Anirudh Sethi: This is the right time to accumulate stocks

Anirudh Sethi has been involved in the Stock Market since 1992

The world outside is nothing like we have experienced before. Just a few months ago, the markets were trading at all-time highs. The black swan named Coronavirus came out of nowhere and spoiled the bull party. The word social distancing was unheard of until the virus emerged. The impact of the virus grew larger with each passing day, swallowing the growth made by economies in the past decade. What should I do as an investor – that is a question I hear a lot these days, says Anirudh Sethi, Founder of Financial Occultist.

Investors have to bear the brunt as markets began a long slither downhill that made even the most experienced investors unnerved. In a storm the valuations have been tossed like a paper. The companies had come to a standstill. The thick clouds of uncertainty shrouded the global economy.

Investors need to remember that a bull market can last for ten years, but bear markets have short shelf-life. Historically, even the worst bear market didn"t last longer than 300 days. Uncertainty and commitment share an eternal bond of friendship, remember, the best things come from suffering. Be systematic, digest the volatility and invest with a time frame of 2-4 years.

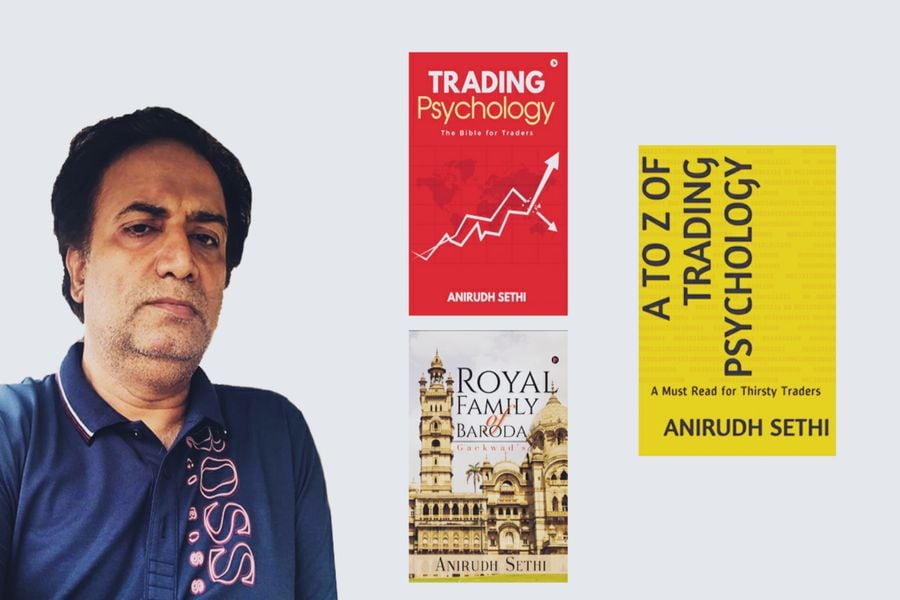

Anirudh Sethi has been involved in the Stock Market since 1992. He received a PhD in Human Psychology. After a 5-year study, his first market forecasting steps were put forth in 1992, by predicting Stock Market movements in India.

After his work got recognized in the early 90s, he gave weekly forecast for Indian Stock Markets in the renowned Indian Business Daily, Business Standard, every Monday, from 1997 to 2001. This brought national exposure to his work, and with the advent of Internet in 2001, his daily trading strategy under the title STOCK MARKET NAVIGATOR flooded India and off-shore. To make his popular work accessible to remote Indian areas, he published the gist of his daily trading strategy in Business-Standard Financial Express till 2007.

When he started writing about Technical Analysis in 1992, there were only few know people knows about Technical Analysis in India.

Anirudh Sethi has written many books, but here are the top suggestions:

Trading Psychology:

The book “Trading Psychology” is about emotions and mental states that dictate success or failure in Stock /Commodity and Forex Markets.

Royal Family of Baroda:

Baroda is enriched with its glorious history. Baroda has interesting stories which are covered in the book. Anirudh Sethi has tried to cover various images of coins and historical places of Baroda along with its history.

A to Z of Trading Psychology:

Trading in the financial markets is a highly technical activity. To become successful as a trader, you need good understanding of the financial markets and how they work, you need a good understanding of the companies you trade in, you need the technical expertise to analyze market trends, as well as a great understanding of the factors that move the market.

Anirudh Sethi analyses international markets from indices, stocks, bullion, energy, forex and crypto. He is a trading coach and organizes online webinars and seminars for traders, with clients across the globe.

Sethi has a large collection of rare objects and is fond of collecting, among other things, Mahatma Gandhi pieces, historical journals, photographs and autographs.

Disclaimer: The views, suggestions and opinions expressed here are the sole responsibility of the experts. No Forbes India journalist was involved in the writing and production of this article.

First Published: Jun 17, 2020, 10:53

Subscribe Now