Mukesh Ambani: India's richest man strengthens his lead

Mukesh Ambani has created India's largest profit-generating company with three distinct profit pools—oil and gas, telecom and retail

In a year when each of the top 10 members on the Forbes India Rich List saw their net wealth increase, Mukesh Ambani was no different. An increase of $27.5 billion to $119.5 billion allowed him to maintain his position at the number one spot, as his flagship Reliance Industries Limited remained the most valuable Indian company with a market cap of ₹17.05 lakh crore, as of November 18.

Key to Ambani sustaining his lead will be the operational performance of his businesses, the fate of his new energy ventures as well as the planned, but not yet announced, public market flotations of his retail and telecom businesses. Each of these could unlock value as well as become new growth drivers.

“There was a time when the market was willing to believe any story. Now it is looking for performance," says Ambareesh Baliga, an independent market analyst. He points out that though its operational performance has been strong, its new energy ventures will take some time to show up in the numbers.

A recent fund raise by Reliance Retail provides clues to how Reliance Industries [owner of Network 18, the publisher of Forbes India] may be looking to value it. In October 2023, Reliance Retail raised funds from the Abu Dhabi Investment Authority, KKR and Saudi Arabia’s Public Investment Fund. These were made at a pre-money valuation of $52 billion to $64 billion, making it the largest retail company in India.

While retail continues to add new offerings, Reliance’s telecom offering is showing signs of maturity. With 489 million subscribers, it is the largest telco in the country and Ambani clearly sees limited upside in pushing subscriber numbers. Hence the move to increase tariffs even at the cost of losing customers.

In Q2FY25, post the tariff hikes, its base fell by 11 million to 478.8 million. At the same time, average revenue per user rose from ₹14 to ₹195 per subscriber per month, taking revenue and Ebitda up by 18 percent to ₹31,709 crore and ₹15,931 crore respectively. Still, it is pertinent to note that its closest rival, Airtel (which also has an Africa business), is valued at ₹10,00,000 crore or 58 percent of Reliance Industries’ market cap.

In Q2FY25, post the tariff hikes, its base fell by 11 million to 478.8 million. At the same time, average revenue per user rose from ₹14 to ₹195 per subscriber per month, taking revenue and Ebitda up by 18 percent to ₹31,709 crore and ₹15,931 crore respectively. Still, it is pertinent to note that its closest rival, Airtel (which also has an Africa business), is valued at ₹10,00,000 crore or 58 percent of Reliance Industries’ market cap.

Click here for Full Rich List

A more aggressive approach to its home broadband offering as well as tariff hikes are likely to see its profitability surge past the ₹21,000 crore that it made in FY24. A key advantage for Jio is that the market has now largely consolidated around two players—Jio and Airtel—as Vodafone Idea and BSNL continue to bleed subscribers on account of poor network quality.

Lastly, there is the oil and gas businesses as well as the new-age oil-to-chemical venture. Both saw robust volumes, but saw a decline in Ebitda due to a weak margin environment. Expect the business to increase its margin profile as the international oil market sees maintenance-related shutdowns as well as some refiners going slow on expansion due to lower crude prices.

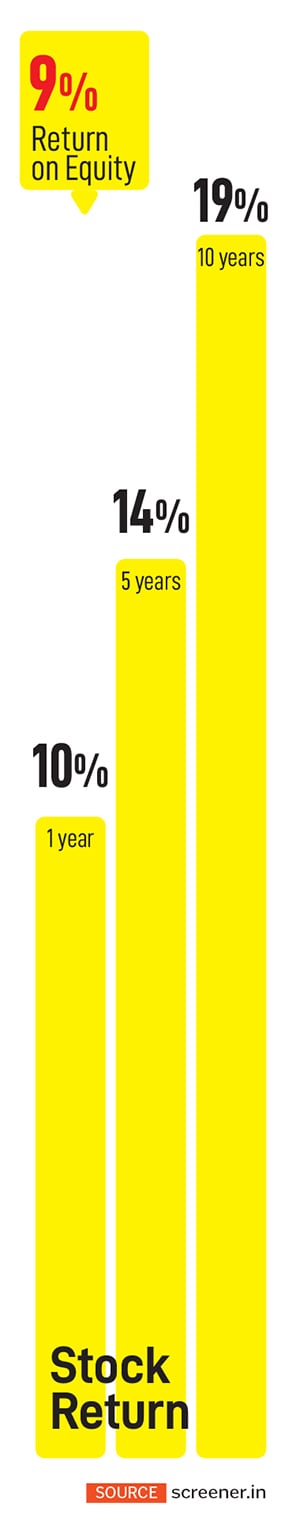

With its various and disparate businesses, the market has adopted a ‘sum of the parts’ approach to valuing Reliance Industries. The legacy businesses drag down the value of the newer telecom and retail businesses. Only an independent listing will allow the market to discover a higher valuation. A market cap of ₹17,22,000 crore prices it at 21 times FY24 earnings, which is about the same as Nifty PE of 21.9 times. Its return on equity is 9 percent.

It’s hard to see Ambani relinquishing his number one spot any time soon. His empire has the cash flows to support its valuation as well as a set of mature businesses that can be spun off anytime soon. Investors have also been rewarded with rising dividend payouts over the last decade. In October, a 1:1 bonus issue kept the market and investors excited.

Disclaimer: Network18, the publisher of Forbes India, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

First Published: Nov 29, 2024, 12:38

Subscribe Now