Auto industry preps for a long journey to recovery

Even as auto industry players prepare to get back to factory floors, they don't expect the sector to recover before 2021

A lone car drives through a Noida underpass during the lockdown. Demand is not expected to recover even after lockdown norms are relaxed

A lone car drives through a Noida underpass during the lockdown. Demand is not expected to recover even after lockdown norms are relaxed

Image: Virendra Singh Gosain / Hindustan Times via Getty Images

The rough ride for India’s automobile companies, which began with a two-year slowdown and will worsen with the Covid-19 outbreak and its aftermath, is unlikely to be over before 2021.

Once the pandemic hit the country, companies were asked to shut down manufacturing facilities, dealer showrooms, and service centres overnight. It led to the sales of passenger vehicles crashing by 51 percent, and of two-wheelers by almost 40 percent, in March. In April, the fall could be even steeper: The Society of Automobile Manufacturers (Siam) expects the country’s auto industry, the world’s fourth-largest, to lose `2,300 crore in production turnover for every day of closure.

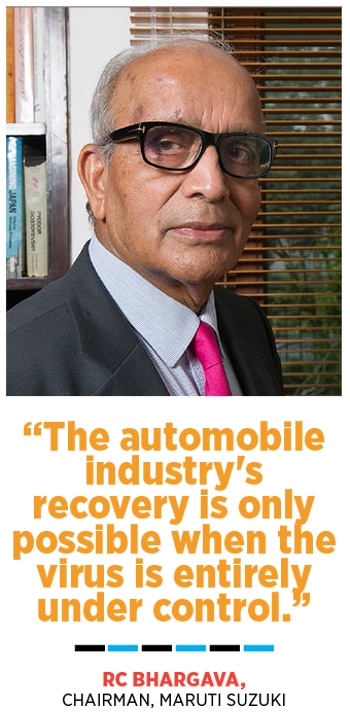

Now, into over 40 days of the lockdown, there is still no clarity on when companies could restart operations. Maruti Suzuki and Hyundai India, the country’s largest and second-largest carmakers, who control nearly 70 percent of the passenger vehicle market, have confirmed the uncertainty. “Production cannot start until the entire supply chain needed for manufacturing a vehicle is assured,” says RC Bhargava, chairman, Maruti Suzuki. “Manufacturing cannot be on a stop-go basis. It has to be continuous and, at the moment, factories belonging to suppliers are in containment zones. While it is possible that some models could be produced, it is not possible to produce all the models until things are settled completely.”

Hyundai Motors, which manufactures vehicles at its facility in Chennai, too will wait for more clarity on the lockdown. “We will review the situation after May 3 based on the new guidelines,” says a spokesperson. Others such as Toyota, Tata Motors, and Honda Motors have not resumed operations either.

Uncertainty looms over the two-wheeler sector as well as the country’s largest manufacturer, Hero MotoCorp, is yet to start working, while others such Honda Motorcycle and Scooter India, and Yamaha are contemplating the road ahead post-lockdown.

Only Bajaj Motors has, so far, begun operations since the government announced a relaxation of lockdown norms from April 20 as have a few auto component manufacturers, including Uno Minda, Setco, Timken, Varroc, and Sebros. “These plants shall be resuming at a lower scale and would gradually ramp up to align with the off-take from our customers, subject to compliance with standard operating procedures [SOPs] for social distancing,” Varroc Engineering said in a statement while reopening its factories.

Changing shop floors

On April 15, the Ministry of Home Affairs had laid out guidelines for companies to follow in order to open up factories these include the disinfection of entrance gates, canteens, meeting rooms, equipment, in addition to arranging special transportation facilities with only 40 percent capacity in the vehicles. Additionally, these vehicles have to be disinfected upon entry and a thermal screening has to be carried out at facilities. While large gatherings aren’t permitted, workplaces must have a gap of one hour between shifts and stagger the lunch breaks to ensure social distancing.

“This is going to be the new normal as far as factories are concerned,” says Raju Ketkale, deputy managing director, Toyota Kirloskar Motor. “Everything will change going forward, including the way we operate, the facilities we provide, and even material procurement. Companies have to learn to work under such conditions, and employees have to ensure self-discipline.”At Toyota Kirloskar Motor, the company has already put in place operating manuals for when the company resumes operations. This includes resuming production with just 50 percent of the workforce, before gradually increasing it to 70 percent and eventually 100 percent.

