Indian space startups ready for take off in 2022

A handful of private space startups have come tantalisingly close to getting their products off the ground. The government's clear intent and support are welcome, but they also need more money to succ

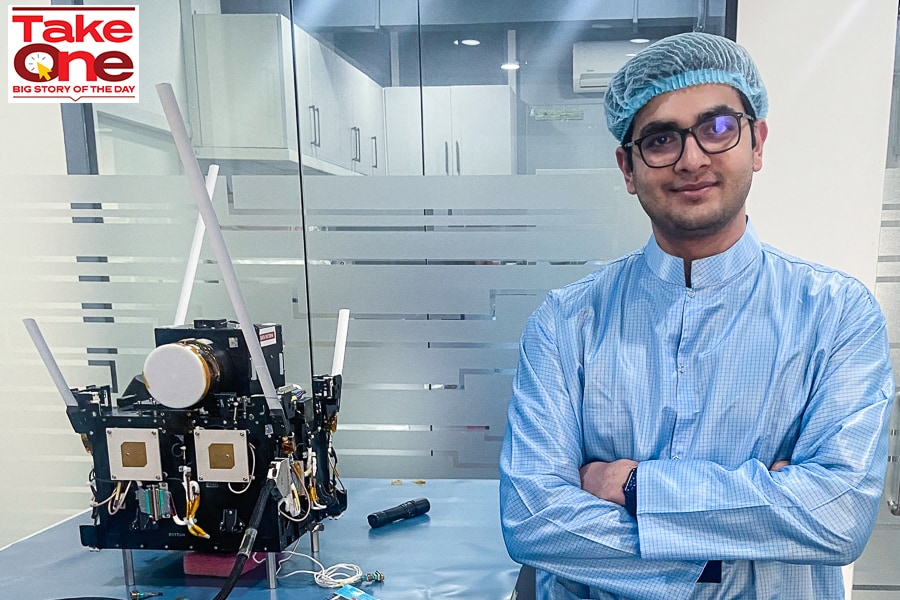

Awais Ahmed of Pixxel

Awais Ahmed of Pixxel

Awais Ahmed has come a long way from the astronomy book, and later a telescope, his father gave him as a schoolboy. If all goes as planned, the first demonstration satellite at Pixxel, the satellite data company that Ahmed and his friend Kshitij Khandelwal started in 2019, will be launched atop an Isro (Indian Space Research Organisation) rocket to an orbit some 500 km above Earth as early as January 2022.

If that satellite—named Anand to honour the memory of a young intern at Pixxel, who passed away later—proves a success, demonstrating the ‘hyper-spectral’ imaging technology that the company has developed, it will help Pixxel push ahead with its plan of putting up a constellation of 36 micro satellites in what are called low-Earth orbits. Typically in the range of 500 to 550 km above Earth.

“The plan is to have a constellation of satellites that can do global coverage on an every day basis so that we are able to see how things are changing daily," Ahmed tells Forbes India. “In that process, our first satellite has been built, it has been tested, it"s ready to launch… we are just waiting for the Isro rocket to get on the launch pad."

Ahmed hopes that in January 2022, Bengaluru’s Pixxel will be able to send it up. And following that, the plan is to launch the first phase of the constellation before the end of the year, which will help the startup to start serving customers around the world.

Pixxel is among a clutch of startups coming up in India that reflect the coming together of multiple factors that are set to usher in the private space industry in India—a sector dominated in the country so far by the phenomenal work done by Isro.

This time, some 40 to 50 startups are coming up across the supply chain. From the so-called up-stream companies, which are making the satellites and even rockets and propulsion systems and new rocket fuels, to the down-stream ventures which are looking to analyse satellite data to provide useful insights to customers ranging from agriculture to insurance to infrastructure planning and maintenance.

GalaxEye, in Chennai, is another Indian startup that is attacking the problem of getting better satellite imagery. The venture was incubated at the Indian Institute of Technology (IIT), Madras, and founders Suyash Singh and Denil Chawda are developing a kind of a hybrid sensor combining the best capabilities of optical cameras and radar technology. They aim to launch a constellation of satellites fitted with these sensors.

