Apollo Global: Time for a big splash

Setting out on its own after a joint venture with AION Capital Partners ended, Apollo Global has set its eyes on big targets

Utsav Baijal, head of India PE at Apollo Global, says investing in distressed assets is as complex as it is opportunisticImage: Manoej Paateel for Forbes India[br]Imagine a hall booked in New Delhi for 150 people. Though star-studded with noted lawyers, bankers and fund managers, it was neither a wedding nor a soirée. A private equity firm had booked the venue in 2018 for a session where people, representing 28 lenders, were present. The fund had to pitch a resolution scheme that would eventually decide the fate of the sale process of one of the ‘dirty dozen’ companies.

Utsav Baijal, head of India PE at Apollo Global, says investing in distressed assets is as complex as it is opportunisticImage: Manoej Paateel for Forbes India[br]Imagine a hall booked in New Delhi for 150 people. Though star-studded with noted lawyers, bankers and fund managers, it was neither a wedding nor a soirée. A private equity firm had booked the venue in 2018 for a session where people, representing 28 lenders, were present. The fund had to pitch a resolution scheme that would eventually decide the fate of the sale process of one of the ‘dirty dozen’ companies.

The ‘dirty dozen’ is probably the most talked about list of companies in Indian financial circles—companies that were referred, for the first time in India, to the Insolvency and Bankruptcy Code (IBC) by the central bank to kickstart the resolution process in the middle of 2017.

On this not-so-merry list was Monnet Ispat & Energy Ltd (MIEL) promoted by Sandeep Jajodia with admitted claims of $1.6 billion. While trouble had been brewing at the company for some time and over the years many private equity fund managers had looked at the asset, nothing had ever really worked out.

One of the frequent visitors had been AION Capital Partners, the joint venture between the US-based alternate asset manager Apollo Global Management, Inc and homegrown fund ICICI Ventures (I-Ven). AION, which had been on the road to raise capital since 2011, returned home with $825 million by 2014 with a focus on investing in distressed assets and Monnet Ispat was on their radar.

“People think of distress as something where you can go and try to find an asset which is not performing well and buy it pportunistically at a much cheaper price, right? But some of these situations are very, very complex,” says Utsav Baijal, senior partner and head of India private equity at Apollo while explaining how they went about acquiring Monnet Ispat in a joint venture with Sajjan Jindal-owned JSW Steel in 2018. It was the first distressed asset deal in India by a private equity firm as part of the insolvency process. The JV jointly owns 88 percent of the company of which 74.33 percent is AION’s stake. Baijal emphasises that it isn’t only about finding a lower price, but figuring out how one can fix the business and turn it around. Nipun Sahni, India head for real estate at Apollo, closed two big deals for the firm in 2020

Nipun Sahni, India head for real estate at Apollo, closed two big deals for the firm in 2020

Image: Amit Verma[br] In fact, Monnet Ispat had been on their radar even before 2017. Baijal met the company management for the first time in 2015-16, as AION looked at Monnet Ispat’s 1.5 million tonne steel plant in Chhattisgarh. Back then, it was more about a deal evaluation to provide additional finance to the company. By the next time they looked at the company, Monnet Ispat had turned into a non-performing asset (NPA) and fund managers at AION spoke to lenders asking if they could buy the debt from them. However, the banks declined to sell. In 2017, when Monnet Ispat reached the IBC, AION Capital knew it was time to roll up their sleeves and finally try to get the deal done.

But the deal wasn’t easy. Here was a plant that had been shut for many years. It also had a lot of leverage for a small plant. “It had some older technology patched with some new in different parts of the plant. It was an incomplete plant which hadn’t really produced steel yet. But we had spent enough time on the asset over the last few years and along with our partner JSW Steel, we had a thesis that this could be turned around,” says Baijal animatedly, as he recollects how they came to acquire this ‘hodgepodge’ of a steel plant.

Another problem was that Monnet’s plant capacity was too small to compete with others so how would they sell the steel and to whom? For context, Tata Steel Ltd has a capacity of 33 million tonnes per annum (MTPA), while JSW Steel’s present capacity is 18.1 MTPA that it is expanding to 23 MTPA by this fiscal year. Monnet’s capacity is 1.5 MTPA.

