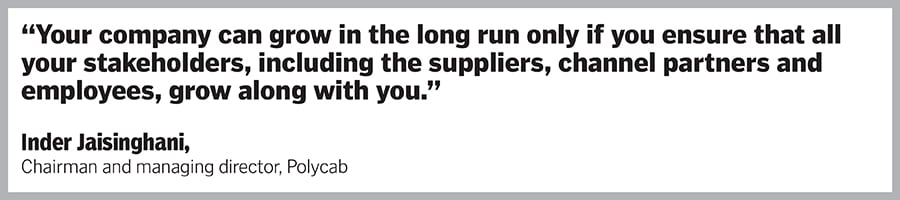

Starting from a cubbyhole decades ago, Inder has now made his debut on the Forbes India Rich List 2021, ranking No. 57 with a net worth of $3.6 billion (approx. ₹27,000 crore). And Polycab India, the company that Sind Electric Stores blossomed into under his aegis, now has over 4,100 dealers and distributors, 1.6 lakh retailers and 30 warehouses in India. It also has 25 manufacturing facilities, including two joint ventures with Techno and Trafigura, located across Gujarat, Maharashtra, Uttarakhand and the union territory of Daman and Diu.

As a child, Inder would accompany his father to the shop and always had a keen interest in starting his own business. After joining his father’s shop as a teen, he realised he wanted to take the business deep, rather than wide—if there were too many products (the shop sold a variety of lights, switches, fans and other electrical goods) the venture would be limited to one shop.

“We decided we will only sell wires and cables. This was the time BEST (Brihanmumbai Electricity Supply and Transport, the city’s civic transport and electricity provider), had made cables compulsory for buildings. I noticed an increase in demand for cables. However, on many occasions, we were at the mercy of manufacturers to ensure we had the right and required inventory. It was then that we decided to pursue forward integration and rather set up a factory of our own," says Inder, the chairman and managing director of Polycab India. “We started off modestly from a garage-type arrangement in Sewri measuring about 1,000 sq. ft. This is when my younger brothers Ramesh and Ajay joined us. Since we were a small team, we would have to wear multiple hats."

The Jaisinghanis worked relentlessly for hours—while Inder would manage sales and marketing, his brothers would handle production, and they worked round the clock to meet deadlines. “We set up a factory at Daman, and it was here that I encountered a man at a petrol pump with a Polyfab branding on his scooter. On asking him the meaning he said, ‘poly’ stands for ‘many’ and ‘fab’ means fabric. I decided to derive a similar brand analogy for our business and thus came into being the brand we know as Polycab. Our tagline of ‘Connection Zindagi Ka’, isn’t just a mere marketing slogan. We have practised it in true spirit. Even now, the 15-20 people who were part of our first factory set-up in Sewri continue to be with us. Similarly, our relationships with our dealers and distributors span over three generations," Inder tells Forbes India.

“When I joined Polycab in 1996, I was the first employee of the company and we used to operate from the garage in our promoter’s old home in Wadala," recalls Shashi Amin, who joined as a general manager heading sales for cables and has now become the executive president and chief business officer (cables).

In those days, he adds, he used to travel with the CMD to Vadodara and Daman in second class local and passenger trains. “Together, we have spent many sleepless nights seeking approvals and fulfilling orders. This is how I started and grew together with the company expanding aggressively post-2000."

Amin recalls another instance from 2008 when the world was going through an economic crisis following the collapse of Wall Street investment firm Lehman Brothers. Copper prices tanked nearly 65 percent, leaving contractual agreements with suppliers in jeopardy.

“Despite the sharp decrease in metal prices, Polycab took delivery at higher metal prices, which shows the commitment Inder bhai has towards our suppliers/vendors. Our channel partners also incurred heavy losses as the value of inventory lying with them dropped. In such difficult times, he went out of his way to extend monetary benefits and additional credit facility to the trade fraternity which helped them navigate the crisis successfully. The kind of respect and trust he commands among our channel partners has been instrumental in developing our distribution network as our key competitive advantage."

![]()

Battling Covid-19

Just like every other business, Polycab, too, encountered difficulties last year due to the Covid-19 pandemic. The nationwide lockdown took a toll on the wires and cables vertical, which saw near-zero business in the first 45 days of the June quarter of FY21. The consumer durables business, which contributes nearly 10 percent to the revenue, saw some activity, but was down by 20-30 percent in the South and the East and by 50-60 percent in the North and the West compared to the previous year. Overall sales in the quarter declined 50 percent year on year.

