When Gupta and Mehta hired an agency to pick a name for the flagship product of Imagine Marketing, an audio distribution company they launched in 2013, a number of options—Sonic and Audio Zoom to name some—were up for grabs. “But we wanted to create a lifestyle brand, and wanted a name that didn’t have an audio connotation. The meaning of boAt has to be read with its tagline–Plug Into Nirvana. Whenever you ride into the water, you leave your worries behind. It’s just the feeling when you plug into a boAt product—you get into a zone of your own," says Gupta, co-founder and chief marketing officer.

Global market intelligence firm IDC says boAt leads India’s overall audio category (that includes neckbands, over the ear and true wireless stereo), with 48 percent market share in the quarter ending December 31, 2021, retaining pole position for six consecutive quarters. It had a 39.3 percent market share in TWS (true wireless stereo) in 2021, up from 23.9 percent in 2020, and higher than the total share of the next four players.

It has also climbed to the second spot in wearable watches, a vertical it launched only in October 2020, with a market share of 25.1 percent in 2021, clipping the heels of Noise, the market leaders with 27 percent.

boAt’s burgeoning market share is reflected in its balance sheet, as the company ended FY21 with a revenue of ₹1,313.7 crore, up from ₹609.10 crore in FY20 during this period, profits nearly doubled from ₹47.79 crore to ₹86.53 crore. If its numbers in the first six months of FY22—a topline of ₹1,547.86 crore and a bottomline of ₹118.31 crore—are anything to go by, the startup is clearly tearing ahead of the pack.

![]() While modern founders are known to pick growth over profitability in their early years, both Gupta and Mehta have watched their bottomline with a hawk’s eye since the first year of operations.

While modern founders are known to pick growth over profitability in their early years, both Gupta and Mehta have watched their bottomline with a hawk’s eye since the first year of operations.

“What else do you expect when a Gujju and a Baniya start a business? To not lose money is in our DNA," laughs Mehta, co-founder and chief product officer. “Right from Day 1, we’ve ensured good unit economics. Besides, we are frugal at heart. For the first three years, Aman worked out of a co-working space in Delhi and me from a small office in Mumbai. We also worked with a small team, with only about 40 employees till we had about ₹700 crore in revenue. Growth is a key factor for us, but so is being profitable."

Customer focus

Till 2013, Gupta and Mehta were complete strangers, brought together by a business acquaintance who goaded them to sit down and have a chat. “Ours is an arranged marriage," says Gupta, “which has now turned into a love marriage." Both their families were anti-business partnerships, especially Gupta’s father who had suffered business losses, and it was only a leap of faith that got them to start Imagine Marketing. They began with chargers and cables that sold on the back of a sound product and word of mouth—“We didn’t have the marketing dollars back in the day," says Mehta—and, along with it, accrued a deep understanding of the audio market before launching earphones in 2016.

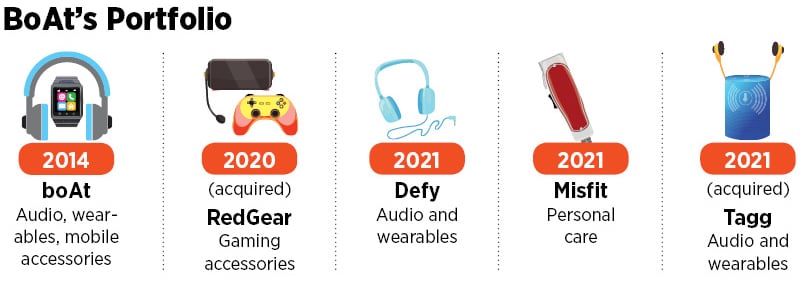

The coming together of the two entrepreneurs might have been fortuitous, but their journey has been anything but. “We don’t rush into any category," says Gupta. “We get into one, build market share and then move into another."

Both Gupta and Mehta have been astute in their understanding of the consumer, having tapped vast swathes of unexplored markets that were at an inflection point. For instance, hearables, their most prominent foray yet in 2016, grew at a CAGR of about 31 percent between 2018 and 2020, from ₹9,900 crore to ₹17,000 crore, says a report by consulting firm RedSeer. For the six-month period ended September 30, 2021, this category brought in 83.13 percent of revenues for boAt.

Similarly, despite the pandemic in October 2020, they launched wearable watches, a category that grew by 364 percent year-on-year in 2021, from 2.6 million units to 12.2 million, says IDC. The vertical raked in 14.05 percent of boAt’s revenues in the first half of the current fiscal.

“As data became cheaper and the cost of smartphones fell, the demand for quality personal audio products rose as there was a lot of content to be consumed. boAt saw a huge demand in the area and captured the market with their quality products," says Kanwaljit Singh, managing partner of Fireside Ventures, the first investor in the company in 2018, with another round the following year. “There was also a positive tailwind during Covid, with aspects like work from home increasing the scramble for personal audio devices."

At the core of every boAt product is a deep customer-centricity and problem-solving that Gupta and Mehta are obsessed with. Wires that get tangled? Bring on flat cables. Earphones that tear? Get metal instead of plastic. Love the dhol or the tabla? Add more bass. “We didn’t invent any of the categories we sell. We’ve just brought innovation and disruption," says Gupta. “And we are going to up the game every single day."

