100X.VC: Building a bridge between traditional companies and new-age startups

100X.VC has doubled down on its bets on moonshot ideas. With the early-stage space getting cluttered, can it continue with its distinctive play?

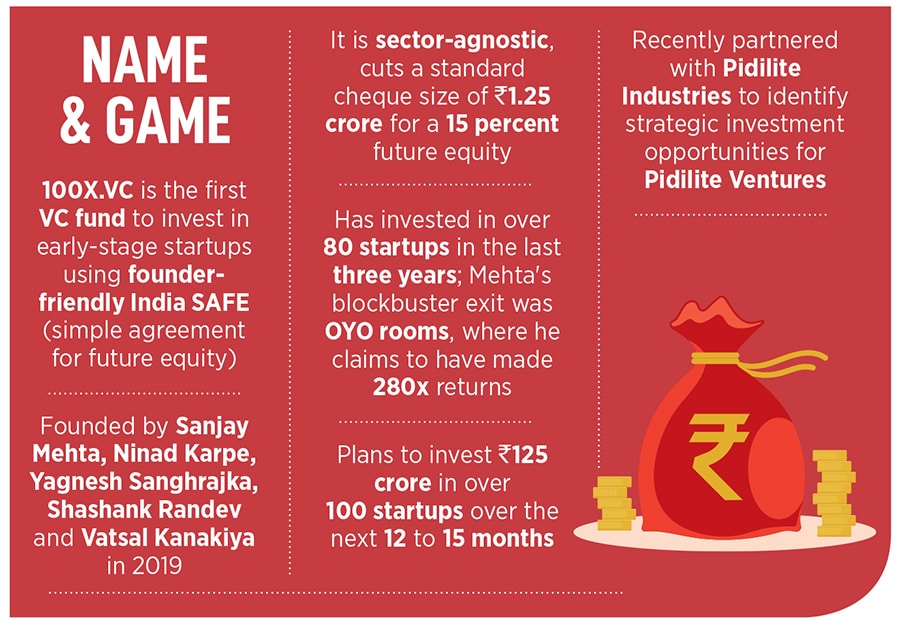

When it comes to investment, Yagnesh Sanghrajka hunts for stickiness. “It has to have a unique value proposition," reckons the co-founder and chief financial officer of 100X.VC, an early-stage investment fund. The venture capitalist outlines the distinctive style of deal-making done by 100X.VC, which was co-founded by Sanjay Mehta, Ninad Karpe, Shashank Randev, Vatsal Kanakiya and Sanghrajka in 2019. “Everybody must find the product sticky," he says, dishing out the example of BuildNext.

Started by Gopikrishnan V and Finaz Naha in 2015, the Kochi-based tech-enabled home builder offers a battery of solutions ranging from visualisation, estimation, product selection, procurement, budget control and project tracking to consumers. BuildNext, Sanghrajka underlines, leads to a higher level of transparency, and brings down cost and time overshoots in construction of buildings. But for a fund which cuts a standard cheque of ₹1.25 crore for a 15 percent future equity in startups and also happens to be a first institutional investor, what was so sticky and compelling about BuildNext, which already had backers? “It’s Pidilite," he smiles.

It was a pointed brief to 100X.VC. Pidilite, the makers of Fevicol brand of adhesive, was keen to pump in corporate venture fund into startups with innovative business model. BuildNext’s offering and segment in which it operated interestingly had a strong overlap with Pidilite. “We knew Pidilite’s products would make sense for these kinds of businesses," says Sanghrajka, who did the initial round of screening, evaluation, preliminary talks with the startup founders to gauge their interest and then connected the interested parties. What followed next was a $3.5 million Pre-Series A investment by Pidilite in July this year.

100X.VC had more in store for Pidilite’s corporate venture capital. Kaarwan, a learning and upskilling platform for architects and designers, was spotted as another investment opportunity. Another venture to grab the attention of the VC fund was Finemake, an online platform to choose, customise and book designs for modular kitchens, wardrobes and TV units. The collaboration between a corporate biggie and a venture fund, underlines Sanghrajka, is a unique experiment in a country where traditional brick and mortar players have been increasing their exposure to tap into the innovative products and services of startups. In fact, Pidilite itself has had a bunch of such investments, which includes funding in HomeLane and Livspace.

