The economy needs more than a rate cut

The Reserve Bank's tough decision of a 25-basis points rate cut tilts towards stimulating consumption over currency stability

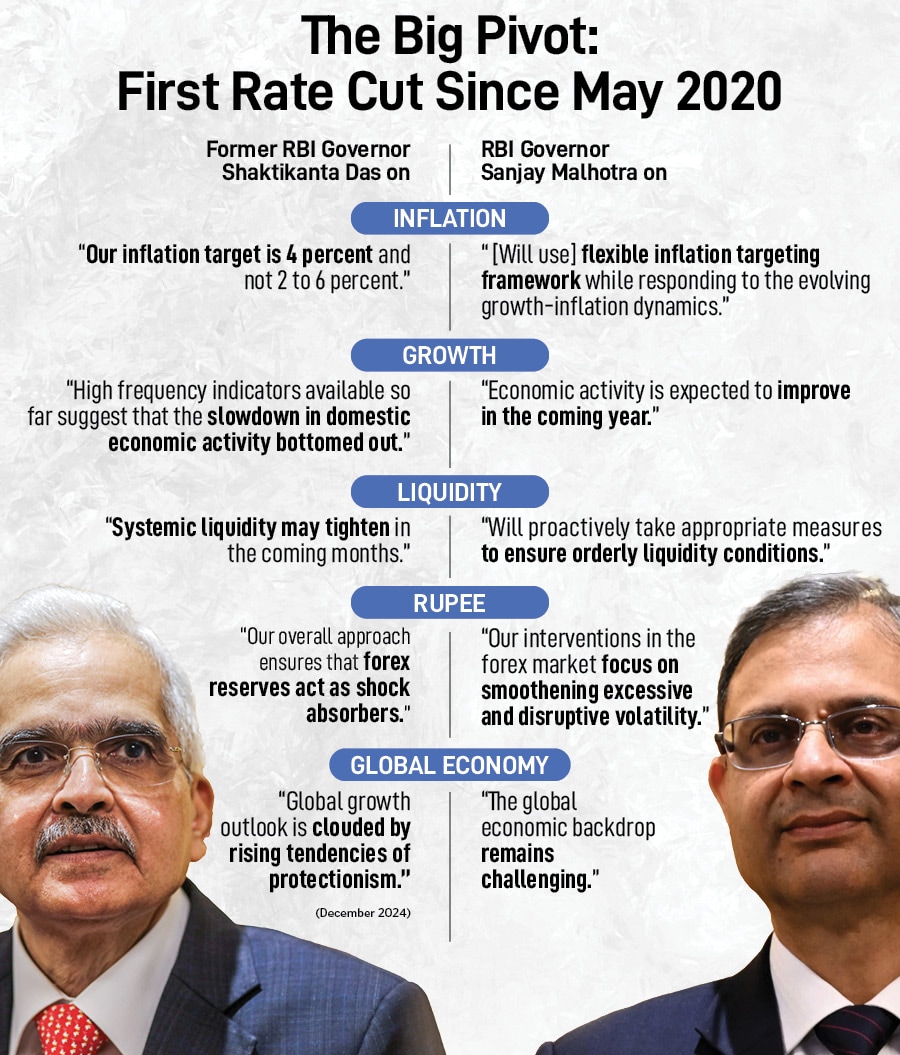

On expected lines, RBI Governor Sanjay Malhotra reduced the repo rate by 25 basis points to 6.25 percent. This is the first rate cut since May 2020, when former RBI Governor Shaktikanta Das slashed the repo rate by 40 basis points to a historic low of 4 percent in May 2020, in an out of cycle Monetary Policy Committee meeting.

The Reserve Bank’s rate-setting panel unanimously voted to lower the benchmark rate, and continue with the ‘neutral’ policy stance, to revive growth against a volatile global economic backdrop.

“The global economy is growing below the historical average, even though high frequency indicators suggest resilience, along with continued expansion in trade," Malhotra said when he unveiled the credit policy on February 7. “Progress on global disinflation is stalling, hindered by services price inflation."

The first monetary policy meeting of the current calendar year comes at a particularly tough time in recent months. The central bank is grappling with multiple challenges such as tight liquidity, slowdown in consumer demand, and heightened global risks of trade wars and capital outflows.