“For manufacturers, it was a significant impact since this period is generally a prime sales period, particularly for the wires and cables segments. As soon as the pandemic hit, we activated a business continuity plan that placed employee safety and well-being as our prime consideration. The situation did not deter us from lending a helping hand to our dealers, distributors, and retail partners and gradually things started gaining traction. The dealers in metros faced greater challenges due to continued restriction in physical movement," says Inder.

Fifty-nine-year-old Kantilal Jain from Chennai, a retailer with Polycab for 11 years, says, “The company has always stood by its distributors and clients during tough times. Even during the pandemic, Inderji extended full support. With their excellent supply chain and material availability we could easily resume work post the lockdown."

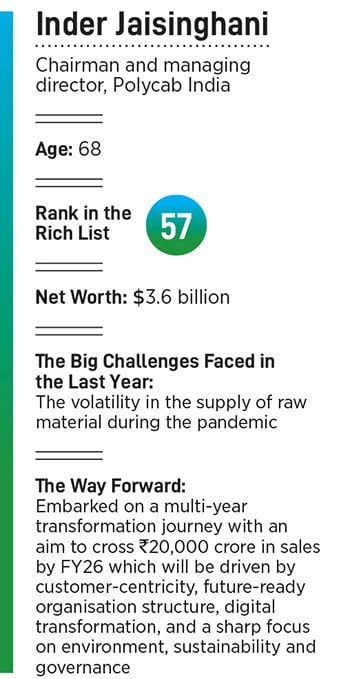

While Polycab’s revenue halved during the first quarter due to falling demand and delay in shipments, says Ashish Poddar, senior vice president of the Systematix Group, a diversified financial services company, “however, swifter than anticipated recovery was witnessed in subsequent quarters and Polycab managed to report 1 percent YoY growth in FY21. It further strengthened its leadership position in the cable and wire industry and gained 1-2 percent market share. While the volume for cable and wire is reaching near-normal levels, better realisation due to rise in copper prices will help healthy value growth in FY22. The FMEG segment continued to report strong growth (FY21: 24 percent) aided by market share gains and will continue."

![]()

Work has now resumed after the second wave, but certain aspects in factories have been impacted by issues like limited manpower as well as underutilisation of capacity. “We monitored the situation and ramped up the production depending on the ground environment, demand, and liquidation of inventory. Our supply chain framework is now back in totality and supplies from national as well as international vendors continue unabated," Inder adds.

It’s evident from the doubling of the wires and cables business—from ₹793.50 crore in the first quarter of FY21 to ₹1,586.20 crore in the June-ended quarter this fiscal—as well as well the distribution and B2C verticals. In the second quarter too, the wires and cables business grew by 46 percent on a YoY basis to ₹2,548 crore from ₹1,740.8 crore in Q2FY21.

The consumer durables business, too, is coming back to normal despite the closure of retail shops across many states during the second lockdown. It grew 41 percent, from ₹244 crore in the Q1 quarter of the current fiscal to ₹342.9 crore in the second quarter of the current fiscal.

“We had a healthy Q2. Robust sales growth was underpinned by market share gains across categories. Given the strengthening macroeconomic fundamentals, we see a massive opportunity to spread our wings across B2B as well as B2C categories by leveraging on our strong brand equity and increased consumers’ affinity for our products," says Inder.

To ramp up the demand post the lockdown, Polycab grew their market reach in Tier-II and Tier-III cities and continued with branding initiatives during the year to improve popular connect. Their experience centres were redesigned as Polycab Galleria Knowledge Centre to engage customers and influencers and strengthen their presence in the consumer electricals segment.

“Amidst the upheaval, we continued to remain nimble with unwavering focus on business execution and excellence. As a result, our revenue increased from ₹8,830 crore in FY20 to ₹8,930 crore in FY21, despite pandemic-induced disruptions. Economic contractions witnessed in the first half of the year put us to test. It was not until the latter half that India began its upward trajectory. Consumer and market sentiment improved as crucial indicators, such as infra investments, GST revenues, IIP, PMI, building materials consumption, among others began to indicate an economic rebound," says Inder.

Next-Gen steps in

![]() The Jaisinghanis of Polycab India: (From left) Ramesh, Ajay, Girdhari, Inder, Nikhil, Bharat, Anil and Kunal have been nimble post the Covid-19 upheaval, continuing with branding initiatives during the year to improve popular connect

The Jaisinghanis of Polycab India: (From left) Ramesh, Ajay, Girdhari, Inder, Nikhil, Bharat, Anil and Kunal have been nimble post the Covid-19 upheaval, continuing with branding initiatives during the year to improve popular connect

Nikhil and Bharat, sons of Inder’s younger siblings Ramesh and Ajay, respectively, joined the business in 2006 when both were in their early 20s. They started off by shadowing Inder, undergoing training and working in various departments, from operations and purchase to finance.