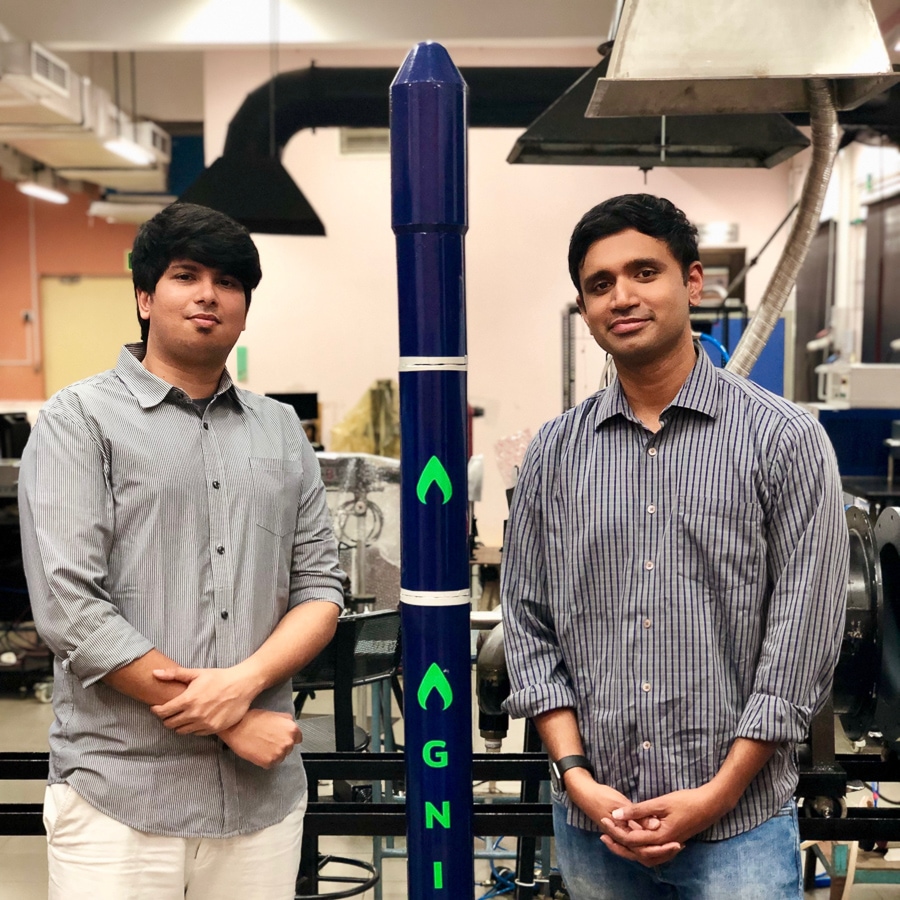

At Skyroot Aerospace in Hyderabad, co-founders Pawan Kumar Chandana and Naga Bharat Daka are developing multi-start capable space rockets. At Agnikul Cosmos, Srinath Ravichandran and SPM Moin are 3D-printing engines for small rockets that can put satellites like the ones Pixxel is building, for example, into low-Earth orbits.

And at Dhruva Space, Sanjay Nekkanti and his co-founders have persevered for almost 10 years now. Today they are building a strong business around space-grade solar panels.

Billionaire Elon Musk’s dream to put humans on Mars, his company SpaceX’s rocket programmes and Starlink’s satellite-based internet connections to individual households have not only attracted investors, but also caught the imagination of people around the world. It has inspired a generation of youth in India to get into space startups.

In fact, it was a visit to SpaceX, as part of a competition to build pods for the hyperloop vacuum-tunnel transportation experiment—another Musk brainchild—that motivated Ahmed to do something in the space industry.

Starlink is only awaiting the government’s nod, in the form of a licence, to start operations in India. In fact, the company even took pre-orders for connections and Starlink’s India head had tweeted about getting some 5,000 pre-orders quickly. The government, however, warned people to not buy the connections because Starlink didn’t have a permit to sell its services in the country yet.

That said, government backing is an important factor now that the private space industry is taking off in India.

Moin SPM, Co-Founder & COO (L) & Srinath Ravichandran, Co-Founder & CEO, AgniKul Cosmos

Moin SPM, Co-Founder & COO (L) & Srinath Ravichandran, Co-Founder & CEO, AgniKul Cosmos

“I think the biggest change has been the willingness from the department of space and Isro and related parties to engage with private entities. That wasn"t the case before," says Ahmed. The space department’s engagement with private companies from 2019 to 2021 reflects the government’s clear intent to both accelerate and increase the level of private industry’s participation in the country’s space sector, he adds.

