Once a fortnight, the senior management of IDFC Bank, 35 in number, gather for what they call the ‘Safe Space’ meeting at its headquarters in Mumbai’s Bandra-Kurla Complex. It is here that Rajiv Lall, the bank’s founder MD and CEO, outlines the areas of concern for India’s youngest bank.

There are debates, discussions and the odd slanging matches too. The meeting, says Lall, “helps to break communication barriers and enables the individuals, who are empowered at different levels, to problem-solve, instead of following top-down instructions from the boss”. Sessions like these—typical of many modern private lenders in the country—reflect the keenness and agility to resolve issues before they blow out of proportion and are a far cry from banks’ traditional mode of functioning—in silos, where teams build and run products and service lines, often disjointed.

For IDFC Bank, these sessions have proved useful in untangling knotty problems. For instance, it was in a Safe Space session in January this year that the bank discussed the differing interpretations of compliance requirements to set up bank accounts electronically and arrived at a consensus. A directive from the top management ensured that all the departments of the bank were on the same page and did not come up with conflicting analyses of the norms.

Debates have also helped to outline the scope of IDFC Bank’s products such as micro-ATMs that the bank installs in shops to facilitate everything from opening an account to accepting deposits.

And when it comes to resolving issues and steaming ahead, Lall, 59, is proactive. His bank’s legacy parent Infrastructure Development Finance Company (IDFC), incorporated in 1997, has earned a name for itself as an infrastructure lender. But IDFC Bank, which completed a year of operations on October 1 this year, remains largely obscure to individual households. This compounds the biggest challenge the young bank faces—customer acquisition.

“Our strategy is to become a mass retail bank,” Lall tells Forbes India. For this, IDFC Bank has set the ball rolling through the acquisition route. In January this year, it picked up a nearly 10 percent stake in ASA International India Microfinance, the Indian arm of Dhaka-based ASA International, for around Rs 8.5 crore, giving it access to India’s northeast and eastern regions, including Assam, Tripura, West Bengal and Bihar.

Down south, in July this year, IDFC Bank announced a 100 percent acquisition of Tamil Nadu-based Grama Vidiyal Microfinance for an undisclosed amount. This deal will provide the company access to the microfinance institution’s (MFI) large customer base—currently, 1.2 million across seven states and 321 branches. With its own 100,000 clients, IDFC Bank’s current customer base stands at 1.3 million.

Lall aims to take this number to 6 million by 2020. As a first step, IDFC Bank’s target is 1.5 million customers by March 31, 2017. The bank currently adds 20,000 customers every month.

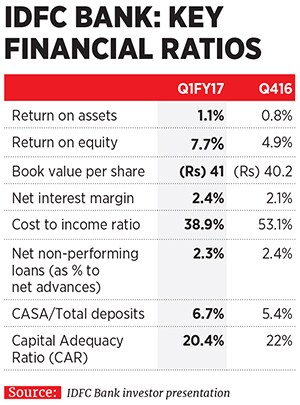

Customer acquisitions apart, IDFC Bank has also recorded impressive top- and bottomlines. For the first quarter of the current financial year, the bank reported a 60 percent sequential jump in net profit to Rs 264.8 crore, on total income of Rs 2,188.28 crore. The bank’s assets stood at Rs 101,694 crore for the June-ended quarter, while deposits grew by 59 percent sequentially to Rs 13,029 crore. Current and savings accounts (CASA) stood at Rs 869 crore and term deposits were at Rs 12,160 crore.

Asset quality too has improved from initial levels. Gross non-performing loans (NPLs) as on June 30, 2016, were at Rs 3,030 crore, or 6.1 percent of gross advances, compared with Rs 3,058 crore, or 6.16 percent of gross advances, as on March 31, 2016.

Until the RBI’s recent move to make banking licences ‘on-tap’, acquiring a banking permit was rare and challenging. Prior to IDFC Bank and Kolkata-based former micro-lender Bandhan Bank, which was granted a licence along with IDFC Bank in April 2014, Kotak Mahindra Bank and Yes Bank were the only new private banks established in the previous decade.![mg_89671_bandhan_bank_280x210.jpg mg_89671_bandhan_bank_280x210.jpg]()

Bandhan Bank started operations in August 2015, a few weeks prior to IDFC Bank. The two have ventured into the sector during a period when most state-owned banks are crippled with stressed balance sheets, and lending and recoveries of loans have become difficult. Consequently, public sector lenders have been reluctant to expand operations into remote parts of the country.