The early-stage VC fund is beefing up its play by adding corporate levers to its strategy. The idea is simple. India Inc is feverishly scouting for disruptive startups that can help traditional companies tap into opportunities unexplored over the last few years. Pressing the acquisition button obviously makes sense for large companies that can quickly add value by acquiring nimble startups. “We are a unique bridge between a corporate and a startup fund," says Sanghrajka, adding that 100X.VC is well placed to handhold corporates.

The seasoned venture capitalist points out twin benefits that his fund offers. First, being an early-stage investing firm, 100X.VC has more skin in the game. What this means is wide and deep exposure to the talent pool. What it also means is an opportunity to make an early entry into the journey of a startup that is yet to climb the valuation ladder. “We are not advisors. We don’t make money on a transaction fee," he says, alluding to partnerships with the corporates. “Our only revenue model is exit," underlines Sanghrajka. Once a corporate, he lets on, takes a significant minority, and slowly builds it up, a roll-up at some stage is not ruled out. Second, 100X.VC not only plays matchmaker, but also does portfolio review, monitoring and management even after a corporate had made an investment. “It’s a non-stop engagement, and we know the long-term value," he adds.

Meanwhile, in the short term—over the last few years to be precise—early-stage investment ecosystem has exploded in India. It jumped from $5.1 billion in 2019 to $8.7 billion in 2021. While during the Covid year the numbers shrunk ($3.6 billion in 2020), they strongly bounced back the subsequent year, and have maintained the tempo in the first three quarters of this year by posting $7 billion. Sanghrajka sees no reason for the strong inflow of funding to dip over the next few years. “Funding winter has not impacted early-stage investment," he says.

It’s not hard to fathom why the early-stage ecosystem has survived the winter chill. A startup at pre-seed, seed, Pre-Series-A is at 0 to 1 stage of its journey. It’s a phase when the founder will keep experimenting, exploring, pivoting to find product-market fit, growth and revenue. Money at this stage acts as oxygen rather than rocket fuel. So there is no scramble among VCs to get into a startup. Even when it comes to late stage, funding is not an issue. “Money is always available for smarter guys," contends Sanghrajka. Most of the good companies, he adds, were born out of recession. If the founder is disciplined in the use of capital, has not let unit metrics go wayward, and has played up to the valuation that it has got, then raising funds is not an issue. “There is no fear of missing out (FOMO)," he says.

Interestingly, FOMO is largely conspicuous in the early-stage as well. What this does is that it keeps valuation sane, sober and rational. Funding winter, Sanghrajka explains, is for the growth-stage startups who picked up funding at fancy and sky-rocketing valuation last year, and now can’t get money at the same insane multiples. “Forget chill. It’s warm and the sun is shining brightly for early-stage startups," he says.

But can too much of sunshine also cause trouble? Well, the early-stage funding ecosystem has not only got hyper cluttered over the last few years, but it has also seen a wave of angels giving a tough time to the institutional VCs. “The angels definitely have become bolder and are cutting big cheques," acknowledges Sanghrajka, adding that founders have an easy access to capital and don’t have to depend on VCs as their only source of money. He, though, is quick to add that he is not competing with angels. “We are competing with bigger boys who are cutting smaller cheques," he adds.

What could be the flip side? With angels, early-stage VCs and a bunch of big boys—late-stage funders also getting into early-stage investing—chasing rookie founders or at times serial founders, what does this mean for funds like 100X.VC? Sanghrajka points out the biggest challenge. “A lot of early-stage guys will face credibility issues," he underlines, explaining his point.

There are two kinds of businesses: VC-fundable businesses and lifestyle businesses. The latter might look attractive in terms of unit economics but doesn’t have scale. “So these are not the ventures where VCs would put money," he says. The problem arises when an investor can’t differentiate between these two kinds of businesses and gets too enamoured with the lifestyle ones. And when this happens, exit becomes a problem. The second problem is from founders’ side. With ‘all angels descending to earth’—as one of the VCs took a dig at the alarming pace at which everybody is turning angel and cutting cheques—founders will realise that devil lies in detail.

Handing too many angels won’t be an easy task. “Moreover, early-stage is no more about capital," says Sanghrajka. “That’s why funds like 100X.VC come into picture," he adds, underlining that irrespective of the dynamics of funding, the nature of doing business will never change. His one-point advice to all budding founders is: Understand numbers. “I have seen a hell lot of brilliant product and tech guys," he says, alluding to his interaction with thousands of founders during VC pitches.

Though most are promising, they lack in one crucial aspect, which is understanding financials, cash flow and burn. “Homemakers knows their math," he signs off.

First Published: Nov 10, 2022, 11:20

Subscribe Now