Why are Indians ordering less pizzas, burgers and fried chicken

The slowdown in discretionary consumption, especially in the post-festive season, has dampened the strong demand sentiment that QSR players witnessed in the past few quarters

As prices of staples like milk, wheat, egg, cheese and vegetables escalated rapidly, households in India reduced dining out or ordering their favourite pizza or that chocolatey doughnut. In addition, there was a conscious decision by households to cut expenses, especially after the festive season in Diwali. The result: Indian Quick Service Restaurants (QSR) are feeling the brunt.

By attracting several international brands, the QSR segment in India achieved high growth even during the tough times of the pandemic-induced lockdown, but it is now gradually seeing a hit in business.

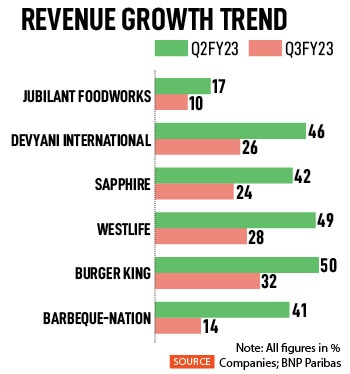

In the three months ended December, Pizza Hut reported a sequential decline in sales while rival Domino’s showed a flat growth. During the period, same-store-sales-growth (SSSG) of Sapphire Foods India declined by 4 percent and Devyani International"s fell by 6 percent. The like-for-like growth for Domino"s was 0.3 percent. KFC faced a decline in the average daily sales per store (ADS), both sequentially and yearly, due to weak consumer spending and incremental store additions in non-metro cities. Typically non-metro cities have a lower ADS. However, McDonald’s (run by Westlife) bucked the trend, reporting a 20 percent YoY SSSG, largely driven by higher guest count and average order value, due to its meals and omnichannel strategy.

Sapphire Foods India runs the franchisee business of KFC, Pizza Hut and Taco Bell restaurants. Devyani International run stores of KFC, Pizza Hut and Costa Coffee in India.

In January, food delivery company Zomato stopped services in 225 smaller cities, which contributed 0.3 percent of its gross order value (GOV) in the December quarter. It reasoned, “Performance of these cities was not very encouraging in the past few quarters, and we did not feel the payback period on our investments in these cities was acceptable." The company reported losses of Rs 346.6 crore in the September-December period, but revenue from operations also leaped 75 percent.

According to Zomato, there is an industry-wide slowdown in the food delivery business since late October (post Diwali). “This trend has been seen across the country, but more so in the top eight cities. As a result, GOV growth in food delivery in Q3FY23 was only 0.7 percent QoQ in an otherwise-seasonally strong quarter," Zomato said.

According to Zomato, there is an industry-wide slowdown in the food delivery business since late October (post Diwali). “This trend has been seen across the country, but more so in the top eight cities. As a result, GOV growth in food delivery in Q3FY23 was only 0.7 percent QoQ in an otherwise-seasonally strong quarter," Zomato said.

The trend is widespread, and not restricted to just one food category, or just metro or non-metro cities. Overall, there has been a slowdown in consumption. That, however, hasn’t deterred the owners of QSR businesses in India in aggressively expanding their stores, but that comes with warnings. Perhaps, expectations of better returns in the QSR business fuels that optimism.

While overall inflation has moderated, prices of agri commodities and dairy products (particularly cheese) have remained elevated in the December quarter. This, along with an inferior mix and a decline in ticket size, weighed on margins, which managements are striving to cover up by making changes to their product mix over the next few quarters. “Given the high competitive intensity and soft demand, QSR players have increased their brand-building campaigns and marketing spends, leading to higher operating expenses. This, combined with negative operating leverage, has resulted in annual contraction in Ebitda margin contraction. Given the tepid demand, players are hesitant to hike prices in the near term and remain focussed on offering value propositions and driving volume growth," explains Kunal Vora, head-India Equity Research, BNP Paribas India.

According to Vora, despite demand uncertainties, companies have largely retained their aggressive store expansion plans. “Most companies target mid- to high-single-digit SSSG/LFL growth, which we think will be challenging over the near term. Companies face cost pressure from high wheat and cheese prices, the accelerated pace of store expansions and their hesitancy to hike prices due to further risk of a demand slowdown," cautions Vora.

The slowdown in discretionary consumption, especially in the post-festive season, has dampened the strong demand sentiment that QSR players have witnessed in the past few quarters. This is attributed to rising inflationary pressures, a cut in household expenses and consumers’ down-trading behaviour, Vora adds.

