India's Richest: Relaxo, on strong footing

Utility footwear giant Relaxo's sensibly priced, customer-relevant footwear flew off the shelves during the pandemic, helping the company weather the Covid-19 crisis better than its peers

Ramesh Kumar Dua inherited a rubber business from his father and, with his brother Mukand Lal, built it into India’s largest footwear maker

Ramesh Kumar Dua inherited a rubber business from his father and, with his brother Mukand Lal, built it into India’s largest footwear maker

Image: Amit Verma[br]In mid-April, when the country was in phase 1 of a complete lockdown, wholesalers in parts of rural Rajasthan and Haryana had been approaching large distributors to pick up essential goods, which included dairy products, groceries, medical equipment and medicines. “In the tempos where wholesalers were stocking goods for sale, they also bought three to five cartons of Relaxo slippers, to be sold through their own channels,” says Ramesh Kumar Dua, managing director of Relaxo Footwears, India’s largest footwear maker.

Dua narrates this incident, which a distributor told him, while speaking to Forbes India from his corporate headquarters in New Delhi. It indicates the need for affordable footwear—so much so that it is considered an essential—for the public at a time when most services and factories were shut due to the pandemic. Relaxo exclusive stores and factories did not open until mid-May.

The company, which started operations in 1976 with just one product—the Hawaii slipper—continued to innovate and has grown to become the maker of over 300 different types of shoes, slippers and sandals across four brands: Bahamas (includes Hawaii slippers), Sparx, Flite and Schoolmate. The company has four additional brands—Boston, Mary Jane, Casualz and KidsFun—in its portfolio, sold only at Relaxo’s exclusive brand outlets (EBOs).

The Indian footwear industry is estimated to be between ₹40,000 crore and ₹80,000 crore, of which the branded non-leather market is about ₹18,000 crore. Here, Relaxo holds a 9 percent market share by net prices, Dua says. In this space, the company battles with rivals such as Paragon Footwear, Khadims, Ajanta Shoes, Campus (Synergy Action Group), Bata India, VKC Footwear and Pantaloons across different regions, categories and segments, and has found its strength as a mass, utility-based and essential footwear maker.India is the second largest producer of footwear globally, producing 220 crore units annually, behind China which manufactures 1,420 crore units each year. Despite this, the per capita footwear consumption in India is very low at 1.7 pairs, compared to six pairs in developed nations, according to the Council for Footwear, Leather and Accessories (CFLA).

In the post-Covid world, demand for utility-based footwear such as sandals and flip-flops has increased, so comfort and fit have become critical elements compared to style and exclusivity. This is where branded footwear from the organised sector are being favoured over small businesses from the unbranded sector.

The scale of Relaxo’s operations can be gauged from the number of pairs it sells. It sold 17.92 crore pairs in FY20. Compare this to Bata India, another listed footwear company in India, which sells in excess of 5 crore pairs each year. Unlisted Paragon Footwear is estimated to sell about 14 crore pairs while another unlisted brand Campus is estimated to be selling around 3 crore pairs.

