For PolicyBazaar, health care's the best policy

With investment from SoftBank, India's biggest online insurance aggregator is ready for its next big foray: Health care on tap

Yashish Dahiya, CEO Policybazaar.com

Yashish Dahiya, CEO Policybazaar.com

Image: Amit Verma

Yashish Dahiya has come a long way from the time he first took his laptop to Sanjeev Bikhchandani’s office and showed him a comparison of prices at which the founder of Info Edge could buy insurance for his car. That was mid-2008.

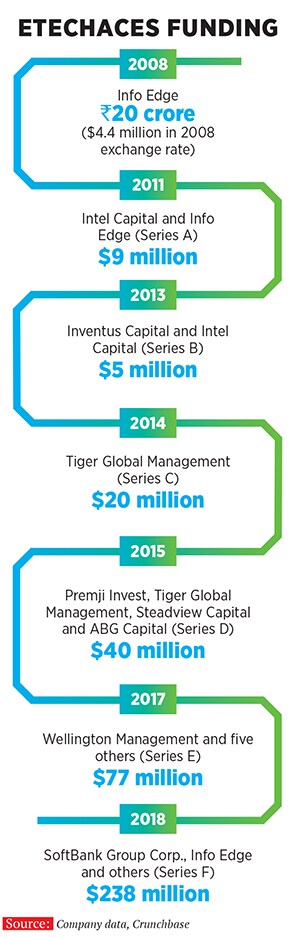

“The story for us was much bigger than that, but for a long time he ignored that, and trusted us that there was a business opportunity there,” Dahiya recalls, sitting in his Gurugram office. Dahiya, and co-founders Avaneesh Nirjar and Alok Bansal were starting out building an insurance comparison business, PolicyBazaar, and Bikhchandani and partner Hitesh Oberoi handed the trio “pretty much the biggest cheque they’d written at the time,” Dahiya says.

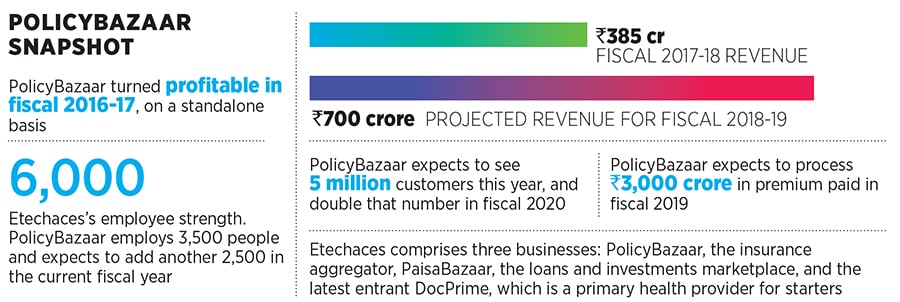

The ₹20 crore from Info Edge, which runs the online job portal Naukri.com, made for a fairly large seed fund. As things panned out, it was the next round, led by Intel Capital in 2011, which became the official Series A round, and Info Edge participated in that as well. The early bet has made Info Edge one of the largest investors in Etechaces Marketing and Consulting, PolicyBazaar’s parent, which also owns the online lending marketplace PaisaBazaar.com.

But that “bigger story” of Dahiya’s is beginning to come together only now, a decade after his 2008 meeting with Bikhchandani, and is testimony to the tenacity and staying power of the triathlete who completed the Iron Man last year.

This June, Japan’s SoftBank Group agreed to lead an investment of $238 million in Etechaces, making it India’s latest unicorn. Of the $238 million—which includes $200 million in primary investments and $38 million in secondary investment—SoftBank is investing $150 million, while Info Edge is putting in $58 million, with the rest coming from other investors.

With SoftBank’s backing, Dahiya and Bansal—Nirjar quit in 2013—are casting the net wider: From insurance, they are now testing the waters in the health care business itself.

The new vertical under Etechaces has been named DocPrime. “We are no longer going to just sit here and rely on advertisements… we are going to upwards integrate,” which means generating demand for health care insurance itself, so that the company can sell more health insurance. “It’s a big step,” Dahiya explains the business sense behind the latest offering.  (From left) Yashish Dahiya, CEO, Alok Bansal, CFO, and Ashish Gupta, CTO of PolicyBazaar.com

(From left) Yashish Dahiya, CEO, Alok Bansal, CFO, and Ashish Gupta, CTO of PolicyBazaar.com

Image: Amit Verma“This is a high growth area for sure,” Gayathri Parthasarathy, partner and head of financial services advisory at accounting and business consultancy KPMG, said in a phone interview. “The foray into health insurance can be profitable, provided you find the right customer segment, and design the product around not only indemnification but also spend efficiency.”