“When I became part of the team, Polycab had firmly established itself as a formidable player in the wires and cables business. As a fresh lens of the team, I identified that there was immense scope to further enhance the high benchmarks we set for ourselves, by embracing the best of new-age digital technologies. The collective focus of our team was to enable Polycab to attain an identity as a sustainable long-term growth bet," says Bharat, 36.

He took up activities around the transformation that involved inculcating a higher sense of professional mindset, creating new organisation structures, implementing a new ERP (Enterprise Resource Planning) system, expanding the sales and distribution network across India, foraying into newer businesses like the FMEG sector and introducing practices that are in tune with modern times.

According to Inder, their next generation of leaders have picked the right pace and direction in taking Polycab to newer heights. “They are focussed and well-versed with the expectations of the current world. One aspect where I believe they can consider gaining exposure is to work at the ground level to understand the business holistically. My experience says that working at the grassroots also helps one establish the strongest of relations with people. Overall, the passing of the baton is being undertaken in the ideal way and the future looks bright and vibrant for Polycab under the younger generation," he says.

Way forward

Going ahead, Polycab wants to expand its presence in international markets riding on the anti-China wave. The company has identified markets where imports from China have been high—it has already established subsidiaries in the US and Australia for trading wires and cables.

In 2008, the International Finance Corporation, the private equity arm of the World Bank, invested ₹401.75 crore in Polycab and picked up a minority stake in the company. Later, in 2019, the company made its market debut and raised ₹1,346 crore through an initial public offering (IPO) that was subscribed more than 52 times.

![]() Polycab has 25 manufacturing facilities located across Gujarat, Maharashtra, Uttarakhand and the union territory of Daman and Diu

Polycab has 25 manufacturing facilities located across Gujarat, Maharashtra, Uttarakhand and the union territory of Daman and Diu

“Polycab’s stock price has become 4x in less than three years since its IPO in April 2019. With earnings growth, market share gains and strong FCF-generation (free cash flow-generation) have supported a good re-rating in its valuation multiple and will continue," says Poddar.

After falling approximately 45 percent over February-May 2020 due to Covid-19, Polycab’s stock price rebounded strongly and has given around 300 percent returns since then. This was supported by a swifter than expected revival in its business performance after a weak Q1FY21, he adds.

The company recently also acquired 100 percent stake in Bengaluru-based automation company, Silvan Innovation Labs, for ₹18.2 crore.

“With technology increasingly influencing our lifestyles, a natural extension to this phenomenon is the emergence of the smart home automation concept that promises to enhance our lifestyles. Polycab already serves this space with a bouquet of offerings such as smart fans, smart lighting, IR blaster, smart plugs, and smart heaters, to name a few. We are working to up our game in this space and, to this end, shortlisted Silvan, since the company, too, has quickly made its mark as a formidable startup in the space," says Inder.

![]()

This year, Polycab completes 25 years as a structured entity—since 1998, they have recorded a robust 43 percent compounded annual growth rate. Even in the last five years, the growth has been relatively healthy, at 11 percent CAGR, while maintaining market leadership in the wires and cables business.

“We have embarked on a multi-year transformational journey with an aim to cross ₹20,000 crore in sales by FY26, which will be driven by customer-centricity, future-ready organisation structure, digital transformation, and a sharp focus on environment, sustainability and governance. We are dedicated to using our resources in a responsible manner. Our endeavour to serve the communities, have a positive impact on the environment and ensure corporate governance form an integral part of our business. We aim to significantly step on the pedal on our sustainability agenda," says Inder.

Inder Jaisinghani, chairman and managing director of Polycab IndiaImage: Mexy Xavier

Inder Jaisinghani, chairman and managing director of Polycab IndiaImage: Mexy Xavier

The Jaisinghanis of Polycab India: (From left) Ramesh, Ajay, Girdhari, Inder, Nikhil, Bharat, Anil and Kunal have been nimble post the Covid-19 upheaval, continuing with branding initiatives during the year to improve popular connect

The Jaisinghanis of Polycab India: (From left) Ramesh, Ajay, Girdhari, Inder, Nikhil, Bharat, Anil and Kunal have been nimble post the Covid-19 upheaval, continuing with branding initiatives during the year to improve popular connect Polycab has 25 manufacturing facilities located across Gujarat, Maharashtra, Uttarakhand and the union territory of Daman and Diu

Polycab has 25 manufacturing facilities located across Gujarat, Maharashtra, Uttarakhand and the union territory of Daman and Diu