The slowdown in discretionary consumption, especially in the post-festive season, has dampened the strong demand sentiment that QSR players have witnessed in the past few quartersImage: Shutterstock

The slowdown in discretionary consumption, especially in the post-festive season, has dampened the strong demand sentiment that QSR players have witnessed in the past few quartersImage: Shutterstock

Weaker consumer spending, new store additions, and expansion into Tier II and III cities, which have lower ticket spending, have led to a reduction in average daily sales for almost all store formats, except McDonald’s (Westlife). “The QSR space witnessed a sharp, sudden slowdown starting in November 2022, resulting in subdued ADS trends in a seasonally strong quarter," according to Kotak Institutional Equities.

While management commentaries have been bearish, they remain confident that the trend is transient and they have maintained their capex guidance. “Muted consumption sentiment during the quarter, high staples/food services inflation dented consumer sentiments and demand (October and December 2022 were better than November 2022). We believe this is a temporary phenomenon and expect consumer spending to improve once inflation stabilises," Devyani International said. Devyani International plans to open at least 10 percent of new KFC stores as flagship stores, which will account for a 9 to 10 percent increase in general capex.

Smilarly, Barbeque Nation bore a capex of Rs110 crore in the first nine months of FY23, out of which Rs90 crore was for opening new restaurants. “During the quarter, we noticed a subdued demand environment, which led to a marginal decline in same-store sales growth by 1.2 percent. November, specifically, was not that great. October 2022 was impacted by the festive season. Unfortunately, we are not seeing any uptick in the current quarter either. January 2023 was weaker than our expectations on the SSSG side," said Barbeque-Nation Hospitality management.

Smilarly, Barbeque Nation bore a capex of Rs110 crore in the first nine months of FY23, out of which Rs90 crore was for opening new restaurants. “During the quarter, we noticed a subdued demand environment, which led to a marginal decline in same-store sales growth by 1.2 percent. November, specifically, was not that great. October 2022 was impacted by the festive season. Unfortunately, we are not seeing any uptick in the current quarter either. January 2023 was weaker than our expectations on the SSSG side," said Barbeque-Nation Hospitality management.

Within the listed QSR space, Jubilant FoodWorks market share declined in Q3FY23, while Devyani and West Life gained market share. Jubilant Foodworks said, “While the festive season helped us deliver record revenue in October 2022, the consumer demand momentum suddenly decelerated starting November. In December 2022, demand marginally improved month-on-month. However, it remained uncertain in January 2023 as well." Jubilant Foodworks guided its FY23-24 capex at Rs650 to 700 crore, with the majority going towards new store openings, followed by investments in the new commissary and digital investments.

For Restaurant Brands Asia, which runs Burger King in India, demand was subdued due to lower mall traffic, particularly in December. Ticket sizes of food ordered were higher compared to pre-Covid, but dine-in cheques have not fully recovered. The company remains confident of 7 to 10 percent SSSG in FY24.

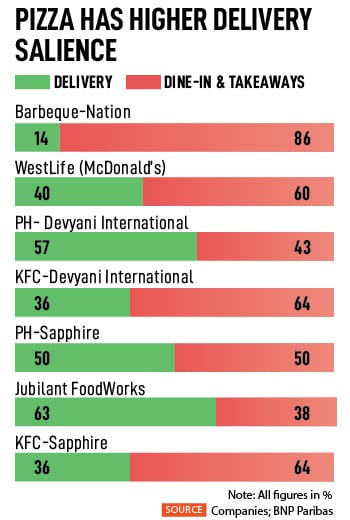

Pizza as a category underperformed burgers and chicken business in September. “Softer demand continued in the pizza category owing to larger delivery salience, relatively higher penetration and elevated competitive intensity. Pizza Hut launched a new product, "Fun Flavour" pizza, under Rs100, to drive volumes, which led to lower average realisations and margin dilution," says Vora.

QSR-focussed companies are now rejigging their strategies to grow business beyond the key brands. For instance, Jubilant FoodWorks expanded its Popeyes network to Chennai from its existing operations at Bengaluru with "open to sky" seating arena. The store is the largest Popeyes India outlet currently with a seating capacity of 150. “We believe the brand will compete fiercely with KFC and wrest some of its market share. The market may eventually expand to accommodate both brands however, KFC does have an air-pocket to tackle for now," say analysts at ICICI Securites.

First Published: Mar 16, 2023, 15:51

Subscribe Now