Forbes India's 100 Richest 2024: How billionaires are making most of India's gro

Entrepreneurs across sectors—from auto and aviation to IT and pharma—are making the most of the India growth story by taking bolder bets

Sajjan Jindal, the son of India’s richest woman, Savitri Jindal, is steering his Mumbai-based steel-and-energy giant JSW Group into making cars. In March, he bought 35 percent of MG Motor India from China’s SAIC Motor for an undisclosed amount.

Parth Jindal, son of Sajjan and a director of the renamed JSW MG Motor, is especially bullish on the electric vehicle market (EV) as India promotes the industry to reduce its dependence on imported crude oil. “When the transition [to EVs] started happening… we felt the playing field was becoming a lot more even, because for an established car player to get into EVs or a new player…it’s almost one and the same thing," he says. (SAIC retains 49 percent in the joint venture while Singapore-based private equity firm Everstone Capital holds 8 percent employees, 5 percent and MG car dealers, 3 percent.)

JSW Group is injecting roughly $1.8 billion into JSW MG Motor to stoke production capacity to 300,000 units a year by 2026 and 1 million by 2030, compared with 100,000 units currently. The joint venture has a sole factory in Gujarat, but plans to build another one nearby as it aims to launch a new model every three to six months. To reduce costs, the joint venture will buy more local parts, including materials from JSW Group.

JSW Group is injecting roughly $1.8 billion into JSW MG Motor to stoke production capacity to 300,000 units a year by 2026 and 1 million by 2030, compared with 100,000 units currently. The joint venture has a sole factory in Gujarat, but plans to build another one nearby as it aims to launch a new model every three to six months. To reduce costs, the joint venture will buy more local parts, including materials from JSW Group.

In March, India lowered import duties on certain EVs made by carmakers that agree to invest at least $500 million and start manufacturing within three years. The government “must push auto majors to bring their technology into our country", Parth says. “That is the only way we’ll be able to achieve [India’s] objectives of transitioning from engines to EVs."

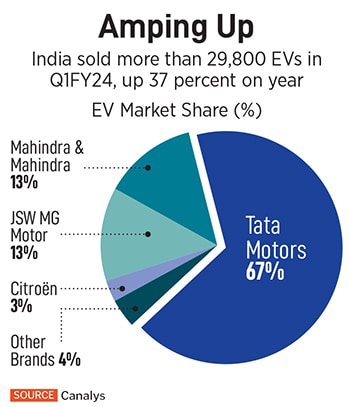

According to the Society of Indian Automobile Manufacturers, domestic passenger car sales jumped 8 percent in the year ended March 31 to 4.2 million units, with EVs accounting for 2 percent of the total. Tata Motors dominated the EV market in the first quarter of 2024, with a 67 percent share, while Mahindra & Mahindra and JSW MG Motor were in second and third place, respectively, with 13 percent each, according to Singapore-based research firm Canalys.

Parth predicts passenger car sales will balloon 67 percent to 7 million vehicles by 2030, with EV sales surging to between 2 million and 2.5 million units. “We would like to be selling 600,000 vehicles by 2030," he says, of which 75 percent will be EVs. He expects JSW MG Motor to post a 10 percent rise in revenue to nearly $1.5 billion in the year to March 31, 2025, and grow tenfold thereafter to $15 billion in FY30. He says it will list in three to five years and while it has not yet set a funding target, “auto companies [in India] are trading anywhere between two-to-three times revenue, so that would be our aim."

â— Gloria Haraito

(Left) Kumar Mangalam Birla and Gautam AdaniImage: Birla: Getty Images

(Left) Kumar Mangalam Birla and Gautam AdaniImage: Birla: Getty Images

Until two years ago, billionaire Kumar Mangalam Birla was India’s undisputed cement king. These days his UltraTech Cement is facing heat from an ultra-ambitious rival: Ambuja Cement, controlled by fellow billionaire Gautam Adani. In 2022, Adani became India’s second-biggest cement producer by capacity when he acquired Ambuja, together with its subsidiary ACC, for $6.4 billion.

Boldly declaring his ultimate goal, Adani said he wanted to be “the industry leader" by 2030. While he’s busy making moves to meet that target, Birla is on overdrive to expand his turf. In July, UltraTech snatched control of India Cements in South India for $700 million. A month later, Ambuja’s capacity increased to 89 million tonnes when it completed the $1.2 billion acquisition of Penna Cement Industries, also in the South. Adani is reportedly eyeing the Indian cement business of Germany’s Heidelberg Materials.

With nearly a quarter of the country’s total installed capacity, UltraTech plans to expand annual production to 200 million tonnes by 2027 from 150 million tonnes currently. As Birla explained to the company’s shareholders in August, “Our ambitious capacity expansion builds on the significant long-term growth opportunity for the cement sector in India."

The country’s infrastructure buildout bodes well for the business. Akash Gupta, a director at Fitch Ratings, says in an email, “We expect overall capacity for the industry to grow largely in line with demand, and do not see a material risk of overcapacity in the next four to five years."

â— Yessar Rosendar

Sridhar Vembu Image: Courtesy Of Zoho

Sridhar Vembu Image: Courtesy Of Zoho

Sridhar Vembu, co-founder and CEO of Chennai-based cloud services company Zoho, is venturing into manufacturing. Zoho has lined up several projects, ranging from semiconductors to power tools and drones. The $1 billion (revenue) company confirmed it has filed an application with the Ministry of Electronics and Information Technology to build a chip fab. The move comes as India positions itself as a chip- and display-making hub, with the government offering financial incentives, tax subsidies and land parcels for factories. Vembu wrote on X: “This technology is vital for our nation. The government is very supportive and now is the time."

