Apple, Micron Technology, First Solar: India is bagging mega tech projects that

Things have started on a good note, but experts say roadblocks like infrastructure, red tape, a complex tax system and skilled labour remain

Global manufacturers are betting big on India. The current global supply chain is heavily dependent on China’s manufacturing capacity. But things are changing now, and many manufacturers around the world are looking for ‘China Plus One’. This term, which came into being back in 2013, is a business plan to avoid investing only in China and expand the business into other countries, and India seems to be the current favourable market for many. Over the past decade, countries like Vietnam, Thailand, Malaysia had emerged as the hot alternatives to China for the United States. Recent announcements, starting with Apple and more recently First Solar, suggest that India is the current favourite. Is it?

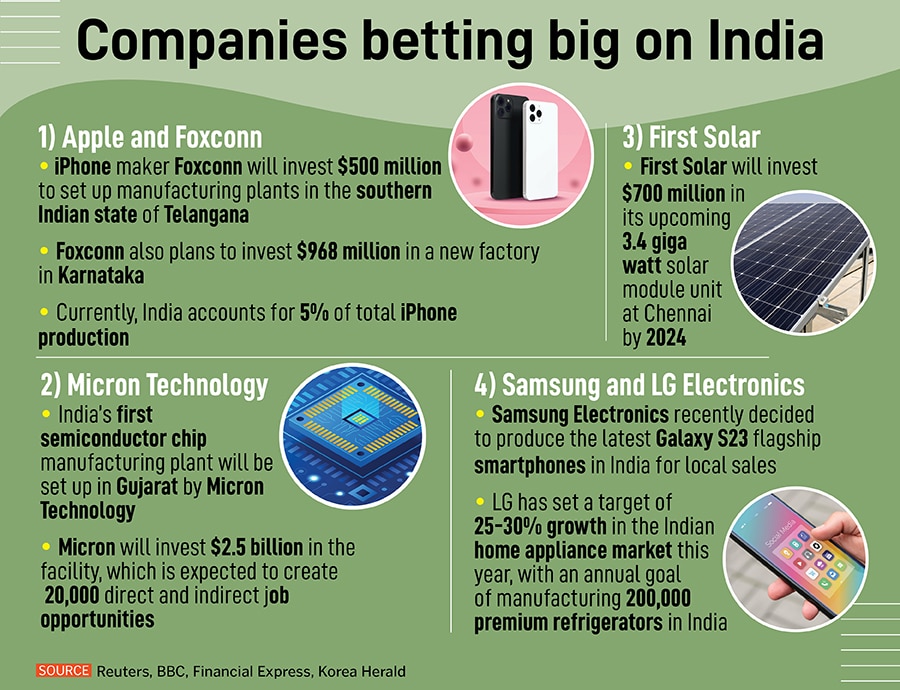

Before the Covid-19 pandemic, China remained an important supplier to most countries. However, with the onset of the pandemic, the US-China trade war, and rising labour costs, manufacturers are looking for substitutes to avoid experiencing shortages due to supply chain disruptions in China.To be sure, a flurry of companies has shifted their focus and increased investments to set up manufacturing plants in India. First, Apple decided to reduce its dependence on producing iPhones in China and chose to make some of them in India. Taiwanese company Hon Hai Technology Group (Foxconn) is expanding its production facilities in India to make the iPhone 12, 13, 14 and 14+ models. It is also evaluating a semiconductor manufacturing project. Foxconn, which is a major Apple supplier and the world’s largest contract electronics maker, has been also attempting to break into making chips as it seeks to branch out and expand into the electric vehicle market. The company recently said in a statement that it is committed to India and sees the country successfully establishing a robust semiconductor manufacturing ecosystem.

Another Taiwanese company Wistron recently sold its iPhone assembly facility in Kolar to the Tata Group, according to news reports. Tata Group is on the verge of finalising the deal to acquire their factory. A report by Bloomberg said that the agreement could be sealed by August 2023. If this deal works out, it will be an important milestone as for the first time a local Indian company will enter into iPhone assembly.

And last fortnight, coinciding with Prime Minister Narendra Modi’s US visit, chip-maker Micron Technology sealed a deal to set up a semiconductor facility in Gujarat. Reports also suggest that South Korean tech giants Samsung and LG Electronics have moved their production operations away from China due to growing uncertainties and are looking very closely at the world"s fifth-largest economy.

