Udayy's Saumya Yadav: In search of a new dawn

After three years, Saumya Yadav's edtech venture Udayy shut down this April, and not for lack of funding. Now the gritty founder is valiantly picking up the pieces

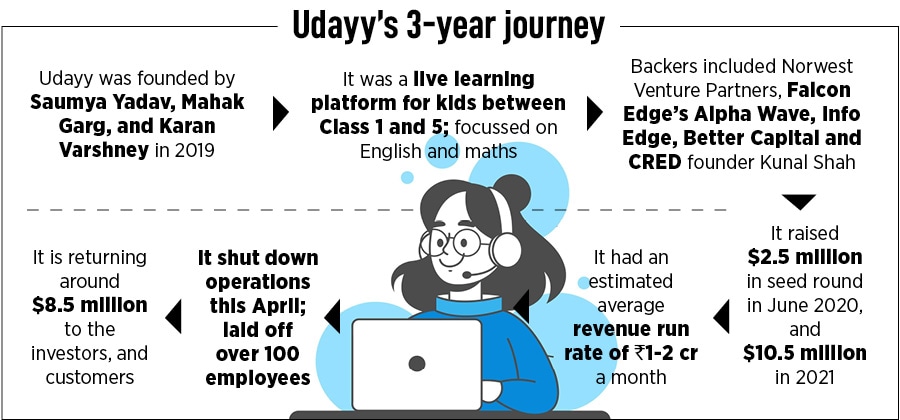

March 2022, Gurugram. “It felt like a brutal slap on my face," recalls Saumya Yadav. The first-time founder, who co-founded Udayy, an edtech venture, along with Mahak Garg and Karan Varshney in 2019, was facing the darkest moment of her life. Her dream run—cracking IIT in the first attempt, joining marquee global management consulting firm Kearney as a maiden job, making it to Stanford for MBA, and getting the backing of heavyweight investors such as Sanjeev Bikhchandani-owned Info Edge, Falcon Edge’s Alpha Wave (the investment firm behind Swiggy, Dream11, Policybazaar and Cred), and Better Capital—was coming to an end after three years. “It seemed like somebody had violently woken me up from my dream," recalls the young founder who turns 31 this July. “Nothing went wrong for so long. That’s why I thought nothing would go wrong," she says.

This March, Yadav’s dream had turned into a nightmare. Udayy had been on ventilator for a few weeks all ways to inject life into the terminally ill patient had failed, and the writing was on the wall. Udayy—a live learning platform in English and maths for kids in Classes 1 to 5—was about to die. There was no hope of saving it. Not even a faintest. “For long, I was in a zone where nothing went wrong," recalls Yadav, who raised $2.5 million in a seed round in June 2020, made most of the pandemic tailwinds to scale the venture, and raised another $10.5 million last year. In March, Yadav still had the last round of funding lying in her bank. “I had ample runway. I didn’t run out of money," she says.

Money, though, was not the antidote Yadav needed. The first-time founder did an honest assessment along with her team and realised that as a business model, Udayy no longer made sense. “There was an option to consistently burn money to buy growth," she says in a candid interview with Forbes India. The co-founders could have easily dipped into their bank balance and burnt $5-6 million and stayed alive for at least over a year or so. “But doing this would have been unethical to investors as well as employees," she says. Another option of staying in the game was a complete pivot, starting another venture and trying their luck with it. This choice, too, was dumped. Reason: A venture born out of haste would have died in haste. “I was at this point after three years. I didn’t want to be at the same point again after three years," she says, explaining the move of not making a botched-up attempt.

Back in mid-2019, Yadav hit upon the right idea for her first venture. After working with Kearney as an analytics consultant for two years, she realised her “mistake". “I was not made for this job," she says. Though the salary was hefty, money was never a motivating factor for Yadav, who comes from a family of army men. In 1999, when she was 8, she lost her father in the Kargil War. Over the next few years, she found motivation in her mother and maternal grandmother.

