Amitabh Chaudhry's game plan: Can Axis bank beat HDFC Bank, ICICI Bank?

Under Amitabh Chaudhry, Axis Bank is focusing on leadership in select areas and identifying growth engines. Can he chew all he is biting off?

A year or so before Amitabh Chaudhry took charge as the CEO and MD of Axis Bank, the news flow and buzz surrounding the institution was not all positive. Chaudhry’s predecessor Shikha Sharma had had to cut short her fourth term and quit by the end of December 2018 after the Reserve Bank of India (RBI) raised concerns over another extension to her term.

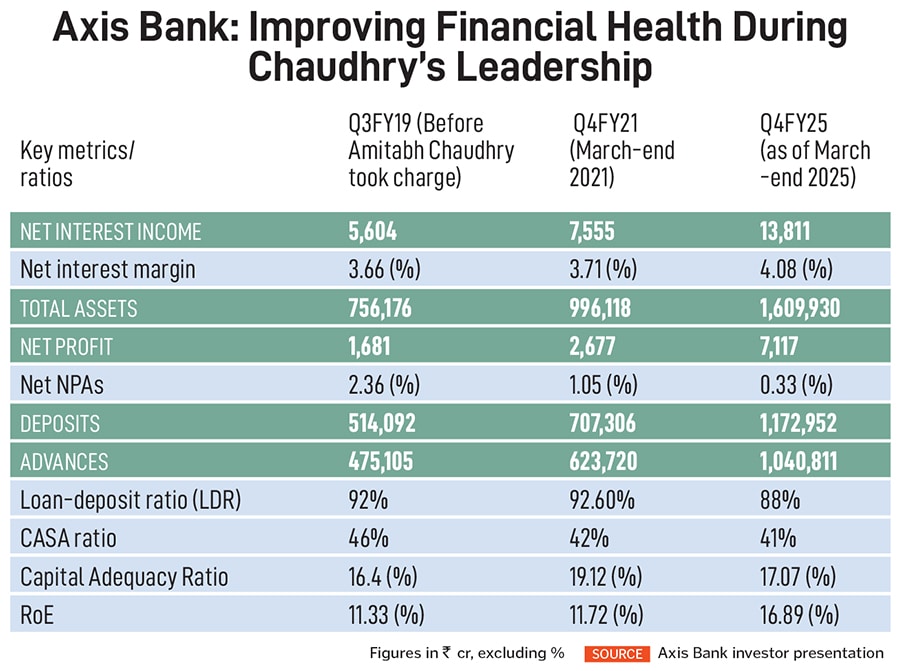

Though a lender of size (see table), Axis Bank was under media scrutiny after its asset quality had deteriorated, forcing it to increase provisions to offset the possibility of a rise in bad loans. It also raised unsupported news that rival Kotak Mahindra Bank might be interested in buying the bank. This would have been a tough task, considering the stake (and active interest) that Life Insurance Corporation (LIC), other insurance companies, and the government had in Axis Bank.

Axis Bank began operations as UTI Bank in 1994, one of the first new-generation banks in the private sector, promoted by Unit Trust of India (UTI) and a bunch of state-owned insurance firms. In 2007, it was rebranded as Axis Bank to avoid paying royalties to UTI AMC. That also helped it move away from the different connotations the UTI brand had acquired.

When Chaudhry joined Axis in 2019, it was a period when profitability of banks—particularly of public sector banks—had thinned due to rising non-performing assets (NPA). Nonetheless, Chaudhry, who came after a long stint as the CEO of HDFC Life, began with a declaration that he now thinks of as “grandiose". At that time, Axis was the third largest private sector bank in the country—the same position it had occupied in 2007 and occupies now.

“When I joined, I made a grandiose statement that we wanted to move away from third," Chaudhry, clad in a soft pink shirt, tells Forbes India in a good-humoured manner.

The banking order has not changed in the interim. If anything, among private lenders, HDFC Bank, the largest private sector bank with an asset size of Rs39,10,200 crore as of FY25, has become larger after merging with HDFC Ltd in 2023, increasing its lead over the second-placed ICICI Bank (asset size: Rs26,42,241 crore). Axis stays third with Rs16,09,930 crore.

