In just one year, Pai’s Manipal Health Enterprises Private Limited (MHEPL) has completed the acquisition of two hospital groups and is in the middle of closing another one, worth a combined ₹4,000 crore, at a time when numerous hospitals across India have shut down due to the financial turmoil caused by Covid-19.

It all started with the acquisition of Bengaluru-based Columbia Asia hospitals last April for ₹2,100 crore which gave the group an additional 1,300 beds across 11 hospitals. That was followed by the acquisition of Bengaluru-based Vikram Hospital for ₹350 crore, adding another 200 beds. Set up in 2009, Vikram Hospital is a high-end tertiary care facility located in the central business district of Bengaluru and focuses on cardiac and neuro sciences.

Now, Manipal is in the midst of advanced talks with Kolkata-based AMRI Hospitals, owned by the Emami Group, to purchase four hospitals in an attempt to build its presence in the eastern region. The deal adds another 1,200 beds to Manipal’s current capacity, taking the total number of beds to nearly 8,700. The deal will also make Manipal the largest hospital group in eastern India and puts it within striking distance of India’s largest hospital chain, Apollo Hospitals, though Pai says he isn’t in it for the numbers game. Apollo Hospitals currently has 71 hospitals across the country with some 12,000 beds.

“No, no, I don’t think there is a hurry," laughs Pai. “I think it’s years of hard work that’s finally culminating with these deals. But it’s been a good four to five years. While you can acquire assets, the more difficult part is integrating them with the cultural fit, and I think our acquisitions have been integrated very well."

This year, Pai is ranked 2,076 on the annual Forbes World’s Billionaire’s List, up 187 positions, with a net worth of $1.4 billion. Pai is chairman of Manipal Education and Medical Group (MEMG), commonly known as the Manipal Group, with six colleges and 27 hospitals in the country. Pai’s Manipal University has overseas campuses in Malaysia, Antigua, Dubai and Nepal.

A trained doctor himself, Pai’s acquisition of three hospital chains comes at a time when no other hospital group has followed a similar trajectory in the past few years. And much of that may have to do with two failed transactions over the past few years, when the group was looking to strengthen its business in northern India.

Back in 2018, Pai and his team had revised their offer three times to acquire New Delhi-based Fortis Hospitals and its subsidiary, SRL Diagnostics, for ₹3,300 crore.

![]()

Eventually, Malaysia-based IHH Healthcare acquired Fortis for ₹4,000 crore. Soon after that deal fell through, the company had set its sights on the Gurugram-headquartered Medanta Hospitals run by popular surgeon Naresh Trehan. That deal also did not go through reportedly after the groups couldn’t agree on a common price.

“We’ve always been looking since the Fortis transaction to expand our footprint because, while we continue to do greenfield projects, it takes time to build a hospital," Pai says. “The lead time is around three to four years—from identifying a site to getting approvals for construction and constructing them. But ideally, when we want to go into a city, we like to do an acquisition, and then expand in that city. From our perspective, that position has worked out well."

That’s precisely why the acquisition of AMRI Hospitals works out well for the company’s foray into the eastern region, where it has one hospital, which too came into its hands only last year by virtue of its acquisition of Columbia Asia Hospitals. It also makes sense since the hospital’s headquarters in Bengaluru sees a large number of patients coming from eastern India, and even Bangladesh.

![]() TMA Pai founded India’s first privately-owned medical school, the Kasturba Medical College, in the town of Manipal in Karnataka in 1953

TMA Pai founded India’s first privately-owned medical school, the Kasturba Medical College, in the town of Manipal in Karnataka in 1953

Scaling up from the South

For a long time, Manipal Hospital was a South-focussed health care provider, something that Pai and his team are now looking to change quickly.

The brand has a stellar reputation, largely thanks to its founder, TMA Pai, who founded India’s first privately-owned medical school, the Kasturba Medical College, in the town of Manipal in Karnataka in 1953. By 1991, the group set up Manipal Hospitals and its first hospital came into existence in Bengaluru.

In 2000, Ranjan Pai, armed with a medical degree from the Kasturba Medical College and a fellowship in hospital administration, joined the family business. He began his career as managing director of the Melaka Manipal Medical College in Malaysia. By 2000, he set up MEMG, out of a rented house in Bengaluru, with a capital of $200,000, as part of his plans to corporatise the family business and attract capital. The business then comprised two verticals—education and health care.

Since then, the business has grown steadily and has so far raised over $700 million in private equity funding. While the education vertical is split into two divisions—Manipal University, a self-financing, not-for-profit deemed university, and Manipal Universal Learning, a commercial venture which operates colleges in Malaysia, Antigua, Dubai, and Nepal—much of Pai’s attention over the past few years has shifted to health care, as the pandemic necessitates a relook at the sector in India.