Parthasarathy declined to comment specifically on the SoftBank-PolicyBazaar deal, but added that such investments in the online sector could prove to be strong “enablers” of growth. The flip side could be that “insurers are also coming up with their own online platforms and would prefer to encourage customers to use their own channels”. Therefore, the quality of service will hold the key to the success of online aggregators, she said.

Bansal adds: “We want to give customers free access to quality doctors through tele-consultations.” He reckons the bulk of the users will benefit on the very first call of a consultation. For those who have to physically visit a doctor, to get tests done and so on, DocPrime will grow to help customers access that entire ecosystem.

Currently, health insurance claims are typically made for inpatient treatments in hospitals. DocPrime, it is hoped, will lure customers to try out the various policies available on PolicyBazaar at the stage of outpatient treatment. “If we can create a product that combines both inpatient and outpatient [insurance policies], then why not?” Bansal muses.While DocPrime is at a preliminary stage of its development, Bansal is gung-ho about its promise. “This is an underserved market, with a huge potential, and it is growing fast… there are only two things on which people don’t pinch and scrape—their children and health care,” he says, adding, “it’s very early days, but to do something innovative, we’re willing to put in the effort and the capital.”

The possibility of collaborating with PolicyBazaar notwithstanding, DocPrime will run on a separate app. Etechaces has been working on it for the last two or three months, with inputs from SoftBank. A few doctors have been hired, and a launch is expected even as this story goes to print.

Dahiya has a pretty straightforward reason for the evolution from health insurance to health care: PolicyBazaar needs to grow much faster. Despite the successes to date—the insurance aggregator business of Etechaces turned profitable in the fiscal year 2016-17—the share of online or digital services in the overall ₹1,10,000-crore insurance market in India is still just about 5 percent, he points out. Of this 5 percent, PolicyBazaar accounts for about half. In other words, it accounts for just 2.4 to 2.5 percent of the overall industry, Dahiya says. The IIT Delhi and Insead alumnus aspires to take this share to 30 percent in the years to come.

And there are tailwinds that might aid this growth. If one were to look at just the ‘protection insurance’ business, PolicyBazaar has cornered 20 percent of the overall market, Dahiya says. Protection insurance refers to people buying insurance against disease, disability and death, on their own volition. This is the ‘voluntary protection’ market, as against, say, motor insurance, which is mandated by law. Today, only about 2 percent of health care expenses are settled through insurance claims in India, according to industry data. The aspiration is that DocPrime will grow to change that, and in the process make money for itself.

The way it’s planned, the first consultation, by voice, chat or video call, will be free. The subsequent call will be a paid service, but it will still be discounted. And then the service is made more attractive by offering a subscription, which will open up other benefits, such as selling insurance discounts on tests and so on. It is unlikely to make money on its own in the short to medium term.

“We are in insurance, and basically what we are doing is building out the [health] insurance part,” says Dahiya. The doctor-on-demand services can then be covered under a health insurance plan, for instance, and the user may not have to pay separately.The way things are now, a customer makes a medical claim, on an average once a year or sometimes once every four years, but DocPrime could bring that frequency to once every two months and then the customer interactions increase. Therefore, this is to basically sell insurance and get more people covered, but it is also to make the customer have many more touch points with PolicyBazaar, adds Dahiya.

All this also means that PolicyBazaar gets to collect large volumes of data about its customers. Data processing capabilities have gone up dramatically, Dahiya points out, with the advent of cloud computing.

The company handles 2 lakh voice conversations every day. It used to have a quality team that listened in on about 1 percent of the calls. Now, on a regular basis, calls are converted to text and analysed for words indicative of claims, fraud, and miscommunication by agents.

Analysing existing data, is also helping PolicyBazaar unearth fraudulent claims by identifying words commonly used by customers who have made such claims earlier. Companies today have a fair idea about a potential customer’s claims ratio and it becomes easier to check if the claim is genuine or not. “We are creating products on the basis of such knowledge,” says Dahiya.

“In fact this month [July] is important, as many of the features will go live,” says Ashish Gupta, the company’s chief technology officer. Much of the technology, such as a speech engine primed to recognise thousands of key words in Hindi—which accounts for about 75 percent of the calls PolicyBazaar handles—has been built in-house, Gupta says.

