For Adar Poonawalla and the Serum Institute of India (SII), however, it turned out to be a much-needed shot in the arm.

That’s because, in just a few years, the Pune-headquartered company has become a household name in India with millions becoming familiar with Adar, his father, Cyrus Poonawalla, and their 55-year-old vaccine company, SII. Globally, the vaccine maker has become recognised for its sheer scale of operations with the likes of AstraZeneca, Novavax, and the Russian Direct Investment Fund tying up with the company to manufacture vaccines.

Not that it needed much validation. After all, the Poonawallas are among India’s 10 richest people, with a net worth of $16.6 billion, almost the GDP of Botswana. SII is the world’s largest vaccine maker by volume and in 2021, Poonawalla was listed as India’s fifth richest man. Since April 2020, his wealth has doubled from $8.2 billion to $16.3 billion according to Forbes.

“What happened in the pandemic was that we became far more internationally known," says Adar, 41, CEO of SII. “I get offers and partnerships from people all over the world. That"s at least some positive that"s come out of this dreadful pandemic… that at least now we are known internationally and that does open the doors to many opportunities."

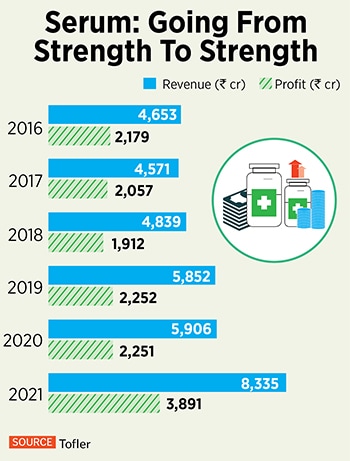

Between April 2020 and March 2021, once the pandemic began, SII’s revenues grew by 41 percent, while its profits grew by 73 percent to Rs3,891 crore. The numbers are only expected to leapfrog in the ongoing fiscal, since the company has been responsible for inoculating nearly 90 percent of India’s population since the country began vaccinations a year ago.

SII has provided 143 crore doses (and counting) of its Covishield vaccine, the Indian version of the AstraZeneca vaccine, to the government so far. India has administered two doses of the vaccine to 75 percent of the population to date.

Yet, despite all the newfound recognition and admiration, the Poonawallas aren’t sitting tight or resting on their laurels.

If anything, over the past few years, Adar has been busy finding newer frontiers to invest the family wealth as the group looks to diversify its fortunes. For much of his time, his father, Cyrus Poonawalla, had focussed his attention and investments only on SII, with the group barely diversifying outside its forte.

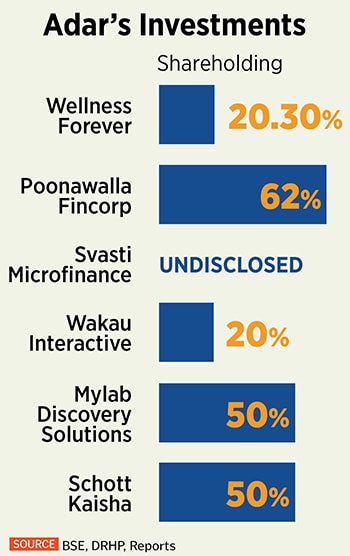

Adar’s investments over the past few years include those into a non-banking financial corporation (NBFC), a microfinance company, a 24-hour wellness provider, a manufacturer of syringes and glass vials, a cookie maker, and a firm that manufactures home testing kits for Covid-19. Adar made these investments in his personal capacity, although they all fall under the Cyrus Poonawalla Group, which comprises his father and him.

“I spent my time fundamentally in three different areas," Adar says. “One is SII and growing in Serum, building new vaccines and capacities. Then, in my spare time, I like to make and manage my own investment portfolio, which is both my personal wealth and that of Serum, where the treasury function is of investing and building and helping grow other private companies."

![]() A file photo of operations at a vaccine filling machine inside a lab at the Serum Institute of India, in Pune, India, November 30, 2020.

A file photo of operations at a vaccine filling machine inside a lab at the Serum Institute of India, in Pune, India, November 30, 2020.

Photo: Francis Mascarenhas / Reuters

Late-stage investor

Adar doesn’t consider himself an early-stage investor, and most of the investments that he had been making have been in companies that have been able to show profits.