So why was Baijal and his team so keen to acquire this small asset with so many drawbacks?

The answer lies in the product mix. Monnet Ispat’s plant was designed to make commodity steel which is amply available, but what AION wanted to do was invest more money and transform it into a specialised steel manufacturing unit which can then be sold to the automobile sector and other categories. While the plan looked good on the drawing board, the question was who will operate the plant? Who will bring about this product transformation?Baijal and his team realised they needed a partner. AION then approached a few strategics and figured JSW Steel would fit the bill. At that point, JSW Steel was looking to bid for Monnet Ispat and another ‘dirty dozen’ asset Bhushan Power & Steel Ltd.

“As we went through the journey, we decided that we will be the senior lead partner in this equation. But we rely on them heavily on everything when it comes to operations, distribution and technology.” explains Baijal.

It took AION Capital 366 days from start to finish to get the deal done. It remains one of the rare deals where PEs invested in a distressed asset through the bankruptcy process. In 2018, there were nearly 28 lenders and the JV eventually clinched the deal for 26 cents to a dollar for $372 million.

“Frankly a lot of the debt was built up through delay on payments. We valued the business on a fundamental value basis, saying, if we invest more capital and if we turn this around, what is the earning potential of this business? That’s how we did it and we are now finally seeing signs of some movement,” says Baijal, smiling over a Zoom call from his Mumbai residence on a Saturday evening.

But he is quick to point out that had they started looking at the asset after it reached the IBC, it would have been too difficult to close the deal as the data available for distressed asset companies is often not at par and in many cases, there are many unknowns that hinder the deal making process. “Despite the complexity of the situation, the IBC process only allowed for two visits as part of the process, thankfully we had already done plant visits in the past and had a view,” says Baijal.

It is January 2021 and the company has now made its first slab of steel. Monnet Ispat is now unlisted and has been renamed and rebranded as JSW Ispat Special Products Limited.Generally, the perception about PEs is they will bring in financial resources and look for some return, but I don’t think so, says Seshagiri Rao, joint managing director and Group CFO at JSW Steel speaking about AION’s role. “My understanding is that they have a huge amount of experience in investing in steel globally too and they bring that to the table. Their inputs are also very qualitative in nature and focused on governance, management, technical knowledge. They even brought in a technical expert as their board member.”

Rao adds, “When we acquired the plant it was completely shut and when we went in to buy the asset, the JV had clear plans on its revival strategy. Like if it is commodity steel it is difficult to get good margins, so we converted it to alloy steel.”

While the plant is slowly turning around, 2020 was also when the AION Capital Partners JV ended. Both Apollo and I-Ven continue to manage the investments. ICICI continues to maintain its position in the advisory committee of the fund. Some of the key faces of the fund like Parth Gandhi and Kalpesh Kikani have left AION. Another person synonymous with the fund was Mintoo Bhandari who left the firm in 2018 and relocated to London. Baijal had moved from the US office to its India office, located in Hyatt Hotel in Mumbai’s western suburbs, in 2010.

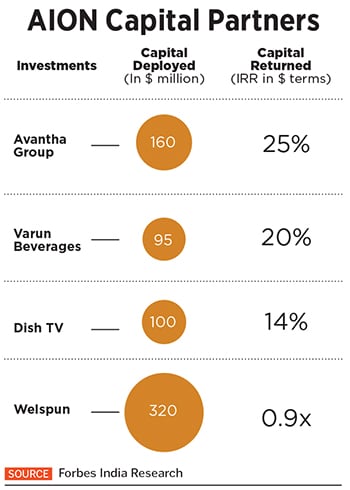

Before forming the JV to create AION, Apollo’s first deal was in November 2009, when it acquired a 11 percent stake in Dish TV for $100 million (then ₹465 crore). It sold its entire exposure in 2015 across two tranches and managed to take home ₹1,144 crore. One of its other early large transactions was its investment of ₹2,250 crore in the Welspun Group in 2011, but the deal did not really pan out the way the fund had hoped. While it struck some mega deals (in those days), it decided that a local partner would help them carve better structured credit and special situations transactions. After all, banks have exposures to companies and they can get easier access to deals.

