But look closely into his journey into Forbes’s billionaire club and Desai’s life appears rather tumultuous, involving walking away from his family business after his father’s demise to trading his family’s upmarket and swanky bungalow for a one-bedroom house before giving up control of a company he built from scratch.

“There are two types of people in this world," Desai tells Forbes India on a video call from Surat. “Those who are brilliant and those who are hardworking. I belong in the second category, and I take pride in that." Desai, with a net worth of $1.2 billion, is ranked the 2,259th richest person in the world, according to the 2023 Forbes World’s Billionaires List. He entered the club after his company, Aether Industries, had a spectacular rally on the bourses through last year.

Desai is the founding promoter and managing director of Surat-based Aether Industries, a publicly traded specialty chemical company that manufactures active ingredients for sectors as diverse as pharmaceuticals, agriculture, and oil and gas. It is also a provider of contract research and manufacturing services (CRAMS) to numerous multinationals. “I never thought I would be a billionaire," says Desai. “Because, at heart, I’m still a core engineer or a technician. Maybe you can label me a technocrat."

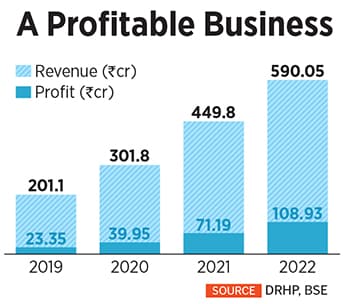

Desai took Aether public in June 2022, almost a decade after he started the company, raising ₹808 crore from the capital markets. The company’s shares were listed at a 10 percent premium, rallying over 42 percent in the last nine months, and are today valued at ₹11,200 crore. The company posted annual revenues of nearly ₹600 crore last year with profits of ₹108 crore. Desai and family own 87 percent stake in Aether, whose clients range from Saudi Aramco to Dr Reddy’s and United Phosphorus Limited, among 200 others.

![]() About half of the company’s revenues come from the pharmaceutical business while one-third from supplying products for the agrochemical industry. The remaining comes from material science, photography and coatings, among others. Aether primarily operates its business under three business models that involve large-scale manufacturing of its own intermediates and specialty chemicals, followed by CRAMS and exclusive contract manufacturing.

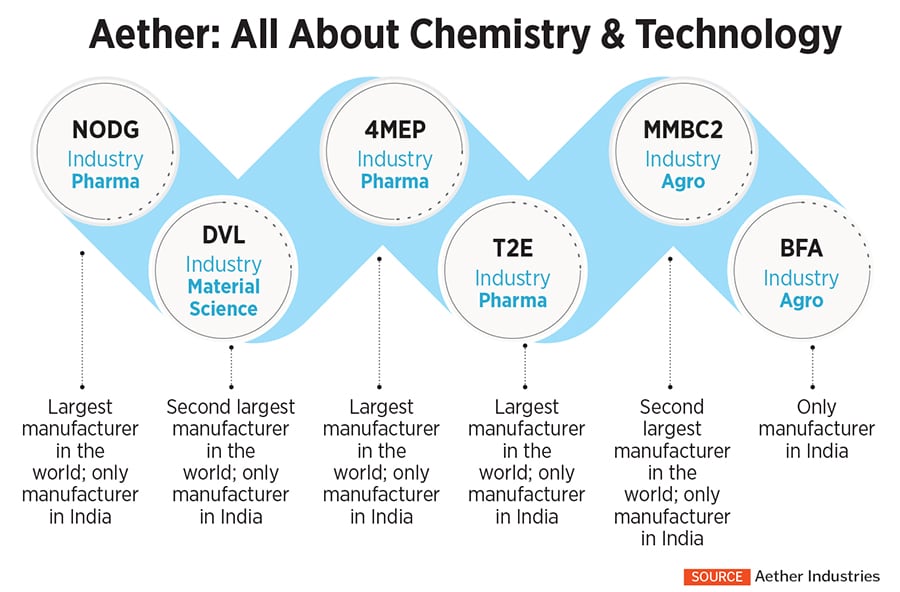

About half of the company’s revenues come from the pharmaceutical business while one-third from supplying products for the agrochemical industry. The remaining comes from material science, photography and coatings, among others. Aether primarily operates its business under three business models that involve large-scale manufacturing of its own intermediates and specialty chemicals, followed by CRAMS and exclusive contract manufacturing.

