Cement's big boys get bigger

The cement business has witnessed rapid consolidation over the past five years. However, the next wave of acquisitions would be slower due to the paucity of assets available and promoters' unwillingne

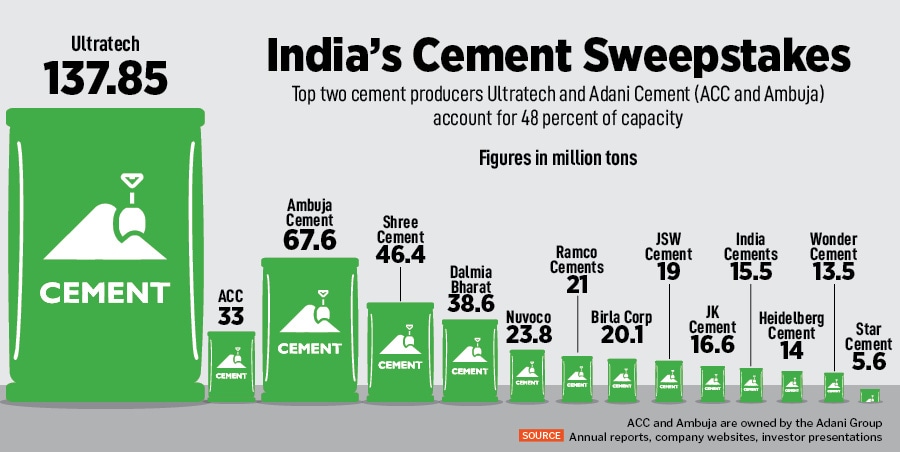

A little over a year ago the Adani Group had no cement business. It is now the second largest player.

Not to be left behind larger rival Ultratech has set its sights on 200 million tons of capacity, up 45 percent from its present 137 million tons. While Chairman Kumaramangalam Birla didn’t specify a timeframe at the company’s annual general meeting, he said, “The scorching pace of expansion is unprecedented in the sector." With the business consolidating and the top 4-5 players accounting for over two-thirds of India’s installed capacity of 510 million tons Birla knows he has his task cut out to maintain Ultratech’s lead.

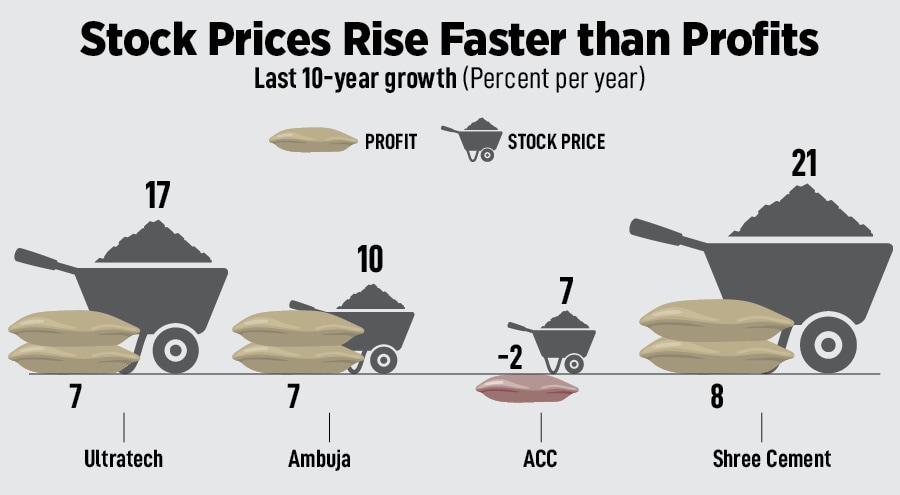

Ultratech’s rapid ascent and stay at the top also provides an insight into why promoters are after expanding the scope of their operations. First, growth is not hard to come by. The business usually grows at 1.2 times nominal GDP growth and over the last decade Ultratech has grown sales by 12 percent a year (this number includes acquisitions). Profitability has grown slower at 7 percent a year.

In the last five years Ultratech has generated Rs 28,468 crore in free cash flow. Shree Cement generated Rs 6,632 crore of free cash flow in the same period and Dalmia Bharat made Rs 4,182 crore. It is this easy conversion of profits into cash that makes the industry such a sought-after one. It is also why promoters of smaller plants (2-10 million tons) are loath to sell. Making money in this business is not that hard.

