How health tech player Infinx grew at a scorching pace

Now the big challenge for the Tandon brothers is to hedge their bets as 100 percent of the revenue of the AI-driven health tech company comes from America

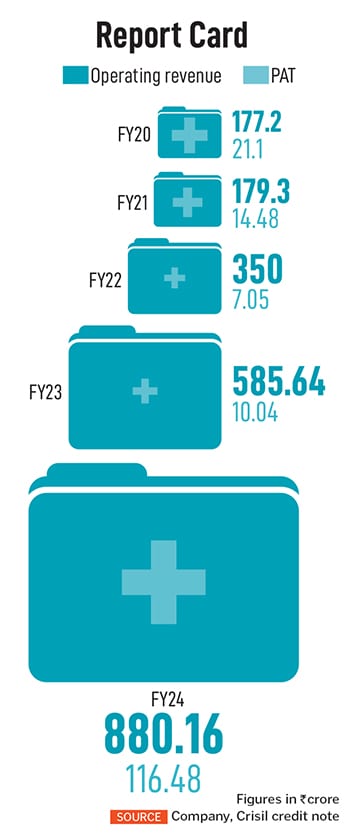

Shiv Chaudhary might have showered the same compliment for his other portfolio companies. Well, as an investor, he must be impartial in action and words. But when the managing director of Norwest India reiterates the same and cliched two attributes—unique and special—for Infinx, one can sense a rapacious delight in his voice. Rightly so. Infinx is unique. A company that reportedly clocked an operating revenue of ₹20.44 crore in FY13—the first fiscal after starting operations in 2012—and has seen the numbers leapfrog over 28x to ₹585.64 crore in FY23, must indeed be unique. Add 12 more months, and the revenue balloons to ₹880.16 crore in FY24. And if PAT (profit after tax) grows from a low single-digit crore to ₹116.48 crore during the same period, then the company must be special.

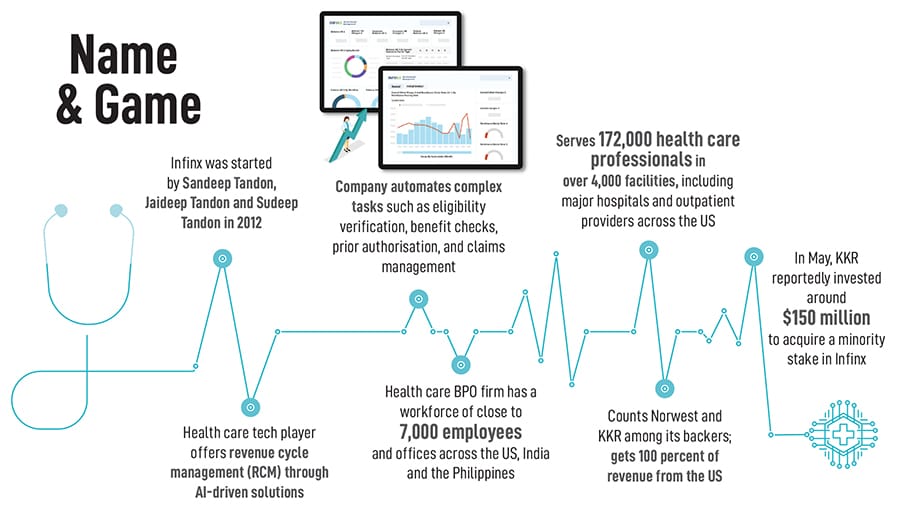

Add two more data points, and Chaudhary’s enthusiasm becomes self-explanatory. First, Infinx gets 100 percent of its revenue from the US. Second, the company serves 172,000 health care professionals in over 4,000 facilities, including major hospitals and outpatient providers across the US. “Customers are delighted by Infinx, and this is reflected in its NPS scores, customer references, healthy growth of customer cohorts, and financial metrics," says a proud backer. “Infinx is unique and special," Chaudhary reiterates.

