Make some Noise for the profitably bootstrapped

The Khatri brothers, cousins, have built Noise by remaining bootstrapped for over eight years. But now, India's biggest wearable brand needs to build a war chest to sustain its high decibel growth

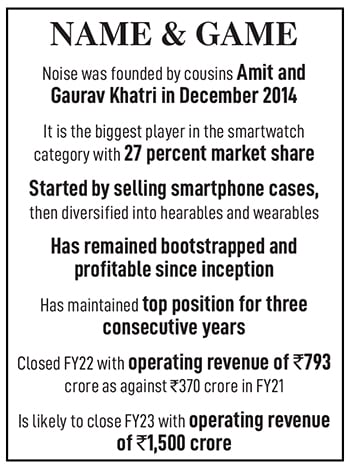

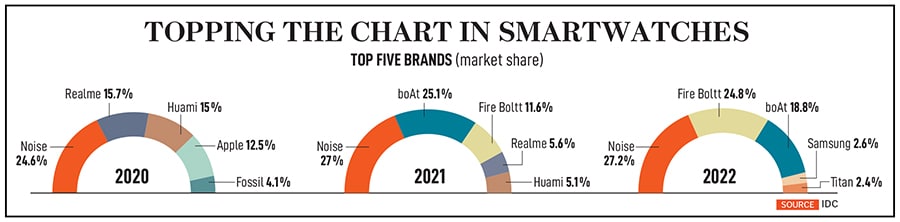

Gurugram, 2021. The squeaky sound morphed into a belligerent noise, recall cousins Amit and Gaurav Khatri. It was sometime during the beginning of July 2021. With a 28.6 percent market share in the second quarter (April-June) of 2021, Noise had maintained its pole position as the biggest smartwatch brand for five straight quarters. It was a high-five moment for co-founders Amit and Gaurav, who had founded Noise in December 2014, and had started their entrepreneurial journey by selling smartphone cases. Over the next few years, they diversified into hearables and wearables.

The sweet sound of success didn’t last long though. The company, which clocked a little over ₹24 crore in sales in FY17, was gripped with two pressing problems. First, the ASP (average selling price) of mobile cases had dipped, which meant that churning higher volumes would lead to same value growth. Second, the brothers were still dealing with products. Noise was not a brand. Consequently, the duo exited the accessories business by the end of 2017, and rolled out premium TWS (true wireless stereo) products. This time, the idea was to build an aspirational brand.

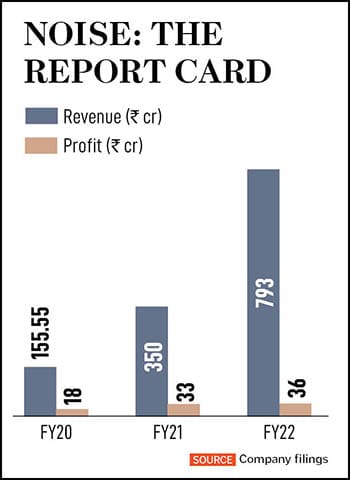

The move, however, bombed. The market for premium products was niche, and aggressive pricing by multinational rival brands changed the competitive landscape. The duo then rolled out smartwatches, and there was no looking back. The bootstrapped brand, which had been profitable since inception, almost doubled its operating revenue and closed FY21 at ₹350 crore. The brothers were ecstatic. Holding on to the crown for 15 consecutive months called for a loud celebration.

But in 2021, somebody gate-crashed the party. “Are you guys going to shut down?" the panicky voice from the other side of the phone asked Amit. “They are saying that you have run out of money," said the vendor, a contract manufacturer who was paranoid about the prospects of losing his lucrative business. Gaurav too got a call from one of his top hires, who was set to join the company in two weeks. “Is it true that the company is in sell-out talks?" he asked, anxiously.

But in 2021, somebody gate-crashed the party. “Are you guys going to shut down?" the panicky voice from the other side of the phone asked Amit. “They are saying that you have run out of money," said the vendor, a contract manufacturer who was paranoid about the prospects of losing his lucrative business. Gaurav too got a call from one of his top hires, who was set to join the company in two weeks. “Is it true that the company is in sell-out talks?" he asked, anxiously.

The news of Noise running out of steam was a rumour. But it spread like a wildfire, throwing the brothers into firefighting mode. Two years ago, in May 2019, the brothers had heard a different kind of noise. “I must have met over 100 investors," recalls Amit. “Nobody believed in our story." To be fair to the capitalists, their scepticism had some merit. The flop show of Micromax, Intex, Lava and Karbonn—from close to a combined volume market share of 39 percent in smartphones in Q2 of 2015, their numbers had dipped to less than 3 percent by early 2019—had taken the sheen off homegrown brands. The India story was getting discredited.

Noise paid an unwanted price. As the narrative of an Indian player taking on the might of the Chinese and a clutch of multinationals sounded dubious at the time, the brothers kept staring at a nagging question mark on their credibility. ‘Fly-by-night operator’, ‘too good to be true’, and ‘the bubble will soon burst’ were some of the comments hurled at the rookie founders, who couldn’t find backers.