As a group, IDFC has taken to full-fledged banking at a time when the Narendra Modi-led government has renewed its thrust on infrastructure lending. So, why did the organisation move beyond its core specialisation?

Much before veering towards full-fledged banking, a ‘push factor’ had started to build up since 2010-11 for IDFC to look further than infrastructure financing. In the infrastructure sector, the boom was turning into a bust and the listed company found itself focussed on a sector going through prolonged stress. “It became almost a fiduciary responsibility to shareholders… to find a strategic response to a changing macro [economic] landscape,” says Lall, recounting the genesis of his bank.

At the time, the RBI also felt that big non-banking financial companies (NBFCs) were posing a systemic threat due to the high proportion of risky borrowers on their books. They were hence being encouraged to build a depository franchise and convert themselves into banks.

What emerged alongside for Lall and his team was the fact that there was, and still is, a vast portion of India that remains unbanked. India’s financial system is dominated by nationalised banks that command close to 70 percent of banking assets. Close to half of all banking credit (45 percent) is only to 300 corporates, according to RBI data. “This means there are large chunks of the economy that do not have access to formal credit, which is a tremendous opportunity,” explains Lall, who was educated at Oxford University and has an economics degree from Columbia University in New York.

Further, nearly 60 percent of household savings are not intermediated through formal financial institutions but through moneylenders and chit funds, data from IDFC Bank’s internal investor presentation shows. These were all compelling factors for Lall. “There are at least 200 to 300 million people in the country who need banking services,” he adds.

Against this backdrop, the plan to set up IDFC Bank as an arm of IDFC took shape. As of June 30, 2016, IDFC holds a 52.9 percent stake in IDFC Bank through IDFC Financial Holding Company Ltd. The government of India has a 7.7 percent stake, overseas investors 23.4 percent, retail investors 9.2 percent with mutual funds, corporate bodies, financial institutions and insurance companies holding the rest.

IDFC Bank has recognised the importance of catering to all segments of society. Therefore, in retail banking, it has created two segments: Bharat Plus comprising the affluent (self-employed professionals and businesses with an annual turnover of less than Rs 75 crore) and ‘mass affluent’ (the salaried class). The second segment is Bharat, which caters to servicing the micro-, small- and medium enterprises (MSMEs), microfinance customers and self-employed women.

At a time when almost every universal bank is trying to sell personal loans, financial investment products or insurance policies to the urban class, IDFC Bank, too, is introducing a range of technologies and strategies to woo urban customers. For debit card holders, the bank offers unlimited free ATM transactions, for instance. The bank has also introduced the ‘Truly One’ account, which offers the convenience of integrated current and savings accounts records, for viewing on one screen. Funds can also be transferred automatically from the personal to business account. This segment also gets the facility of doorstep banking. ![mg_89667_account_opening_280x210.jpg mg_89667_account_opening_280x210.jpg]() An IDFC Bank official assists a customer at its Bankhedi branch in Madhya Pradesh. The bank wants to become a mass retail bank in the country

An IDFC Bank official assists a customer at its Bankhedi branch in Madhya Pradesh. The bank wants to become a mass retail bank in the country

Courtesy: IDFC Bank

For the lower-income classes in rural India, IDFC Bank has adopted a business correspondent-based strategy, mapping customers by segment and not product, the aim being to offer multiple solutions. Dedicated relationship managers (RMs) and business correspondents (BCs), who are solely working for IDFC Bank, provide the last mile connectivity here.

Lall hopes that about 15 percent of his proposed customer base of six million will be the affluent class.

But as it seeks to acquire a wider customer base, IDFC Bank will need to cover large portions of the country. In the past one year, it has built a total of 894 ‘points of presence’ across 14 states, which includes 74 branches and 820 micro-ATMs and dedicated BCs.