“My fundamental point has always been that ‘please demonstrate you can make profit in the first two years’," he says. “Otherwise, your business model is rubbish. I don"t believe in any of these companies that have huge scale and burn cash to acquire customers. But ultimately, if you can"t just make a profit, those kind of investments are not for me. That"s now becoming more and more obvious to everybody. Funds like to still chase those kinds of investments, but I"ve stayed completely away from them."

Adar’s first investment came in 2015 in the Mumbai-based omnichannel retail pharmacy chain, Wellness Forever. “I came to know of the company through a friend, who had recommended it as a good company," he says. “That time I"d only bought 5 percent or 10 percent." Adar then followed it up with multiple rounds of investments, and Wellness Forever has now filed its Draft Red Herring Prospectus (DRHP) with market regulator, the Securities and Exchange Board of India, to raise Rs1,500 crore through an initial public offer (IPO). “That is the natural transition for most of these startups or early-stage companies," says Adar.

Around the same time, he had also invested in Mumbai-based Svasti Microfinance, and his since participated in numerous rounds of funding at the company. Svasti has raised Rs130 crore to date from a clutch of investors. The company, founded in 2008, provides services to some 187,500 customers across 63 branches spread over four states, with a loan portfolio of around Rs400 crore.

“I had invested about 24 percent in Svasti more than four or five years ago, and then later in another NBFC, and finally I said, let me start my own NBFC," says Adar. “Because I felt, there"s tremendous demand. This is a sector which has seen a lot of people become stressed before winding up, leading to consolidation and opportunities."

India’s NBFC sector has been stuck in a quagmire for a few years now, struck by a liquidity crunch and defaults at some of the largest NBFCs, including the likes of IL&FS and Dewan Housing Finance. “If you saw the Piramal Dewan deal, and some of the other NBFCs go down," Adar says, “it has brought them to a value that is very attractive for takeover or merger."

That’s why in April 2019, Adar set up Poonawalla Finance, an NBFC focusing on offering business loans, personal loans, and loans to professionals, and grew it to have assets under management of Rs1,000 crore in just a year. By 2021, he picked up controlling stake in the Kolkata-headquartered Magma Fincorp, a publicly traded company that had a loan book of some Rs15,000 crore. It has a presence in 21 states with 298 branches serving more than five million customers. Adar had bought a 60 percent stake in the company for Rs3,456 crore in February 2021.

“When I took over Magma, it was undervalued because the performance had slowed down," says Adar. “But it was still way undervalued to the assets it had to offer. So that was where we put in capital." Magma also had an insurance business, Magma HDI, offering the Poonawallas a play into India’s fast-growing insurance sector. India’s insurance sector is expected to grow to a $250 billion industry by 2025, according to government estimates.

Since the acquisition, Magma has been renamed Poonawalla Finance, and continues to be traded on the bourses. “The market capitalisation is now Rs21,000 crore," says Adar, who is chairman of Poonawalla Fincorp. “When I took over, it was maybe one-third of that. It has grown by 300 or 400 percent in a year."

“With a change in guard, we believe that the company will see superior profitable growth, resulting in a significant improvement in return ratios," market research firm Emkay said in a report in August 2021. “We continue to believe that Poonawalla Fincorp is well-placed in terms of adequacy and liquidity."

With investments in retail and finance, Adar also purchased a 20 percent stake in Wakau Interactive Pvt Ltd, a subsidiary of JetSynthesys Pvt Ltd, a digital content and technology company in December 2021. Wakau Interactive offers a mobile-first screen experience and short video content. The company has over 500,000 daily user engagement events and can serve over one million users concurrently.

![]() People queue for Covid-19 Rapid Antigen test campaign at a railway station in Mumbai, India on January 13, 2022. Following regulatory approval, Mylabs has announced the launch of CoviSwift, an RT-PCR kit that detects virus in 40 minutes.

People queue for Covid-19 Rapid Antigen test campaign at a railway station in Mumbai, India on January 13, 2022. Following regulatory approval, Mylabs has announced the launch of CoviSwift, an RT-PCR kit that detects virus in 40 minutes.

Image: Francis Mascarenhas / Reuters

Complementing Serum Institute

Alongside his investments into newer pastures, Adar has been busy investing in companies that have the potential to complement SII.

Last August, he purchased a 50 percent stake in Schott Kaisha, a manufacturer of glass vials and syringes, largely to secure the pharma packaging supply. “This is the largest glass vial and ampoule manufacturer in India, and is a very good industry to be in," says Adar. “It’s one of the major suppliers to Serum. But it’s an industry which you can"t really go wrong, especially with low debt, good margins, and a good future demand." Schott Kaisha manufactures some 2.5 billion units a year.

