Should you invest in the stock market right now?

Geopolitical conflict, rising inflation, rising oil prices, and the surge of Covid-19 in China have played a part in enhancing the volatility of the stock markets across the world. Dr Hemant Manuj - A

A majority of the asset markets, including bonds, equities, and currencies, across the world, have been declining over the last few months. The withdrawal of the quantitative easing (QE) and hike in Federal funds rate, the war in Ukraine, and the fresh outbreak of Covid-19 in China are the main factors cited by analysts for this decline. The common question on everyone’s mind is—when will the bonds, emerging market (EM) currencies, and equity markets bottom out? No one has a crystal ball for looking into the future. That’s why predicting the markets is often called a dud’s game. Yet, we can’t give up trying as a lot of our financial as well as real-world outcomes depend on how the financial markets behave.

Here I attempt to forecast where the Indian equity market is heading. The S&P BSE Sensex and the Nifty50 formed a top on October 18, 2021. Then they hit the bottom on June 17, 2022, with a decline of about 17 percent from the top. They have since moved up by six percent in about three weeks. This is quite a roller coaster ride.

Multiple fundamental factors affect the market prices and expected returns. Here I focus on the historical behaviour of a few key market parameters to see what they are telling us about the future. I look back at three time periods –

a) since 1992, when the foreign portfolio investors (FPIs) began investing in India, till date,

b) since 2008, the year of the occurrence of the global financial crisis, till date, and

c) since 2014, the year after the taper tantrum as well as the year of change in the government at the Centre.

Each of these dates marked a structural event for the Indian markets. Hence, I have chosen periods based on these dates instead of a random period of 5, 10, or 25 years.

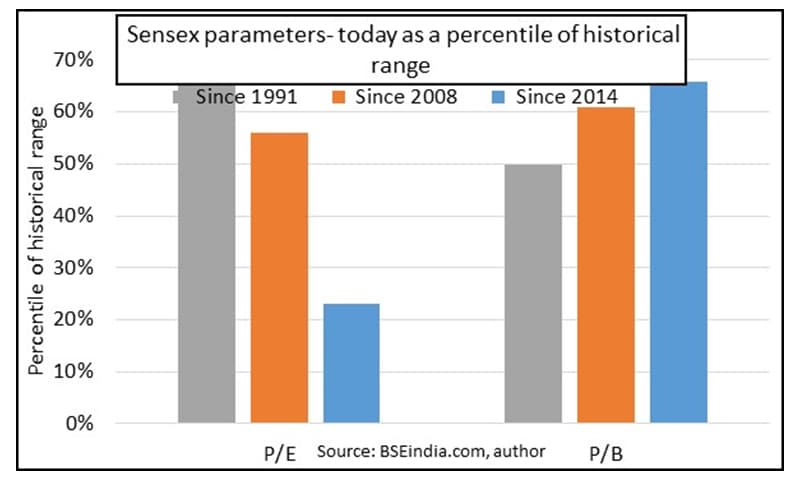

There are two commonly used market parameters to assess if the markets are over- or under-priced. These are the price-to-earnings ratio (P/E) and the price-to-book value ratio (P/B). The BSE has been publishing these parameters for Sensex every month. This is why I have chosen Sensex as the market index of interest. The values of these parameters are based on the historical (and not forward) financials of the firms. Using the range of values over the historical time horizons, I have computed what percentile of the historical range is the current Sensex at. The lower the percentile rank, the more attractive the market should be.

As we can see in Figure-1, the Sensex parameters are currently, at a higher level than the median value, by roughly 10 percent. Thus, the market level is not yet good enough to buy. The only exception, based on the P/E over the period since 2014, suggests that it is significantly under-priced.

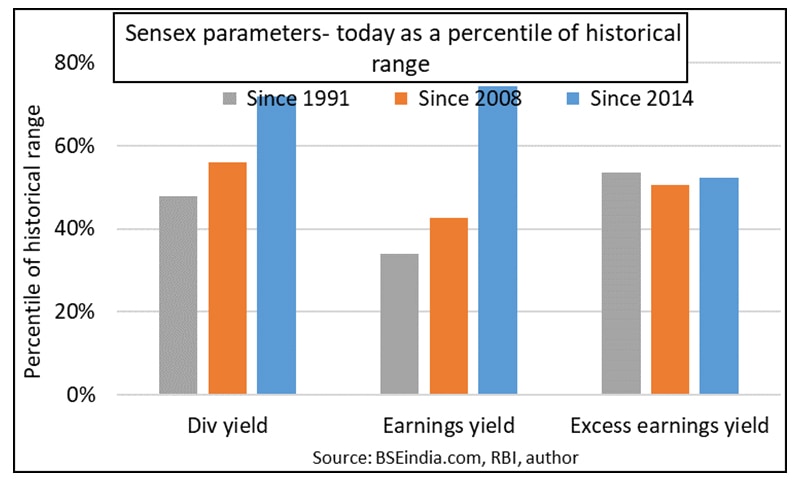

I would, however, look at another set of more informative parameters. These are the dividend yield, the earnings yield, and the excess earnings yield (EEY). The EEY is the difference between the earnings yield and the yield from government security (G-sec) maturing in 10 years. The higher these parameters are, the more attractively priced the market should be.

As shown in Figure 2, the current value hovers around the median of the historical range in most cases. The percentile values, based on the post-2014 range, do suggest optimism. These parameters suggest that the market is priced in the fair range, but not yet attractive.

Figure 1

Figure 2

Given these results, what should we conclude? We should look at a few surrounding parameters as well.

On the negative side, the US Federal Reserve Bank (Fed), as well as the Reserve Bank of India (RBI) are expected to raise their benchmark rates for some more time. While we do not know when the rate cycle will peak, these rate hikes will both hurt corporate earnings as well as raise the cost of capital for the investors. Even if we assume a 50 bps hike from here, both the earnings and dividend yields would deteriorate. The current value of MRP would fall to below 25 percent of the median range, considering just the direct impact of the G-sec rate hike alone. If we add the possibility of any fall in earnings yield, it gets even worse. The market price would need to fall by 10 percent to neutralise the impact of a 50 bp rate hike.

On the positive side, the rate hikes are almost definitely followed by rate cuts. Again, this will be led by the Fed but followed by other central banks across the world, including the RBI. Any news on the cooling down of inflation or economic growth will hasten this sequence of events. The US data suggests that while the labour market is tight as of now, there has also been a rise in inventories, which would soon lead to a fall in prices and output. For the Indian economy, fuel and commodity prices are the key factors. The latter appears to be normalising. However, in my view, oil prices may not cool down soon, given some structural factors related to emerging geopolitics and some reversals in renewable energy efforts.

Finally, coming back to the Indian equity market outlook, the data suggest caution in the short term. The market is more likely to fall from the current level before forming the bottom and rising. One factor that we should watch for in the next few months, is the revival, or at least maintenance, of consumption demand through the rate hike cycle. The best approach is, of course, to diversify across assets and invest for the long term.

First Published: Jul 19, 2022, 11:36

Subscribe Now