Inflation is showing signs of easing: Retail inflation stood at 5.2 percent in December and the RBI expects inflation to fall to 4.5 percent in Q1 4 percent in Q2 3.8 percent in Q3 4.2 percent in Q4. The central bank sees inflation at 4.2 percent for FY26.

“These growth-inflation dynamics open up policy space for the MPC to support growth, while remaining focussed on aligning inflation with the target," Malhotra explained.

Importantly, though outside the mandate of the MPC, tight liquidity conditions have been a big concern. Durable liquidity in deficit stands at Rs 40,000 crore forex reserves declined to ~14 billion in January credit growth has been flat at around 11.5 percent y-o-y.

“The RBI will need to monitor liquidity conditions more closely to ensure liquidity stance remains in sync with the policy stance," says Upasna Bhardwaj, chief economist, Kotak Mahindra Bank.

Last month the RBI announced Open Market Operations to the tune of Rs 60,000 crore, of which purchases of about Rs 20,000 crore have been undertaken already. The governor signalled the central bank’s commitment to continue measures to reduce overall systemic liquidity deficit.

Madhavi Arora, chief economist, Emkay Global Financial Services, hopes more measures are on the anvil as this level of deficit may leave less room for policy transmission. “After the easing in February, the system liquidity will turn ugly to the tune of ~Rs2.5 lakh crore by March-end, sans any additional liquidity measures," Arora cautions.

So, on the one hand, there is a clamour to bring down rates, to give growth a chance, but on the other hand, the central bank needs to be wary of excessive monetary loosening which could accelerate rupee depreciation. The Indian rupee hit an all-time low of 87.55 against the US dollar on February 6.

“The Indian economy, though continuing to remain strong and resilient, also did not remain immune to these global headwinds, with the Indian Rupee coming under depreciation pressure in the recent months," Malhotra observed without divulging any specific level or band. “At the Reserve Bank, we have been employing all tools at our disposal to face the multi-pronged challenges."

Mint and Dalal Street watchers point out that the rate cut decision is likely to widen the gap between the US and Indian bond yields. This could compound the problem of capital outflows from the country.

“With US bond yields on an upward trajectory, the Indian rupee is facing added depreciation pressure, exacerbating currency risks," Umeshkumar Mehta, CIO, SAMCO Mutual Fund, highlights. “Given these challenges, the rate cut could prove to be a balancing decision on currency stability and stimulating consumption."

Interestingly, any rate cut cheer market investors may have anticipated was missing. At 14:21 the BSE Sensex was trading in the red, down by 0.73 percent to 77,490 points the India 10-year bond yield was up by 2.3 percent to 6.81.

“We remain cautiously optimistic on markets, 10Y yield is likely to trade in 6.55-6.75 percent range in near term," says Avinash Jain, head- fixed income, Canara Robeco Mutual Fund.

Now, the main question remains if the 25-basis points rate cut is enough to kickstart the economic growth engine and is there room for rate cuts in the coming months.

The depth of the rate-cut cycle is arguable. But most analysts and economists have pencilled a cumulative rate cut of 50-75 basis points in the current cycle. However, they agree that future rate cuts will depend on several moving parts in the global economy.

“We can expect further rate cuts up to 50 basis points," believes Bank of Baroda’s chief economist Madan Sabnavis. “The former RBI governor was seen to give the impression that they were keen on inflation going towards 4 percent, but Governor Malhotra has not mentioned that… I think they are not going to be fixed about the 4 percent mark being breached and 4.5-5 percent would be acceptable."

This bears importance because although retail inflation has shown a downward trend—largely driven by a sharp correction in vegetable prices—the risks of higher cost of imports persists given the sharp depreciation of the rupee, along with the possibility of supply chain disruptions due to rising risks of a trade war.

The RBI chose not to err on the side of caution in the February meeting after fiscal policy led the way for reviving the animal spirits of the economy—with tax cuts and a continued focus on building infrastructure—in the budget announcements on February 1. Yet when the MPC meets in April, it will have its task cut out. The rate trajectory will be determined by inflation durability, rupee stability, and global liquidity.

First Published: Feb 07, 2025, 16:03

Subscribe Now