How to survive the critical April-June quarter

Never was one quarter so crucial in the life of companies, especially startups who have mostly lived on the VC ventilator. Those who have battled crises in the past tell Forbes India their biggest tak

Illustration: Sameer PawarSeptember 2008. Ashish Kashyap, former country manager of Google India, was left with only one choice. A cold-blooded one. “I had to kill to survive,” recalls Kashyap, who had started ibibo a year back as an incubator. “It was very hard to kill,” confesses the first-generation entrepreneur, who had started to feel the heat of a global financial meltdown. Kashyap, then 33, had started building and incubating multiple lines of businesses such as social gaming, local search businesses, social media, and goibibo was one of the projects. The downturn turned Kashyap’s world upside down. Investors balked, the runway started to deplete at an alarming pace and a team of around 70 looked like an overwhelming army in a losing war. The choice was cruel, but simple: Kill.

Illustration: Sameer PawarSeptember 2008. Ashish Kashyap, former country manager of Google India, was left with only one choice. A cold-blooded one. “I had to kill to survive,” recalls Kashyap, who had started ibibo a year back as an incubator. “It was very hard to kill,” confesses the first-generation entrepreneur, who had started to feel the heat of a global financial meltdown. Kashyap, then 33, had started building and incubating multiple lines of businesses such as social gaming, local search businesses, social media, and goibibo was one of the projects. The downturn turned Kashyap’s world upside down. Investors balked, the runway started to deplete at an alarming pace and a team of around 70 looked like an overwhelming army in a losing war. The choice was cruel, but simple: Kill.

Kashyap’s ruthless streak—one that he never knew he possessed—came to the fore. First to get slayed were his multiple ventures, his “babies”. All incubator projects, except goibibo, were shut. “We doubled down on goibibo and focussed only on domestic air travel,” he recounts. What he slaughtered next was his “flamboyant” office on the posh Golf Course Road in Gurugram. The office shifted to a nondescript place in the interiors of the city. The rental fell by three-fourths. The army of employees was reduced to a wafer-thin team of eight.

The only option was survival. “At that time, failures were not celebrated,” says Kashyap, who went on to establish a successful travel portal and sold his venture to MakeMyTrip in 2016 in a deal reportedly valued at $1.8 billion. During a crisis, Kashyap underlines, nothing is important except survival and the will to do so. “To survive, one needs the courage of conviction to kill the stuff that you created to survive.”

At the same time in Bengaluru, K Vaitheeswaran, who started Fabmart in 1999, was also planning to turn ‘serial killer’. For online ecommerce brand Indiaplaza, the second venture of Vaitheeswaran, over 70 percent of business came from online loyalty programmes run for large financial services companies. The rest came from online B2C retail. “The corporate business was quite profitable,” recalls the pioneer of online ecommerce in India. But there was an elephant in the room that he had conveniently ignored for long. He couldn’t anymore. The corporates used to take 60-90 days to clear their payments. “We were fast running out of cash and had to survive,” he says.

The lucrative corporate business was shut. Headcount was slashed from 75 to 30. And frugality was embraced. “In retrospect, this was a great decision because we were still surviving in 2011 when we managed to raise some venture funds,” says the entrepreneur who co-founded a dairy beverage brand Again Drinks with his Indiaplaza colleague Sandeep Thakran last October. “If I had not killed the large corporate business, we would have long gone home.”Cut to April 2020, yesterday’s warriors have just one piece of advice for entrepreneurs caught in the pincer grasp of the Covid-19 crisis: Survive the April-June quarter. “Just think about survival,” says Kashyap, who founded wealth management platform INDwealth in June 2018. The ones who manage to last this quarter will have a high chance of winning in the long run. “Remember, Airbnb was born out of a recession,” he says, underlining that Goibibo was also born during a period of turmoil.

As gloom, doom and pessimism engulf the world, including the Indian startup ecosystem, because of the rapid spread of coronavirus, the ‘survivors’ believe there is light at the end of the tunnel. One just needs to hang on.

