Bank transfers using UPI to buy cryptocurrencies are listed as an option but are unavailable. The National Payments Corporation of India (NPCI), which runs the UPI platform, has not banned cryptocurrency transaction but has left the onus on banks to decide.

Maybe Venkatachalam’s trading opportunity was just badly timed. In May, trading and investing in cryptocurrencies through mobile apps and on crypto exchanges became a little difficult after some financial institutions were reluctant in supporting crypto banking transactions. Paytm Payments Banks has stopped providing banking support to cryptocurrency exchanges such as WazirX, CoinSwitch Kuber and startup Zebpay, in independent communications. The same was for large banks such as ICICI Bank which had refrained from crypto-related banking.

Over the years, the Reserve Bank of India (RBI), through various circulars between 2013 and 2017, cautioned users, holders and traders of virtual currencies about the risks involved of dealing in these. RBI’s main concern against cryptos is that there is no underlying asset for cryptos, these are not regulated and are hugely volatile.

In 2018, the RBI had said that entities regulated by it are prohibited from dealing with virtual currencies and providing services to any person or entity in dealing with or settling virtual currencies. They did not ban virtual currencies but stopped entities from dealing in them.

In a move seen to safeguard its own interest, the RBI on May 31 said its 2018 circular was no longer valid, as it had been quashed by the Supreme Court in March 2020.

Then the RBI Governor Shaktikanta Das, at the central bank’s latest monetary policy press briefing, reiterated his earlier stance. “There is no change in RBI’s position. We have major concerns around cryptocurrency which we have conveyed to the government. The Supreme Court had set aside an RBI circular in 2018 but some banks were still citing this circular in their correspondence with their customers, so we set the record straight," Das told the media. He also urged retail investors to do their own due diligence and take a careful and prudent call on their investments in cryptocurrencies.

“All the RBI was doing is making sure that they do not run the risk of being hauled up by the Supreme Court. [Their May 31 note] is to indicate that they are not stopping any regulated entity from providing banking services to crypto companies," Probir Roy Chowdhury, partner at legal firm J Sagar Associates, told Forbes India in a podcast on June 3.

Das’s fresh comments will only make banks more reluctant in dealing with crypto intermediaries. Banks have been told to continue carrying out customer due diligence processes in line with regulations governing standards for KYC, anti-money laundering, combating of financing of terrorism and obligations of regulated entities under Prevention of Money Laundering Act, (PMLA), 2002.

“Now banks, based on their risk management practices, can start to accept or reject working with crypto intermediaries. Some banks will be comfortable doing so and some will not," says Ashish Singhal, founder and CEO of CoinSwitch Kuber, a cryptocurrency investment platform for retail investors. CoinSwitch now attracts 7 million users and is backed by investors such as Tiger Global, Sequoia Capital, Paradigm and Ribbit Capital.

CoinSwitch reported a profit of $8 million in FY21, on revenues of around $50 million.

Praphul Chandra, founder and chief scientist (Cryptoeconomics) of Koinearth, a blockchain-based supply chain startup, says the needle has moved from negative to neutral. “The reason financial institutions had stopped supporting crypto exchanges the basis is no longer there. Crypto exchanges can go back to banks and ask why they are not supporting them," Chandra tells Forbes India.

Nischal Shetty, founder and CEO of WazirX, India’s largest crypto exchange by volumes, says, “We have gone from a state of uncertainty to some clarity, it has pushed India in the right direction."

But in reality, not much has changed even after the RBI clarification. Banks will continue to cite risks in dealing with cryptocurrencies. It is quite likely then that banks may choose to work with the more recognised players in the crypto space, rather than smaller entities. They are also likely to become stricter about the documentation they would seek from decentralised crypto exchanges. There is no formal instruction from the RBI, so not every bank will behave in the same manner.

Forbes India reached out to several private sector banks and the RBI, but they declined to participate in the story.

Lawyers wish that the RBI becomes more proactive. “In the spirit of the IAMAI (Internet & Mobile Association of India) vs RBI judgement, it should be the RBI’s duty to intervene and instruct banks to not decline services to crypto intermediaries," says Anirudh Rastogi, founder of Ikigai Law, who represented the crypto exchanges before the Supreme Court.

Rastogi has no doubt about the legality of trading, dealing or holding crypto in India: “There is no doubt that the trading, dealing or holding crypto is legal. Unless something is prohibited by law, it is permitted," he says.

![]()

Opportunities Beckon

In the absence of regulations, there is a concern over whether India will be able to capture the opportunities that lie ahead as blockchain technologies find a deeper role to play in ecosystems across other countries.

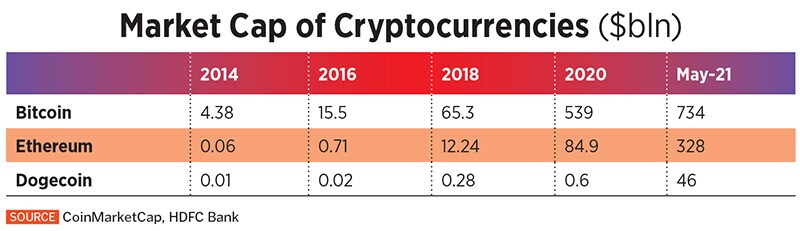

Globally, crypto adoption is accelerating, with the market capitalisation of crypto assets such as cryptocurrencies or tokens crossing $2 trillion earlier this year in April.

The World Economic Forum (WEF) anticipates that by 2025, nearly 10 percent of global Gross Domestic Product (GDP) will be supported by blockchain, the technology used by Bitcoin. A similar potential too can be unlocked in India going ahead, says Sumit Gupta, co-founder and CEO of crypto exchange CoinDCX.