Undaunted, Chaudhry has taken a nuanced approach to the numbers game. “We want to gradually, in the identified businesses, start becoming No 2 and No 1 and in a lot of businesses we have started seeing that," he says.

Aiding him is the just-completed absorption of Citibank’s operations in India (see ‘How Axis Absorbed Citi’s Consumer Business’). The other is its bet on technology. Chaudhry wants the bank to constantly be innovating and staying consumer-focussed. He is confident that if Axis “creates the platform and keeps adding and building on it" over a period of time, it will be able to beat or match its rivals. On whether there is a possibility that Axis will bridge the gap with ICICI Bank, he says the opportunity is there if “technology allows you to leapfrog".

Rajiv Anand, who will retire as the bank’s deputy managing director in August, says Chaudhry has ignited ambition in each business. “He is constantly asking what we can do differently. It inculcates a winning mindset," Anand tells Forbes India.

Focusing on leadership in a chosen few areas is a strategy explored and executed by NBFCs such as Bajaj Finance, whose managing director Rajeev Jain has explained to Forbes India that in the retail business, if one is not among the top three, one will not have a disproportionate profit pool.

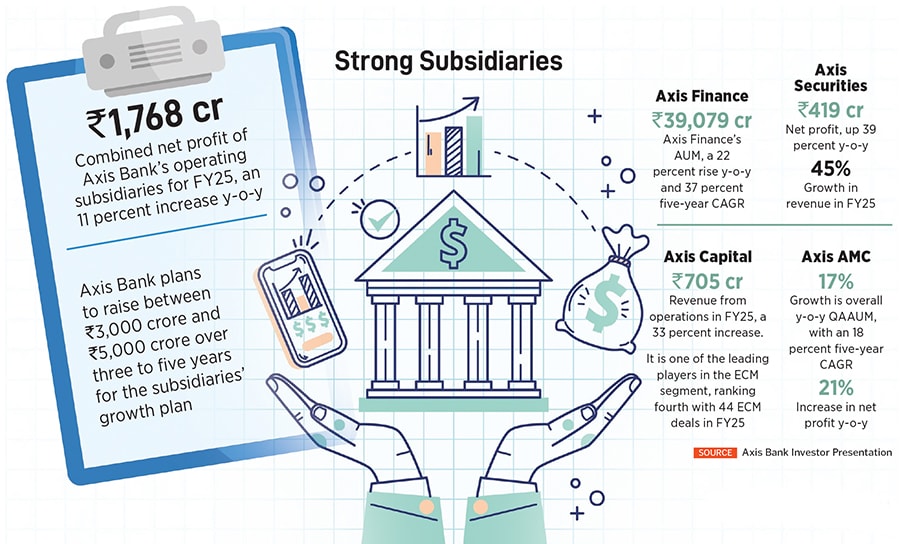

One of the battles Chaudhry chose was wealth management, which he decided to “turbo-charge" with Burgundy Private, launched before the Covid-19 pandemic. Burgundy Private caters to the ultra-rich, offering, besides wealth management, the One Axis features. These features take care of working capital, debt, term loan, trade financing, cross-border trade needs and setting up of a family trust. This has resulted in value creation for its subsidiaries, including Axis Finance (the NBFC), Axis Capital (investment banking), and Axis Securities (brokerage).

Last available industry data from Asian Private Banker places Axis Bank third in private banking and wealth management assets under management (AUM), behind ICICI Bank Private Banking and Kotak Private Banking. Axis Burgundy AUM grew by 10 percent year-on-year to Rs5,92,000 crore in March 2025.

In the Unified Payments Interface (UPI) ecosystem, Axis is now the market leader among Payer PSP Banks, with a market share of 33.3 percent as of March. This is based on the total number of transactions initiated using Axis PSP handles relative to the total number of UPI transactions. PSP is short for payment service provider.

