Why the rural economy isn't out of the woods yet

Rural spending fell to 2.8 percent in the previous quarter but most corporate honchos expect demand to pick up ahead of the festive season even as some caution that there are no visible green shoots o

The world’s most populous country is trying to revive its rural markets. Despite a recent uptick in demand, the signs of stress in India’s hinterlands are hard to rub off. Almost 70 percent of its people live in rural areas where agriculture is an important source of income. Yet, farming contributes less than 20 percent to the country’s GDP. In cracking this conundrum lies the biggest challenge and opportunity for small and big industry players. The mixed signals from towns and villages doesn’t make this task any easier.

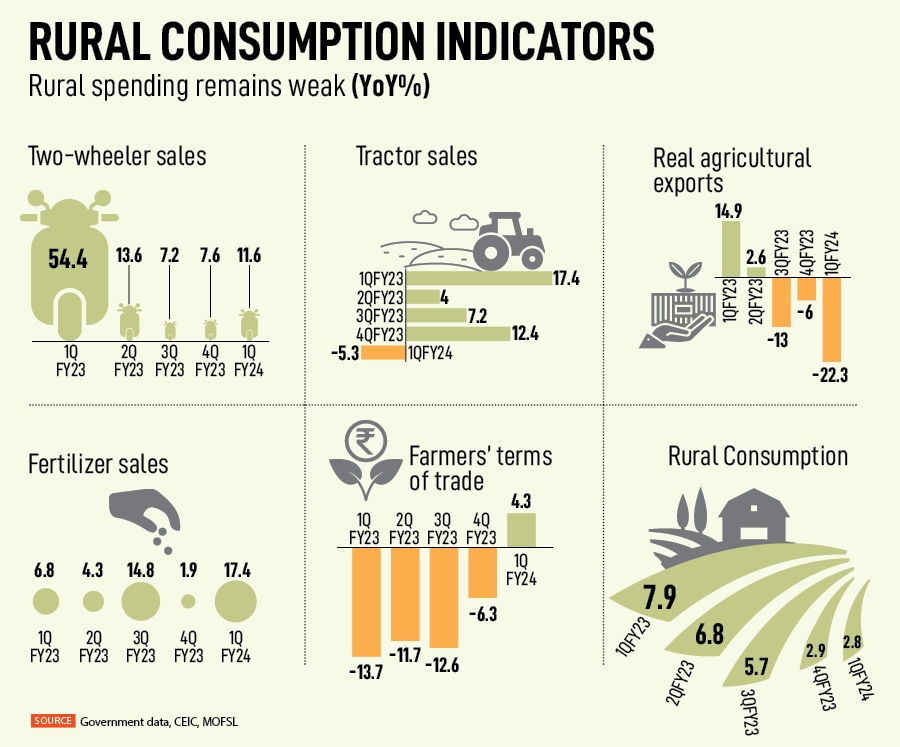

There are ten proxy markers for gauging the state of the rural economy. These include two-wheeler sales, tractor sales, farmers’ terms of trade, agricultural exports, real agricultural GVA, farm credit, reservoir levels, and fertiliser sales. A simple average of these indicators, according to economists, suggests that the rural economy is not out of the woods.

Rural consumption fell to a six-quarter low of 2.8 percent year-on-year in Q1FY24 in comparison to 7.9 percent in Q1FY23 (see table). There was a big drop in farm exports (fastest decline in eight years) and tractor sales (first contraction in five quarters) that slumped to 22.3 percent and 5.3 percent respectively in the April-June period. The blow was partially softened by an improvement in the farmers’ terms of trade and fiscal rural spending which rose by 4.3 percent and 7.5 percent each.

As per the 77th round of the National Statistical Office (NSO) survey, around 49 percent of rural household income comes from wages, approximately 37 percent from crop production, and close to 14 percent from non-farm business, livestock and rent. Currently, the rural unemployment rate hovers close to 8 percent and the demand for work under the rural employment guarantee scheme increased by 15.2 percent in July over the previous year. One reason for this could be the delay in the sowing of kharif crops, which reduced the demand for farm labour. Besides, the withdrawal of some pandemic sops squeezed spending and rural wages remained flattish.

“The stress in the rural sector is also visible in NREGA data. Employment demand by households under MGNREGA was much higher in the first four months of FY24 compared with FY23 and FY18-20 average. It is evident that rural spending remains weak, although the hope of its revival is alive, primarily led by upcoming state elections at end-2023 and general elections next year," Motilal Oswal’s chief economist Nikhil Gupta says. Approximately, 44.2 million and 21 million workers enrolled under the MGNREGA scheme in June and July.

