Fintech firms more enablers, than disruptors: KPMG-NASSCOM report

Investments in fintechs jumped to $1.5 billion in 2015 from $247 million in 2014

Financial technology (fintech) companies are increasingly being viewed as an enabler, instead of a disruptor to the financial services sector, according to a KPMG-Nasscom report released on Tuesday.

The report states that Indian customers, both individual consumers and corporates, have shown an unexpectedly fast adoption rate towards fintech offerings. This surge is thanks to rising customer expectations, e-commerce and smartphone penetration across India. The fintech market in India is expected to double to $2.4 billion by 2020 from $1.2 billion in 2015, according to the report.

India is home to about 200 fintech companies out the total 12,000 fintech startups across the globe.

“The prima-facie catalyst for the success of the fintech industry in India is the government and the multi-pronged approach it has taken towards enabling higher penetration of these digital financial platforms for institutions and the public is commendable,” states Naresh Makhijani, Partner and Head, financial services, KPMG in India.

Emergence of fintech companies in India has been a prelude to the transformation in payment systems, lending and personal finance space. Fintech companies are enabling the entire value chain of the traditional financial institutions, like banks and mutual funds, to provide new products and more efficient services to its customers.

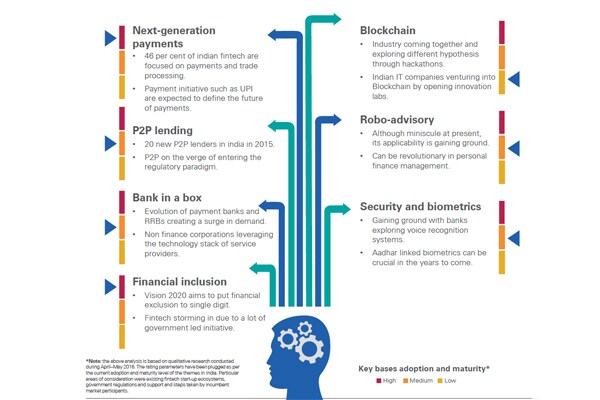

The report lists seven potential areas that could redefine the financial services space. In India, payments and financial inclusion have attracted the most market attention. P2P lending and remittances are other fast growth areas in India. Going forward, security and biometrics would be areas of expansion.

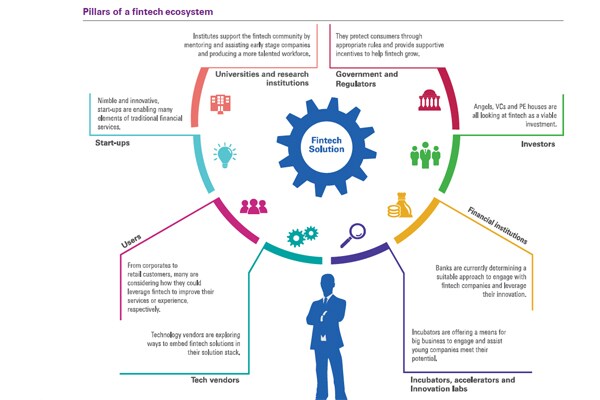

A handful of companies are also exploring robo-device and bank-in-a-box as new investment avenues. Blockchain is an emerging tech-mammoth and has the potential for mass market implementation in the future.Angel deals in fintech companies in India have grown to 691 in 2015 from 370 in 2014. Investments in fintech companies have jumped to $1.5 billion in 2015 from $247 million in 2014. Most of the venture capitalist backed investment deals were concentrated in Bengaluru (11 deals), Mumbai (9 deals) and Gurgaon (6 deals).For the sector to grow, it is essential for all the stake holders to ‘connect, engage and share ideas across vibrant communities and networks, as well as identify and convert opportunities into business,’ the KPMG-Nasscom report says.

Forming an independent fintech-focussed industry association, introducing special visas for start-up entrepreneurs and technology experts to attract foreign talent, strengthening the talent pool, offering coherent tax incentives to start-ups and venture capitalists and adopting leading practices of regulatory initiatives from global markets, are some of the recommendations given by the report to key stakeholders.

“The promise in the number of start-ups cutting across various business segments, coming up with exciting technologies is reflective in their adoption and usage across the value chain of financial institutions,” says Neha Punater, Partner - Fintech, KPMG in India.

First Published: Jun 07, 2016, 18:46

Subscribe Now