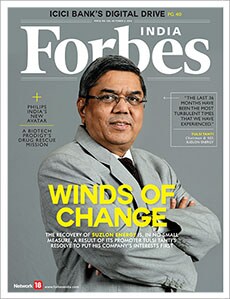

Battling headwinds at Suzlon by putting aside ego

Tulsi Tanti's story is of an owner who has been able to not just set aside personal interests but also work closely with bankers and virtually resurrect his company from the brink of what looked like

But after the economic downturn of 2008 hit home, this trend has been changing. Not just worldwide, India too is witnessing several cases where large promoter groups, which spent lavishly on acquisitions and expansion during the good times, have begun pruning their portfolio of businesses or companies. They are even selling majority stakes in a bid to keep the organisation or the rest of the group above water, as the effects of the global slump dent their balance sheets. This is a heartening trend. A smart owner will put the interests of his business and stakeholders before ego and ambition. If he can do that, very often he will gain in the process as his revamped business begins generating returns again.

The story of Tulsi Tanti is of one such entrepreneur, and is a good example of how an ambitious business owner has been able to not just set aside personal interests but also work closely with bankers and virtually resurrect his company from the brink of what looked like certain death at one point. Tanti’s story of how he brought Suzlon back from the brink—with more than just a little help from lead banker State Bank of India and white knight investor Dilip Shanghvi of Sun Pharma—will, if it continues to play out in the current manner, go down as a lesson in why entrepreneurs must put the welfare of the company above everything else.

As Associate Editor Aveek Datta, who put together the cover story on the problems and consequent, painstaking restructuring undertaken by Suzlon, writes, “Its turnaround is a story of how lenders can work with their borrowers to help a company get back on its feet while ensuring they recover their dues a story of how a well-meaning white knight with deep pockets can change the tide of fortune and, most importantly, of how a promoter can redeem himself by setting his ego aside, putting the company’s interests before his own, and selling assets that may have been the crown jewels of his business.”

To be sure, the Suzlon story is still work in progress as Tanti, the lenders and investor Shanghvi work carefully together to ensure the company emerges from the problems stronger and ready to get back on the growth path again. But the signs so far are encouraging, and the banks continue to back Tanti strongly. If Suzlon is back firmly on the profits path in the coming days, it will not just be good news for the company and its stakeholders, but also a sure sign of the maturing of corporate India. The world is watching.

Best,

Sourav Majumdar

Editor, Forbes India

Email:sourav.majumdar@network18publishing.com

Twitter id:@TheSouravM

First Published: Sep 18, 2015, 06:56

Subscribe Now