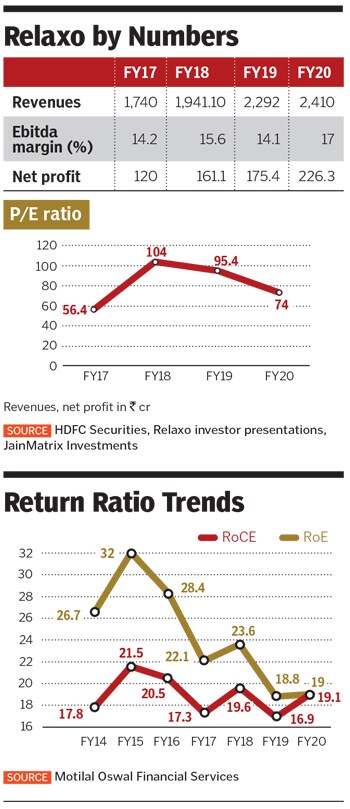

Relaxo has a market capitalisation of ₹16,359.44 crore, very close to that of Bata India, at ₹16,708.58 crore, as of October 29. Consistency in growth remains Relaxo’s strength—since inception, it has compounded its revenues by 25.25 percent each year. In the June-ended quarter, Relaxo reported a 48 percent year-on-year drop in net profit at ₹24 crore, on revenues of ₹364 crore, which also fell by 44 percent. In the September-ended quarter, its net profit edged up by 6.46 percent year-on-year to ₹75.1 crore, on revenues of ₹580.9 crore, which fell by 6.8 percent.

Stronger post-pandemic?

No company was spared the impact of the Covid-19 pandemic, as factories and retail stores downed shutters. But, in a unique manner, Relaxo, whose mojo is manufacturing sensibly-priced, customer-relevant footwear, appeared to have weathered the storm better than most. Its basic Hawaii slipper (advertised by actor Salman Khan) and slippers in its Flite brand (with Ranveer Singh as brand ambassador) became essential products for millions.

As parts of the economy began to open up in phases across India, migrant labourers were moving back towards factories for work and farmers towards fields in the harvesting and sowing seasons. “The slipper became an essential commodity for people. The rubber chappal and our Flite EVA slippers moved off shelves fast,” Dua says. The company had an inventory of 45 days when its factories closed in March.

Though not directly comparable, Bata India, a dominant player in the leather footwear and premium casual footwear segments, has been hit harder. The extended lockdowns meant a lower demand for leather shoes due to the closure of offices and schools and restricted travel and festive celebrations. Also, as the work-from-home culture grew, so did the demand for casual footwear, benefitting the likes of Relaxo. Bata India reported a loss of ₹101.2 crore and an 85 percent drop in revenues at ₹134.8 crore in the June-ended quarter. Relaxo sells through more than 50,000 multi-brand outlets it also sells through its exclusive brand outlets, ecommerce portals and exports

Relaxo sells through more than 50,000 multi-brand outlets it also sells through its exclusive brand outlets, ecommerce portals and exports

Image: Courtesy Relaxo[br]The structure of India’s footwear industry, which by value remains 70 percent unorganised, is also likely to emerge as a huge positive for companies like Relaxo. Emergencies such as the pandemic has meant several smaller footwear makers in the unorganised sector have factories and offices that are still shut or have completely disrupted distribution, logistics and finance cycles.

“If such an unorganised player was operating in 10 geographies, it will have no option but to now operate only in five. Companies such as Relaxo will gobble up that market share, as players in the unorganised sector weaken due to the disruption,” says Rakshit Ranjan, portfolio manager at Marcellus Investment Managers, which has Relaxo in its investment portfolio since 2018.

Also, Relaxo relies on more than 50,000 multi-brand outlets (MBOs) for 80 percent of its revenues. The balance is through EBOs, online sales and exports. “Manufacturing and distribution are the two main competitive advantages Relaxo has,” Ranjan adds. Relaxo has eight state-of-the-art manufacturing facilities, five in Bahadurgarh (Haryana), two in Bhiwadi (Rajasthan) and one in Haridwar (Uttarakhand). The company makes about 9 lakh pairs daily from all these units.

By July, the production capacity for Relaxo reached pre-Covid levels across its brands. Now all its factories are fully operational. Dua is also keeping a close watch on its labour force, most of which originate from the states of Bihar, Uttar Pradesh and Haryana. Relaxo’s workforce (including contractors) is at 18,000 people, close to its pre-Covid level of 20,000. There were no salary cuts or job losses for its over 7,800-odd staff. Innovations & New designs

Innovations & New designs

Even while affordability and distribution have been strengths for Relaxo, the company has remained relevant by constantly innovating, listening to customer feedback and offering unique products.