Of this, the company is the lone maker of some specialty chemicals in India, including 4MEP, MMBC and DVL. 4MEP is used in the pharmaceutical sector, MMBC is used in the agrochemical sector and DVL as a coating additive.

“When we started Aether, we wanted the company to be based on chemistry and technology," Desai says. “Chemistry is obvious. But technology is something the industry doesn’t adopt much. So, we thought that we will encompass chemistry with technology, and that will be our driving force rather than one particular product."

That also meant setting up a pilot plant, where the company experiments with products and makes them in small batches, before large-scale production—a practice not prevalent in the country, according to Desai. The company claims to have one of the largest pilot plants in the world with 106 reactors installed it helps to generate critical scale-up data in the transition from R&D to manufacturing while also helping to manufacture low-volume, high-value products.

“Aether’s strength lies in the large pilot plant (for complex chemistries) backed by a strong R&D team, scale-up facilities and long-term engagement with marquee clients," Ranvir Singh, a research analyst with Edelweiss Wealth Research, said in a report last year. “Our quick estimates suggest the company’s earnings would more than double in the next three years. The company cherry-picks products having more than 25 percent margin for development."

Charting His Destiny

In many ways, Desai’s journey into the world of billionaires has been all about grit and perseverance.

![]() Desai grew up in Indore, in a large bungalow, with his parents and four sisters. His father, who Desai says started from nothing, had an umbrella manufacturing business in the city. Desai, however, wasn’t fascinated by that world. Instead, he wanted to study chemical engineering and enrolled at the Institute of Chemical Technology (ICT), formerly the University Department of Chemical Technology, in Mumbai.

Desai grew up in Indore, in a large bungalow, with his parents and four sisters. His father, who Desai says started from nothing, had an umbrella manufacturing business in the city. Desai, however, wasn’t fascinated by that world. Instead, he wanted to study chemical engineering and enrolled at the Institute of Chemical Technology (ICT), formerly the University Department of Chemical Technology, in Mumbai.

“I had the marks to take admission in any college of my choice," Desai says. “But I chose chemical engineering, and the dilemma was that none of my family or even distant family was in chemicals. My father was amused, as I was the only son. But I was passionate about pursuing my dream in the chemical field and he graciously let me do that."

While in college, Desai’s father passed away and he soon had to decide between staying on with the family business, where his uncle was partner, or stepping away. “Again, I chose my path," Desai says. His uncle, meanwhile, retained him in the umbrella business till he finished college.

By 1976, after a few years of working various jobs, Desai moved with his mother to Surat, where his brother-in-law lived, determined to start something of his own. “We started from scratch because he (brother-in-law) was also not aware of anything in the chemical sector," Desai says. While staying in a one-bedroom apartment in Surat, Desai rented a small farm with a well, far from the city, to manufacture sulfuryl chloride, an inorganic compound that was being imported in the country, and among the most dangerous chemicals. The chemical is used in dyes and the pharmaceutical sector.

![]() Ashwin Desai (right) started Aether in 2013 with wife Purnima and sons Aman (extreme left) and Rohan Desai as whole-time directors

Ashwin Desai (right) started Aether in 2013 with wife Purnima and sons Aman (extreme left) and Rohan Desai as whole-time directors

“We developed a new type of catalyst and succeeded in it, and my whole capital cost at that time fell from ₹2.5 lakh to ₹50,000," says Desai, who, with his brother-in-law, soon started Anupam Rasayan Limited, with the idea of manufacturing sulfuryl chloride. “We went on adding products and developed every product for the first time in India," says Desai.

Much of his success with Anupam Rasayan, Desai reckons, was because of his focus on research and development, with a keen understanding of the market where the company manufactured products that weren’t available in the country then. By 2013, some 36 years after he started Anupam Rasayan, Desai stepped away as chairman and managing director, leaving it to his nephew and their family.

“I had to take a decision," Desai says. “Either I had to retain the company or leave it. Because my nephew was prepared on both fronts." Coincidentally, Anupam Rasayan went public a few months before Aether hit the bourses.