A crisis is also a time when the tough get going. That is what happened with Anupam Mittal, the founder of shaadi.com, who was an employee with an American company in 2001. “The dotcom bust, though heart-wrenching, was liberating for me,” says Mittal. “It made me realise that I had nothing to lose, and I decided to turn entrepreneur. A crisis also comes with opportunity.”

The first big crunch for Mittal as an entrepreneur came in September 2008, just a few days before Lehman Brothers went bust. By that time, Mittal had already built a battery of ventures—shaadi.com, Mauj mobile, makaan.com and a social networking company. The idea was to raise capital and build multiple ventures. A term sheet for funding was ready, the investment was about to happen, and the money was slated to land in the bank in a few days.

“The money never came,” Mittal recalls. The investor backed out, and shaadi.com was left with a runway of three-four months.

Mittal’s first reaction was of denial. “We can get somebody else to fund us,” he tried reassuring himself. That didn’t happen. Everybody chickened out. The idea of getting funded during a crisis sounded outrageous. When reality struck, it hit like a hammer and extreme measures were taken: Layoffs, shuttering non-profitable ventures and putting a lid on cash burn. “It was painful. But we had to do it. And do it quickly,” says Mittal. Survival became the basic, and the only, instinct. “In hindsight, we were ruthless in how we approached the problem. But we had to,” Mittal tells Forbes India.

Stress and survival

As the Covid-19 pandemic adds heaps of layers to the already-high-pressured life of an entrepreneur, the ones managing stress better have a better chance at short-term survival and long-term success. “This is a stress test,” avers Vikram Gupta, founder at IvyCap Ventures, a homegrown venture capital (VC) firm with a focus on consumer, health care, enterprise and financial technology and emerging technology sectors. The test, he lets on, will measure various things, including the founders’ ability to manage distressed employees, vendor supplies, fixed monthly payments, working capital and above all, their cash flows. The ones who are nimble in cutting costs and finding a sustainable way of doing business over the first quarter of the financial year would come off better than their competitors who may have succumbed to pressure. The ongoing quarter will lead to the premature death of many startups with high burn rates and those hoping to raise rounds of funding in the coming months. “There will also be substantial disruptions in the business models,” says Gupta, who in March backed Bengaluru-based Internet-of-Things platform Singularity in its pre-series A funding round.

The ongoing quarter will lead to the premature death of many startups with high burn rates and those hoping to raise rounds of funding in the coming months. “There will also be substantial disruptions in the business models,” says Gupta, who in March backed Bengaluru-based Internet-of-Things platform Singularity in its pre-series A funding round.

Other entrepreneurs agree. “It will test our ability to survive and rise,” says Akanksha Hazari, founder of m.Paani, a Mumbai-based local retailer digitisation platform. The crisis will also test the ability to deliver exponentially more with less, be agile through adversity, and keep people secure and motivated, adds Hazari. Backed by Blume Ventures and Chiratae Ventures, m.Paani reportedly raised $5.5 million in Series A funding last December from a new set of investors.

What the crisis will also permanently change is the definition and perception of growth. “Growth at any cost is no longer sexy or viable,” says Hazari. “Path to revenue and profitability matters much more.”

