From CT Scans to MRIs: How Blue Jet Healthcare made it big with contrast media

Akshay Arora, chairman of Blue Jet Healthcare, has found and stuck to contrast media—a profitable and growing niche in the sector

In the two decades since 1968 when Blue Jet Healthcare was founded, the company specialised in the manufacturing of sweeteners. It was a steady business with fixed customers and a growing market. But by the late 1980s things had changed, and Akshay Arora took a decision that was to change the eventual trajectory of Blue Jet Healthcare.

Dumping from Chinese manufacturers had caused a fall in the price of sweeteners making the business unviable. “It didn’t make sense to sell at those prices," he explains. Fresh out of college with a degree in organic chemistry he, along with a colleague, started making exploratory visits to the European market. A few years later, they received a contract to make a molecule that was a by-product of saccharine and the company started exporting to the European market. Arora had managed to establish a small but profitable niche.

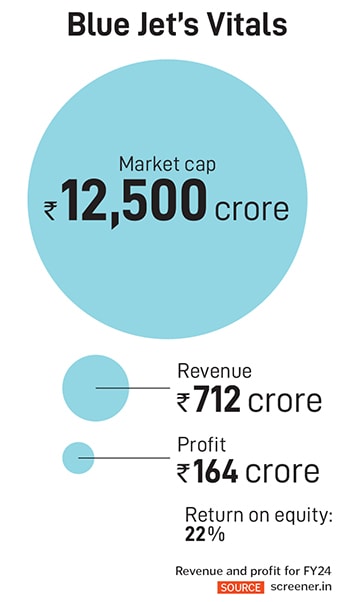

The experience resulted in two learnings that were to establish Blue Jet’s trajectory in the years to come. First, focus on science rather than making me-too generic products where the margins are lower. Second, establish a niche and stick to it. The result has propelled Arora, chairman of Blue Jet Healthcare to the 2025 Forbes World’s Billionaires List with a net worth estimated at $1.1 billion. He owns 86 percent of the business that listed in November 2023. Blue Jet grew revenue at 12 percent a year to ₹712 crore in the year ended March 2024, while profits compounded at 5 percent a year to ₹164 crore with a return on equity of 22 percent.

The experience resulted in two learnings that were to establish Blue Jet’s trajectory in the years to come. First, focus on science rather than making me-too generic products where the margins are lower. Second, establish a niche and stick to it. The result has propelled Arora, chairman of Blue Jet Healthcare to the 2025 Forbes World’s Billionaires List with a net worth estimated at $1.1 billion. He owns 86 percent of the business that listed in November 2023. Blue Jet grew revenue at 12 percent a year to ₹712 crore in the year ended March 2024, while profits compounded at 5 percent a year to ₹164 crore with a return on equity of 22 percent.

What has the market valuing the business at ₹12,000 crore or a 56 multiple is the contrast media niche the company entered into in 1999 that makes up two-thirds of its revenue. These are chemicals that enhance the imaging in CT scans and MRIs. “The image is either good or bad," says Arora pointing to the fact that these chemicals have exacting specifications. Globally the top four companies—US-based GE Healthcare, Germany-based Bayer, France-based Guerbet and Italy-based Bracco—have an 80 percent market share. The rest is controlled by Chinese players.

It was during the phase when Arora had exited the sweeteners business that Blue Jet experimented with different molecules. That took them to customers in Europe who worked in the imaging space. They would make various API formulations that were then further fine-tuned at the customer end. “We realised that this is an area that would grow in the future and decided to stick and build relationships in this space," says son Shiven Arora, managing director. He also points to the demand for preventive health care. Now doctors ask patients to do a CT scan or MRI even before the first visit.

While the market is growing at single digits in the West, in the developing world, the growth is in the mid-teens. The global contrast media market estimated at $6.06 billion is expected to grow at 4.1 percent a year to $9.04 billion, according to a report by Fact MR. Shiven also points to the fact that innovation is happening in the device space as well bringing down the cost. This, in turn, would result in increased demand for contrast media.

Arora points to this business as a pure-play CDMO (contract development and manufacturing organisation) business where Blue Jet works with larger companies on various molecules and then decides on which ones to take forward. Since this is done along with the customer, the risk is low as the research is killed early if the results are not promising.

