma, managing director, chief economist-India and Asia ex-Japan, Nomura, says China is burdened with structural challenges and geopolitical headwinds. “China’s slowdown is already a big drag on global growth, but it may not slam the brakes on global recovery," she says, “But, as the US and European economies slow down in the coming quarters, China may also not provide a growth offset, which is in contrast to past slowdowns, where a big China stimulus has come to the rescue of the global economy, but this time around, higher inflation in DM economies and less policy space in China, means the growth recovery after the slowdown could be slower than in the previous cycles."

Since last March, the US Federal Reserve has hiked its benchmark interest rate by 500 basis points to tame stubborn inflation that hit a 40-year high of 9.1 percent in June last year. This has prompted investors to flock to safer assets such as gold and bonds due to fears of a lurking global recession.

“Previously, commodities, notably crude oil, served as an inflation hedge, but with inflation already peaked and declining, the appeal of this hedging strategy has diminished. As a result, speculative positioning on the oil basket has plummeted, reflecting a low level of confidence in tight physical markets in the coming months," Leon points out.

Yet, Rystad Energy remains confident that significant upside price pressure will materialise in the second half of the year to boost oil prices to around $90 a barrel. But downside risks include a failure to stimulate the Chinese economy and lower-than-expected discipline by OPEC+ in adhering to production cuts, it says. “At some point in the coming weeks, market fundamentals will drive the oil market," Leon notes.

First Published: Jun 21, 2023, 11:20

Subscribe Now