A year before he purchased Schott, Adar also purchased a stake in Pune-based Mylabs, then India’s first company to receive commercial approval for its Covid-19 testing kits. “I wanted to get into syringe manufacturing and Schott Kaisha was doing a divestment at that time," he says. “So, I was lucky. Then, I wanted to get into testing and build good quality RT-PCR and antigen tests."

Adar bought into Mylab Discovery Solutions in April 2020, as the Covid wave began unfolding, and testing became essential. “It is now the largest testing company for RT-PCR and rapid antigen tests," says Adar. He now owns a 50 percent stake in the company. “Over the two years I have increased my stake slowly at different valuations," he continues. “That will probably go for an IPO in a year as well." Mylab currently manufactures some two million kits a day as India grapples with the third wave of Covid-19.

![]() “Some people like to watch TV to unwind," Adar says. “When I wanted to divert my mind and take a break from the latest challenge in Serum, these investments were a little break and diversion from the stress. Because of my sort of position, a lot of proposals do come to me. But the investment is made in areas that I have wanted to get into."

“Some people like to watch TV to unwind," Adar says. “When I wanted to divert my mind and take a break from the latest challenge in Serum, these investments were a little break and diversion from the stress. Because of my sort of position, a lot of proposals do come to me. But the investment is made in areas that I have wanted to get into."

He also struck up a deal with Biocon in 2021, which will see him hold a 15 percent stake in Biocon Biologics, a subsidiary of the biotech major. Under the terms of the agreement, Biocon Biologics will offer approximately 15 percent stake to SILS (Serum Institute Life Sciences Private Limited), a subsidiary of SII at a post-money valuation of $4.9 billion, for which it will get committed access to 100 million doses of vaccines, including Covid-19 vaccines, per annum for 15 years.

To make all these investments, Adar says he relies largely on his gut, and only turns to his chartered accountants and lawyers to do the due diligence. “I personally manage my investment portfolio," he says. “I don"t have investment advisors." Once inside the company, Adar says he has a hands-off approach, where he leaves the day-to-day running to the founders or professionals managing the company.

“I look at the company, the sector, and the people running it," Adar says. “If they tick the three boxes, if I believe in the people running it, I don"t interfere." In May 2021, Adar also offloaded his 5.15 percent stake in Panacea Biotec, a New Delhi-based vaccine maker, which was eventually picked up by SII.

Building the blue-chip company

Now, with his business spread across finance and insurance, Adar also sees a massive opportunity in the green tech business. “I will not get into any other major businesses," he says. “I"m looking at green tech and hydrogen, but in a very small way at the moment, and I"m still waiting to figure out the right way to manufacture the right product."

Even as that happens, the SII scion is clear about one thing. “If you look at the Tatas, there is one flagship company. It"s TCS and everything else is doing okay. I imagine Serum will continue to be the blue-chip company because it"s way ahead of anything else that we"ve just started two or three years ago. Serum was founded in 1966, so it"s the culmination of all that experience and hard work and investment over 50 years."

And that’s precisely why Adar doesn’t want to distract himself from building Serum for the future.

![]() At last count, over 65 percent of children in the world, spread across some 170 countries, have at least once been given a vaccine made by SII. These include polio, diphtheria, tetanus, pertussis, Hib, BCG, r-hepatitis B, measles, mumps, and rubella vaccines, among others. SII manufactures as many as 1.5 billion vaccines annually.

At last count, over 65 percent of children in the world, spread across some 170 countries, have at least once been given a vaccine made by SII. These include polio, diphtheria, tetanus, pertussis, Hib, BCG, r-hepatitis B, measles, mumps, and rubella vaccines, among others. SII manufactures as many as 1.5 billion vaccines annually.

“I"m not distracting myself from the main job at hand, which is to make Serum Institute, one of the largest vaccine players in the world," says Adar. “We may be the largest by way of volume, but in terms of revenue, it"s nothing compared to the big boys in the West."

That means over the next few years, he wants to focus on launching new vaccines and ramping up its play in the western markets. “When we were very small with limited cash flows at our disposal, it was very difficult to go and penetrate those markets," says Adar. “So, you have to have a certain size, and be worth a few billion dollars before you can go and compete in those markets." Today, Serum boasts that size.