Dua talks about the in-house product development centre where, based on feedback and market surveys from retailers and customers, the company continuously designs new products. There are tests prior to a launch and post-launch reviews. “Each brand is now supported by a separate team for focussed product design and development, enabling us to launch over 200 products in 2019-20,” Dua says.

In the Sparx range—a brand promoted by actor Akshay Kumar—Relaxo has launched a never-before air-technology sole in its range of sandals. These offer mid-sole cushioning and detachable straps to match a morning/evening mood. Priced around ₹1,500 a pair, these are among the models that Relaxo introduced this summer.

“Forty years ago, Hawaii slippers were a blend of natural and synthetic rubber. Now it is just 20 percent natural and 80 percent is ethylene-vinyl-acetate [EVA] polymer. Polymers determine the properties of the footwear, whether it is durability or comfort,” says Dua, a London-trained rubber technologist. Along with his older brother Mukand Lal, he brings the expertise of building the rubber business they inherited from their father in the mid-1970s.

Relaxo has now started providing anti-skid features in its Sparx and Bahamas footwear range. “We have been developing anti-skid features over the past one year,” Dua says. A Bahamas casual slipper model offers the feature, besides an embossed foot-bed for additional comfort. Acupressure features are also becoming popular in the affordable Hawaii fitness and ortho range of slippers.

With winter around the corner, Relaxo would see an improved demand for its closed-toe footwear, such as casual shoes. But the lack of demand for its Schoolmate brand of shoes for children is likely to drag down growth for the company. It has stalled fresh production of school shoes until schools reopen across different parts of India. “Till there is no demand for these shoes, it is prudent to wait a bit longer,” Dua says. Relaxo has not disclosed its inventory data for the Schoolmate brand.

Without going into specifics, Dua forecasts Relaxo to close FY21 with a 10 percent drop in business revenues, compared to the previous year. “We should be back to 90 percent of pre-Covid production levels by then. That I believe is a good performance in the current business environment,” he says. Relaxo also expects to touch the production level of 10 lakh pairs a day by March-end.

Online sales

Though a majority of Relaxo’s business is done through its distributors and retail stores, it is strengthening its ecommerce presence. About 10 percent of its business is through ecommerce and it is growing at a faster pace than the traditional business. “When the lockdowns were imposed, we realised the need for a strong online presence,” Dua adds. Relaxo sells its products through Flipkart, Myntra, Amazon India and DMart. The company is exploring the possibility of creating exclusive product portfolios, something it has been reluctant to do in the past. “We prefer to build our own brands and not create new ones for large global or retail giants,” Dua says.

About 5 percent of Relaxo’s business revenues is through exports. The strongest demand comes from Saudi Arabia, Papua New Guinea, Tanzania, UAE and the Panamas, through around 30 overseas distributors. Relaxo plans to strengthen their presence across Africa and the Middle East, where distribution will need to be backed by after-sales service.

Being a family-run business, it is critical for the company to have a diversified group of investors. The Dua family continues to hold a majority 70.98 percent stake, while the balance 29.02 percent is held by others, which includes 3.39 percent with foreign institutions, 6.96 percent with banks and mutual funds, and 4.02 percent with SBI Large Cap fund. To strengthen its human resources systems it has automated entire processes in 2017, and offers stock options to the top management to encourage professionalism.

A range of verticals, which includes sports shoes and sports sandals, flip-flops (basic and designer) and school shoes, helped balance growth for Relaxo during disruptions such as the pandemic. For a stronger investor engagement, the company will need to continue to invest heavily in technology, systems and processes, while increasing automation.

Relaxo finds no need to overhaul its business strategy, which has worked so well for decades: Offering better quality than the competition at the same or lower price, and to keep spending towards building each brand. Dua summarises the philosophy best: “We believe in strengthening our strengths rather than trying to manage our weaknesses.”

First Published: Nov 13, 2020, 12:41

Subscribe Now