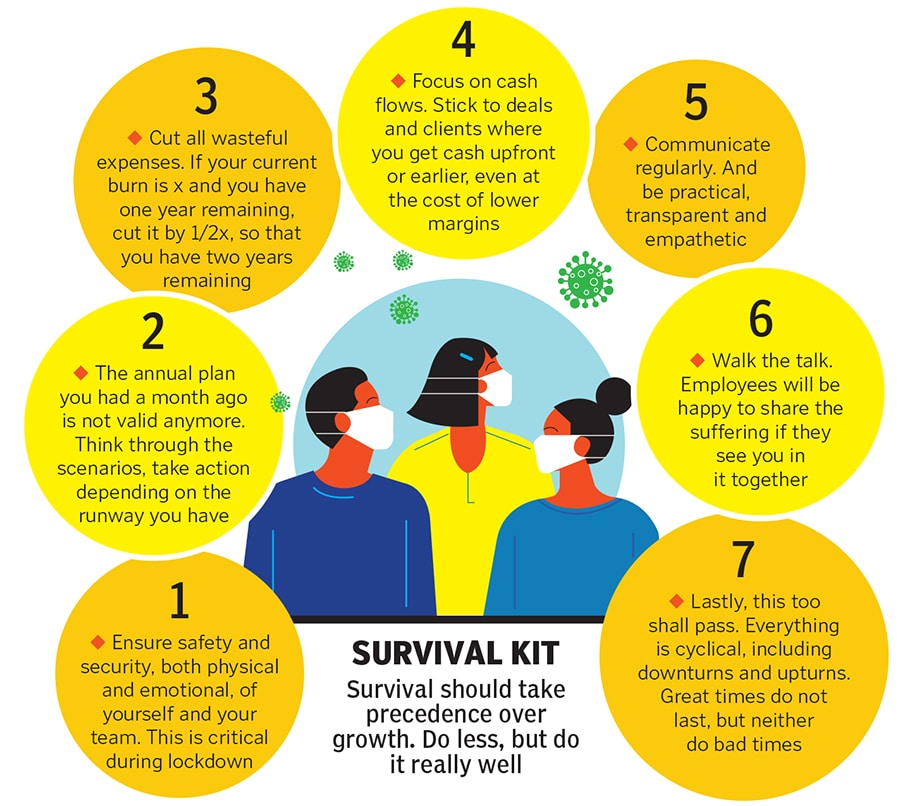

For the next three months, though, what is crucial is a survival plan, rather than a business plan. Anil Joshi, founder at Unicorn India Ventures, offers some quick fixes for entrepreneurs: Be frugal, go for cash deals, don’t get stuck on valuation if you’re looking for funding and stop non-critical activities. “Just focus on survival. That’s it.”

‘Growth’ narrative changes

For many years in India, startups have been built on the narrative of growth, even at the cost of unit economics. “That is already changing dramatically and it will now change even more,” says Rajan Anandan, managing director, Sequoia Capital India. Investors, he adds, would want to see if you’re solving real problems and if you have some level of traction, viable unit economics and how you will manage the next 3-18 months.

Cash flow—being able to run companies—is going to be the only priority for founders as they navigate the next few months. “Startups that don’t have a lot of runway or don"t take significant action will be out of business,” warns Anandan.

The annual plan that a founder had a month back is not valid anymore. One needs to think through the scenarios, and then take action for the next several months depending on the industry one is placed in and the runway one has, says Anandan. For the seed stage startups, there is going to be a much higher focus on businesses that have the potential for a viable economic engine.

The startups facing the maximum brunt would be in segments such as travel, hospitality and offline retail. “Very few companies can survive two or three months of zero revenue,” he adds.

In spite of the gloom, there is hope and optimism. “Some of the best companies in the history of technology were founded in periods like this,” says Anandan. Though a challenging time, it’s also the time for entrepreneurs to really build muscle and find viable ways of building their business. He points to a few industries that would see strong tailwinds in the current scenario. Online education, online gaming and entertainment collaboration tools, medical supplies, health and hygiene products will see accelerated growth. Online groceries, food delivery and online pharma companies will also see a sharp increase in penetration, especially if they can work with the states to unlock the supply chain and delivery issues. “This will be a tipping point for them,” says Anandan.

It’s also a turning point for VCs who see crisis as an opportunity. Scouting for Silver Linings

Scouting for Silver Linings

In Berlin, Germany, Shubhankar Bhattacharya is gearing up to fish in troubled waters. The die-hard ‘pragmatic’ investor, who relocated from Bengaluru in 2018 to join Global VC firm Foundamental as partner, reckons uncertain times create an immense opportunity for investors who can spot and value resilient and nimble companies. Judging by the workload over the last two weeks, he tells Forbes India that the firm is excitedly bracing for an extremely intense quarter. “We are eternal optimists who see new opportunities in a market shake-up,” he says, underlining that not all VCs are equal. The contrast, interestingly, has become starker during the present crisis, as Bhattacharya explains his classification of investors.