India is revising its space industry policies and is also in the process of bringing in new ones to increase private industry participation, K Sivan, Isro’s chairman and secretary, department of space, said in October. He was speaking at the inaugural session on ‘Future of space—international participations and collaborations’ at the The India pavilion in Dubai’s Expo 2020 trade fair.

The policies will enable Isro to collaborate much more with India’s space tech startups, he said. That has meant, for example, that the space startups are getting access to Isro’s sophisticated testing facilities. Pixxel was the first to tap that opportunity, Ahmed says. Today the government’s space department is “actively willing to help to see space startups take off and succeed", he adds.

Then there is the regulatory aspect on which there is a lot more clarity today. The government’s intent is clearer, and policies are being made, tweaked and fine-tuned in multiple areas such as remote sensing, communications and space transportation and technology transfer. In the areas where the drafts have come out for proposed policies and changes, the general direction has all been towards liberalising the sector, he says.

That means “innovation will be able to flourish in the coming years". Of course, these new policies do need to be implemented. But it"s a good start because with regulatory clarity, investors get to take one risk off the table, knowing that there is a regulatory framework that reflects the government’s intent to support and encourage space startups.

In addition to making the sector more private enterprise friendly, Isro’s plans to accelerate its space programmes, with many more satellites and rocket launches each year planned than before, will also be an opportunity for Indian space startups. They get to both partner Isro on those programmes as well as have more rocket launches on which to send up their own payloads.

Pawan Goenka, chairman, Indian National Space Promotion and Authorisation Center (IN-SPACe), says India aspires to launch a dozen missions every year as against four or five currently. He added that the country is working on developing reusable launch vehicles and other advanced applications.

In March 2019, a new entity called New Space India Limited was set up by the department of space to handle Isro’s commercial activities. It aims to bring the products and services developed through the Indian space programme to customers around the world. It is also mandated to accelerate the growth of the Indian space industry through technology transfers, small satellite launch services and satellite and rocket manufacturing collaborations.

Today, the global space economy is estimated to be worth $360 billion in annual spending. In comparison, Isro’s budget for the current fiscal is about Rs14,000 crore—less than $2 billion. India’s overall space economy is estimated at $7 billion. Morgan Stanley estimates the global space economy to be worth $1 trillion. By 2025, Isro wants India’s space investments to touch $50 billion a year.

IN-SPACe is also an opportunity for India to give its space tech startups a single-window navigation of all the multiple clearances that are required, says Narayan Prasad Nagendra, chief operating officer of SatSearch, a space tech marketplace. These clearances include permits from defence departments, the ministries of home, telecom, commerce and others, in addition to, the department of space.

In June, IN-SPACe was announced with this single-window clearance in mind. This is where India can help its space startups “leapfrog the regulatory landscape" in comparison with any other country, Prasad says.

More venture capital (VC) firms are, at the very least, looking to learn more about private space startups in India. Pixxel started fundraising in early 2019, and raised money in 2020 during the Covid pandemic. Its investors include marquee VC firms such as Lightspeed and Blume Ventures. These firms haven’t been known to back hardware tech companies in India in the past, Ahmed points out.

Today, other well-known investment firms have backed private space startup in India, including Kalaari, which invested in Digantara, a startup that is developing ways to tackle space debris, and Mayfield, which led a $11 million Series A investment into Agnikul.

Today, other well-known investment firms have backed private space startup in India, including Kalaari, which invested in Digantara, a startup that is developing ways to tackle space debris, and Mayfield, which led a $11 million Series A investment into Agnikul.

“Agnikul is democratising access to space for the small satellite market, which is largely underserved globally. For these customers, this is a game changer as they now have a zero-wait time and can control their own mission, all at an affordable cost," Vikram Godse, managing partner, Mayfield India, said in a press release.

“This funding is a strong validation for the opportunity in global private space and the potential to build deep-tech companies from India for the world," Vishesh Rajaram, managing partner at Speciale Invest, an early backer of Agnikul, said in the release.