The last five years the industry has seen an unprecedented wave of mergers and acquisitions where larger players have sold to the top five cement companies. Some, like the sale of the Jaypee and Binani Cements’ assets, have come out of insolvency proceedings while others like the recent sale of Holcim’s India arms or Sanghi Industries to the Adani Group have been simple buyouts. Cement companies contacted by Forbes India declined to comment saying they couldn’t speculate on future developments.

The last five years the industry has seen an unprecedented wave of mergers and acquisitions where larger players have sold to the top five cement companies. Some, like the sale of the Jaypee and Binani Cements’ assets, have come out of insolvency proceedings while others like the recent sale of Holcim’s India arms or Sanghi Industries to the Adani Group have been simple buyouts. Cement companies contacted by Forbes India declined to comment saying they couldn’t speculate on future developments.

Still, even as the industry consolidates, analysts say that the next round of buyouts may prove tougher for promoters. “Cement should have consolidated even more but the smaller guys want a huge premium and so it is not happening," says Amit Khurana, head of equities at Dolat Capital. That is the common refrain heard in the industry. Even as companies search for the next acquisition target they are lining up greenfield and brownfield expansion plans.

Unlike other commodities—steel, copper, oil—cement remains a local play. A dominant brand in one region could be weak in another and much like the paint industry uptake is dependent as much on the dealer network as it is on branding. In the 1990s Ambuja Cement was among the first to start a national advertising campaign. There was also banner advertising at the dealer level to push the product.

Now, with the consolidation in the industry, there are signs that one brand’s strength could rub off across regions, as in the case of Ultratech. Local factors like energy costs (cost of production) as well as transport costs play a role but the industry is now starting to see first signs of the same brand of cement available nationally.

In order to get into a market in a significant way a company would have to enter with at least a 10 million tons and as Uttamkumar Srimal, senior research analyst at Axis Securities explains, the problems are two-fold. One, the existing holdouts would want a significant premium. Cement acquisitions are done at about $100 a ton if a limestone mine is not available with the plant and $120 per ton with a mine. After that it all depends on what premium the acquirer wants to pay for market entry, the vintage of the plant, the transport contracts etc.

Also read: One more feather in Adani"s cement empire

For a market entry Adani Cement paid $160 per ton for acquiring ACC and Ambuja but analysts are skeptical about whether large players would want to pay a premium for small plants in the 5-10 million ton range. “There is a mismatch in the expectations of buyers and sellers," says Khurana. Also, promoters see India’s cement consumption at 270 kg per person per year against the global average of 500 kg per person per year and know that there is tremendous scope for growth.

A clear indicator of forward growth is the manner in which the stock market has priced these businesses.

Look at large companies first. In the case of Ultratech, ACC, Ambuja, Shree and Dalmia the stock price rise over the last 10 years has always been faster than the growth in profits. In Ultratech’s case profits rose by 7 percent a year over the last decade whereas the stock price rose 17 percent a year (see box). All the companies above quote at a PE multiple of over 40 indicating that the market is pricing in a lot of future growth for what is a commodity business.

On the other hand analysts point to larger companies that may one day be acquisition targets. “In the southern market we could see some consolidation especially if promoters have reasonable price expectations," Ravi Sodah, cement analyst at Elara Capital, told Forbes India in an interview at the time of the Sanghi-Adani deal. He doesn’t see deals happening for assets in other parts of the country.

The market is also factoring this into the prices of mid-cap cement companies. South-based Ramco Cements, for instance, is valued richly at 60 times earnings. In the last year the stock is up 18 percent taking its market cap to Rs 20,607 crore. Contrast that with Nuvoco, which has similar capacity but trades at a Rs 12,000 crore market cap. India Cements and Sagar Cements are two others that are valued richly. Both lost money in FY23 and could be seen as potential takeover targets.

It is also clear that Adani and Ultratech both have substantial cash reserves that could be deployed for acquisitions in the years ahead. Ultratech has a net worth of Rs 54,000 crore and a debt of Rs 11,000 crore. At Ambuja the net worth stands at Rs 26,000 crore with negligible debt. Expect some of this cash to be deployed for acquisitions or to set up greenfield capacity. Others like JSW Cement and Shree Cement have said they remain open to making acquisitions but have been unable to make any large deals.

As a result most expansion in the sector is now taking place through either greenfield or brownfield expansion at $100 a ton with a three-year time period to get both the clinker and grading units up and running. Ultratech expects its capacity to be 160 million tons with its latest round of expansion and Adani Cement (ACC and Ambuja) plan to get to 140 million tons by FY27 taking the top two to about 50 percent of the market.

First Published: Sep 12, 2023, 14:41

Subscribe Now