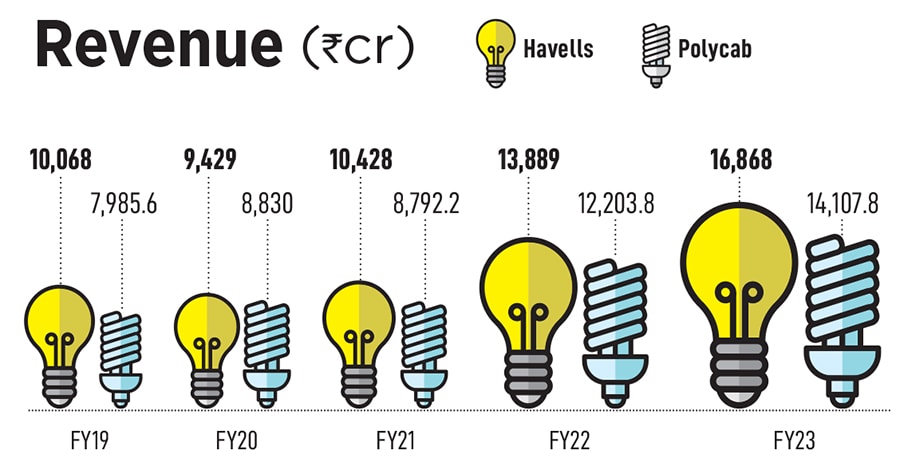

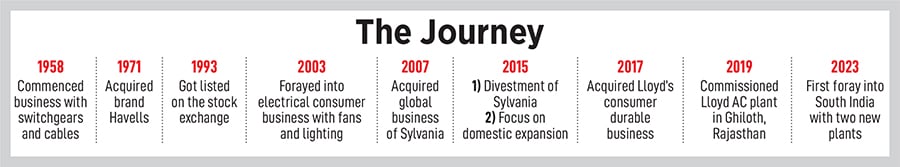

There was no turning back since then. He took the small trading enterprise and turned it into a household brand that it is today with a series of acquisitions, joint ventures, and entering new product categories. Popularly known as QRG and a pioneer of fast-moving electrical goods (FMEG) in the country, he steered the brand from a few lakhs to ₹16,500 crore in revenue over four decades. In November 2014, at the time of his demise, the market cap of Havells was ₹18,000 crore. A couple of months prior to that, the 77-year-old had joined the billionaires club and made his debut on the Forbes India Rich List at Rank 48 with a net worth of $1.95 billion.

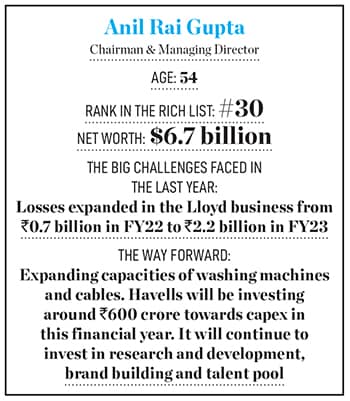

The veteran encountered many setbacks along the way, but remained headstrong during the crisis. “One thing that I learnt from my father and continue to believe in is that during times of crisis, leaders have to come out in front because people look at the leader’s mindset. If it’s positive, the organisation and all the stakeholders related to it become more confident," Anil Rai Gupta tells Forbes India, sitting in his father’s cabin at QRG Towers in Noida. The toughest time for the company was undeniably the 2007 acquisition of German lighting and fixtures maker SLI Lighting, owner of the Sylvania brand. The European market was hit by the financial crisis soon after the acquisition, and Sylvania felt the blow. Havells pulled all the strings to make the deal work—and even briefly managed to do so—but eventually sold it off completely by 2017.

Nip and Tuck

The Jaisinghanis of Polycab entered the business in 1964 and dealt in various electrical products, including fans, lighting, switches and wires. They eventually started manufacturing cables and wires, and officially incorporated the company in 1996. Headquartered in Mumbai, the financial capital of India, Polycab made its market debut in 2019 and raised ₹1,346 crore through an initial public offering (IPO) that was subscribed more than 52 times. With a 24 percent market share, it dominates the wires and cables sector in India. In 2014, it forayed into the FMEG business, which has grown at 30 percent CAGR in the past seven years.