In the first bucket are funds that are ‘deceased’ or in ‘critical condition’. They are facing a crisis due to the fact that many of the large or prominent investees have seen a dramatic reduction in revenue, market value or possibly even impending death as a result of a drastically shortened runway. Then there is another area of concern: Existing or potential LPs (Limited Partners are those who invest in VC funds) have either withdrawn commitments to invest or are limiting the VC firm"s available capital, explains Bhattacharya, whose firm has invested in two Indian startups: Infraprime Logistics Technologies and LocoNav, a fleet management venture. For this group of VCs, the coronavirus has only added stress.

The second kind of investors are the ‘panicked’ ones. These funds see a bleak future (at least in the near-term) for most of their portfolio companies and therefore choose to reserve additional cash to "save" their existing investments through follow-on rounds (think of this as "bailout" money). This class of investors too has nothing to do during this crisis.

Then there are investors who actually do nothing. Reason: The markets are quiet and competition isn"t stirring at all. ‘Why put your neck on the line when you can take it easy’ is the guiding philosophy for them. Covid-19 doesn’t mean much to this class.

The last category belongs to the eternal optimists, who use additional work-from-home time to buy value stocks, learn new skills and stay healthy. These VCs know that the markets will eventually rebound and realise that companies that are resilient and nimble will recover quickly as competition thins out. This is the time, says Bhattacharya, to spot gritty founders who are building lasting companies and back them at highly attractive valuations. The VC has a word of advice for founders looking to raise money during the Covid-19 pandemic: Identify this last category of optimistic investors. They will back you through tough times and will likely be your strongest critics and allies. “Come talk to us,” he says.

Bhattacharya is not the only one talking to founders and reassuring them of unflinching support during the crisis. Sequoia, the American VC firm, also spotted the crisis early and sounded a word of caution and support to its portfolio companies.

In a guidance note sent to founders and CEOs in early March on how to ensure the health of business, Sequoia maintained an optimistic note. “Could you turn a challenging situation into an opportunity to set yourself up for enduring success,” it asked in its note. Many of the most iconic companies were forged and shaped during difficult times. “We partnered with Cisco shortly after Black Monday in 1987. Google and PayPal soldiered through the aftermath of the dotcom bust,” the note continued, adding that Airbnb, Square and Stripe were founded in the midst of the global financial crisis.

Asking founders to question every assumption about their business, including cash runway, fundraising, sales forecast, marketing capital spending and headcount, the address highlighted how a crisis is a blessing in disguise. “Constraints focus the mind and provide fertile ground for creativity,” it said, “This might be a time to evaluate critically whether you can do more with less and raise productivity,” the brief pointed out.

The note concludes by dishing out a priceless lesson for jittery entrepreneurs. Having weathered every business downturn for nearly 50 years, the letter addressed to the founders says we’ve learnt an important lesson: Nobody ever regrets making fast and decisive adjustments to changing circumstances. In some ways, business mirrors biology. “As [Charles] Darwin surmised, those who survive are not the strongest or the most intelligent, but the most adaptable to change,” it ended on an optimistic note.

Back in Gurugram, Kashyap knows how to survive. It"s a simple trick: Blindly follow Darwin. “Adaptation is the key,” he says. Though this time his venture is well-capitalised and doesn’t have any issues of survival, the gritty entrepreneur prefers to err on the side of caution. He will question every rupee spent, cut down on any expense that is not adding value to the company or customers and won’t downsize his team of 90, but will have a hard look at the prospects of adding any new hire. “We had been running the ship very tight,” he says, adding that he has never drawn salary since the day the venture was founded in September 2018.

The most crucial thing for Kashyap are his learnings from his previous stints. This time he has not invested in marketing, has brought users to the application through word of mouth and conserved every bit of cash. “The culture of being tight-fisted has worked well for us so far in this crisis.” The biggest learning that today’s entrepreneurs can cling on to, though, is: Ride out the short-term storm, and you may be in clover for life.

First Published: Apr 08, 2020, 12:33

Subscribe Now