![]()

Brand building

Gupta recalls a time when he was given a cold shoulder by bankers and funders who weren’t convinced with the boAt story. “It was our consumers who built us at a time investors turned us away," he says. One of the strategies he has adopted, thus, is to take his products to more people through marketing and foster a sense of community among its users. “We call them boatheads," he adds.

boAt’s advertisement and promotion expenses have gone from ₹12.3 crore in FY19 to ₹47.8 crore in FY21, and its roster of brand ambassadors includes star cricketers KL Rahul and Shreyas Iyer, actors Kartik Aaryan and Kiara Advani, and musicians Diljit Dosanjh and AP Dhillon the company has also tied up with marquee events like the Indian Premier League, Sunburn, the Lakme Fashion Week, and also with Disney for their Marvel product range.

While Mehta works in giving the products a longevity that his grandkids could be proud of, Gupta feels the popular pulse. “Sometimes, my daughter’s lingo tells me we are going to get a new generation of consumers," he says. “My calendar might be closed, but my eyes and ears are always open for the next big thing."

Says Ronita Mitra, marketing strategist and founder, Brand Eagle Consulting, “boAt has redefined how audio wearables are perceived—as not just a functional, utilitarian product but also as a brand that is fashionable and hip. It has transcended the consumer electronics category and established itself as a lifestyle brand."

boAt’s multi-pronged marketing plans are focussed on a binary: Am I the ‘in’ thing or am I losing the customer? If the digital native customer has moved to Snapchat, so will boAt if she’s fangirling over a rising influencer, boAt will sign him on if she wants simple messaging, so be it. Gupta recalls one of their earliest marketing campaigns to promote sturdy cables. “We showed a pair of scissors across a cable and showed it doesn’t break. The tagline read: ‘Tired of buying charging cables? Switch to boAt’. It was the simplest of messaging, but we put it out on social media and it flew."

“Their communication has been clutter-breaking and impactful. It has resonated with its target group by mirroring its language, via influencers and celebrities," adds Mitra. “Going forward, the brand should identify social cause/s and build campaign themes around them."

What further appealed to the upwardly mobile, aspirational online audience was boAt’s digital-first approach that allowed them to launch products faster than traditional channels. Over 85 percent of boAt’s products in FY21 were sold on online marketplaces and another 2 percent through their own websites—during this period, the company launched 77 SKUs (stock keeping units).

“It speaks volumes about the company’s approach to fast innovation," says Singh of Fireside. “On the digital platform, you need to continuously innovate and give consumers more choice. Being offered new products every quarter is exactly what the consumer of today wants."

When boAt entered the accessories space in India, it was dominated by tier 1 global brands that failed to identify Indian sensibilities, price-sensitivity being one of them. boAt came cheaper than most international brands like Apple, JBL, Sennheiser, and its multitude of models at various price points—from ₹300-odd to ₹4,000-plus—with only a small cost difference between two models, catered to a wide range of audience, says Anisha Dumbre, market analyst for client devices, IDC India. “It has identified the sweet spot at the intersection of aspirational and affordable."

Gupta distils his marketing philosophy to four Ps: Place, price, product and promotion. A product that stood out in quality, aspirational promotion, the right price for Indian consumers, and the proper distribution channels. “The funny thing is Sameer is the chief product officer and he isn’t an engineer. I am the chief marketing officer and I am not a marketeer," he says. “And both of us have built this company with appropriate product and marketing."

![]()

Road Ahead

Despite sitting pretty on top, boAt wears its success lightly. “As much as Sameer and I are passionate about what we are doing, we are equally paranoid about what can go wrong. We only live for tomorrow, not yesterday," says Gupta.

The wearables market in India is highly competitive, having grown 93.8 percent year-on-year in the July-September 2021 quarter, and seen a proliferation of new entrants. But boAt isn’t scared of competitors instead, it is through everyday disruption of its own portfolio that it is trying to stay future-ready.

In 2020, the company set up boAt Labs, a Bengaluru-based in-house R&D team. Early this year, it acquired Singapore-based Internet of Things product development company KaHa to augment its wearables expertise. Besides, it also collaborates with Qualcomm Ventures, one of its investors, for tech knowhow.

In January, boAt signed a joint venture with Noida-based Dixon Technologies for manufacturing Bluetooth-enabled audio products. With most of its contractors in China, homegrown manufacturing will help it avert a crisis should any geopolitical imbroglio emerge.

“Making in India isn’t easy.

It was more expensive to make here than importing because of the inverted duty structures," says Mehta. “The government is now changing the regulations and we are doing more in India in the last 17-18 months." Last year, the company raised $100 million from New York-based Warburg Pincus it seeks to deploy a part of the capital towards local manufacturing capabilities.

boAt’s parent, Imagine Marketing, recently filed for an IPO to raise up to ₹2,000 crore. While the founders are tight-lipped about it, media reports state the company might seek a valuation of $1.5-2 billion. An Economic Times report mentions boAt was last valued at ₹2,200 crore, when it raised ₹50 crore from Qualcomm last April.

Says Mehta: “When Maruti came into the country, it helped build the automobile manufacturing ecosystem in India. Similarly, hum audio la rahe hai [we are bringing in audio], and an ecosystem will grow around it."

While modern founders are known to pick growth over profitability in their early years, both

While modern founders are known to pick growth over profitability in their early years, both