Today, the Manipal Education and Medical Group comprises MHEPL, MaGE (Manipal Global Education Services), a health insurance business, ManipalCigna Health Insurance, e-learning platform UNext Learning and a stem cell research company, Stempeutics Research. Pai acquired a 51 percent stake in Cigna TTK Health Insurance and renamed it as Manipal Cigna Health Insurance in 2019. Today, nearly half of the group’s revenue comes from the health care business, while the others bring in the rest. The recent acquisition of Columbia hospitals also adds over ₹1,000 crore to the company’s topline.

The hospital business has two greenfield projects coming up in Bengaluru in addition to one in Pune. “We will continue to build the greenfields as we find the right location," Pai says. Over the past few years, the Manipal Group has also been steadily shifting focus to North India, to build a pan-India business. While it built a greenfield project in Jaipur in 2014 and a hospital in Dwarka in New Delhi in 2018, its acquisition of Columbia Asia has given it a serious foothold in cities such as Kolkata, Gurugram, Ghaziabad and Patiala.

![]() “This is a big country, and I don’t think anybody can technically be a pan-India player," Pai says. “We are in 15 cities today and we’ll go deeper into those cities. We may add another five or six cities and go into cities that are underserved. From our perspective, it’s not about saying that ‘I want to be the largest player or the biggest player’. And we may get there. But the bigger challenge for us will be, can we do a good job in the markets that we operate in and be the preferred health care provider."

“This is a big country, and I don’t think anybody can technically be a pan-India player," Pai says. “We are in 15 cities today and we’ll go deeper into those cities. We may add another five or six cities and go into cities that are underserved. From our perspective, it’s not about saying that ‘I want to be the largest player or the biggest player’. And we may get there. But the bigger challenge for us will be, can we do a good job in the markets that we operate in and be the preferred health care provider."

Hospitals account for over 80 percent of India’s total health care market, according to Niti Aayog. The hospital industry was valued at $61.79 billion in 2016-17 and is expected to reach $132 billion by 2023, growing at a CAGR of between 16 and 17 percent. Around 65 percent of hospital beds cater to almost 50 percent of the population concentrated in Uttar Pradesh, Maharashtra, Karnataka, Tamil Nadu, Telangana, West Bengal and Kerala.

India has 1.4 hospital beds per 1,000 people, and a shortage of skilled health workers, with 0.65 physicians and 1.3 nurses per 1,000 people. India requires an additional 3 million beds to achieve the target of 3 beds per 1,000 people by 2025.

“We’ll continue to grow in the next five years," Pai says. “Can we add another 2,000 or 3,000 beds? I think the possibility is there. But it all depends on how well we do with these acquisitions, how we integrate them, and what the outcome of those acquisitions turns out to be."

The last two acquisitions, Pai says, have been easy, especially with smooth integration, largely because of the existing systems and processes at the hospitals. That’s something Pai and Manipal are keeping in mind as they chase regions where the group wants to strengthen its presence, including Chennai, Hyderabad, Mumbai and Kerala, where it has zero presence. In addition, it is also looking to strengthen its presence in the National Capital Region, dominated by multi-specialty players such as Max Healthcare and Fortis.

“Tomorrow, Apollo can acquire another hospital and I don’t think it’s about being the largest," Pai says. “In the markets that you are operating in, can you be the leader there and can you really do a good job is a question."

Fighting Covid and growing

For Pai and Manipal, however, super-specialty hospitals remain at the centre of all plans. That’s why, even as the pandemic wreaked havoc across the country, Manipal did not shy away from growing through acquisitions.

![]()

“India is a 1.4 billion market," says Dilip Jose, CEO of Manipal Hospitals. “Secondly, our older population is one of the fastest-growing demographics and our incidents of non-communicable diseases are far more in the past 30 or 40 years. At the same time, access and affordability have become better."

There is also the growing number of international tourists who flock to the country largely because India provides a cheaper alternative. “So if you look at all these factors, we think all of them are fairly sustainable in the mid to long term. The acquisitions are for the next 20-30 years, and the pandemic should not deter us from our strategic intent of growing."

Yet, Manipal’s aggressive strategy of mopping up others isn’t something its rivals have been following of late. “I’m not sure how many others have grown in the recent past," adds Jose. “I think in the last one year, we had grown the fastest. We feel that we should plug the gaps in the geography sooner than later, and we feel if financing and funding are not a big concern, we don’t have to wait. Even now, we don’t need to sit back saying, I’ve done two or three acquisitions, let me wait for two years before we look at something else."