On the other hand, I-Ven found a partner it could tap into to raise capital and who was also a specialist in the distressed assets arena. The AION fund was largely raised from Apollo Global’s existing limited partners (LPs). LPs are investors in a private equity fund. While the fund raised $825 million, it went on to add other pools and the total AUM of the fund stands at $1.1 billion.

AION has made 13 investments from its fund and exited seven of these investments. Some of its control transactions are relatively young which include IGT Capital (the BPO/IT business of Interglobe Group) for $250 million. It also closed a structured debt transaction of $50 million with Chennai-headquartered manufacturing firm Chemplast Sanmar, the flagship company of The Sanmar Group. By 2018 end, the fund had managed to return $250 million to its investors. AION had managed to successfully return capital to its investors from its exits in Avantha Group, realty firm Logix, Varun Beverages, renewables firm Mytrah among others. Some of its bets over the last few years include the acquisition of GE Capital’s NBFC business which has been rechristened as Clix Capital.

While AION was raised as a dedicated India fund and deployed small amounts, the separation from ICICI Ventures now allows Apollo to build its India book the way its global peers like Blackstone, Warburg Pincus and KKR have been doing in India. A vertical head for private equity, one for real estate, and in 2018 they received a licence for the asset reconstruction business. Both vertical heads also do credit deals in their sectors. With direct access to the global balance sheet, Apollo wants to now do large-sized deals and actively expand its India business.

“Traditionally Apollo Global does large-sized deals in the US and it favours their returns thesis, now the India team will have to hunt for such large deals and scan it through that prism. While their model of operations has been different from other funds in India, it will be interesting to see how they perform independently,” says a senior investment banker who has worked closely with the firm in the past and declined to be named.

A FRESH START

Since its inception in India in 2009, Apollo has deployed nearly $2.8 billion across private equity, credit and real estate business (includes AION’s AUM). For the quarter ending September 2020, Apollo Global reported that its total assets under management (AUM) grew to $433 billion, representing an increase of $102 billion since the end of 2019.

Back in India, during the pandemic-stricken year, as the real estate sector went through a completely dry phase of sales in March and April, Nipun Sahni, partner and country head for real estate at Apollo managed to close two big deals for the firm. It effectively deployed $620 million during 2020 and the total AUM of the real estate vertical now stands at $1 billion.

“Ironically it turned out to be a great year,” says Sahni, about the two platform deals they managed to close.

The fund has tied up with Pune-based real estate firm Panchshil Realty and has created a $500 million platform to invest in distressed and special situations realty projects in Mumbai and Pune. Both parties will bring in capital in the platform, but Apollo’s commitment will be higher if they do more commercial realty deals.

“We think this pandemic has caused a lot of dislocation, some of it is not visible today due to the moratoriums on debt. Also, liquidity from domestic sources has really dried up for the real estate sector which could cause more stress. Our platform is more like resolution capital which acquires and solves these stressed assets and projects,” explains Sahni. The platform will look to acquire residential and commercial projects with an average ticket size of $40-50 million.

The platform is also open to last-mile financing of assets. While capital isn’t a constraint for the fund, it needed a partner to complete these developments. “Stuck projects would need development expertise and that is what Panchshil brings to the table, which they’ve proven time and again across their high quality portfolio,” says Sahni over a long call.The second large transaction that Sahni’s team started carving in July 2020 too has now finally fructified. Apollo has joined hands with Ajay Piramal’s non-banking finance company (NBFC) Piramal Housing Finance Ltd to create a $700 million platform to buy developer loans.

“I think it’s probably a first in the country [this type of deal] at scale. There are several developers who are looking for incremental financing. We have created this platform where we are solving for their upcoming debt maturities and providing incremental capital so that they can continue and complete their projects. We have already closed 15 deals from the platform,” says Sahni who joined the fund in 2015. Of the $700 million, more than half the money has already left the bank and been deployed. These loans have a tenure of four-five years.