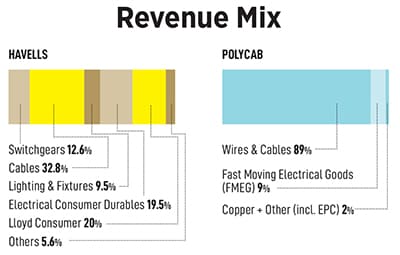

Conversely, Havells, since the beginning, has focussed on expanding its footprint and becoming a complete FMEG and consumer durables brand. It continues to focus on both B2C and B2B segments. A decent chunk of its revenue comes from B2B categories like industrial switchgear, professional lighting and power cables. “In the cables segment, we continue to grow our revenues despite volatility in commodity prices and recent softness in consumer demand. In line with our commitment to building manufacturing capacities, we are in the process of setting up a new cable facility in the Tumkur region of Karnataka. We expect it to be commissioned around the end of this financial year. The facility will complement our existing manufacturing unit in Alwar, Rajasthan," says Anil, 54, chairman and MD of Havells.

![]() Polycab is one of the largest exporters of power cables. It saw an 88 percent growth in exports, with the US and Australia making up a majority of its overseas sales. Looking at the current tailwind in the cable sector, especially on the back of the renewables push, Polycab stands out in terms of a better cable portfolio. This has spurred the growth of the company.

Polycab is one of the largest exporters of power cables. It saw an 88 percent growth in exports, with the US and Australia making up a majority of its overseas sales. Looking at the current tailwind in the cable sector, especially on the back of the renewables push, Polycab stands out in terms of a better cable portfolio. This has spurred the growth of the company.

Forty percent of Havells’s business is generated from wires and cables. Until about three years ago, its export focus was limited. But that is changing now. “We see good opportunities from the developed parts of the world like the US and Europe, rather than just the Middle East and Africa, which we were focusing on earlier. Right now, the percentage of exports is less than 5 percent. Over the next five years, our aim is to take this to at least 10 to 15 percent of our revenues," explains Anil.

Havells currently supplies to more than 70 countries across product categories, including air conditioners, cables, fans, and switchgears. Its plan is to cash in on the macro tailwinds and China’s plus-one export opportunity in global trade to expand, and cable will be an important part of its export product offering.

