Cover story: Why SoftBank changed gears in India

The Japanese investment fund has rejigged its India strategy after deploying nearly $14 billion since cutting its first cheque a decade ago

Every economic cycle will have summers and winters, but we are not seasonal investors. We stand behind founders who are executing their bold visions.: Munish Varma, Managing partner, SoftBank Investment Advisers India

Every economic cycle will have summers and winters, but we are not seasonal investors. We stand behind founders who are executing their bold visions.: Munish Varma, Managing partner, SoftBank Investment Advisers India

Image: Jake Chessum

Until the lockdown hit in March 2020, like most firms, SoftBank India’s team used to meet once a week on a Monday meeting. But things changed as everyone started adapting to working from home. The 12-member team now met online twice a week as it had become all the more important to assess the impact of the lockdown on the portfolio firms, some of which had to halt operations abruptly. These included ride-hailing service provider Ola, hotel aggregator Oyo Rooms, omnichannel eyeware brand Lenskart and logistics firm Delhivery.

“When the pandemic struck, we wanted to understand the new status quo. While we were still under lockdown, China was theoretically coming out of it, so what were the lessons that we could take from them?" explains Sumer Juneja, partner and head of investing in India at SoftBank India Investment Advisors over a Zoom call from his office in Worli, Mumbai.

In April, the team decided that it should do a knowledge-sharing session of portfolio companies across these two countries. By mid-May, SoftBank had lined up a meeting with the top brass of Delhivery, PolicyBazaar and FirstCry, among others, and its China portfolio companies in similar businesses, like ZhongAn Online P&C Insurance and Full Truck Alliance Co.

SoftBank, and its India portfolio firms, spotted a few trends early that may seem obvious today, courtesy of such meetups: Revenge shopping, the faster adoption of online tuition classes and the increase in sales premiums in life and term insurance policies. There were other learnings, too. Full Truck’s founder explained how Delhivery should now manage logistics because unlike other companies, logistics can’t shut down half its capacity without disrupting the entire value chain either all parcels reach from one pin code to the other or the entire batch of shipment gets halted. (Full Truck Alliance, an Uber-like trucking startup, went public this June by raising $1.6 billion in the US.)

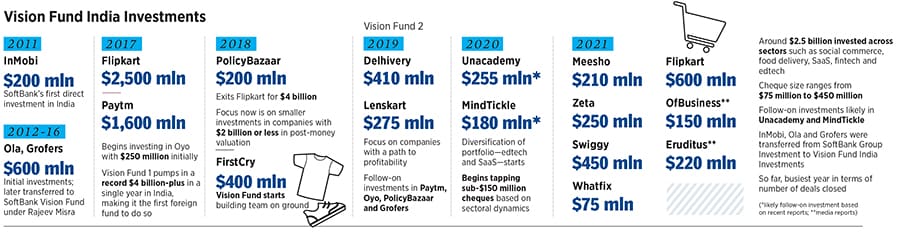

While Juneja says it is up to the founders on what they wish to implement, it is the fund’s job to try and open doors for its portfolio companies. Even for the fund, 2020 was a slow year as it deployed around $221 million across two deals in the previous two years, for instance, SoftBank India had deployed $1.9 billion in 2019 and $1 billion in 2018. But things changed as investments in general picked up in India since January this year. The fund, too, has deployed $2.46 billion in the country over the last six months, which may hit $4 billion by year-end, making it one of the biggest years for SoftBank India.

But Juneja and his team who sit out of Ceejay House building, one of the old iconic commercial office properties of Mumbai, are just three years into the system. To know more about the India team, one first has to learn about how the SoftBank Group operated in India since its debut investment in September 2011. In its old avatar, like other global late-stage funds (think Tiger Global), it had fund managers jettisoning in and out of India. It did not have any team on ground.