Where needed, Gupta has also relied on technology from global giants such as the cloud services business of Amazon Web Services, and startups such as Liv.ai, known for its prowess in Indian language speech recognition.

Bansal adds that SoftBank’s involvement makes an important difference now. The timing is right, with PolicyBazaar looking to expand on multiple fronts, including the core insurance business, and the depth of technology it has been preparing to bring to bear on the business.

“They [SoftBank] are a very large ecosystem player. They want to see how their different investments can benefit from each other, and that is something they can help us with,” he says.

Entrepreneurs can get caught up and a little blinkered in building their own business, but an entity like SoftBank can provide perspective on things that are happening outside. SoftBank coming in also “gives you a different level of confidence,” he says, “you don’t have to worry about the downside, and the possibility is that if you have put in an honest effort, you will have support for much longer, if needed.”

There have already been some calls and connects with some of SoftBank’s portfolio companies, especially in health care. Dahiya is expected to make a visit to China to meet an undisclosed company to learn more about how the health insurance ecosystem is functioning in China, and what can be applied to India.

Tiger Global is the single largest investor in Etechaces, followed by Temasek, Info Edge and SoftBank. There is also a roster of smaller investors holding mid to low single-digit stakes. The investors, and their commitment of hundreds of millions of dollars, should make the 10-year-old business look like a dream run. But, it wasn’t always so, Dahiya recalls. “The higher you build your barrier, the taller I become,” he quotes singer Labi Siffre from the album So Strong.

In 2011, came a rule from the insurance watchdog Insurance Regulatory and Development Authority of India (Irdai), which, according to Dahiya, “Said you [digital insurance players like PolicyBazaar] can’t make ad revenue or lead generation revenue, you can’t display any products without having a contract with the insurer and you can’t have reviews or recommendations. You can only earn one-fourth of what a broker can earn and then only for one year.” All this came out for digital players. “It basically finished off our business.”

The company’s revenue streams came down to 2 to 3 percent of the earnings before the notification. Young companies survive on ad revenues, lead generations and so on. All of that was “shot and shut”. PolicyBazaar was forced to start a sales business, and make money within the constraints of the new laws.

Dahiya says the new rules were goaded by multiple interests in the industry that maintained the status quo, and saw PolicyBazaar as a threat. This was because PolicyBazaar wanted to explain and lay bare every product it sold, allowing the customer, for the first time, to make informed decisions, he says.

“So we struggled, for the next three years, but we didn’t give up. Even our investors asked us to give up, not because they thought we were going to lose money, but because they thought it was futile.” However, they persisted and succeeded. As a result, PolicyBazaar emerged as an organisation that could play by whatever the existing rules were and still succeed. “It’s sad. I think of micro-regulation as chemotherapy. It destroys everybody but makes the one who survives very strong,” says Dahiya. The heartening aspect of the story is that the regulator didn’t stay put and changed the rules, and from 2013 onwards many restrictions have been removed and more are on their way out. By 2015, the industry came around to Dahiya’s view that profitability lay in protection and not in investment. In other words, they started selling customers “pure protection against disease, disability and death” rather than offer complex investment products that also included insurance. As a result of the simpler terms, the cost of the products too could be slashed, making them more attractive to customers. Therefore “insurance for the sake of insurance”.

However, skirmishes with larger businesses are not over. According to media reports, Amfi, the mutual fund industry lobby in India, has objected to PaisaBazaar’s use of film actor Akshay Kumar for celebrity endorsement. Amfi wants PaisaBazaar to seek capital markets regulator Sebi’s approval for such ads. In an unrelated comment, Etechaces CEO Dahiya told Forbes India that he saw his company as one that is meant to empower the “everyman”. The image of a “seedha, saadha Akshay” (straightforward, simple Akshay) represented that philosophy, he says.

One of the reasons why Dahiya can plough through frustrations like the one with Irdai, or the one with Amfi, is the brutal physical fitness regime he puts himself through every day, starting at 4 am, and which involves, swimming, cycling and running.

The triathlete has his own gym down the road from his office, among the nine buildings in Gurugram that PolicyBazaar operates out of. One of the ways in which he cycles, without having to leave the safe confines of the gym, is by mounting his bicycle on a stationary motorised simulator that has the capability to recreate the toughest terrains for him.

With a regimen like this, he has the toughness to take Etechaces through tough terrains, as it explores its next stage of growth with DocPrime.

First Published: Jul 27, 2018, 11:55

Subscribe Now