The young girl from Haryana was taught four priceless values. First, there is no substitute for hard work. Second, there are no shortcuts in life. Third, make frugality your best friend. And lastly, value money. “Bahut paise nahin hote the hamare paas [we never had lots of money]," she says, adding that her pocket money in college was Rs 1,500 for each semester. “One semester doesn’t mean a month. It means 6 months," she smiles. After a stint at Kearney, Yadav wanted to add value to her life. “I wanted to make an impact," she says.

Her next stop happened to be UrbanClap. “I knew I had found my calling," she says. Yadav took a massive salary cut—almost 50 percent—and joined the startup. Over the next two years, her life changed. She decided to go deep into the startup community. The freedom to be one’s own, take risks, experiment and find ways appealed to the young woman who now wanted to start on her own. Though she was equipped to go solo, she lacked the confidence to take the plunge. “I decided to go to Stanford," she says. The biggest pull was the enchanting startup life in the Silicon Valley and the thought that she would somehow muster enough courage and confidence to start up. Exploring and flirting with a few projects during her college days did a world of good to her confidence.

Back in India in July 2019, Yadav was getting ready to take her first plunge. The idea was to start a business of placing digital advertisements on vehicles and geo-fencing them. At Stanford, she had already raised some money for her yet-to-be launched venture. “I could relate to the problems in India. That’s why I came back and didn’t start a venture in the US," she says. The business idea did make sense but there was a small problem. In 2019, the New Motor Act made it illegal to modify the height of a commercial vehicle. In one go, the foundation of the business idea got demolished. Yadav informed her backers at Stanford, and decided to return the money. The angels, though, didn’t want money. They had backed the founder and not the venture, and were confident that she would figure out something.

Back in India in July 2019, Yadav was getting ready to take her first plunge. The idea was to start a business of placing digital advertisements on vehicles and geo-fencing them. At Stanford, she had already raised some money for her yet-to-be launched venture. “I could relate to the problems in India. That’s why I came back and didn’t start a venture in the US," she says. The business idea did make sense but there was a small problem. In 2019, the New Motor Act made it illegal to modify the height of a commercial vehicle. In one go, the foundation of the business idea got demolished. Yadav informed her backers at Stanford, and decided to return the money. The angels, though, didn’t want money. They had backed the founder and not the venture, and were confident that she would figure out something.

Yadav did figure out a new business plan. And this time, the venture had massive impact as well. Along with Garg and Varshney, she co-founded Udayy. The idea was inspired by the high quality of education at Stanford and how it could be replicated in India to make an impact. At Stanford, she explains, people were encouraged to immerse themselves and figure out solutions. “The process resulted in learning," she says, adding that the education was designed to fuel curiosity.

Udayy was designed to cater to early age-groups by offering maths and English. The reasons were obvious. The concepts are simple, kids are impressionable, and their very young age meant the highest level of curiosity. “We took a flipped classroom approach," says Yadav, explaining the model. Every batch just had five kids and the learning was through games and immersive experiences. Udayy started with maths towards the end of 2019, and rolled out a bunch of engaging games in December. A four-month course was priced between Rs 7,000 and Rs 8,000, and a 12-month course cost Rs 15,000 to Rs 20,000. A month later, in January 2020, the startup rolled out live classes.

The response, though, was not encouraging. There were two reasons behind the muted uptick. First, parents never thought live online classes would work out. Second, there was a fear that increase in screen time might not be in the best interest of the kids. “There were very few early adopters," says Yadav. The scene, however, changed drastically after the pandemic induced lockdown in March 2020. In April, there were only 20 kids. By August, the numbers rose to 2,500. And it doubled by the end of the year in December. By now, maths had taken a back seat and English was the blockbuster offering.