But that changed slowly after Munish Varma came on board in March 2017. Varma, who is a managing partner at SoftBank Vision Fund (SVF), the SoftBank group’s venture capital (VC) arm, is responsible for investments in India, alongside fintech investments in the US. He had joined just two months before Vision Fund was officially launched in May 2017. The mega fund, which mopped up $100 billion, was the largest tech fund ever raised. It was towards the end of 2017 that Varma was made responsible for India investments. He and Rajeev Misra, CEO at SVF, made their first investment from the mega fund in 2018 in India when it cut a cheque of $200 million in online insurance firm PolicyBazaar. In the same year, they invested $400 million in FirstCry. Varma says it was the first few investments that “strengthened our conviction about India and the confidence to build a team on the ground. We were quick to grasp how the coming digital disruption would transform the Indian economy and provide significant opportunities for Vision Fund’s investment philosophy—of backing emerging business built on data advantage and AI (artificial intelligence) underpinnings".

Sumer Juneja (left), partner and head of investments at SoftBank Investment Advisers India, believes the fund’s job is to try and open doors for its portfolio companies. Vikas Agnihotri (right), operating partner

Sumer Juneja (left), partner and head of investments at SoftBank Investment Advisers India, believes the fund’s job is to try and open doors for its portfolio companies. Vikas Agnihotri (right), operating partner

Image: Nayan Shah for Forbes India

Another factor that helped was the familiarity of Masayashi Son, founder of the SoftBank Group, with India as SoftBank had been investing in the country since 2011. In its debut deal, it put nearly $237 million in mobile advertising firm InMobi it is still invested in the company which is now headed for a public market listing in the US. The group has now transferred these shares to SVF 2 which is expected to make bumper returns on this investment. Post raising the Vision Fund 1, SoftBank opened multiple offices across the world in cities like Mumbai, Hong Kong, Shanghai, Abu Dhabi, Singapore and Miami.

After a series of interviews which concluded with a meeting with Son, Juneja was hired in December 2018 and was entrusted to build the India team. Along with Varma, Juneja went on a talent hunt. As Juneja says, everything in macro looks good, but the micro is always different. He was clear that he wanted to build a team with people who have been working in India in investment banking, venture capital and private equity (PE)—three different asset classes, but when tied together can empower the firm. “We were clear that we needed people who were entrenched in the system, and not someone coming in from overseas who now wants to learn India," explains Juneja. He hired Vishal Gupta from PE giant TPG who is adept in large-deal transactions Sarthak Misra from early stage venture fund Matrix Partners India who can help discover early bets and Narendra Rathi from Morgan Stanley to do due diligence faster.

This was the first shift in how the fund wanted to position itself in India. In fact, during the first year of building the India team, its initial focus was on understanding the existing companies and relationships.

Founder and CEO Ritesh Agarwal says Oyo began its journey with SoftBank very early in the company’s lifecycle

Founder and CEO Ritesh Agarwal says Oyo began its journey with SoftBank very early in the company’s lifecycle

Image: Amit Verma

In 2014, SoftBank had invested in Ola, but the Street has it that the relationship with Ola’s Bhavish Aggarwal had soured from 2017 when the Japanese Group invested in global rival Uber. So much so that Aggarwal had amended some company laws to restrict SoftBank from increasing its stake. But since Juneja came on board, he has spent time rebuilding the relationship and, in 2019, SoftBank Group invested $250 million in Ola Electric Mobility. Juneja ended up in Ola’s board, replacing the person who was earlier representing the group.

While Juneja was busy repairing relationships, he was also hunting for new leads.

May 2019. Vidit Aatrey had already raised over $65 million for his Bengaluru-based social commerce startup Meesho, which he co-founded with Sanjeev Barnwal in 2015. The IIT-Delhi alumnus didn’t need a formal introduction for a potential investment meet which was scheduled to start in a few minutes past noon. With a long list of marquee investors such as Sequoia India, SAIF Partners (now Elevation Capital), Shunwei Capital, Yuri Milner’s DST Partners and RPS Ventures backing the Y Combinator grad, Aatrey was all set to woo the funders with his business pitch.