Started in 2012 by brothers Sandeep, Jaideep and Sudeep Tandon, Infinx is an AI-driven health care tech player that offers revenue cycle management (RCM). The health care BPO automates complex tasks such as eligibility verification, benefit checks, prior authorisation, and claims management, and has a wide footprint of a workforce of close to 7,000 employees, and offices across the US, India and the Philippines. “Over the last three years, we have been growing at almost 45 to 50 percent year on year organically," claims Sudeep Tandon, co-founder of Infinx. The DNA of the company, he underlines, is to solve customer problems using technology.

The brothers come from a family with a tech background. Their father was an engineer and one of the pioneers who manufactured disk drives and floppy disks from India and shipped them across the world. “So the DNA of serving global customers, innovating with technology and solving customer problems has always been with us," says Tandon, who spotted an untapped opportunity in the US where the brothers spent a chunk of their lives. Therefore, building a ‘US plus India’ play was a no-brainer for the siblings. The US health care, says Tandon, is about a four-and-a-half trillion-dollar market. “This number is larger than India’s entire economy, and about $800 billion is spent on health care administration," he claims, adding that India acted as a delivery front for his business empire.

Despite the growth in business, the journey has had its share of challenges. One of the biggest was a realisation that the health care venture was special, and had to be handled with care. In a heavily regulated industry, the brothers couldn’t think of embracing a quintessential startup mindset of ‘scale fast, fail fast’, and growth at all costs. “Fast and reckless doesn’t work in health care," says Tandon. A razor-sharp focus on data protection and building foolproof and efficient processes were integral to running the business in the US. “A big part of what we do is help hospitals and health care providers process claims from insurance companies," he says. “If you’re not able to do it effectively, this can mean that a hospital can run out of cash," he adds. So, it’s a mission-critical business.

The other big challenge was to ensure that the business was loaded with technology. “Look at how Uber works. There is a lot of tech behind pressing a button and getting a cab at your doorstep," says Tandon. It was a big moat for Infinx. “Within 18 months, we signed up some 75 customers. This was unheard of in this business," he says. Another aspect that makes the venture unique, he says, is the fact that the brothers double up as entrepreneurs and investors. He explains. “When we see a good company, a good market, and a good space, we double down," he says, adding that the company has done five acquisitions in the US. Though the company counts KKR and Norwest as its backers, Tandon claims that Infinx has not raised much capital in its journey.

The other big challenge was to ensure that the business was loaded with technology. “Look at how Uber works. There is a lot of tech behind pressing a button and getting a cab at your doorstep," says Tandon. It was a big moat for Infinx. “Within 18 months, we signed up some 75 customers. This was unheard of in this business," he says. Another aspect that makes the venture unique, he says, is the fact that the brothers double up as entrepreneurs and investors. He explains. “When we see a good company, a good market, and a good space, we double down," he says, adding that the company has done five acquisitions in the US. Though the company counts KKR and Norwest as its backers, Tandon claims that Infinx has not raised much capital in its journey.

The stellar performance has caught the attention of analysts and industry experts. The four decades of promoters’ experience in IT and BPO services industry, their in-depth understanding of market dynamics, and a healthy relationship with a large clientele should continue to support the business, points out Crisil in its credit rating. “The company’s established position in the business process outsourcing industry, specialised into revenue cycle management (RCM) for the health care industry adds to its strong financial risk profile," the note adds.

The challenge, though, for the company emanates from its strength—100 percent of revenue comes from the US. “The geographic and customer concentration makes revenue growth dependent on outsourcing policies of the country," notes Crisil, adding that any change in government policy can adversely impact the business profile of Infinx. The backers, though, see a different set of challenges. Many health care providers in the US don’t outsource their RCM function yet. “The main challenge for Infinx is to convince them to take a leap by demonstrating potential efficiency gains," says Chaudhary of Norwest India.

Tandon, meanwhile, points out a diverse set of impediments. First, the highly regulated nature of the industry is something that’s not going to change. So one has to be careful and calibrated in devising strategies and stringent in execution. Second, one has to be cognisant of the fact that one has to be in line with the regulations. “Sometimes, strict adherence can put a bit of a speed restriction on how fast you can move," he says. But that’s the nature of the segment. The entrepreneur prefers to look at the vast, untapped opportunity in the US. “The US is still a huge market, and we see AI as a big enabler in our mission," he says.

First Published: Nov 28, 2024, 12:19

Subscribe Now