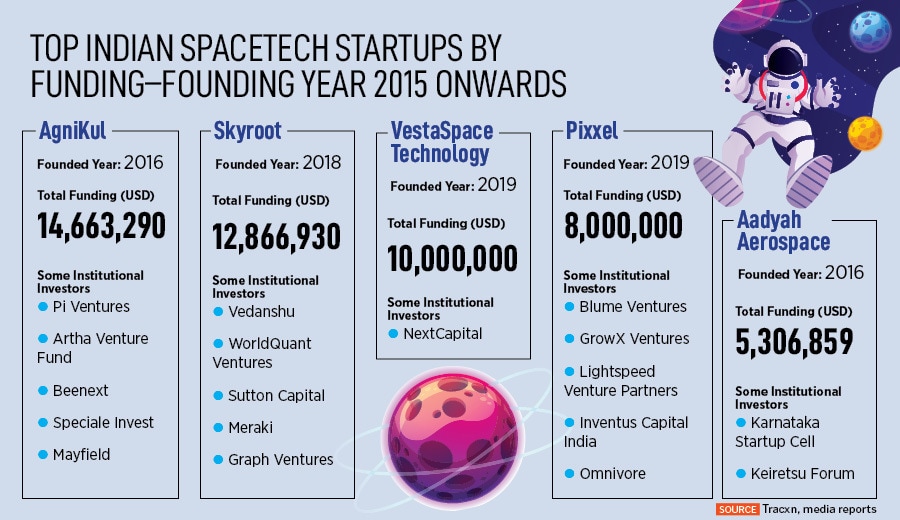

Over the last two years VC firms have done about 20 deals and invested about $90 million in India’s space startups, according to Tracxn, which tracks investments in startups around the world. That $90 million might be a small figure in comparison with the billions of dollars that investors have poured into consumer app startups in India, but only a few years ago, Indian space startups were struggling to raise even a million dollars. In that sense, the funding situation is brighter. Skyroot Aerospace also announced a $11 million funding round in 2021, and data from Tracxn shows Pixxel closing a $28 million round in April.

With investors such as Lightspeed and Mayfield starting to take an interest in the space startups in India, other global names too may not be far behind.

As some of these startups get to the growth stage, which they will soon, “the challenge is mainly capital", Ahmed says. There is no dearth of talent or research and innovation. For private companies, it"s been predominantly a lack of requisite funding, he adds. “That"s required to get through the valley of death." He is referring to the phase that all tech companies go through during which they have to demonstrate their technology readiness levels or TRL. Scientists and engineers look at this in terms of nine TRLs. TRL 1 is when work is just beginning and a TRL 9 is a flight-proven product that is close to commercialisation.

At a TRL 6, for example—which is a fully functional prototype—a large, established company may be willing to partner a startup to take it to TRL 9 and then commercialise it and customers might be willing to buy the product.

At a TRL 6, for example—which is a fully functional prototype—a large, established company may be willing to partner a startup to take it to TRL 9 and then commercialise it and customers might be willing to buy the product.

“In the space industry, India still does not have a Series B level funding, if a company wants to raise $40-50 million. That"s a challenge that still needs to be solved for some of these companies," says Prasad at SatSearch. For now, Indian space startups aren’t at the level where they are ready to raise that kind of funding, adds Prasad. But he expects that to change over the next year, and certainly in 2023.

To get there, however, takes money for the requisite product development. And it will also take some time to ramp up to the number of customers to where the business can sustain itself. Ahmed says the government has to become a big buyer of these early levels of technologies.

Knowing that the government can be an anchor customer in the early stages gives more confidence to investors and private customers. The government also needs to figure out some way of providing grant funding to early-stage companies to demonstrate their innovations. Over time, it could also set up some sort of a sovereign fund that can invest in space startups, take a stake in them and get returns if the startups succeed. This also helps bridge the funding gap that exists because private funds won’t take the risk.

In summary, “I can boil it down to one thing, the requirement for capital," he says.

Exposure to demand from the government can be a game changer for startups, Prasad points out. In the case of Nasa or the European Space Agency or the Japanese space agency, once there are some credible startups and credible products that are being planned, by VC-invested companies, the space agencies will look to become anchor customers.

In India, government demand consolidated by Isro isn’t yet exposed to the startups, he says. End users of data in the government aren’t interacting with the startups, but getting their services through Isro’s missions. ISRO consolidates their requirements, and gives the exchequer an estimate of what it will cost and once that is cleared, the mission goes ahead and various government ministries—the agriculture ministry, for example—get the data.

Even if Isro makes a start by connecting the government demand with the lower-resolution or niche applications that startups are beginning to work with, it will start opening up the market to the startups. They can use that as a launchpad to go after customers around the world, he says. “It will be interesting to see if Isro will move in this direction," Prasad says.

First Published: Dec 15, 2021, 15:17

Subscribe Now