Juneja was sitting in the room with his colleague Sarthak, who had joined the India team as vice president in April. Just two months back, Delhivery had entered the unicorn club when it raised a $413-million round led by SVF 2 (created in November 2019, it now has assets under management of $30 billion, which will be increased soon. The entire capital for fund 2 has come from the SoftBank Group). For their next bet, Juneja and Misra were hunting for something unconventional. The India team of SoftBank, which had seen its valuations soar in Flipkart, Paytm and Ola, was expecting a polished pitch.

Aatrey was at his eloquent best once the presentation began, but within minutes, Juneja interjected. “Who is this Anu aunty? What is this?" asked the baffled VC and stared at Sarthak, who looked equally bemused. Aatrey, though, stayed calm. “You need to understand Anu aunty." Once the meeting ended, both the parties decided to stay in touch.

Aatrey was at his eloquent best once the presentation began, but within minutes, Juneja interjected. “Who is this Anu aunty? What is this?" asked the baffled VC and stared at Sarthak, who looked equally bemused. Aatrey, though, stayed calm. “You need to understand Anu aunty." Once the meeting ended, both the parties decided to stay in touch.

Staying in touch is something that the firm religiously practices in its deal-making process. Juneja is clear about some of the values that the fund adheres to. Number one is that they will not be reactive, but proactive in nature. “If there is a deal happening, let’s go and get it done in the next two or three weeks—we don’t think we work that way." Which is why deals like Swiggy ($450 million), Unacademy ($255 million) and Meesho were sealed after engaging with the founders for 15 to 18 months.

“We get to understand the entrepreneurs and their ambitions, and they are convinced about our unique global ecosystem and value beyond capital. And they appreciate the significance of long-term, patient capital in fuelling sustainable growth," says Varma. “It took us two years to understand who this Anu aunty is," he laughs.

Vidit Aatrey (left) and Sanjeev Barnwal co-founded Meesho in 2015

Vidit Aatrey (left) and Sanjeev Barnwal co-founded Meesho in 2015

Image: Nishant Ratnakar

In the early days of Meesho, sometime in 2016, the co-founders stumbled on an interesting discovery. A lot of women were using the app to run shops on WhatsApp. A woman in Bengaluru was running a fashion boutique—Anu’s boutique—and doing brisk business. “Vidit told us about Anu aunty and why she is important," recounts Varma.

Understanding Anu aunty’s business was one of the key milestones in the SoftBank investment of $210 million in Meesho in 2021. This April, Meesho was valued at $2.1 billion after it raised a Series E round of funding of $300 million led by SoftBank.

Juneja has identified three corners of the triangle that he needs to connect. One, give returns to limited partners (LPs), the investors in a fund. Two, don’t just go to the captable, but work alongside them to increase value. And, three is the sheer amount of VC sloshing in the Indian startup ecosystem.

According to EY, in the first five months of 2021, PE/VC investments have surpassed $20 billion—almost twice the value recorded in the same period last year. Even for SoftBank, in terms of number of deals, it is the most hectic year, with investments across social commerce, food delivery, software as a service (SaaS), fintech and edtech, with cheque sizes ranging from $75 million in Whatfix to $450 million in Swiggy.

Juneja knew that he had to get to the captable early in the game, as once a SaaS firm, for instance, is doing more than $75 million ARR (annual recurring revenue), it wouldn’t require too much additional capital. And one way to get there is to build better relationships with other early-stage and growth VCs. “We have to work alongside the community and provide optimum capital to the company. Therefore, we are happy to take smaller stakes and be one of the multiple board members and shareholders, and build the company together," he says. In most of the investee startups, he lets on, SoftBank might not be the highest bidder. “They wanted us and therefore we got in," adds Juneja.

It’s not only India where SoftBank is bullish about its new bets. Globally too, the Japanese tech conglomerate has seen a rebound after a disastrous $18-billion loss last year emanating from troubles at WeWork and Uber. In May this year, SoftBank reported a record $45 billion Vision Fund unit profit from a fourth-quarter investment gain on Coupang¸a South Korean ecommerce firm, and DoorDash following their successful public market debuts.

In India too, some of its portfolio companies are on their way to a public market listing. Its portfolio company Paytm is headed for a `16,660 crore share sale programme where SVF will also offload its portion of shares taking home nearly two times in returns. Its other portfolio companies which are preparing for a markets listing include PolicyBazaar and Delhivery, among others. Lenskart is also preparing a warchest for adding scale to its operations for a probable listing next year.