Noise paid an unwanted price. As the narrative of an Indian player taking on the might of the Chinese and a clutch of multinationals sounded dubious at the time, the brothers kept staring at a nagging question mark on their credibility. ‘Fly-by-night operator’, ‘too good to be true’, and ‘the bubble will soon burst’ were some of the comments hurled at the rookie founders, who couldn’t find backers.

“Naa toh inventory ke paisey they aur na hi branding ke [we neither had money for inventory nor for branding]," recalls Gaurav. While the rivals had a stock of at least 90 days, Noise had an inventory of 15 to 20 days. There was paucity of money for branding. Another challenge, the co-founders say, was the inability to roll out a bouquet of products. “We never had money to launch an array of products," says Amit.

The solutions, interestingly, were embedded in the problems. “We were forced to do more with less," reckons Gaurav, explaining how every handicap turned out to be a blessing in disguise. Let’s start with hiring. Roping in a band of believers during the formative years created stickiness. It also didn’t let salaries bloat. A pack of youngsters coming from non-pedigreed backgrounds—non-IIT, IIM and the likes—hustled hard to progress. Less days for the inventory was also a plus. Noise never had to deal with the problem of excess stock that got dumped whenever new stock-keeping units (SKUs) rolled out in the market.

The solutions, interestingly, were embedded in the problems. “We were forced to do more with less," reckons Gaurav, explaining how every handicap turned out to be a blessing in disguise. Let’s start with hiring. Roping in a band of believers during the formative years created stickiness. It also didn’t let salaries bloat. A pack of youngsters coming from non-pedigreed backgrounds—non-IIT, IIM and the likes—hustled hard to progress. Less days for the inventory was also a plus. Noise never had to deal with the problem of excess stock that got dumped whenever new stock-keeping units (SKUs) rolled out in the market.

Paucity taught the brothers to think out of the box. “We never had the luxury to launch too many products," says Amit, adding that the room to experiment and make mistakes was excessively constricted. Noise not only focussed on entry-level price segment, but it also loaded watches with industry-first features such as Bluetooth calling, higher display brightness, fresh designs, enhanced app integration and a wider presence across large-format stores. “We lacked the comfort of spray and pray," he says.

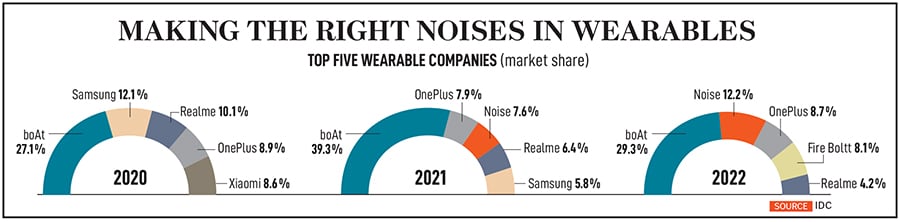

Cut to 2023. A tight-fisted life and consistent survival hacks have made Noise top the chart for three consecutive years. Analysts explain how the brand amplified its appeal and market share. “They made smartwatches affordable," reckons Navkendar Singh, associate vice president (devices research) at IDC. Competitive pricing, aggressive marketing and faster adoption of new features made the brand click with masses.

A boom in wearables provided the much-needed rocket fuel for Noise. The India wearables market, IDC pointed out in its recent report, registered a strong 46.9 percent YoY (year-over-year) growth, as shipments breached the 100-million unit mark. Interestingly, the share of smartwatches grew from 17.9 percent in 2021 to 30.7 percent in 2022. In terms of numbers, smartwatch shipments were at 30.7 million in 2022, a growth of 151.3 percent YoY.

What also fanned growth was a fall in the ASP (average selling price), which was at $42.5 last year compared to $61.2 a year ago. Wristbands declined for another year with a negative growth of 73.2 percent YoY, as shipments dropped to half a million. “Noise strengthened its smartwatch leadership with a 27.2 percent share, growing 152.6 percent annually in 2022," says Singh, adding that models ‘Colorfit Icon Buzz’ and ‘Colorfit Caliber’ emerged as key models for Noise with a million plus shipments, respectively. “Given the context and challenges, they have done well so far," he says.

The going, though, might not be easy. Singh explains. Staying bootstrapped for so long helped Noise to reach from point A to B. But if the brand now wants to reach to point C and beyond, it needs to actively and quickly arm itself with outside capital. “Let’s be realistic," says Singh, adding that there are inherent limitations in a bootstrapped journey. And for a consumer brand, staying tight-fisted beyond a point becomes counter-productive. “The rivals are loaded and they are going to come hard," he says.

Most Indian players, including Noise, have played price warrior for long. Though it helped them expand their consumer base, it comes with a flip side. “The leader will have to play a highly differentiated game," points out one of the leading industry experts requesting anonymity. Noise will have to spend disproportionately on research and development. “It will also have to move up the price ladder," he says. The fact that the profit for the company has stagnated for two years—₹33 crore and ₹36 crore in FY21 and FY22, respectively—makes it amply clear that Noise will need to up the ante and play the value game in the future. “One must not get fooled by volume only," the expert says. “It is value that makes you valuable."

First Published: Apr 04, 2023, 11:08

Subscribe Now