FirstMeridian: Running the business in a tight way and the right way

Three private equity players started FirstMeridian in 2018, which is now India's third-largest staffing company by revenue

September 2018. The offer letter was littered with bold red flags. No office, no designation, no promotion and no entity. The only thing certain was the uncertainty. Ironically, the veteran recruiter, who had mastered the art of sounding alarm bells in over 15 years of his career of sifting through millions of resumes, deliberately dropped his guard. For Sunil Nehra, taking the biggest risk of his life made more sense than all the nonsense conjured by the rational side of his mind. “There is no CEO, no CTO, no COO… there was no designation," recalls Nehra, alluding to his weird predicament in mid-2018 when he started exploring the idea of joining a staffing upstart that just had a name: FirstMeridian. “I was offered the role of sales head and the irony was I had never done pure-play sales in my life," recounts the seasoned headhunter who spent close to a decade at Quess, the largest staffing company in India, and was known for his operations’ role.

A watered-down designation was not the only demotion that Nehra settled for. He had nine promotions in nearly a decade, managed a business north of ₹250 crore, and had a clear path to the next stage of his life: CEO. Yet, the recruiter was keen to enlist for unpredictability. Why? “It was a ‘if not now, then never’, situation," recalls Nehra, who was not a hot commodity in the job market. Prolonged stints—first at IT contract staffing company Magna, and then at Quess, which bought Magna in 2009—had rendered him untouchable and reinforced a fallacious perception that Nehra would never like to come out of his comfort zone.

“Nobody offered me a job. People thought this guy would never quit Quess," he recalls, adding that job stability was perceived as his weakness. And when Nehra finally did get an offer from FirstMeridian, he was compelled to trust his biggest strength: Hunch. The opportunity, he pondered, might be the last and only big one to leapfrog his career. “Let’s do it," he muttered and took the plunge in September 2018.