The engineer has also made two investments in Tamil Nadu in line with his oft-stated goal of encouraging rural development. In May, he invested an undisclosed sum in drone startup Yali Aerospace and in July formed Karuvi to make power tools using locally sourced components. Zoho is 88 percent-owned by Vembu and his family, whose net worth rose by nearly a fourth to $5.8 billion

â— Anuradha Raghunathan

Rahul Bhatia Image: Nathan Laine/Bloomberg

Rahul Bhatia Image: Nathan Laine/Bloomberg

With a fanatical focus on costs and efficiency, Rahul Bhatia built his single-class, budget carrier IndiGo into India’s largest domestic airline with a market share of over 60 percent. On IndiGo’s 18th anniversary in August, Bhatia, managing director of the listed airline’s parent, InterGlobe Aviation, announced that it was making “a departure from the past" by introducing what it has so far shunned: More leg room and frequent flier frills.

The airline will launch a business class section (IndiGo Stretch) on busy domestic routes. Also, for the first time, IndiGo introduced a loyalty programme (IndiGo BlueChip), an offering, which Bhatia once disclosed to Forbes, “only adds to costs". While analysts say competition from the Tata Group-owned Air India could be one reason, Bhatia maintained that “what was valid 10 years ago, no longer is. Customers in India deserve a choice".

Bhatia set up IndiGo with US-based airline veteran Rakesh Gangwal, who resigned from the board and decided to sell his stake in stages. After racking up losses due to the pandemic, IndiGo turned in a $980 million net profit in the year ended March.

â— Naazneen Karmali

(Left)Ramesh and Rajeev Junejaand GV Prasad Image: Prasad: Dhiraj Singh/Bloomberg Juneja By Nishanth Radhakrishnan For Forbes Asia

(Left)Ramesh and Rajeev Junejaand GV Prasad Image: Prasad: Dhiraj Singh/Bloomberg Juneja By Nishanth Radhakrishnan For Forbes Asia

India’s pharma tycoons are on an expansion tear to carve out new niches beyond generic medicines and grow their global reach. A leader in low-cost drugs, India supplies 20 percent of the worldwide total by volume. Now, as companies move further into next-generation therapeutics, the country’s pharmaceutical industry is likely to double to $130 billion by 2030 and more than triple to $450 billion by 2047, according to global consultancy EY-Parthenon.

Mankind Pharma, controlled by billionaire brothers Ramesh and Rajeev Juneja, announced in July plans to buy Mumbai-based Bharat Serums and Vaccines for $1.6 billion from Advent International, a US private equity firm. The deal, expected to be completed soon, will position Mankind as a market leader in women’s health and fertility treatments, according to Mumbai-based HSIE Research analyst Mehul Sheth in a July report. It will also expand the Delhi-based firm’s presence to more than 70 countries compared with over 20 in the year ended in March. The acquisition “represents a pivotal milestone in Mankind’s journey", said vice chairman Rajeev, who, together with older brother Ramesh, the group’s chairman, built the generics drug maker over three decades into one of India’s largest pharma firms by domestic sales (fiscal 2024 revenue: $1.2 billion).

The Reddy family’s Dr Reddy’s Laboratories is also bulking up its global consumer health care business. In June, the Hyderabad-based drugmaker agreed to buy Northstar Switzerland, part of the UK-based health care group Haleon for $656 million. Reddy’s will acquire Haleon’s nicotine replacement therapy business outside of the US, which includes top-selling Nicotinell gum and patches, and strengthen Reddy’s footprint in Europe. Co-chairs Satish Reddy and GV Prasad, the son and son-in-law of late founder K Anji Reddy, respectively, have in recent years parlayed their successes in generics and over-the-counter medications to create new growth drivers like health and wellness. Revenue is expected to hit $3.6 billion in the year ending March 2025, HSIE’s Sheth wrote in June.

Hiren Patel, son of detergents-to-cement tycoon Karsanbhai Patel, founder and chairman of Nirma, is turbocharging the family’s ambitions in the pharma space. In March, the younger Patel, who is managing director at the group, led the acquisition of a 75 percent stake in Glenmark Life Sciences, which specialises in treatments for chronic conditions like cardiovascular disease and diabetes, from listed Glenmark Pharmaceuticals. The $680 million deal follows Nirma’s earlier purchase of an eye drops maker to bolster its small portfolio of health products ranging from IV fluids to injectables.

Meanwhile, Mayank Singhal, son of PI Industries chairman emeritus Salil Singhal, is diversifying beyond the family’s agrochemicals business into pharmaceuticals. In the past 18 months, PI Health Sciences, helmed by Mayank, has made two pharma acquisitions—one in the US and another in Italy, and set up its third R&D centre in Hyderabad. Last year, PI Health Sciences completed its purchase of Alabama-headquartered Therachem Research Medilab, which specialises in drug development for rare diseases, for $75 million. This followed the purchase of Italian active pharmaceutical ingredients manufacturer Archimica from Germany’s Plahoma Twelve for $38 million. The investments marked an “accelerated beginning" in pharma, leveraging the group’s “capabilities across complex chemistries in the value chain", the younger Singhal said in a statement.

India’s pharma sector will see 8 percent to 10 percent compound annual sales growth over the next few years, propelled partly by higher volumes and new products, HSIE Research’s Sheth wrote in March. “Similarly, leading companies are poised to surpass the IPM [India pharma market] through strategies like M&As, expanding field forces [sales teams], and new launches."

â— Gloria Haraito

First Published: Nov 29, 2024, 16:27

Subscribe Now