India is not the only beneficiary of this China plus one strategy. Countries like Vietnam and Malaysia have also hugely benefited from the re-shift of the supply chain network. Investments in China are now being directed to MITI-V countries. Malaysia, India, Thailand, Indonesia, and Vietnam—termed ‘MITI-V’ or ‘Mighty Five’. India is the biggest beneficiary out of the lot, says Chandranath Dey, India head, operations and business development, logistics, and industrial at JLL, a global real estate services firm.

The Indian government is working on addressing the pain points of multiple legal hassles and approvals. For instance, 38 approvals have now come down to 12, adds Dey, who has also been working with the government on the Make in India programme since it was launched in 2014. “The government is focusing a lot on ease of doing business. The competitive advantage of manufacturing in India has increased manifold post-2019."

On July 18, US-based solar manufacturing company First Solar said that it is set to invest billions of dollars for solar panel production in India and will not source materials from China, a media report said, quoting US energy secretary Jennifer Granholm. The minister also indicated that Tesla is in discussions about investing in India.

Things have definitely started on a good note, but there’s still a long way to go.

India has a window of three to five years to seize this opportunity to attract investment, said Ajay Banga, the former Mastercard CEO who recently became World Bank chief. "I think India’s opportunity currently is to cash in on the "China plus one" opportunity. This opportunity won"t stay open for 10 years," Banga told reporters in New Delhi during his first official visit to the country.

India has overtaken China as the world’s most populous country. However, China’s economy is about five times larger, with a GDP of $18.1 trillion as opposed to India’s GDP of $3.39 trillion. The Economic Survey 2022–23, which was tabled before the Union Budget 2023, stated that India’s manufacturing sector accounts for about 16 percent of the country’s GDP, and the target is to increase this to 25 percent by 2025. The survey also underlined three primary assets to capitalise on this opportunity: The potential for significant domestic demand, measures by the government to encourage manufacturing, and a distinct demographic edge.

India now ranks 63rd in the world for manufacturing, up 23 places from a few years ago, according to the World Economic Forum’s Global Competitiveness Index. The key sectors in India’s manufacturing ecosystem include automobiles, pharmaceuticals, electronics, and textiles.

With over 27.3 million workers, the manufacturing sector plays a major role in the Indian economy. India’s manufacturing exports for FY22 reached $418 billion, an overall growth of more than 40 percent compared to $290 billion the previous year. According to the India Brand Equity Foundation (IBEF), mobile phone production has increased five-fold in the past five years, and India is set to emerge as a global exporting hub of mobile phones, which creates a robust demand for integrated circuits and semiconductors. This will get a boost with the focus moving from assembly to developing expertise in end-to-end hardware component manufacturing.

Still, there are several roadblocks for India to become a global manufacturing powerhouse. The biggest one is infrastructure, like insufficient roads and ports, which can hinder the movement of goods and increase costs. Furthermore, bureaucratic red tape and a complex tax system can make it difficult for companies to do business in India. Skilled labour is another concern that will have to be looked into.

Nikhil Gupta, chief economist of Motilal Oswal Group, says, "We know that a few plants or companies are coming in to set up their plants here. But what we don"t know is what kind of investments they will be making on a yearly basis. For instance, there are a lot of these state-level meetings that happen, and many state governments come in and tell us that they have received investment proposals worth Rs 1 lakh crore and more. We have been hearing it for years from many states. But we have not seen any significant growth in India"s investments in the last 10 years. That is why it is very complicated to say anything right now because we don"t have enough data to make a very informed conclusion."

For instance, the joint venture between Anil Agarwal-led Vedanta and Foxconn was called off by the latter recently. On July 10, Foxconn said that it has decided not to move forward with Vedanta to manufacture semiconductor chips in India. Both the companies had signed a pact last year to invest $19.5 billion to set up the semiconductor plant in the country. One of the biggest reasons the deal didn’t work out is because the Indian government delayed in giving clearances to the project to set up a semiconductor plant in India.

Things will not be as smooth in the initial years in terms of infrastructure and manufacturing, but they will gradually fall into place, asserts Amnish Aggarwal, head of research at Prabhudas Lilladher. "Both the industry and the government will have to take several steps to make sure that the overall experience of investors in setting up a manufacturing base is smooth."

The experts conclude that it will take two more decades for India to reach China"s manufacturing capacity.

First Published: Jul 21, 2023, 16:22

Subscribe Now