Is the worst over for IndusInd Bank?

Despite resignations of the top management, including CEO Sumant Kathpalia, analysts are confident that IndusInd Bank will ride through this crisis by ensuring stronger internal compliance and audit p

The resignations of IndusInd Bank’s top management—a direct fallout of disclosure lapses and incorrect accounting of derivative trades, announced in March—are unlikely to hurt the bank in the medium- to long-term, analysts say. The incorrect accounting has created a nearly Rs1,959 crore deficit in the bank’s finances, according to a Grant Thornton investigation.

The Hinduja Group-promoted IndusInd Bank is yet to announce its March-ended quarterly earnings, though it did put out an update in early April.

The release of the Thornton report saw a spate of resignations. IndusInd Bank’s CEO Sumant Kathpalia resigned on April 29, taking ‘moral responsibility’ for the lapses, a day after the bank’s deputy CEO Arun Khurana put in his papers.

Khurana had, in a conversation with analysts on March 10, indicated that problems had arisen due to adapting to a new regulatory framework. “So, it’s about a process that was put in place, which we realised now is based on this new framework that we had to adopt on April 1," he said.

Media reports now say the independent questioning of IndusInd bank employees by the Grant Thornton team did not match with what Khurana claimed. After the findings, the Reserve Bank of India (RBI) then approved the creation of a ‘Committee of Executives’ at IndusInd Bank to oversee operations during the leadership transition period, which it is currently going through.

IndusInd Bank awaits the approval of a new leader, which will have to be approved by the RBI. In 2020, when Yes Bank had climbed out of a regulatory moratorium, the RBI appointed Prashant Kumar at its managing director and CEO. In June 2022, RBL Bank’s current CEO R Subramaniakumar was granted an extension in term by the RBI till 2025 and now further till June 2028.

bank amid the crisis as credibility has been completely lost. But, as with Yes Bank earlier, IndusInd Bank will need to rebuild trust among all stakeholders, as there is a clear confidence deficit.

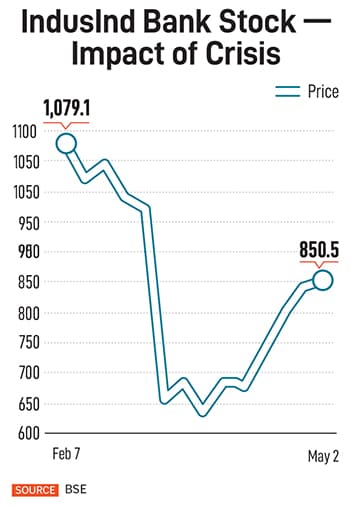

“This will be a mini reset for the bank. The new management will begin with plugging all the gaps and examine current operations more closely," Nitin Aggarwal, head-BFSI (institutional equities) at Motilal Oswal Securities, tells Forbes India. He adds that “one should not benchmark growth to what the bank achieved in earlier years". The IndusInd Bank stock has already been reflecting this (see chart), falling over 40 percent from its February levels. The stock recovered a bit from the March lows—after trading earlier at 0.6x FY27earnings, it is now 1x trailing book, Aggarwal says.

IndusInd Bank is likely to report a weak set of earnings for the March-ended Q4FY25 quarter. “Q4FY25 will see a deceleration in its loan book. Margins will also take a hit… do not be surprised to see a double-digit dip in margins," Aggarwal says.

Over FY26-27E, Aggarwal expects IndusInd Bank to report average around 1.2 percent RoA (return on assets), while in the past, the bank delivered an average 1.7 to 1.8 percent RoA over FY23-24.

Macquarie analysts retain an ‘outperformer’ investment rating on IndusInd Bank. The rationale for this is the immediate financial impact is contained and broadly in line with earlier estimates.

In the short term, the focus will be on maintaining corporate governance and ensuring no more bad unknowns come to light. “The new CEO would repose more confidence among stakeholders and provide a better understanding of business growth and profitability outlook," Aggarwal explains.

IndusInd is still counted among the top five private lenders. In many segments, it has a decent franchise, particularly vehicle financing (25 percent of the loan book), which is a high-yielding business. Its asset mix is also relatively controlled and though the MFI segment is undergoing pressure, that is a system-wide stress.

In its Q4FY25 business update, IndusInd Bank reported net advances of Rs3.47 lakh crore, edging up just 1.4 percent year-on-year and a 5.2 percent decline over the previous quarter. Its CASA (current account savings account) ratio showed a sharp over-30 percent decline from levels a year ago, while retail and small business deposits also declined marginally.

“IndusInd’s valuations remain attractive from a medium-to-long-term perspective," Kranthi Bathini, director of equity strategy at WealthMills Securities, tells Forbes India. “It will sail through this crisis."

Bathini adds that IndusInd Bank carries a strong legacy. It has, in the past years, gone through turbulent times, but has shown resilience and resurgence each time. This included taking a hit in profit during 2019 as provision rose due to exposure to loans extended to IL&FS Group. It has ridden out of whistleblower allegations in 2021, relating to evergreening of loans from a subsidiary Bharat Financial Inclusion Limited (BFIL). IndusInd Bank denied these allegations as baseless and inaccurate.

IndusInd Bank, continues Bathini, now has strong responsibility to improve internal compliance and audit processes, so that the derivative accounting lapses do not occur again.

The bank’s CRAR (capital to risk weighted assets ratio) is healthy at around 16.46 percent as of December-end 2024. “The bank does not need growth capital, but it could do with 1 to 2 percent increase in confidence capital," Aggarwal says.

First Published: May 14, 2025, 14:24

Subscribe Now Subramaniakumar was earlier the MD of Indian Overseas Bank. It is likely that the new leader at IndusInd Bank will be from the outside. A person from within the bank appears unlikely to lead the

Subramaniakumar was earlier the MD of Indian Overseas Bank. It is likely that the new leader at IndusInd Bank will be from the outside. A person from within the bank appears unlikely to lead the