In the Unified Payments Interface (UPI) ecosystem, Axis is now the market leader among Payer PSP Banks, with a market share of 33.3 percent as of March. This is based on the total number of transactions initiated using Axis PSP handles relative to the total number of UPI transactions. PSP is short for payment service provider.

In the debt market, Axis emerged at the top in terms of amount raised (Rs1,06,284 crore) through 175 bond issuances, according to Bloomberg league tables for 2024. This was ahead of the State Bank of India (SBI) and HDFC Bank, though Trust Investment Advisors, ICICI and Edelweiss scored higher in terms of number of issues managed.

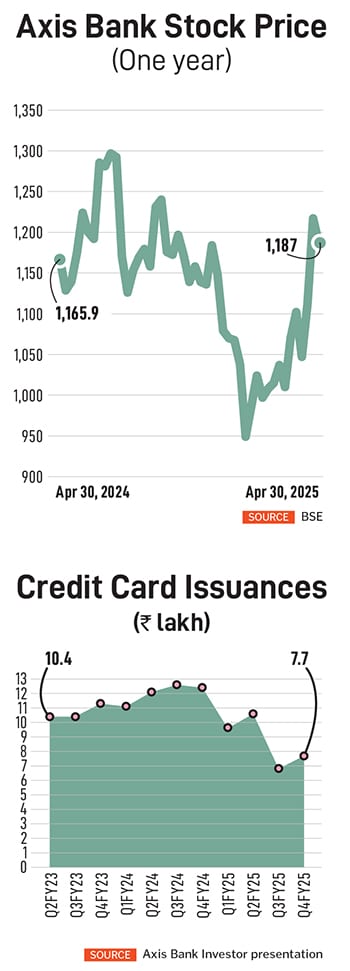

When Axis Bank acquired Citi’s credit card portfolio, it was aimed at continuing its premiumisation plan. Axis Bank is India’s fourth largest credit card company—after HDFC Bank, SBI and ICICI Bank—in terms of issuances, according to Forbes 2024 data, both in terms of number of cards, at around 14.5 percent, and spends, at around 12 percent.

But the credit cards ecosystem is sluggish, with spending, transaction volumes from customers, and the number of card issuances from banks slowing in recent months due to a weakening economic sentiment. This has affected all top banks that issue cards. “Axis Bank’s issuance market share (adjusted for the merger) has dropped around 100 bps while the spends market share has dropped 50 bps since the merger," says Krishnan ASV, Institutional Research Analyst (BSFI) at HDFC Securities. A bps, short for basis point, is one-hundredth of a percentage point.

In the wealth management space, Axis has expanded its business, with the combined AUM of the wealth franchise expected to increase by Rs947 billion, or 33 percent, in FY23. Pre-Citi, the Burgundy AUM had grown to around Rs2,61,000 crore in March 2022 from Rs1,33,000 crore, at a four-year CAGR of 18.32 percent. After the Citi deal, the pace of growth has been similar, at around 18 percent CAGR, to show a Rs5,92,000 crore AUM, as of March 2025. Axis competes with foreign giants such as Julius Baer and Barclays in India and domestic experts such as ICICI Bank, Kotak Mahindra Bank, 360 One, Nuvama and HDFC Bank in this segment.

One distinctive growth engine Axis has chosen to ride on is Bharat Banking, which is its distinctive unit to cater to semi-urban and rural areas with tailored products, increased footprint (both physical branches and digital), partnership with facilitators such as Common Service Centres. “Being an asset-led liability business, about 50 percent of new branches of Axis Bank are in semi-urban and rural areas," says Munish Sharda, executive director at Axis Bank, who earlier headed Bharat Banking.

Around the time Chaudhry took charge five years ago, banks were also becoming the best bets among private equity investors and mutual funds to leverage on the country’s economic growth phase. And Bain Capital, in 2017, found Axis to be an interesting entry opportunity.

“The bank was in need of confidence capital to strengthen its balance sheet. There was a lot of uncertainty on the outlook for the bank at that time and questions that it could be a potential takeover target," Amit Chandra, partner and chair in India at Bain Capital Private Equity, tells Forbes India. Entities affiliated with Bain Capital and the bank’s promoter, LIC, were early investors.

