Can Atomberg take on market leaders like Havells and Crompton?

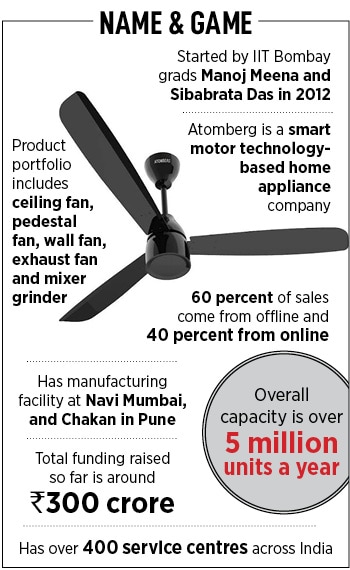

Manoj Meena and Sibabrata Das failed five times, but the sixth time, they built Atomberg as a startup manufacturing energy-efficient fans. How far will home appliances take them?

Thangadh, Gujarat, December 2015

“10 lakh kaise maange tuney? (How dare you asked for Rs10 lakh)," the industrialist fumed. The tall man in his mid-40s was sitting bare-chested on a cushy red sofa. His frail personal assistant, standing close to him, started trembling in fear. “Aap shaanth ho jaiye (Please calm down)," he implored. Sibabrata Das looked clueless, so did his colleague Arindam Paul. Both had made an urgent trip to the industrial town of Tahangadh to deliver 500 fans through their fledgling fan startup Atomberg, and had requested for an advance payment of Rs10 lakh to deliver another 1,000 units. The duo was desperate. There was almost no money in the bank, salaries had been inordinately delayed and could not be pushed any further. Getting an advance payment was the only way to wriggle out of the crisis.In Thangadh, though, the lads from Mumbai were staring at a much bigger—and potentially fatal—crisis. The industrialist, in an uncharitable tone, asked them to first deliver the shipment. “Paisa kuch mahine baad milega [you will get the money after a few months]," he said. Eventually, Das and Paul managed to get Rs7 lakh out of him.

For the young duo, the idea of coming to Gujarat to collect payment was certainly outrageous. But going back empty-handed was not an option, as funding of Rs1 crore from the promoter family of specialty chemicals manufacturer Aarti Industries in July 2015 was about to get exhausted. And much like the speed of the fans they were manufacturing, money had evaporated at a fast clip. “We had zero idea about mass manufacturing," recalls Das, who joined Atomberg as co-founder in 2013. A year ago, his IIT Bombay senior Manoj Meena had started Atomberg as a technology consulting business.

By December 2015, eighty percent of the maiden funding had been consumed consumed. “The expenses got inflated," Das says. While capital expenditure sucked up most of the money, a significant chunk was used in sourcing raw materials. Four months down the line, the funds were about to get over, and Atomberg was struggling to deliver its maiden institutional order of 21 fans in October.

Sales, marketing and R&D (research and development) team doubled up as production executives. A team of around 20 burnt the midnight oil for three days. “Nobody went home," recalls Das. In fact, the last five fans were assembled using mobile torch as electricity outages threatened to derail the production schedule.