“Employees have to do a health check before leaving home, and once they are in the vehicles, there will be strict social distancing,” adds Ketkale. “There will be a thermal check before getting into the vehicle, and if it reads above 37.5°C, then they won’t be allowed to board. At canteens, we will have four lunch shifts instead of two, and masks will be compulsory in addition to sanitisers.” The company is hopeful it can bring back 70 percent of its workforce by September.

Lumax Industries, which manufactures headlamps for automobiles, has taken baby steps to resume work. But, for now, the company is only focusing on maintenance and upkeep of its machinery. “While the safety and well-being of our employees take precedence over everything, it will also mean that productivity will be altered and optimisation will remain low,” says Deepak Jain, chairman and managing director, Lumax Industries. “What we are going to see is an entire redesign of the shop floor and more digital interventions. We cannot afford to be in a similar situation once again and that means focus on robotics and other low-cost automation.”

Yet, even as companies undertake massive efforts to follow norms laid out by the government, experts reckon it won’t be easy when it comes to practice, considering the nuances involved in the manufacturing process. “While many of these norms are likely to stay on for long, there are also challenges that come along the way,” says Puneet Gupta, associate director of Automotive Forecasting at IHS Markit. “You need three people to push an engine upwards into a vehicle, particularly in companies where automation levels aren’t very high. How is it possible to enforce such rules there?”

Going contactless

Meanwhile, even as factories undergo a transformation, sales channels too are beginning to see some dramatic changes.

On April 27, Volkswagen India announced it is digitising the sales and service portfolio, integrating 137 sales and 116 service touchpoints, to help customers choose their dealership while booking online. “We aim to provide our customers with the flexibility in choosing their preferred Volkswagen product through a contactless channel,” says Steffen Knapp, director, Volkswagen Passenger Cars India.

Volkswagen isn’t the only company shifting gears online. Carmakers from Hyundai to BMW and Mercedes have also begun offering various schemes to allow customers to make purchases online. “Since its launch in April 2020, we have seen a tremendous increase in customer engagement, configuration requests, and virtual product presentations on this platform,” says Arlindo Teixeira, acting president, BMW Group India. “As business dynamics evolve post-Covid-19, the BMW Contactless Experience will play a crucial role in offering seamless sales and aftersales services to our existing and new customers.”The sudden focus on the online model also comes largely due to restrictions likely on people’s movements once the government lifts the lockdown. “Even after the lockdown is lifted, sales volume will remain muted as consumers are unlikely to flock to the dealerships,” research firm Crisil said in a report. “Indeed, consumers may avoid shopping malls/markets due to the fear of infection for an extended period.”

Even then, companies such as Toyota Kirloskar aren’t shying away from putting together a dealer restart guideline that seeks to educate its dealer partners on safety and hygiene practices. “Given that the withdrawal of the lockdown does not in any way mean the pandemic is over and adherence to good safety and hygiene practices is the only key to keeping the virus at bay, the recovery phase will require unprecedented levels of caution,” says a spokesperson for Toyota Kirloskar. The measures include constant sanitisation of touchpoints and showrooms, in addition to the usage of face masks and sanitisers, regular thermal checking, and formation of a Covid-19 task force.

In addition, companies have also begun stepping in to help dealers facing financial stress. On April 21, Kia Motors India said it will support the interest-cost of dealer stocks, including vehicles in physical and transit stock. The company has already remitted unutilised dealer funds in its possession, along with crediting accepted service claims for warranty. “We are committed to offering our continued support in these testing times and will undertake all necessary steps to help them navigate through the situation together with us,” says Kook-Hyun Shim, managing director and CEO, Kia Motors India.

With a rider

However, it isn’t likely until 2021 when sales could see some recovery. “It will take until August for car manufacturers to restore some normalcy in terms of manufacturing,” says Gupta of IHS Markit. “If there is government stimulus and the economy gets back on track, we will see some sentiments returning during the festive season. Banks will be looking to pass on the benefits of lower interest rates, and with the real estate sector in a crisis, the next opportunity will be in retail finance, and vehicle buyers could benefit.”