In parallel, IDFC Bank is expanding its urban presence organically 18 of its 74 branches are in urban centres that cater to the affluent and mass-affluent segments of customers, largely in western and central India. The points of presence have the look and feel of a regular IDFC Bank branch, where eKYC, withdrawal and deposit of money, all government/utility payments, remittances and ATM transactions can be carried out.

BCs will also become dedicated points of presence, who will be trained by the bank to use its technology and distribute its products. By March 2017, Lall forecasts the number of points of presence to rise to over 1,400, including Grama Vidiyal’s network.

Tapping into India’s unbanked population is a given for almost every financial institution. It is a crowded space in which several NBFCs, public and private banks, MFIs, corporate BCs and small finance banks are trying to make their presence felt.

In semi-urban and some rural areas, there has been an overlap in services and products among lenders such as Axis Bank, HDFC Bank, L&T Finance and IndusInd Bank. Even in the microfinance lending space, the end products are similar. “MFIs and NBFCs will need to evolve new strategies for growth,” says Bindu Ananth, chairperson of IFMR Trust, a private trust which aims to bring inclusion.

In some pockets of India, households with an income of Rs 1-3 lakh per annum have multiple sources of borrowing funds. In that scenario, though opportunities are several, IDFC Bank must continue to differentiate—either by service or technology—to maintain a sustained presence for their Bharat banking.

Dharmesh Kant, head of retail research at Motilal Oswal Securities, believes the pie is big enough to operate and grow in. “[But] the real game for them will be how they build CASA and get more people to park deposits with them,” he says.

With a focus towards the salaried segment, IDFC Bank hopes that it can convert salary accounts into CASA, something that HDFC Bank and ICICI Bank have done successfully.

“The entire financial inclusion move [for IDFC Bank] sounds good. The biggest concerns [for new banks] will be managing the asset side of the balance sheet. IDFC Bank is being driven by the flow… but it is trying to build a bank on an Excel sheet,” says a senior analyst at a foreign brokerage, on condition of anonymity.

The analyst is also concerned with the rush to tap rural areas. “The need for credit has always been there, but we may see overleveraging in the rural markets, where supply will outstrip demand… this is a positive element in the ecommerce industry but not in rural lending,” he tells Forbes India.

But Lall does not agree. “The country does not have enough of them [sources of capital]. People get excited when they talk about [the MFI] Ujjivan Financial Services and Equitas Holdings [which was recently given the nod to start a small finance bank]. Investors are not worried about the opportunities for growth in their case. Why be concerned about my bank’s ability to grow. What is the difference?”

![mg_89673_idfc_280x210.jpg mg_89673_idfc_280x210.jpg]()

One year on, Lall says he is “happy” with the way the bank has pursued customer acquisitions and delivered to its customers with a mass employee base (2,700 at present) and branches. In the next two years, IDFC Bank hopes to have nearly 200 branches and at least six strategic BC relationships.

The bank has also attracted some well-known names on its board, including Google’s vice president for Southeast Asia and India Rajan Anandan, veteran banker and advisor Ajay Sondhi and trade and structured finance expert Veena Mankar, all as independent directors.

But there is much more that needs to be done. “We want to be growing faster than other banks. The speed of execution is good, relative to the industry. But the speed of execution relative to our own ambitions is not there, and I am not happy with that,” Lall says. This is where more Safe Space sessions would help.

He said the bank needs extreme agility in terms of execution, whether it is in decision-making, responding to customers, partnership opportunities, developing products or integration with partners.

In its first year, IDFC Bank has taken more than baby steps. Its moves have been firm and well-calculated, which, if executed well, can bear results in the coming years. But as it expands, the battle for retail banking will only get more competitive. Add to this, the fact that the number of banks in India will increase given that licences can be acquired ‘on-tap’. IDFC Bank, in the coming years, will also face the need to raise fresh capital, to meet regulatory norms and bring in more investors.

But Lall appears unflinching in his vision and approach for the bank. “Why should one be scared of more banks? A small country like Sri Lanka has several,” he says with confidence. Evidently, competition does not unnerve him.

An IDFC Bank official assists a customer at its Bankhedi branch in Madhya Pradesh. The bank wants to become a mass retail bank in the country

An IDFC Bank official assists a customer at its Bankhedi branch in Madhya Pradesh. The bank wants to become a mass retail bank in the country