Much of that confidence is also thanks to the group’s investors: Private equity (PE) major, TPG Capital, Singapore’s sovereign fund Temasek and India’s quasi-sovereign wealth fund, the National Investment and Infrastructure Fund (NIIF). Last year, NIIF invested ₹2,100 crore in Manipal for an undisclosed stake. NIIF is backed by the government of India and institutional investors such as Abu Dhabi Investment Authority (ADIA) and Temasek. One of the largest PE players, TPG, had invested in Manipal around four years ago and roughly holds 22 percent, while Temasek, which invested two years back, holds around 18 percent.

“I think we’ll continue to be acquisitive, and we will continue to consolidate our play," Pai says. “We are not going to stop with this. We will continue to grow as we go forward." That means scanning the country for opportunities on a regular basis. It also means as many hospitals have shut down due to financial constraints, Manipal is looking at operations and maintenance of hospitals. “We have a good understanding of what is out there," Pai says. “We scan the entire country in terms of deals. We know what price it will trade at. So, we are watching and as we close one, we are looking at two or three others." That, however, usually takes 12 to 18 months to close.

With the Indian hospital industry expected to further see consolidation in the coming years, Pai seems to be on the right path. India’s hospital bed density is less than half the global average of three hospital beds per 1,000 population, which means about 2.2 million beds will be required over the next 15 years, according to Niti Aayog. “There are nearly 600 investment opportunities worth $32 billion (₹2.3 lakh crore) in the hospital/medical infrastructure sub-sector on Indian Investment Grid (IIG), a platform maintained by Invest India for showcasing investment opportunities by the sector," Niti Aayog said in a 2021 report.

Even then, it may not be easy-going for Manipal, particularly when it comes to acquisitions. “MHEPL is exposed to increased competition from several large hospitals in various micro-markets, where its hospitals are located, leading to lower occupancies," ratings agency India Ratings & Research said in a report last year. “MHEPL also remains exposed to regulatory risks faced by the health care industry mainly in the form of price capping for medical procedures and devices, including Covid-19 treatment price cap imposed by some states."

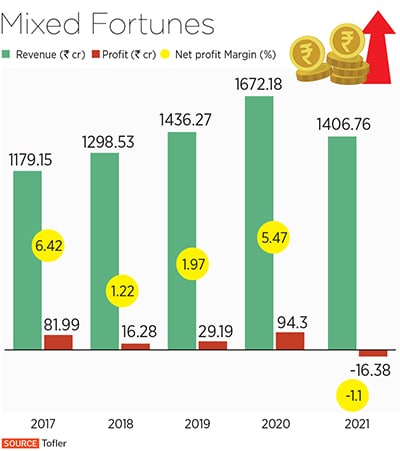

Over the past few years, Manipal’s acquisitions seem to have had an impact on its finances. For instance, last year, Apollo Hospitals, with a net profit margin of 1.15 percent, fared better than Manipal, which posted a net margin of -1.11 percent. Fortis Hospitals, another rival, had a net margin of 0.66 percent. A year before that, Apollo had a net margin of 4.8 percent, while Manipal had a net margin of 5.47 percent. Fortis, however, had a 73 percent net margin. “It’s too early for me to say what the RoI [return on investment] will be on these investments," Pai says. “We feel comfortable sitting on the acquisitions we did and the way it’s panned out, we feel very confident. But only time will tell."

Pai is also looking to take his hospital venture public, while charting newer frontiers, including focus on technology to power the next growth phase. For instance, in March, the hospital announced its plan to use Google’s Fitbit wearables and a remote monitoring platform to check patients recovering after high-risk surgeries. “We need to give our investors an exit," Pai says. “We are looking at listing in the next 12 to 24 months, depending on some of these acquisitions and how they pan out." Its rivals, Fortis and Apollo, are already trading on the bourses.

So how does he look back at the two decades, changing the destiny of a business group that his grandfather and father built? “The next 20 years are going to be even more exciting and in the sectors that we are in—education, health care and insurance—there’s enough growth potential there," Pai says. “India as a market is opening and all of these are good tailwinds for us. We must just put our heads down and execute well. There’s a lot of capital available."

At just 49, Pai has firmly turned around his family’s fortunes. Now, he is just getting ready for the long haul.

“This is a big country, and I don’t think anybody can technically be a pan-India player," Pai says. “We are in 15 cities today and we’ll go deeper into those cities. We may add another five or six cities and go into cities that are underserved. From our perspective, it’s not about saying that ‘I want to be the largest player or the biggest player’. And we may get there. But the bigger challenge for us will be, can we do a good job in the markets that we operate in and be the preferred health care provider."

“This is a big country, and I don’t think anybody can technically be a pan-India player," Pai says. “We are in 15 cities today and we’ll go deeper into those cities. We may add another five or six cities and go into cities that are underserved. From our perspective, it’s not about saying that ‘I want to be the largest player or the biggest player’. And we may get there. But the bigger challenge for us will be, can we do a good job in the markets that we operate in and be the preferred health care provider."