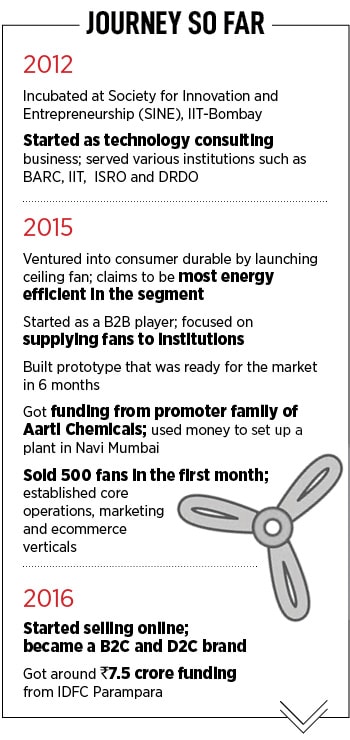

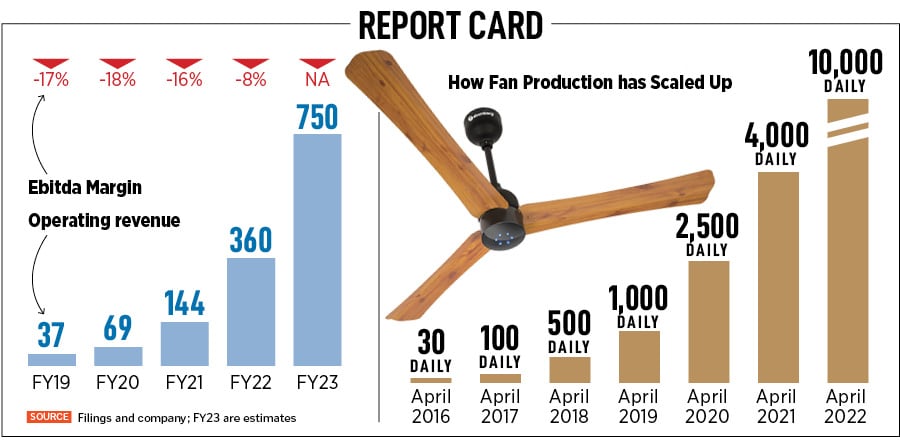

Then came a lifeline in 2016. IDFC Parampara pumped in Rs7.5 crore in the fledgling fan startup which was still into the B2B business of supplying fans to institutions such as colleges and hospitals. The booster helped Atomberg produce 30 fans per day on an average by April 2016. By next April, the numbers shot to 100 fans per day and the startup had morphed into a direct-to-consumer (D2C) brand.

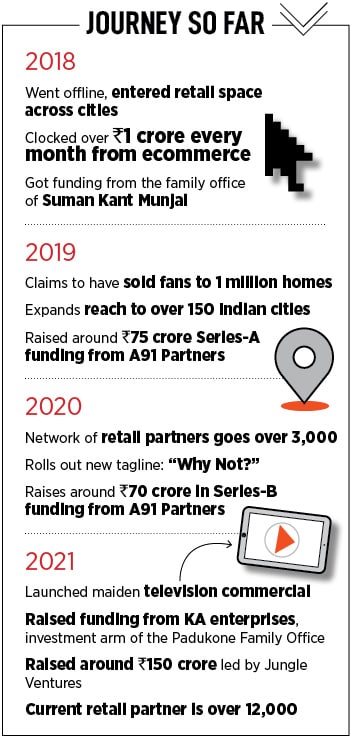

Another twelve months down the line, production jumped to 500 fans and the startup got an undisclosed funding from the family office of Suman Kant Munjal, chairman of auto components company Rockman Industries. By April 2019, Atomberg was making 1,000 fans every day, and posted Rs37 crore in operating revenue in FY19. “From around Rs10 lakh a month we had scaled toRs 1.5 crore a month," says Meena.

What the founders did not know is that they were speeding toward a devastating crash. In April 2019, buoyed by the scale at which operations expanded, the co-founders valiantly stepped out for funding. “We reached out to almost every investor in India and abroad," recounts Das. Though the VCs found the numbers exciting, nobody was willing to write a cheque. Reason was simple: Nobody bought their story! The biggest stumbling block was their ‘David versus Goliath’ narrative. “You can’t take on Crompton, Havells, Bajaj and Usha’ was the concluding remark with which all funding discussions got aborted in the last round.

The Atomberg story, funders said, had other missing ingredients. First, offline distribution footprint was missing as the startup was largely selling online. Second, manufacturing capabilities were still not proven. Third, Atomberg was still not a brand. It was neither a household name like its famed rivals, nor was it close to capturing the imagination of consumers. “In India, nobody was convinced with our story. And outside India, nobody understood the fan business," says Meena.

Then came another false alarm. A strategic investor—whose company was into the business of manufacturing appliances—evinced interest, sent a term sheet and the deal was about to be sealed. The funding, however, never happened. Das and Meena were now in a deep hole. The startup, which was now over a 100-member team, had been delaying salaries. It had not even made payments to the vendors existing investors were not willing to pump in more funds and only one-and-a-half month of operational runway was left. With no funding in sight, the writing was on the wall. “We realised we had to close the company," says Das. There was no reason, he rues, why it should not.

What happened next was the ‘why not’. The co-founders got to know about a consumer brand-focused fund—A91 Partners—which former Sequoia executives Gautam Mago, VT Bharadwaj and Abhay Pandey had started. But A91 Partners had a ticket size of $10-15 million, and Atomberg’s requirement was $5 million. They reached out anyway, and ended up raising around Rs75 crore ($10 million) in Series-A funding from A91 Partners.

Their operating revenue jumped from Rs69 crore in FY20 to Rs144 crore the next fiscal, and unaudited numbers for FY23 stands at Rs 360 crore. The daily production of fans too leapfrogged from 1,000 in April 2019 to 2,500 in April 2020, 4,000 in April 2021 and 10,000 in April 2022. The Ebitda margins too have improved: From a negative 17 percent in FY19, it has come down to a negative eight percent in FY22. “We aim to become a Rs5,000-crore business in five years," says Das, claiming that Atomberg, which recently forayed into mixer grinder and plans to be a multiple product company in five years, is clocking a revenue run rate of Rs750 crore for FY23.

“They are no longer the Davids," says VT Bharadwaj, general partner at A91 Partners. He gives three reasons for backing the first-time founders. First, the Das and Meena were trying to attack the market as a challenger brand with a superior product, which, according to him, is unusual and interesting. Most of the time, Bharadwaj explains, challenger brands try to fight big category guys by becoming a price warrior by playing a low-cost game, or formulating more value-for-money strategy, or having a slightly differentiated marketing positioning. “After a long time, we met a company that was trying to take on the big boys with a much better and differentiated product," he says.