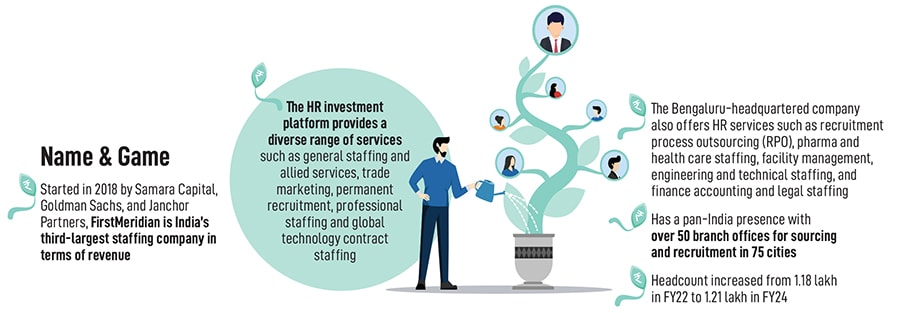

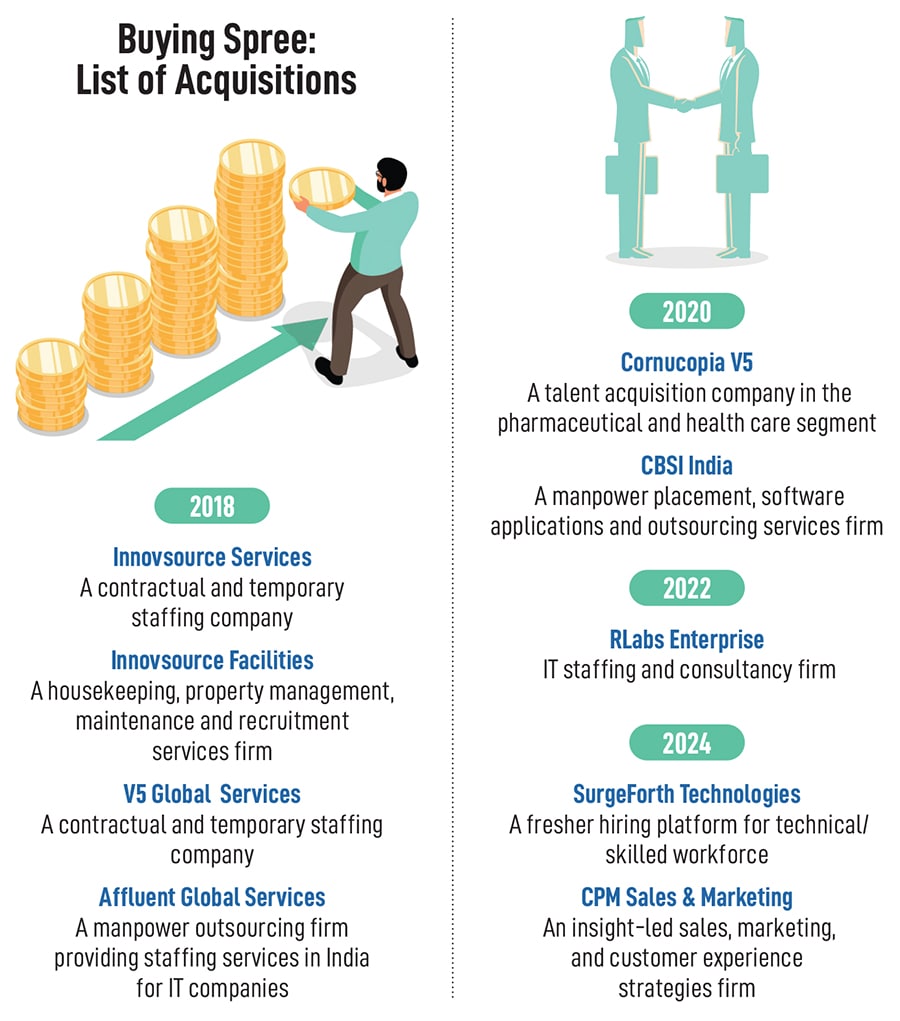

Meanwhile, FirstMeridian—an HR investment platform started by private equity (PE) biggies Samara Capital, Goldman Sachs and Janchor Partners in mid-2018—started with a bang. Its playbook was simple: Roll up HR companies. Nehra explains. In the hiring world, it’s tough to become a large organisation by organic growth. One must look for buyouts. Late to the party, FirstMeridian stepped on the pedal from day one. “Our preamble was to do acquisitions. We had big investors, there was enough money in the bank, and we needed to make sensible buys," he says, adding that FirstMeridian bought three companies within months of starting up: Innovsource Services, Innovsource Facilities, and V5 Global Services.

For the PE backers of FirstMeridian, though, the playbook was much more than a last-mover advantage. Manish Mehta reckons there was a big opportunity that somehow nobody was willing to grab. “India has the largest working-age population and labour pool," says the managing director and co-CIO of Samara Capital. For the next 20 to 30 years, the country will present an opportunity for businesses like FirstMeridian to help people find employment, and businesses get human capital. India is also the largest exporter of manpower, he adds. “So, FirstMeridian was well-poised to play a crucial role."

The birth of FirstMeridian coincided with an interesting wave. The unorganised labour world was fast moving towards its organised counterpart in India. “There was an opportunity for investors like us to consolidate, build scale, and create value through economies of scale," he says. Globally too, Mehta points out, the wave was playing out and a bunch of large companies have been created in the space: Randstad, Manpower Group, Adecco and Recruit Holdings. “There was a similar opportunity in India," he says.

Meanwhile, back in September 2018, Nehra sniffed an opportunity. The first three buys of FirstMeridian were in the non-IT space. Affluent Global Services, an IT manpower outsourcing firm based out of Hyderabad, was the first IT acquisition for FirstMeridian. Nehra, unfortunately, didn’t spot a glaring red flag. The company had a headcount of around 240, was clocking decent numbers, and had high customer stickiness. The missing part, though, was Affluent Global Services had just one company as its client.

The over-dependence on one company proved disastrous. The situation went downhill six months after the buyout. “The client started releasing employees and the numbers dipped from 240 to under 90," recounts Nehra, who was in a fix. The amount paid for an acquisition, he explains, is derived from the company’s Ebitda (earnings before interest, taxes, depreciation, and amortisation.) “The Ebitda was alarmingly coming down. We almost reached one-fourth of the Ebitda," he says.

The over-dependence on one company proved disastrous. The situation went downhill six months after the buyout. “The client started releasing employees and the numbers dipped from 240 to under 90," recounts Nehra, who was in a fix. The amount paid for an acquisition, he explains, is derived from the company’s Ebitda (earnings before interest, taxes, depreciation, and amortisation.) “The Ebitda was alarmingly coming down. We almost reached one-fourth of the Ebitda," he says.

There was one big learning. “We decided to stay away from buying companies highly dependent on one or two customers," says Nehra, adding that the second learning stemmed from the first one. “One must do forensic auditing before making an acquisition," he says. Even if there is a 1 percent chance that the target company might not fit into the cultural ethos of the parent company, one must not go ahead with the acquisition. “Forensic diligence has to be supplemented by cultural diligence," he reckons.