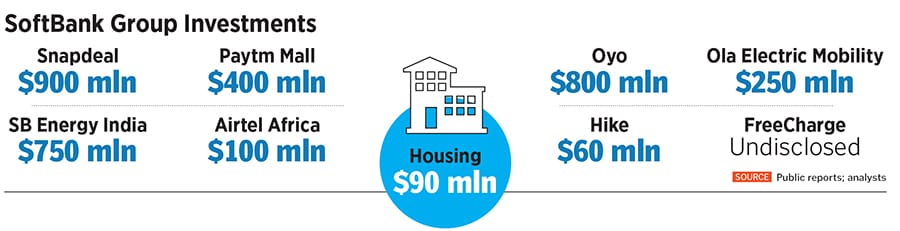

Like WeWork, where the fund’s investment value decreased by $8 billion in 2019, SoftBank has had its setbacks in India too. Snapdeal, in which it had invested $927 million, is a much-scaled-down version of its earlier avatar the once-high-flying, but later brought down to earth Housing.com has been merged with Proptiger and, in January this year, Kavin Bharti Mittal’s messenger service Hike, a one-time unicorn, was taken down from the app stores Hike is now looking at new business models.

Like WeWork, where the fund’s investment value decreased by $8 billion in 2019, SoftBank has had its setbacks in India too. Snapdeal, in which it had invested $927 million, is a much-scaled-down version of its earlier avatar the once-high-flying, but later brought down to earth Housing.com has been merged with Proptiger and, in January this year, Kavin Bharti Mittal’s messenger service Hike, a one-time unicorn, was taken down from the app stores Hike is now looking at new business models.

April 2020, Pune. Krishna Depura knew it was not the right match, after being hounded for over eight months by Juneja’s team member Narendra Rathi. The co-founder of MindTickle, a sales readiness platform, eventually reluctantly agreed to a 30-minute call. The SaaS startup, headquartered out of Pune and San Francisco, was in no mood to raise money, and Depura too was not in the mood to mince words. The entrepreneur was convinced that SoftBank was used to writing big cheques, going by the track record of the marquee investment firm helmed by Son. What also made Depura shy away from entertaining the Indian team was that SoftBank had not invested in any SaaS company in the country. “We don’t need money," Depura spoke his mind on the call.

Juneja didn’t relent. Signalling his intent, his team asked for another call so that Depura could be introduced to the senior leadership team at SoftBank. Over the next few weeks, both the parties kept the plate warm Depura was starting to become more comfortable and Juneja was increasingly getting confident of investing in a business where SoftBank had no exposure in India.

A few months later, Depura got into a Zoom call with SoftBank CEO Son on one of the weekdays. The meeting started at 4 am. Depura duly put out a five-year roadmap for the startup. Masa San—that’s how Masayoshi Son is addressed in the tech world—stumped the co-founder with a searing question. “Why can’t you achieve in one year what you plan to achieve in five?" reminisces Depura. From that moment, Depura was sold on SoftBank. In November 2020, the fund made its first SaaS investment in India, with $100 million in MindTickle.

Some nine months before this transaction, Vikas Agnihotri was roped in as operating partner in the Mumbai office last February. Once MindTickle was in the bag, SoftBank’s operating team—led by Agnihotri—worked with the SaaS startup to refine the go-to market strategy and make introductions within the SoftBank global ecosystem to facilitate geographical expansion in Japan and MENA (Middle East and North African regions). “What the Vision Fund brings to an entrepreneur is mature counsel and elevated connections, besides capital," says Agnihotri, who joined SoftBank from Google where he was a managing director.

Vision Fund is leading a follow-on round which would turn MindTickle into a unicorn. “SoftBank amplifies the vision and ambitions of founders. Being well-capitalised, which all Vision Fund portfolios are, helps entrepreneurs to do what they know best: Build great companies and focus on executing with speed and scale," adds Agnihotri.