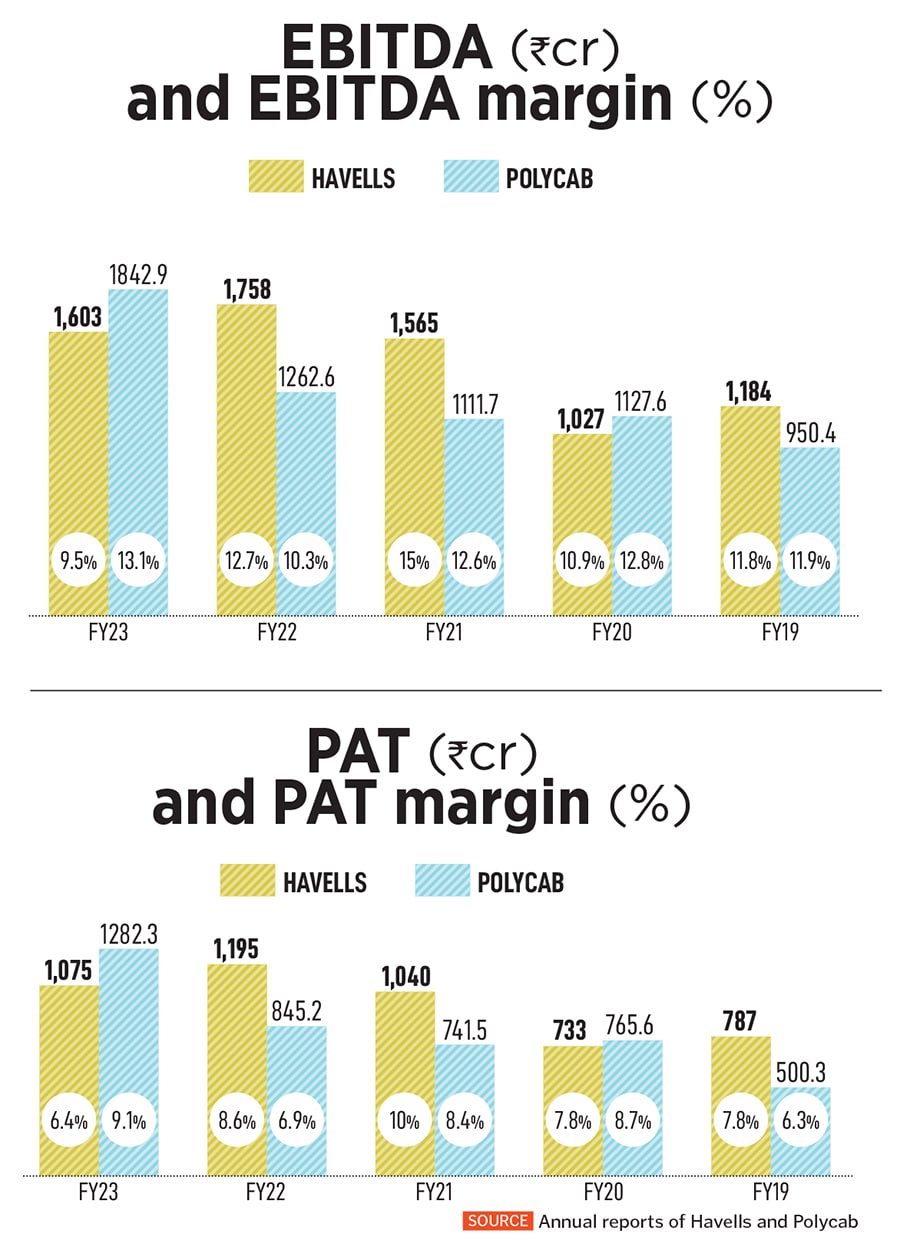

Both Havells and Polycab have their own expertise in wires and cables, and FMEG. Havells has a diversified product portfolio in the electrical goods sector, but in the past few quarters, some offerings have been facing headwinds – specifically the Lighting and Electrical Consumer Durables (ECD) segments, explains Natasha Jain, lead research analyst, Consumer Durables and Electricals sector at Nirmal Bang, a stockbroking firm. “While its RAC business (through Lloyd) has been consistently gaining market share, high advertisement and promotional spending has led to negative margins at EBITDA level. Greater diversification can sometime suppress the overall performance when few divisions tend to underperform". Once consumers start spending buoyantly on these durable items, Havells is expected to reap greater benefits due to presence of a premium portfolio and also, superior execution capabilities by the management, she adds.

![]()

In 2017, Havells acquired the consumer durable business of Lloyd Electric and Engineering for an enterprise value of ₹1,600 crore, giving it a foothold in the fast-growing consumer appliances market. In the last five years, whatever was planned out for Lloyd has panned out well, explains Anil. Today, 50 percent of sales come from distribution, and the rest come from online, modern format and regional retailers. “We’ve broken into the top two in the air conditioning category. In the last one-and-a-half years, we tried to be in the top three. Market share buildup is happening… of course, when you invest so heavily, profitability is always a question mark initially, but we are looking at the long-term play here. And the idea is that we’ll continue to grow market shares and expand product categories," he adds.

![]()

However, according to analysts, Lloyd’s business has led to a loss of market share, and a lot of investments in it are impacting the bottom line. The growth of Havells has been stagnating in comparison to other players. For instance, explains Aditya Vora, research analyst at Equitymaster Agora Research Private Limited, because of their strong foothold in the FMEG business, Havells gets a high multiple in the market because usually the stock market gives the B2C company a much higher multiple in comparison to a B2B company. But when a company like Havells is trading at such high multiples and growth alters, then the market is ruthless and it will derate the multiple because what will happen is earnings and the multiples will start going down. “Havells will have to get its earnings growth back, because the only thing the market cares about is earnings growth, and the only thing the market cares about is the fact that when you have high earnings, you can justify such high multiples. Havells will have to up its game to regain lost market share," he says.

A vast pan-India distribution and premium brand positioning are the key strengths of Havells. While growth in the last few quarters has been muted, the company has maintained or gained market share in many of its key product categories, explains Ashish Poddar, senior vice president of Systematix Group, a diversified financial services company. Lloyd has grown at a robust pace and gained market share in RAC [room air conditioner] profits are sometimes away, though. Many players have ventured into the FMEG business in the last decade, but only a few have been successful due to stiff competition from existing large brands.

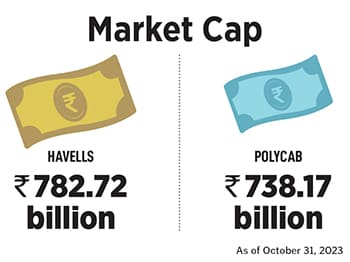

![]() Havells’s stock price hasn’t moved much in the last year due to its muted earnings growth. On the other hand, Polycab’s stock price has doubled in the last year due to a combination of robust performance in its core cables and wires segment, and price-to-earnings (P/E) re-rating. “Havells remains the most expensive stock in the peer set due to its diversified business, strong management, distribution and brand pull, and high cash flow generation. Havells is among the top three players in many of its key product categories. While it remains a strong brand in the mid-premium segment, expansion into the mass-mid segment will be key to determining the sustenance of its market share position," adds Poddar.