The earlier board and management at Axis Bank wanted an investor who could anchor the recapitalisation and provide long-term support. “We were well positioned to lead that capital raise round given our reputation, financial services experience and our existing relationship with the management," Chandra says.

Thus, by the time Chaudhry stepped into Shikha Sharma’s shoes, some of the concerns had already been addressed. But the bank needed to both scale up its retail lending book and build new product lines. Just before Chaudhry was set to take charge, the bank’s retail book, despite a five year compound annual growth rate (CAGR) of 26 percent to FY18, was, at Rs2,32,397 crore in Q3FY19, less than half that of ICICI Bank at Rs5,64,800 crore in Q3FY19.

Axis Bank needed to clean up its NPAs—which it did—and yet be conservative over future wholesale lending. Product lines were explored and expanded into, which included education loans and small businesses, besides building a deep partnership in the life insurance space, with Max.

In keeping with Chaudhry’s belief in using technology to leapfrog, Axis has invested in a platform that evolves with emerging technologies. Salesforce provides solutions for both customers and employees. One of them is Axis Bank’s ability to build and test agentic solutions, a technology that is fairly bleeding edge—a possibility that would have been unimaginable with traditional technology partners, the bank says. It also uses Salesforce to manage its small and medium-sized enterprise (SME) operations, offering a range of products and services for small businesses, including financing, trade solutions and digital tools.

There are at least 18 transformative projects the bank is now working on to build scale. Some of these include:

Though Axis has shown growth in deposits, much will depend on sustained liquidity support from the RBI. Chaudhry hopes liquidity will improve in the next few quarters, even as credit growth improves.

Bain and its affiliate investors had the advantage of buying into Axis at attractive valuations. The entities affiliated with Bain Capital proposed to invest Rs6,854 crore and LIC proposed to invest Rs1,583 crore in the 2017-18 raise. The shares were priced at Rs525. Bain exited in multiple tranches between 2022 and 2024, the last two tranches being in the region of approximately Rs1,100 per share.

Ashish Kotecha, Bain’s former nominee to Axis Bank’s board, explains the exit. “By 2024, our investment thesis was playing out well with growth and RoE being materially higher than when we entered," he tells Forbes India in an email. “The re-rating of Axis Bank’s trading multiple had also started reflecting this stronger trajectory. We were seven years into our investment, and while proud of what the management team had achieved and confident about the bank’s future, it was time for us to exit." Axis’s RoE, or return on investment, rose to around 14.5 percent between 2022 and 2023, compared to around 5.6 percent on entry.

HDFC Securities’ Krishnan says under Chaudhry’s leadership, Axis Bank covered credible ground on the retail liabilities front (see table). “Faced with a trade-off between quality, cost and growth, Axis Bank has focussed on improving the quality of its deposit franchise (greater deposit granularity) and, consequently, sacrificed growth," he says. “However, on the asset side of the balance sheet, we believe that Axis Bank’s performance has been patchy at best, reflecting a franchise prone to frequent experiments on the asset side, with constant churn in their approach to various asset classes."

For the March-ended quarter, Krishnan says the key takeaway from Axis’s earnings call on April 25 was that “the unsecured book is likely to take longer to normalise. We don’t see immediate answers to the bank’s growth challenge (adjusted for system-wide liquidity trends). We also continue to search for stability in Axis Bank’s risk management and provisioning policies",

The integration of the Citi deal has coincided with a period of system-wide stress in unsecured lending and the credit cards ecosystem. So, the longer-term benefits around operating leverage and cross-sell synergies are yet to play out for Axis.

For a lot of its businesses, there is still work to be done. But Chaudhry has time. On the day of the results, the bank announced he had been reappointed for three years effective January 1. Having sharpened his axe over the last six years, he will be wielding it—even if that means slicing and dicing his areas of Axis’s ambition.

First Published: May 15, 2025, 12:21

Subscribe Now