![]()

“Very few people can let go and that’s often a limiting factor," says Aman Desai, wholetime director at Aether, and Desai’s younger son. “It’s not easy to find someone in India who has built up two specialty chemical companies from scratch and made them successful. He had spent his lifetime building Anupam, and it’s not easy to step out of your comfort zone at 62 to build something from scratch again. That ability to let go, especially for someone from that era, and free up his mind is what makes him strong."

Desai, Aman says, had the option of retaining Anupam but decided to build something new with his sons. “He said he wanted to spend the next 10 years of his productive life doing something he was passionate about," says Rohan Desai, wholetime director at Aether and Desai’s elder son. “We did have the option of a private equity while at Anupam to retain control, but he was of the firm belief that he didn’t want to leave any liabilities for us. That’s also why, at Aether, we skipped private equity."

Building Aether

Aether, which means pure in Greek and infinite in Sanskrit, began operations in 2013. His sons, Rohan and Aman, along with wife Purnima joined as whole-time directors. “After the split with Anupam, we were asked if we would like to work together to see how well we can get together," says Rohan about working with his brother. “And we said yes. Both of us rely on each other. We thought we can take up the challenge."

![]() Aman, like his father, holds a bachelor’s degree in chemical technology from ICT, and a PhD in organic chemistry, while Rohan looks after the commercial side of the business. “The four of us started on slate zero, with no person from Anupam, and no product from Anupam," Desai says. This time, Desai says, he wanted to pay more attention to technology alongside chemicals, which led them to set up their pilot plant.

Aman, like his father, holds a bachelor’s degree in chemical technology from ICT, and a PhD in organic chemistry, while Rohan looks after the commercial side of the business. “The four of us started on slate zero, with no person from Anupam, and no product from Anupam," Desai says. This time, Desai says, he wanted to pay more attention to technology alongside chemicals, which led them to set up their pilot plant.

“We chose to have a business model based on a pilot plant," Desai says. “In the Indian chemical industry, there aren’t pilot plants. They have a lab and then they go straight to production. That was one of the most unique concepts we had."

They spent the initial three years setting up the R&D facility and the pilot plant, and began manufacturing on a large scale in 2016. In 2015, the company acquired land to set up two production facilities, and also chose to begin commercial production of its flagship product, 4MEP.

“Like a true technocrat, I didn’t transfer the money (from his Anupam Rasayan stint) to mutual funds, shares, gold or any farmhouse," Desai says. “I am a typical technocrat, who’s happy to follow my passion than focus on status."

The company also identified some 20 products that were not being produced in India before it finalised 10. It also helped that the Chinese chemical industry was in the midst of some turbulence. “In 2016, when we entered the market with our product, the Chinese downturn had started because of issues relating to pollution and safety," Desai says. “There were shutdowns, and we had a red carpet welcome with all our customers. That was our luck."

India’s share in the global chemicals sector could triple to 10 to 12 percent by 2040, creating an additional $700 billion market value, over and above the current contribution of $170-180 billion, according to a report by McKinsey in March. “The specialty chemicals segment is likely to be a key driver of this growth. It has the potential to contribute more than $20 billion to India’s net exports by 2040, a 10x jump from the current total of $2 billion," the report says.

Today, Aether is the largest global manufacturer of products such as NODG, 4MEP, T2E and HEEP, and remains their sole manufacturer in India. Along the way, Desai reckons he has taken the fight to the Chinese, especially on the cost front. “We are now exporting products to China," he says.

Newer Frontiers

With its newfound success on the product portfolio, Aether turned its attention towards CRAMS as well as exclusively manufacturing for companies. The company is currently conducting contract research for almost 10 to 15 multinationals.

In March, Aether signed a pact with Saudi Aramco Technologies Company to exclusively manufacture and commercialise the converge polyols technology and product line. Before that, Aether had worked with Aramco on a contract research and manufacturing model business model.

“One of Aether’s main focus areas is to convert R&D (CRAMS) opportunities provided by its clients into large-scale/contract manufacturing projects," HDFC Securities said in a report in April. The company does so by offering value engineering, developing innovative processes and undertaking its core competency chemistries in the company’s contract manufacturing/exclusive manufacturing operations. This allows the company to enter into long-term contracts with its customers that provide assured product offtake and better margins, thereby helping improve Aether’s profitability."