It is estimated that around 15 million Indians hold some form of cryptocurrencies. Globally about $5.5 billion has been invested into blockchain startups, but India has managed to attract only 0.2 percent of this capital, due to the uncertain regulatory status in the country. Bitcoin is legal in the US, Japan, the UK, and most other developed countries, including Switzerland.

![]()

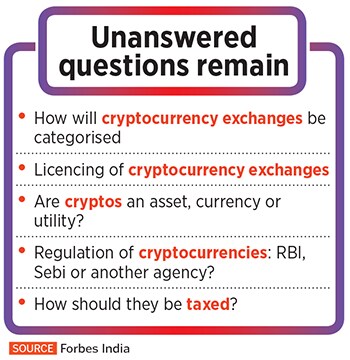

IndiaTech.org, a think tank for Indian startups, says because of the lack of existing regulations that specifically govern cryptocurrency, and no ban, it is all the more essential to bring regulatory clarity and predictability to this undefined species moving around in the financial system.

Rameesh Kailasam, CEO of IndiaTech.org, has proposed a five-point framework to regulate cryptocurrencies in India through a white paper that was presented to the government and concerned ministries in May. Kailasam is yet to receive feedback from any government agency on the same.

The suggested framework includes:

* Defining cryptocurrencies as digital assets, not currencies, and granting them recognition as digital assets (similar to gold, stocks, or marketable securities).

* Introducing a system of registering crypto exchanges and granting them recognition by establishing checks and balances. Kailasam recommends a minimum ownership of 26 percent by Indian founders/ entities in these exchanges, similar to that for banking institutions, where Foreign Direct Investment (FDI) is capped at 74 percent.

* Disclosure norms for individuals holding crypto assets at the end of a financial year, similar to those by the Ministry of Corporate Affairs for firms holding crypto assets.

* Establishing a provision in the direct tax laws to recognise and treat cryptos under the head of “Income Profit and Gains from Business and Profession" or “Income from Capital Gains," depending on the holder’s kind of business and the timeline of ownership.

* Self-regulation: The government should recommend principle-based self-regulatory guidelines. A government-recognised body should implement this self-regulatory model and ensure accountability and transparency.

![]()

Crypto Business Grows, Foreign Investors Bullish

Despite lack of regulation in this space, foreign investors remain positive. India has always been slow to adopt new technologies, whether it in artificial intelligence, blockchain or internet-of-things (IoT).

Zack Rosen, an investor in Ribbit Capital, which made its first crypto investment in India into CoinSwitch Kuber, is confident about India’s “rich culture" around engineering, innovation and skilled developers, which he believes will drive strong crypto adoption.

“The Indian government has been a strong supporter of technological innovation, including in payments with UPI. We expect regulators to eventually see crypto with that lens," he tells Forbes India in an emailed response.

Venture Capital firm Ribbit Capital, along with San-Francisco based crypto-focussed investment firm Paradigm, Sequoia Capital and Cred’s Kunal Shah have invested $15 million through Series-A funding into CoinSwitch. Another $25 million has been raised through Tiger Global in Series-B funding. Rosen declined to comment on fresh investments into CoinSwitch but said they “remain committed" to supporting the partnership.

Strengthened by the backing of foreign investors, several crypto exchanges and startups have seen a rise in retail participation and surge in trading volumes.

CoinSwitch’s rival CoinDCX, which is backed by Bain Capital, Polychain and others through seed capital and Series A-funding, has a user base of 1.3 million and clocks a monthly trading volumes worth $1.5 billion. CoinDCX’s Gupta said the company is now working on new products such as a systematic investment plan for some cryptocurrencies, but declined to offer more details.

Another exchange, WazirX, has seen monthly trading volume at its exchange soar to worth $6.2 billion in May 2021 from $599 million in April last year. The average customer at WazirX is a millennial, who operates with Rs10,000 to Rs30,000 in the crypto wallet.

![]()

An RBI-backed Digital Currency on Cards?

Where do things go from here? The RBI is in its right to be concerned because it has not been given the comfort of a regulatory cover, by adding cryptocurrency into existing laws and regulations already passed by the legislative, says IndiaTech’s Kailasam.

Ikigai’s Rastogi says that one cannot still rule out a “knee-jerk reaction" from India, but he is confident that “with each passing year, there is stronger argument for the regulation for cryptocurrencies in India, instead of a ban. Now there is increased adoption, a mature industry and increasing regulation around the world as well".

The government is working on a draft of the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021. There is no clarity at this stage on when this Bill, which aims to ban ‘private cryptocurrencies’ in India and introduce a central bank-backed digital currency (CBDC), will be introduced.

The People’s Bank of China has been working on its digital currency roadmap for several years now and has already started trials. Sweden, Singapore and UK are also planning pilots or evaluating proposals for their CBDCs, Ikigai’s fintech team said in an April newsletter. But while a CBDC is a good move for India, it is not an alternative to private cryptocurrencies. The primary use of a CDBC is a currency while private cryptocurrencies such as Bitcoins and Ethereum are an investment asset or utility tokens.

Framing CBDC guidelines are a complex matter and experience from other countries shows that it will take years. In the short term, this regulatory flux is not good. The government’s silence to deal with the matter will not help the RBI or the financial ecosystem. As each year goes, India cannot afford to stand isolated from the rest of the world in a globally connected financial ecosystem, where crypto and blockchain will play a strong role.

The National Payments Corporation of India (NPCI), which runs the UPI platform, has not banned cryptocurrency transaction but has left the onus on banks to decide.

The National Payments Corporation of India (NPCI), which runs the UPI platform, has not banned cryptocurrency transaction but has left the onus on banks to decide.