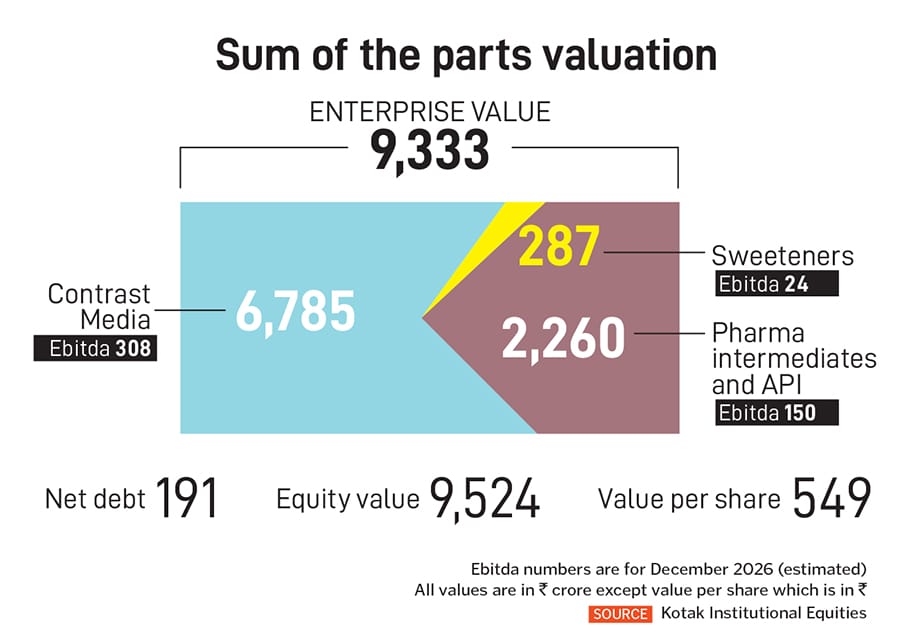

While these molecules are off patent, their customers have relationships with hospitals and diagnostic labs, making them stick to their machines. While one level of formulation and manufacturing is done in India, the customers control the last stage of the process, and the final formulation is made at their plants in Europe with different specifications for different markets. Analysts at Kotak Institutional Equities estimate that contrast media contributes 73 percent of the sum of the parts valuation for Blue Jet.

A significant tailwind for Blue Jet has been the shift in customer preferences from sourcing from China. As customers look for alternative suppliers, they prefer to work with companies that are tried and tested, resulting in increased business for contract development and manufacturing players as well as pure-play contract research players.

While a majority of its business in the advanced intermediates space comes from contrast media, Blue Jet is also working with companies that supply drugs for cardiovascular, central nervous system and oncological issues. These relationships are both with multinational generic companies as well as innovator pharma companies. One area where the company has pinned its hopes on is with Bempedoic Acid, a cardiovascular intermediate. The product is patent protected till 2032 and Blue Jet doesn’t expect any competition for the next three to four years.

Arora, who was out of the sweetener space for about a decade, re-entered it in 2000. He hasn’t forgotten where the roots of the company lie and worked on fine-tuning the process and says it is the “world’s best process". Their sweetener is found in every toothpaste in the Indian market, and they have been able to make sure they supply with the consistency that manufacturers want. “They (the manufacturers) have as many as 50 people checking for the consistency and flavour of the sweetener," says Arora. The business makes up about 18 percent of sales.

Arora, who believes in the power of education, says he would want to do more to support students who want to study further. The chemist who is most comfortable in a laboratory has handed over operational and financial matters to his son Shiven. He also spends time on his farm.

While both father and son are unwilling to put a number to future growth, there is every probability of it being rapid. “This decade was for CDMO companies—the overall development on the R&D side and also manufacturing footprint, the ability to have these world-class plants fit for these regulated markets and the attention to GMP (good manufacturing practices) is very evolved in the India ecosystem," says Shiven. It would be fair to expect smart entrepreneurs to continue to capitalise on this.

First Published: May 05, 2025, 13:14

Subscribe Now