The second reason was the massive opportunity in the consumer electrical space. “A lot of high-quality players have got built in the segment," says Bharadwaj. The sector also offered reasonable scale and size. “We haven’t seen a young, scrappy company trying to build a business in this category for 15 years. So, Atomberg offered an exciting opportunity," he adds. The third reason for betting on them was the grit story of the co-founders. “They really struggled," he says. Though they complete a decade this year, their story for the first seven years had a lot of blood, sweat and tears. “They were very resilient and frugal, scaling a Rs35 crore business with little access to capital," Bharadwaj says.

Back in 2011, Meena started his entrepreneurial journey with an innocuous lie. The IIT Bombay grad, who completed his BTech and MTech integrated programme in electrical engineering, landed his maiden job with the Indian Space Research Organisation (ISRO). “Everybody in my family was elated," recalls the first-time founder from Jaipur whose family was into government service. ISRO meant a stable job, and for a middle-class family, there is no bigger rocket than stability. Meena, though, had other plans. He wanted to create something by starting his own venture. Just to ensure that the enthusiasm of his family didn’t dampen, he told them that he has got an extension and can join ISRO after a year. “I thought I would crack something big in a year," he says.

Meena started small. He borrowed money from his friends, shifted to a chawl and started exploring various options for a year. In 2012, he founded Atomberg, but his then co-founder soon left to take a stab at the civil services examination. A year passed, Atomberg got incubated at Society for Innovation and Entrepreneurship (SINE) at IIT-Bombay in 2012, but Meena was still dependant on his friends for money, and survival.

Meanwhile, Meena’s IIT Bombay junior, Das, had a string of failures as a founder. In his second year, Das started a website development venture with his friend. The year after, he started trading in silk. “We used to export silk from Assam to Dubai," he recalls. In the fourth year of IIT, he started an online cosmetics marketplace, somewhat similar to Nykaa. All the ventures bombed. “Some didn’t have product-market fit and some failed due to immaturity of founders," Das confesses.

By 2013, Das was at crossroads, and Meena too was struggling alone. Both the hostel mates met again, and Atomberg started as a tech consulting business by taking projects from institutions such as ISRO, Bhabha Atomic Research Centre (BARC), Indian Institute of Technology (IIT) and Defence Research and Development Organisation (DRDO).

For the next three years, the duo kept hunting for a silver bullet. “We tried a lot of ideas but none could scale," rues Das. From a vehicle tracking system to data acquisition device to three more ideas, they tried their luck in vain. All five ideas bombed. For four years, Meena explains, Atomberg had been doing only projects but the B2B businesses hadn’t scaled.

By 2015, Das and Meena were branded failures. “We were tagged as failures by everybody," rues Das. The mentors at their incubator advised them to take up a job and quit entrepreneurship, friends also politely nudged them to get into a 9-to-5 role. As their IIT Bombay senior and juniors started making noise in terms of funding and business, the peer pressure became overbearing to handle.

Their self-confidence had hit a new low, when they had a Eureka moment—the idea of disrupting the fan business. But the friends couldn’t muster courage to discuss it with their incubation centre of funders. When they did, the story progressed with a predictable script. “Are you guys crazy to get into the fan business", and ‘Do you know how big Havells and Crompton are,’ were remarks intended to show them the ground reality.

The duo, however, just had one thought: Why not. “Why can’t fans be disrupted" they wondered. And they had their reasons. A conventional ceiling fan motor consumes around 75-watt power, but the mechanical output is just 22-watt. “So over-50 watt was getting lost," says Meena. “We looked at this opportunity and got excited," he adds.

For the engineers, the most important thing was to change the motor. Most of the fans use induction motors. Atomberg zeroed in on BrushLess Direct Current Motor (BLDC), which is more energy efficient. The fans could be remote-controlled, and claimed to consume only 28-watt of energy as against 80-watt used by others. Use of high-tech ensured that fans were more resistant to voltage fluctuations and ran three times longer on an inverter than traditional counterparts. “The energy saving results in cost saving of Rs 1,500 per year," claims Meena.

The gambit worked. Atomberg’s product portfolio now includes ceiling fans, pedestal fans, wall fans, and exhaust fans, and mixer grinder. Around 60 percent of sales come from offline and the rest is online. The company has a manufacturing facility at Navi Mumbai, and Chakan in Pune, and claims to have an overall capacity of over five million units a year.

So what next? Can Atomberg become the biggest fan player and a dominant small appliances major? “Why not," says Das, adding that the company has had enough buyout offers over the last three years. “It’s a long game. We are building for decades," he says, adding that the company has charted out a plan to break even the next fiscal. The goal, Meena chips in, is to build an aspirational product company out of India. People keep saying, he explains, that the next Apple would emerge from India. “Somebody has to do it. Why not us," he smiles.

First Published: May 09, 2022, 17:39

Subscribe Now