![]()

Its partnerships, especially with over 200 customers across 18 countries, has helped improve the company’s expertise, giving it enough ammunition to build a wide array of products. “We have worked with hundreds of thousands of products in the last 10 years, and that knowledge has enriched us in a very big way," Desai says. “We are one of the few companies that can give a gram-level product to our customer, or at a tonne level, or even at 1,000 tonnes."

It also helped that China’s supply chain issues have pushed global companies to seek out India’s specialty chemicals sector in recent times. “India is cost-competitive in several chemical segments due to low capital and operating expenses such as labour, utility and overhead expenses etc," McKinsey adds in its report. “Coupled with the promoters’ focus on high profitability and a culture of process innovation, Indian chemical companies generate one of the highest Ebitda per unit of investment in fixed assets. The future of the Indian chemical sector looks promising, and the country could potentially become the driving force of the demand and supply of the world chemical market."

For now, Desai has serious ambitions for Aether. The company has procured 31 acres of land, where it says it will be adding more production capacity over the next decade in addition to launching new products. The company is also looking at acquisition opportunities in the US and Europe for R&D and manufacturing assets. “We have a good reason to grow," Desai says.

Desai now has two more years to part with 13 percent of his stake in the company in line with market norms capping promoter stakes. That also means more money in store for further expansion. “At the same time, whatever we are accruing in our profit is being put back into the system," Desai says. “We want to grow in a structured manner, and at the same time come up with something unique that we will be known for."

“We may be small compared to many global companies," says Aman. “But we have only been manufacturing for 10 years. While import substitution, pharmaceuticals and agrochemicals are part of our focus area, it’s the non-pharma, non-agro part of business where there is significant potential, and we have become pioneers there. We are in a golden era for Indian specialty chemicals, because people have severely burnt their fingers in the China basket and the West cannot manufacture."

That means Desai, who still puts in 10 hours at work, knows very well that his 10-year-old company is only getting started. He has now handed over the active running of the business to his sons, while he plans the direction of the company.

“If you are free, if you are open, then you get a lot of good ideas," Desai says. “So, I believe that my job is to create ideas and give direction to the company."

So, what would he tell the young boy who left his parents and family in his quest to study chemical engineering? “If you believe in something, you must never worry about it," Desai says. “You can succeed only when you are totally involved in it." And as for his billionaire tag, he likes to reiterate. “These figures are all fun. I don’t take them seriously."

About half of the company’s revenues come from the pharmaceutical business while one-third from supplying products for the agrochemical industry. The remaining comes from material science, photography and coatings, among others. Aether primarily operates its business under three business models that involve large-scale manufacturing of its own intermediates and specialty chemicals, followed by CRAMS and exclusive contract manufacturing.

About half of the company’s revenues come from the pharmaceutical business while one-third from supplying products for the agrochemical industry. The remaining comes from material science, photography and coatings, among others. Aether primarily operates its business under three business models that involve large-scale manufacturing of its own intermediates and specialty chemicals, followed by CRAMS and exclusive contract manufacturing. Desai grew up in Indore, in a large bungalow, with his parents and four sisters. His father, who Desai says started from nothing, had an umbrella manufacturing business in the city. Desai, however, wasn’t fascinated by that world. Instead, he wanted to study chemical engineering and enrolled at the Institute of Chemical Technology (ICT), formerly the University Department of Chemical Technology, in Mumbai.

Desai grew up in Indore, in a large bungalow, with his parents and four sisters. His father, who Desai says started from nothing, had an umbrella manufacturing business in the city. Desai, however, wasn’t fascinated by that world. Instead, he wanted to study chemical engineering and enrolled at the Institute of Chemical Technology (ICT), formerly the University Department of Chemical Technology, in Mumbai.

Aman, like his father, holds a bachelor’s degree in chemical technology from ICT, and a PhD in organic chemistry, while Rohan looks after the commercial side of the business. “The four of us started on slate zero, with no person from Anupam, and no product from Anupam," Desai says. This time, Desai says, he wanted to pay more attention to technology alongside chemicals, which led them to set up their pilot plant.

Aman, like his father, holds a bachelor’s degree in chemical technology from ICT, and a PhD in organic chemistry, while Rohan looks after the commercial side of the business. “The four of us started on slate zero, with no person from Anupam, and no product from Anupam," Desai says. This time, Desai says, he wanted to pay more attention to technology alongside chemicals, which led them to set up their pilot plant.