Gupta reckons the demand for automobiles usually stems from two factors: Natural demand, and replacement demand. “As far as replacement of vehicles goes, between 50 and 60 percent of buyers could postpone their purchases as there is no urgency, and the economic situation, particularly job security, needs time to stabilise,” Gupta says. “As far as natural demand is concerned, the current crisis means people will be more careful about travelling in public. That means we could see a spike in demand for two-wheelers and entry-level vehicles.” An employee at a Maruti Suzuki showroom in Chennai. With disruption in demand and supply the auto sector is looking at an uncertain future

An employee at a Maruti Suzuki showroom in Chennai. With disruption in demand and supply the auto sector is looking at an uncertain future

Image: Dhiraj Singh / Bloomberg via Getty Images

Meanwhile, the government’s plan to lift the lockdown across many parts of the country, barring hotspots, may not be enough to revive the sector. “Our analysis of automobile retail sales pattern and spread of Covid-19 across districts in India shows the level of risk for two-wheeler and passenger vehicles segments is considerably different in ‘very high impact’ districts, or districts where both automobile sales intensity and Covid-19 infection are significantly high,” Crisil says in a report. “These districts account for 50 percent of passenger vehicle sales in the country. In case normal business activity does not resume in these districts after the first week of May, half of passenger vehicle sales will be at ‘very high risk’.

“Besides, the hotspot districts also account for 33 percent of two-wheeler sales, which means if normalcy does not return after the first week of May, a third of two-wheeler sales will also be at ‘very high risk’. "High’ and ‘very high impact’ districts together account for 56 percent of two-wheeler and 68 percent of passenger vehicle sales in India,” Crisil adds.

Hotspots, meanwhile, have also been hubs for manufacturing. “For us, about 20 percent of our supply chain is in NCR, another 15 to 20 percent in Pune, and some in Chennai. We have about 80 suppliers and some of them are in the red zone. We can’t start anything till things settle there,” says Ketkale of Toyota.

Much of that is because a vehicle is usually made up of thousands of components and a disruption in one could upset production. “The problem is there is still no clarity about the rate at which businesses will open up in the country,” says Vinay Piparsania, consulting director–automotive at Counterpoint Technology Market Research, and former executive director at Ford India and. “The non-availability of one small spare part in a vehicle can disrupt the entire manufacturing process.”

“The automotive component industry is structured in such a way that even if one of the companies cannot function, the entire supply chain is disrupted,” says Jain of Lumax Industries, also the president of the Automotive Component Manufacturers Association. “We are facing `1,200 crore a day in losses, and we had spent over Rs 30,000 crore in the past three years to shift from BS IV to BS VI.”

A long way off

That’s perhaps why Bhargava of Maruti Suzuki is still sceptical about a recovery. “As far as the possibility of selling cars go, the demand has to come up. We don’t know when it’ll pick up, and as cities remain under lockdown, people won’t be willing to come to showrooms,” says Bhargava. “Vehicle purchases require finance, registration, and a lot of paper work. While some can be done online, it’s not entirely possible. When there are very few vehicles moving, the load on the workshop will also reduce. As far as the auto industry goes, recovery is only possible when the virus is entirely under control. Even if component makers come back, recovery has to be backed by sales demand. The government can’t make up for lost economic activity.”

Consultancy firm PwC now reckons that under a realistic scenario, two-wheeler sales are likely to decline by 18 percent to 14.2 million, passenger vehicles by 12 percent to 2.43 million and commercial vehicles by 21 percent to 1.06 million. It believes that in the two-wheeler segment, the used-vehicle market could play a huge role in reviving demand, in addition to online sales. “Passenger vehicles are expected to show strong growth post-recovery,” a PwC report says. “While the shared mobility segment will remain subdued in the coming months, segment downgrades are likely by buyers.” That means consumers buying passenger vehicles and two-wheelers could opt for a lower segment or variant.

“This is a massive disruption, and it will all depend on the spending power of the people,” adds Ketkale. “People will travel less, and will be very cautious about spending. So, I would expect another six months before a recovery is possible and we expect action to come back around next January.”

With oil prices at record lows, experts reckon the government could be instrumental in reviving interest in the sector. “For the next two or three months, the scenario might be gloomy,” Gupta says. “After that, the sentiment will come back. And by the end of the festive season, we can start seeing some good recovery. For that, the government has a big role to play.”

First Published: May 08, 2020, 12:33

Subscribe Now