Overall, according to market researcher NielsenIQ, the FMCG sector grew at its fastest rate in one-and-a-half years at 12.2 percent in the April-June quarter versus 10.2 percent between January-March. It said rural market volumes rose to 4 percent after declining 2-5 percent over the last four quarters. Rural demand has been under pressure due to higher prices of food staples, such as milk and wheat, which led to a major cutback in spending by households, and was mainly driven by the non-food category.

Moreover, the previous quarter saw projections of an improvement in rural demand range from confidence to cautious optimism. Pidilite, a leading manufacturer of adhesives, art material, industrial and construction chemicals, reported a double-digit growth in its rural market which was 1.5 times more than the urban business. Its management sees encouraging signs of recovery in the rural economy.

Bharat Puri, managing director, Pidilite, said at an earnings call, “The good thing we have seen over the last six months, at least in our sector, [is] rural demand slowly coming back. It is still not the buoyant twice urban demand that we used to see, but slow and steady. We are actually quite optimistic about the next six months simply because we do not see demand conditions domestically changing dramatically. There is a long festive season and most importantly, from our point of view, input prices are fairly stable."

Interestingly, according to Puri, discounts in rural markets tend to be lower than urban markets, but freight and logistics costs tend to be higher, because in rural and semi-urban areas the competitive intensity is lower. The Fevicol-maker’s rural mix comprises smaller packs and portfolio products of starting price points. Puri explains the strategy: “We obviously have lots of rural marketing and penetration models. We classify markets into various substrates, and we believe there is an ideal product mix for every substrate and we keep working towards reaching that ideal product mix."

In the first quarter of the current financial year, domestic FMCG companies reported a weak growth of 2.2 percent in gross sales although operating profit rose to 12 percent, largely on the back of lower input costs of raw materials. Consumer goods company Dabur earns nearly half of its revenue from rural areas. Its CEO Mohit Malhotra believes rural demand has recovered. He told analysts, “With moderation in inflation, rural business across the board actually has recovered and there is a volume uptick. So rural [business] for the FMCG market has actually grown by 4 percent. We are growing ahead in rural [markets] at around 8 percent."

However, many companies are hesitant to predict if the rural economy has turned the corner. For example, Mohan Goenka, vice chairman and wholetime director, Emami, at the company’s first quarter earnings call, cautioned, “Coming to rural, I think still there is some challenge. I would not say that all the challenges are behind us. Some markets are slightly better, but we will have to still wait till the inflation moderates to see long-term growth in the rural markets." Rural markets contribute roughly 55 percent to Emami’s sales, according to industry estimates.

Care Ratings warns that the rising cost of living led by high food inflation underlines the stress in rural demand. Retail food inflation jumped to 10.6 percent in July from 4.7 percent in June. Vegetable prices rose 37.3 percent, price of cereals and milk rose by 13 percent and 8.3 percent respectively on a year-on-year basis. The rise in prices of wheat, rice, and cereals tends to be sticky, and a poor harvest or supply disruptions can keep the price levels elevated for longer.

Parachute hair oil maker Marico’s managing director and chief executive Saugata Gupta says green shoots are not visible in rural markets yet. “Factors such as retail inflation dropping to sub-5 percent levels, late pickup in monsoons, hike in kharif crop MSPs and higher government spending continue to give hopes of a gradual recovery in rural sentiment, although, the extent of impact of spatial distribution of rainfall and erratic weather patterns on rural farm incomes may also have a bearing on sentiment in the near-term," he explains.

FMCG behemoth, Hindustan Unilever, is seeing mixed trends. Recently, its chief financial officer, Ritesh Tiwari, told analysts in a post earnings call that the operating environment was volatile and the management is watchful of how the situation pans out. He expects volumes to continue recover gradually due to the high levels of cumulative inflation and the fact that consumption habits typically recover with a lag.

“Rural market volume, which, at one point, was declining in double digits has just turned positive in this quarter. Having said that, we need to be cognizant that these growths have come on back of volume decline in June quarter 2022. If we were to look at market growth on a 2-year CAGR basis, total volume growth is still marginally negative, with rural volumes declining at 4 percent," Tiwari notes.

Tiwari is optimistic, though. But he raises the red flag for weather-related risks: The quantity, timing, and distribution of rain. These will determine overall rural growth. “El Nino has come earlier, and we know that when it comes early in the season grows more in the season. That is one element we called out as part of unknown," he adds.

Care Ratings highlights that the risk to farm income remains high as uneven distribution of monsoon could affect the sowing of some crops and lower crop yields. “Amid these evolving global developments and weather-related vagaries, rural demand remains most vulnerable and can be hit by a dual blow of higher food inflation and lower income. A rise in food inflation could further destabilise the feeble rural demand recovery," its economists add. The overarching hope is that the government’s ambitious capex plan will bring in private investments which in turn will create a multiplier effect to boost demand jobs and consumption.

First Published: Aug 30, 2023, 11:51

Subscribe Now