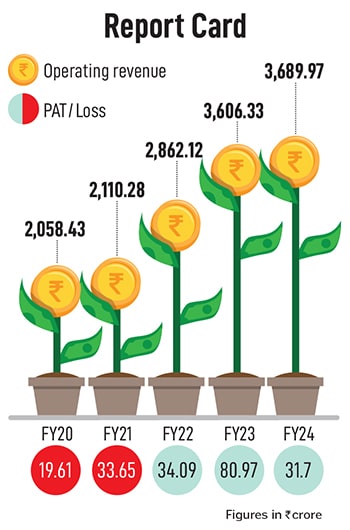

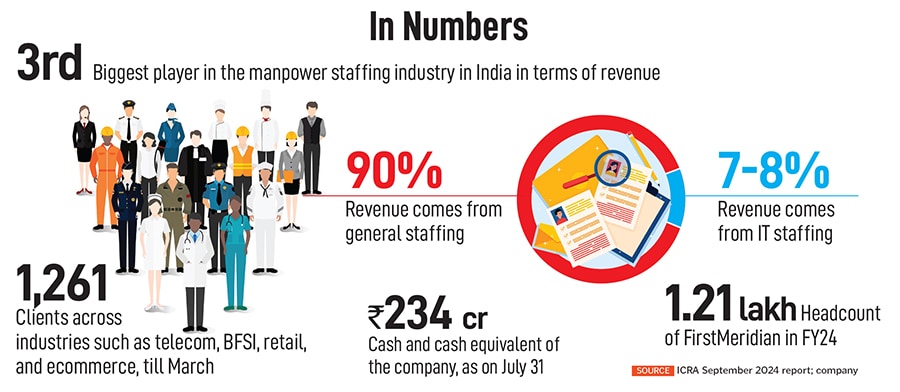

Fast forward to November 2024. Nehra, now the CEO of FirstMeridian, has propelled the HR platform to new heights. FirstMeridian has emerged as India’s third-largest staffing company in terms of revenue. The fast pace of growth is reflected in a staggering jump in revenue, which has pole-vaulted from ₹2,058.43 crore in FY20 to ₹3,689.97 crore in FY24. The company has stitched up nine acquisitions over the last six years, has taken its headcount to 1.21 lakh, gets 90 percent of revenue from general staffing, and has over 1,200 clients across industries such as telecom, BFSI, retail and ecommerce.

The report card gets a thumbs-up from industry experts and analysts. “The FirstMeridian Group is supported by strong brand equity and increasing formalisation of the staffing industry," underlines an ICRA credit rating report released in September. Through various acquisitions, the group has built a strong presence in general and IT staffing, and has established a pan-India presence with over 50 branch offices for sourcing and recruitment in 75 cities. A steady growth in the employee base, increased focus towards the more margin-accretive IT and professional and industrial staffing, and planned inorganic growth acquisitions are expected to support the revenue increase and margin expansion, the note says.

A diversified set of clients has added heft to the financial profile of the company. A wide geographical footprint with a client base consisting of top multinational firms from diversified industries has worked well for the company, points out ICRA. Though the group reported a slight moderation in revenue growth and operating margins in FY24, the financial risk profile remains healthy, and is supported by a strong net worth of ₹519.8 crore as of March 31, 2024, a net debt negative status, and a comfortable liquidity position. Going forward, ICRA underlines, the overall financial profile is expected to stay healthy, given higher revenue growth, supported by stable cash flow generation, and no material increase in its leverage levels despite payouts against planned acquisitions. “The group is expected to continue to spend on its inorganic growth initiatives," the note adds.

Despite the scorching pace of growth, FirstMeridian will have to contend with a set of challenges. The biggest one is a thin operating margin, leading to low PAT (profit after tax). While the company has done well to emerge from a loss in FY20 to post a PAT of ₹31.7 crore in FY24, the numbers are dwarfed when contrasted with the staggering revenue. The group’s operating margins are inherently thin (1.9 percent in FY24) due to the high share of revenues from the general staffing segment, ICRA points out. Due to low mark-up in the general staffing industry, players have a low gross margin of about 4 to 5 percent and an operating margin of 1.5 to 2 percent.

“Further, intense competition limits pricing flexibility in the general staffing business," the note says. The staffing industry is a fragmented market—the top five players have a market share of 13.8 percent—and large unorganised players offer services at low prices. “Consequently, competition continues to limit FirstMeridian’s pricing power and scope for margin expansion in these segments," it highlights.

Nehra, for his part, is aware of the challenges. Low PAT, he maintains, is the nature of the industry. “We would still have a higher PAT than our rivals," he claims, adding that the loss incurred in the past had to do with a spate of acquisitions made by the company. Sudhakar Balakrishnan, the group CEO and founder, points out how the company has been hedging its bets.

FirstMeridian is creating new organic business units engaged in engineering and technical staffing, finance, accounting, and legal staffing across the entire group of companies that would also add to its profitable growth. “We are growing the FirstMeridian platform at a consistent pace," he reckons.

The next big target for Nehra is to take the company public. FirstMeridian filed its DRHP in 2022 but had to pull back due to a turbulent global IT market. “Sometimes we wonder how companies who are not making money are valued so high in the private market," he says. “We had to push our IPO because IT business was going down, the company was losing headcount, and this would have hampered our valuation."

So, can PE-run companies play the high-valuation game? Nehra prefers to follow the old-school way of doing business. “We are simple people. We are not fancy guys. We are not flamboyant. We don’t want to be in the limelight," he reckons. “We run this organisation in a tight way and the right way, and create wealth for our stakeholders," he signs off.

First Published: Nov 27, 2024, 11:48

Subscribe Now