The company is poised to manufacture some four billion doses of Covid-19 vaccines this year, up from 1.5 billion doses in 2021. That includes two billion doses of Covishield and two billion doses of Covovax. The Covovax is the Indian name for the vaccine manufactured by Novovax, which has an efficacy of over 90 percent. Adar expects Covovax to soon join the vaccines approved for those aged below 15. The company currently has stockpiled 500 million doses of Covishield vaccines and is regularly supplying them to the government.

“We are urging the government to allow everyone above 18 to take boosters," says Adar. “We have recommended that everyone over 18 be given a dose with a six-month gap after the second dose." The company had initially laid out plans to manufacture 100 million doses a month, which has since been ramped up using existing facilities. “In terms of manufacturing ability, we have over-delivered," says Adar. “We were saying we would make 100 million a month, which would translate to 1.2 billion in the year, but we"ve given 1.5 billion."

With India having double-vaccinated 75 percent of the population, Adar sees a massive opportunity to export vaccines to some of the world’s poorer countries. According to the World Health Organization, only half of its 194 member states were able to inoculate 40 percent of their populations due to distortions in global supply.

“We probably won"t even sell more than a billion doses in India in 2022, and I"ve got 500 million doses of stock lying in my warehouse already," says Adar. The company had also struck a deal to manufacture Sputnik V, the Russian vaccine, which hasn’t quite worked out due to low demand in India. In addition, Adar reckons that the demand for new vaccines entering the domestic market may be rather poor.

“We have covered 75 percent of India with two doses, and they can only take Covishield or Covaxin for a booster dose," says Adar. “Unless they allow mixing of vaccines, those new vaccines of others and my own have no real potential in India." The government hasn’t approved the mix-and-match of vaccines for booster, which means 90 percent of the population who have taken Covishield can only take the same.

In the meantime, Adar, who had to go slow on manufacturing some of the other vaccines due to the huge demand for Covid-19 vaccines, is gearing up for the next phase of growth. The company was to launch a Dengue Monoclonal this year which had been pushed ahead by a year due to the demand for Covid vaccines. In addition, it also has a robust pipeline for the next few years.

“We"ve got the meningitis vaccines, HPV which is a vaccine for cervical cancer, and we"ve got travellers’ vaccine," says Adar. “So, we’ve got a good portfolio of non-Covid-19 vaccines. We would have launched some of them this year and next year. But that"s all been deferred by two years because we used up facilities to make Covishield and Covovax."

With SII firmly in the driver’s seat, Adar is seemingly only getting started when it comes to chasing new frontiers for the group and himself. And in that, he is only scripting the next phase for the world’s largest vaccine maker.

Adar Poonawalla, CEO, Serum Institute of India (SII)

Adar Poonawalla, CEO, Serum Institute of India (SII) A file photo of operations at a vaccine filling machine inside a lab at the Serum Institute of India, in Pune, India, November 30, 2020.

A file photo of operations at a vaccine filling machine inside a lab at the Serum Institute of India, in Pune, India, November 30, 2020.  People queue for Covid-19 Rapid Antigen test campaign at a railway station in Mumbai, India on January 13, 2022. Following regulatory approval, Mylabs has announced the launch of CoviSwift, an RT-PCR kit that detects virus in 40 minutes.

People queue for Covid-19 Rapid Antigen test campaign at a railway station in Mumbai, India on January 13, 2022. Following regulatory approval, Mylabs has announced the launch of CoviSwift, an RT-PCR kit that detects virus in 40 minutes.  “Some people like to watch TV to unwind," Adar says. “When I wanted to divert my mind and take a break from the latest challenge in Serum, these investments were a little break and diversion from the stress. Because of my sort of position, a lot of proposals do come to me. But the investment is made in areas that I have wanted to get into."

“Some people like to watch TV to unwind," Adar says. “When I wanted to divert my mind and take a break from the latest challenge in Serum, these investments were a little break and diversion from the stress. Because of my sort of position, a lot of proposals do come to me. But the investment is made in areas that I have wanted to get into." At last count, over 65 percent of children in the world, spread across some 170 countries, have at least once been given a vaccine made by SII. These include polio, diphtheria, tetanus, pertussis, Hib, BCG, r-hepatitis B, measles, mumps, and rubella vaccines, among others. SII manufactures as many as 1.5 billion vaccines annually.

At last count, over 65 percent of children in the world, spread across some 170 countries, have at least once been given a vaccine made by SII. These include polio, diphtheria, tetanus, pertussis, Hib, BCG, r-hepatitis B, measles, mumps, and rubella vaccines, among others. SII manufactures as many as 1.5 billion vaccines annually.