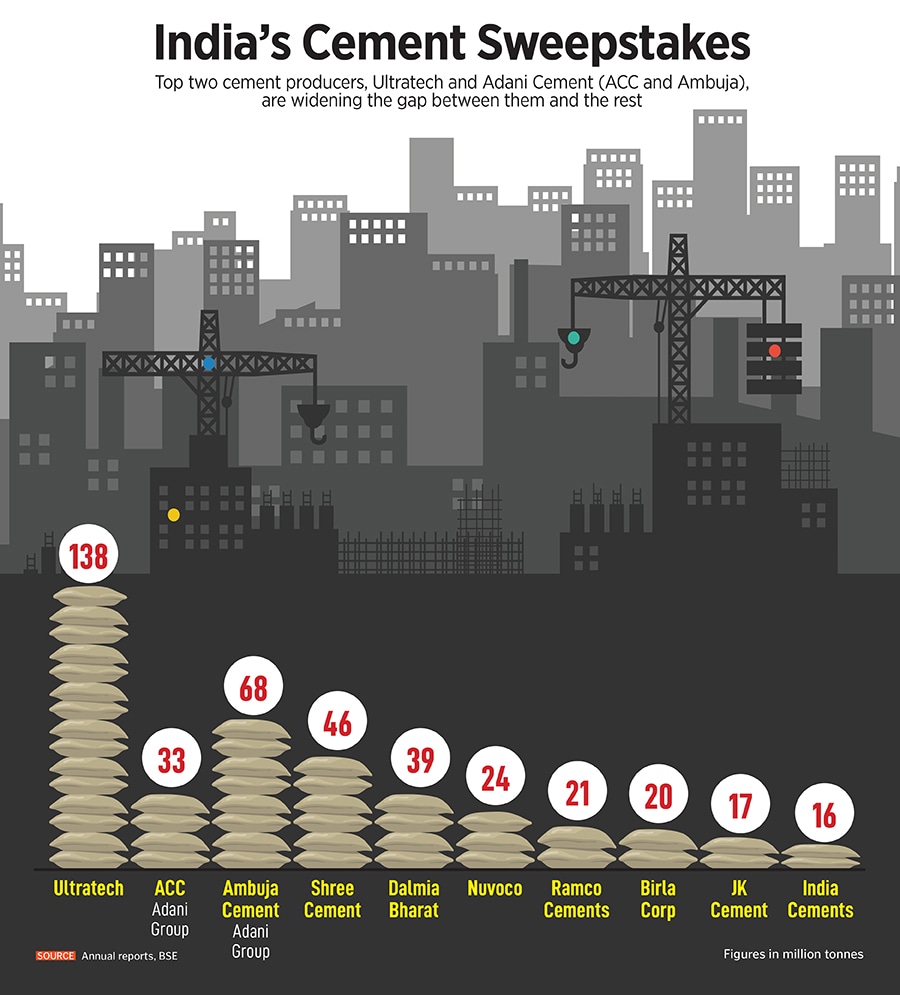

One more feather in Adani's cement empire

With Adani's purchase of Sanghi Industries, the industry consolidates further. Both Adani and Ultratech have significant cash hordes that could be deployed for further acquisitions

Ambuja Cement, part of the Adani Group, has added an additional 6 million tonnes in capacity with the acquisition of Sanghi Industries units in Kutch, marking another chapter in the ongoing consolidation of the Indian cement industry.

The deal also brings Adani’s cement business another step closer to Ultratech, the country’s largest cement maker, as both vie for the biggest company crown by the end of the decade. And finally, it marks the return of Adani to the dealmaking table post the Hindenburg report controversy that saw the group’s valuation plunge by over $100 billon.

Ambuja Cement has set itself an ambitious target of reaching 140 million tonnes in capacity by 2028, up from the current 73.6 million tonnes. According to the company, this target would now be achieved ahead of time. “With this deal, Adani will consolidate its position in the western region where Ultratech is a leader," says Uttamkumar Srimal, senior research analyst-cement and infra, Axis Securities.

At an enterprise valuation of Rs5,000 crore, Ambuja gets 56.7 percent stake in Sanghi Industries. The company will also make a mandatory open offer to shareholders at Rs114.22 per share. Sanghi Industries has some obvious synergies for Adani Cement. Its plants are based in Gujarat and its cement can be shipped by sea, opening up markets in Saurashtra, Mumbai, Karnataka and Kerala. In a statement, Karan Adani, director, Ambuja Cements, said, “Synergy with Adani Ports will help us accelerate the implementation of this strategy."

Adani, which acquired ACC and Ambuja from Holcim in September 2022, is the country’s second-largest cement maker with a capacity of 80 million tonnes at present. It has ongoing projects in Dahej and Ametha totalling 5 million tonnes as well as ongoing capex for 14 million tonnes. Once these are commissioned by FY25, the group’s cement capacity would be 101 million tonnes. By then, Ultratech, which is the country’s largest cement maker, has said it should get to 160 million tonnes.

The M&A activity in the cement space has come about at a time when cement prices have stayed robust at Rs300-400 per bag, depending on the quality of cement, the brand and the region. Since there is a limit to how fast companies can grow organically, they have chosen the acquisition route to scale up capacity.

As a result, India’s cement market is witnessing consolidation among the largest players, and this could put more cement companies into play. In April, Dalmia Bharat had signed agreements to acquire Japyee Cements’ assets. While companies have always been on the lookout for targets, steady growth as well as the entry of an aggressive player in Adani Cement have led the industry to believe that some smaller players could be up for grabs. “In the southern market, we could see some consolidation, especially if promoters have reasonable price expectations," says Ravi Sodah, cement analyst at Elara Capital. He doesn’t see deals happening for assets in other parts of the country.

The market is also factoring this into the prices of mid-cap cement companies. South-based Ramco Cements, for instance, is valued richly at 60 times earnings. In the last year, the stock is up 18 percent, taking its market cap to Rs20,607 crore. Contrast that with Nuvoco, which has similar capacity, but trades at a Rs12,000 crore market cap. India Cements and Sagar Cements are two others that are valued richly. Both lost money in FY23 and could be seen as potential takeover targets.

Adani and Ultratech both have substantial cash reserves that could be deployed for acquisitions in the years ahead. Ultratech has a net worth of Rs54,000 crore and a debt of Rs11,000 crore. At Ambuja, the net worth stands at Rs26,000 crore with negligible debt. Expect some of this cash to be deployed for acquisitions and the industry to consolidate around four to five large players. Ultratech, Adani, Shree and Dalmia Bharat have a shot at emerging as large players.

First Published: Aug 03, 2023, 16:31

Subscribe Now