The two basic assumptions behind starting Udayy—kids would find the engaging form of education interesting and would get hooked to it, and parents wouldn’t mind shelling out money to ensure that English gave their kids an edge and made them ready for the future—was turning out to be true. “We were growing. We were doubling week on week," says Yadav. The customer acquisition cost [CAC] was low, the burn was almost negligible and enrolments were happening at a faster clip. The business was rising, in January 2021 the startup had a runway of 12 months, and the sun was shining.

The eclipse, though, was around the corner. By July-August 2021, pandemic started waning, and schools reopened in phases. As students started returning to offline modes of learning, parents started to lose interest in ‘extra’ online English classes. “We were seeing a post-pandemic world for the first time," says Yadav. All the assumptions on which Udayy was built started to collapse. Kids got engrossed in school, homework, play and extra-curricular activities. “There was no time for anything else," rues Yadav. Parents too started to deprioritise English learning. “We thought the need would be so strong that people would prioritise it over other things," she says. Yadav was wrong. Parents started asking for refunds, and the chorus grew.

By the end of 2021, the warning bells started ringing louder. CAC jumped by 4x over a span of two quarters. In simple terms, this meant a high burn. There was a question mark on the business model, parents became highly reluctant to shell money, which they now found “exorbitant", and there was another “cheap" problem. “We were competing with tuition aunties," says Yadav, alluding to neighbourhood teachers who would charge around Rs 1,500 for five subjects. Suddenly, Udayy looked “pricey" and aunties emerged as cheaper substitutes. “Their rates were indeed cheap and for us taking a cut was not feasible," she adds.

Running a business model where there were just five kids in one class and a batch only made sense when the fees were high. In one go, aunties made Udayy look redundant. What also didn’t help was the fact that Udayy was yet to figure out its own customer acquisition channel. Yadav now looked at all options to shore up Udayy. A low-cost solution was figured out. ZeZe—a confidence-building app for kids to learn English—was launched this January, and other options, including a collaboration with schools or going offline, was also explored. In three months, the result were for all to see. The needle failed to move an inch the app could not be monetised, and the only way to continue Udayy was to keep burning cash.

For Yadav, though, this was not an option. In spite of having the complete backing of investors who were even okay with the idea of pivoting, exploring options and figuring out a way, Yadav decided on the most pragmatic solution. “Sanjeev Bikhchandani and other investors backed us to the hilt. Money was never a problem," says Yadav, adding that continuing a business which could not be monetised looked outrageously ridiculous. Udayy was shut down this April.

Three months later, Yadav is coming to terms with a new life. The tag of a failed entrepreneur hurts, but the gritty founder is warmly embracing the harsh reality. “I am a martyr’s daughter," she says. “I was never taught to run way or hide. I have to face this," she says, adding that it has not been an easy three months since she shut down. Her co-founders too are boldly facing the situation. “We never burnt loads of cash, and have been frugal," says Garg. That’s why, she adds, the startup is returning money. “It’s okay. We failed but it’s not the end of the world," she adds. Varshney, too, sounds optimistic about the future. “I always believed in failing fast. We will be back," he says.

The backers, for their part, give full marks to Yadav and her team for a spirited fight. “How many founders return capital," asks one the funders, requesting not to be named. The reasons for commenting off the record looks weird as the VC always supported the team. “We always silently cheered the team, and now also want to do that," he says, explaining the reason for staying anonymous. The team, he adds, had always stayed frugal, tried its best to course correct and experiment, but couldn’t succeed. “At times, it’s outside circumstances that kill a company," he adds. Udayy was a pandemic baby, and a waning pandemic killed it.

Yadav, for her part, is busy killing mental demons. She talks about peer pressure, to begin with. There are a bunch of Stanford friends, she points out, who are now unicorn founders. “They started almost at the same time," she says, adding that a few more from her IIT batch are also doing well. “It will take me a couple of months to come out of it," she says. “There is no shame in failing. The shame lies in not fighting," she adds. “I am fighting back and I will be back," she signs off.

First Published: Jun 14, 2022, 16:38

Subscribe Now