Havells’s stock price hasn’t moved much in the last year due to its muted earnings growth. On the other hand, Polycab’s stock price has doubled in the last year due to a combination of robust performance in its core cables and wires segment, and price-to-earnings (P/E) re-rating. “Havells remains the most expensive stock in the peer set due to its diversified business, strong management, distribution and brand pull, and high cash flow generation. Havells is among the top three players in many of its key product categories. While it remains a strong brand in the mid-premium segment, expansion into the mass-mid segment will be key to determining the sustenance of its market share position," adds Poddar.

Anil feels organised competition is better than unorganised competition. He says there are established companies like Polycab and Atomberg. Then there are established brands like Philips, Schneider and Crompton, so this organised competitiveness is good. The problem is with the unorganised players—small brands offering low-quality products, fooling customers, buying material from China and selling them. “Thankfully, the country is moving in a direction where there will be more and more organised competition. GST and demonetisation have pushed the unorganised market behind to a large extent. So, when you see companies like Polycab growing, it’s a good thing. This is the beauty of running a business. You are always surrounded by competition, but ultimately, your objective is your consumer, not competition."

Going Forward

Havells has been consistently investing in augmenting its manufacturing capacities. Ninety percent of the products sold are being manufactured in-house. Last year, the company commissioned a new air conditioner plant in Sri City, Andhra Pradesh, and this year it’s expanding its washing machine and cable capacities. Havells will invest around ₹600 crore towards capex this financial year. It is also evaluating the setting up of a manufacturing facility for refrigerators. Havells has also been focusing on building its research and development (R&D) capabilities.

![]()

Anil reveals that 20 years ago, Havells was dependent on foreign technology—for instance, it would go to Germany or Europe and get technology for switchgears or lighting. To eliminate this, Havells started investing in R&D. Today, it has more than 800 engineers dedicatedly working on product development. The company has also traversed the journey from being a mass player to a mass premium player. So, consumer expectations are different from what they were earlier.

“There will be a lot of technology in the coming years. Whether it is the Internet of Things, digitisation, or connected homes, a lot of technology will play a role in electromechanical products as well. The challenge will be to be a mass player, making mass products that are unique for consumers. So, this is something we are working towards," he adds.

Anil is on a quest to fulfil QRG’s wish of making Havells an institution that should not be remembered by the people who founded it, but for the products it makes.

The second-generation entrepreneur admits that he had big shoes to fill after the passing of QRG, but he gained a lot from the experience of working under him for 20 years. Today, the company manufactures everything from switchgears, cables, and electrical consumer durables to air conditioners and refrigerators in its 15 facilities across the country. The 52-year-old company, which got listed on the bourses in 1993, has a market cap of ₹77,767 crore and six brands under its umbrella, from mass to mass-premium category.

The second-generation entrepreneur admits that he had big shoes to fill after the passing of QRG, but he gained a lot from the experience of working under him for 20 years. Today, the company manufactures everything from switchgears, cables, and electrical consumer durables to air conditioners and refrigerators in its 15 facilities across the country. The 52-year-old company, which got listed on the bourses in 1993, has a market cap of ₹77,767 crore and six brands under its umbrella, from mass to mass-premium category. Polycab is one of the largest exporters of power cables. It saw an 88 percent growth in exports, with the US and Australia making up a majority of its overseas sales. Looking at the current tailwind in the cable sector, especially on the back of the renewables push, Polycab stands out in terms of a better cable portfolio. This has spurred the growth of the company.

Polycab is one of the largest exporters of power cables. It saw an 88 percent growth in exports, with the US and Australia making up a majority of its overseas sales. Looking at the current tailwind in the cable sector, especially on the back of the renewables push, Polycab stands out in terms of a better cable portfolio. This has spurred the growth of the company.

Havells’s stock price hasn’t moved much in the last year due to its muted earnings growth. On the other hand, Polycab’s stock price has doubled in the last year due to a combination of robust performance in its core cables and wires segment, and price-to-earnings (P/E) re-rating. “Havells remains the most expensive stock in the peer set due to its diversified business, strong management, distribution and brand pull, and high cash flow generation. Havells is among the top three players in many of its key product categories. While it remains a strong brand in the mid-premium segment, expansion into the mass-mid segment will be key to determining the sustenance of its market share position," adds Poddar.

Havells’s stock price hasn’t moved much in the last year due to its muted earnings growth. On the other hand, Polycab’s stock price has doubled in the last year due to a combination of robust performance in its core cables and wires segment, and price-to-earnings (P/E) re-rating. “Havells remains the most expensive stock in the peer set due to its diversified business, strong management, distribution and brand pull, and high cash flow generation. Havells is among the top three players in many of its key product categories. While it remains a strong brand in the mid-premium segment, expansion into the mass-mid segment will be key to determining the sustenance of its market share position," adds Poddar.