Similarly, Varma and Agnihotri had been working with the Oyo leadership and the bankers in the run-up to the recently closed $660 million bond issue, which was oversubscribed and they raised $660 million.

“We started our journey with SoftBank very early in our company’s lifecycle... we were then available in just three cities. One of our existing investors had introduced us to them and I had travelled with my CEO to meet Son, who had helped build Alibaba," says Ritesh Agarwal, founder and CEO of Oyo.

“We started our journey with SoftBank very early in our company’s lifecycle... we were then available in just three cities. One of our existing investors had introduced us to them and I had travelled with my CEO to meet Son, who had helped build Alibaba," says Ritesh Agarwal, founder and CEO of Oyo.

Agarwal had landed in Tokyo on the day of SoftBank’s annual general meeting and met Son in a corner of a small room. Agarwal recalls that Son emphasised on building a strong management team and scalability of the product. “His understanding of consumer unit economics while operating a large organisation is quite unparalleled," he adds.

Till December 2018, Oyo was primarily an India-oriented company it decided to go overseas from January 2019. “It didn’t happen overnight... we started experimenting since 2016 when we launched our first property in Malaysia.

Just from a data perspective, our company today receives approximately 28 percent revenue from Europe, 20 to 24 percent from other parts of the world, and roughly 40 to 45 percent from India and Southeast Asia," says Agarwal.

Varma and his team helped Oyo list its properties on Chinese platform Didi. Varma sits on the board of the company along with Gerry Lopez, who is head of the operating group at SoftBank.

While Agarwal went on an expansion spree with money in his bank account, with rapid expansion came the setbacks. Oyo found itself in the midst of a bad press due to merchant and room issues, people leaving the company and revenues taking a hit because of the pandemic.

Agarwal explains, “I think there was some critical commentary a year and a half back on a couple of things which we have been working on. While we grew our merchants, customers and revenues, there were some improvements to be made in terms of our merchant proposition. Just when we were starting to improve on it, Covid hit us."

While Varma and Agarwal were on frequent calls, the operating team worked with the company’s India and Southeast Asia CEO Rohit Kapoor in marshalling the improved operational metrics. “Oyo used the pandemic to fine-tune the product and tech to haul in significant efficiencies. This, along with the fact that it remains one of the top three hospitality booking platforms globally, is re-establishing the investor appeal as witnessed in the recent financing round," says Agnihotri.

The company has now allowed merchants to change hotel room prices, which they couldn’t do earlier. Reconciliation of funds happens at a quicker time span and Agarwal now holds weekly townhalls with all property owners. “We have an open communication, including very tough questions that we both share with each other. I think that is why in the last year and a half, the commentary has substantially reduced because if merchants have complaints, they can reach out to us directly. And we can work together and resolve them. I always share the product roadmap coming up in the future," says Agarwal.

Oyo now operates in Europe, Americas and other geographies and is present in 1,000-plus cities.

According to VC funds who share common captable and investment bankers who have pitched clients and raised capital from them, SoftBank 2.0 is a better version, with more stability. “There is a method to their madness. They are easily sitting on 1.5x to 2x returns on their investments. They have a conscious strategy of chasing deals in the used-car space (which they are yet to close) and SaaS companies which are predictable money-makers," says the managing partner of a large investment banking firm on condition of anonymity.

But one thing that has remained constant, he adds, is that every founder has to meet Son before any deal is signed.

Juneja accepts that the firm has had its share of mistakes. “We were not early enough in our SaaS portfolio. But we are now gathering momentum, especially as Indian companies are beginning to define the space," he says.

While SVF’s exposure is the highest in the US, in Asia (ex-China), India is the biggest country in terms of capital deployed, and Varma believes that it is not going to change anytime soon. “There are multiple macro trends—favourable demographics, expanding internet connectivity and skilled workforce among others—which point towards India’s robust growth potential in the coming decades," he says. Varma’s last word? “Every economic cycle will have summers and winters, but we are not seasonal investors. We stand behind founders who are executing their bold visions."

First Published: Aug 04, 2021, 14:13

Subscribe Now