The JV will ideally fund brownfield projects. The largest single cheque from this platform is around $80-100 million and the smallest deal is around $25million.

“This deal enables us to strengthen our lending business through a new co-investment and co-origination model. We were impressed with their team’s ability to grasp the complexity and the depth of insights to offer effective solutions,” says Ajay Piramal, chairman at Piramal Enterprises Ltd.

Besides, the Apollo Infrastructure Opportunities Fund (AIOF II), the second infrastructure equity fund, and the Asia RE Fund II, the second Asia-focused real estate equity fund, had their initial closes and made their first investments during the last quarter.

Apollo does not have a dedicated India fund and like its global peers brings in capital from its regional (Asian) fund or from the main fund which is raised in New York.

“India is a really important market for us in Asia. We have experience creating solutions for our partners and will continue to invest across structured credit and equity in partnership with strong sponsors,” says Philip Mintz, senior partner and head of real estate equity (US and Asia).

Apollo’s real estate unit in India has also been an active acquirer of portfolios rather than just buying out assets. In 2010, it had acquired Citi Property Investors, the real estate arm of Citigroup Inc’s portfolio. In 2018, it acquired JPMorgan Asset Management’s $300-million real estate investments.

At its peak, the AUM of these two portfolios collectively was around $400-450 million. It has exited over 90 percent of Citi’s portfolio and has returned capital to its investors. It has also exited several of its investments from the JPM fund.

While 2020 has been the most active year for the real estate team since inception in terms of capital deployment, going forward, it believes that their investment thesis, which has so far focussed more on structured credit deals across its investments, will be built around more platform-style transactions where the fund will focus on specific themes. “There are new themes emerging around data centres, warehouses and logistics. The growth story of startups, ecommerce and digitisation is well under way and it will open up new asset classes and opportunities for the next decade. Indian ecommerce is yet to hit a $100 billion whereas China is closer to $2 trillion,” says Sahni, adding, “We will continue to invest via platforms with high quality promoters with a proven execution track record.”

Another observation that the fund came across during the pandemic was that more people wanted to buy homes as their safe space. For example, in the last five months, across its investee portfolio companies, it has seen more sales than in the 12 months of 2019. Interest rates at an all-time low and the Maharashtra government’s move to slash rates has helped developers sell their inventory.

While the realty team is busy closing deals, Baijal and his private equity team have a clear mandate too. According to Apollo Global’s presentation earlier this year, its growth strategy includes geographic expansion and expanding distribution channels to focus on India private equity and credit build out.

“We have completed 10 years in India and are committed to investing actively across all our business lines of private equity, real estate and credit in the future. We see the improved business environment, the ability to do large control transactions in private equity and the need for flexible capital solutions in real estate and credit as the three key aspects that make India an important market for Apollo. The Indian private equity market crossed $35 billion in the last two years which points to the growth of alternative capital in the economy and we hope to participate more actively in India in the future on behalf of our global and regional funds,” says Sanjay Patel, chairman international and senior partner of private equity at Apollo Global. Patel, who sits out of the headquarters in New York, focusses on building and developing Apollo’s international businesses.

In its early days the fund’s focus was to find deals of over $100 million, which were difficult to come by. For example when they invested $100 million in Dish TV, the deal was one of the largest single deals of the year. Both Indian private equity and the fund has evolved since then and in the next leg of its journey the fund is looking to do even bigger deals.

Baijal says, “We think that given that the market is now seeing larger transactions, we are desirous of backing the largest groups in the country and we thought that we could be much more effective and opportunistic if we’re investing capital from our global funds.”

For this, it is also looking to partner with Indian firms to acquire assets jointly. While it will continue to deploy capital independently, the fund will be focusing on large control deals with a minimum ₹1,000 crore deal size and on the credit and hybrid pool side it will be chasing deals in the range of ₹500 crore or so. Over the decade, the fund has moved from doing control deals to buyout strategies and distressed deals. As the focus becomes wider in its solo ride, it is surely all set for its 2.0 journey in India.

First Published: Jan 19, 2021, 10:20

Subscribe Now